annopk/iStock Editorial via Getty Images

Investment Thesis: I am optimistic about the BMW Group given strong revenue growth and expectations for further growth from the upcoming Neue Klasse model.

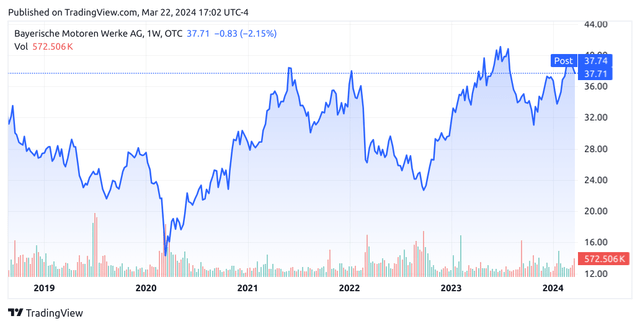

bavarian automobile factory or bmw group(OTCPK: BMWYY) is a stock that has made a strong post-COVID recovery, driven by significant demand growth in the electric vehicle segment and encouraging performance across the luxury car market.

Recently, we’ve seen the stock trade in a stable manner over the past year – trading at $37.76 at the time of writing.

trading view

The purpose of this article is to assess BMW Group’s ability to drive further growth in the future, in light of recent performance results.

Performance

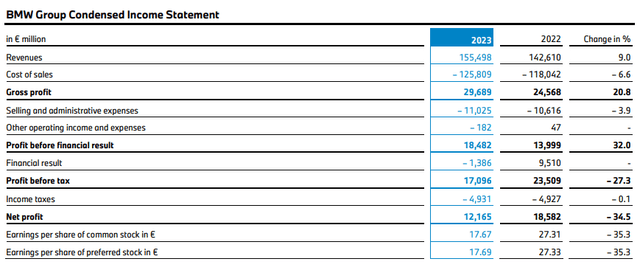

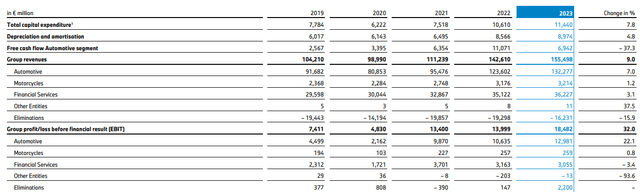

When looking at the BMW Group Report for Based on 2023 data released on March 21, 2024, we can see that revenue grew by 9%, exceeding the cost of sales growth of 6.6%. Additionally, earnings before interest and taxes (or earnings before financial performance) increased 32% from the previous year.

BMW Group Report 2023

Furthermore, when looking further into the revenue and EBIT performance by segment, we can see that Automotive (the largest segment by revenue) continues to show strong growth compared to the previous year – with full year revenue up 7% , EBIT grew by 22.1%.

BMW Group Report 2023

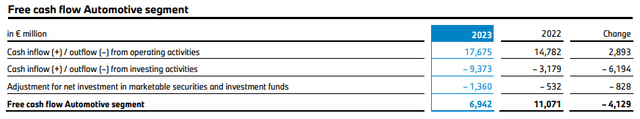

Having said that, we can also see that free cash flow in the Automotive segment fell significantly by over 37%, while total capex increased by almost 8%, driving this decline.

From a balance sheet perspective, we can see that the BMW Group’s quick ratio (current assets minus prepaid expenses in inventory and current liabilities) has consistently remained below 1 over the past year, indicating that the company does not have enough assets to meet its current liabilities.

| 2022 | 2023 | |

| current assets | 92204 | 94972 |

| in stock | 20005 | 23719 |

| Current liabilities | 84421 | 87001 |

| quick ratio | 0.86 | 0.82 |

Source: Data (in millions of euros) from BMW Group Report 2023. Quick ratio is calculated by the author.

Over the longer term, non-current reserves and liabilities relative to total assets have remained roughly the same as last year:

| 2022 | 2023 | |

| Non-current reserves and liabilities | 71217 | 70966 |

| Total assets | 246926 | 250890 |

| Non-current reserves and liabilities as a proportion of total assets | 28.84% | 28.29% |

Source: Data (in millions of euros) from BMW Group Report 2023. Non-current reserves and liabilities as a proportion of total assets are calculated by the authors.

My opinion and outlook

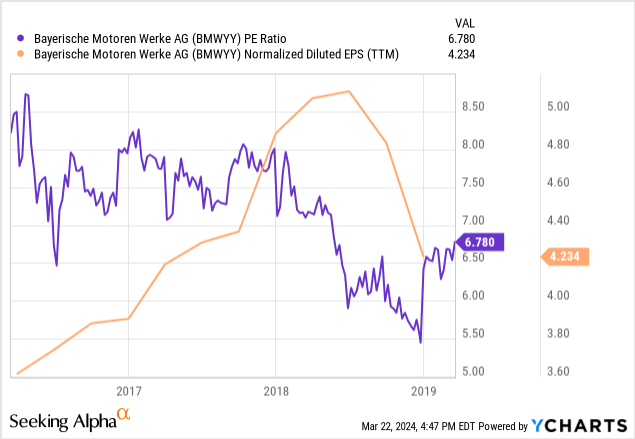

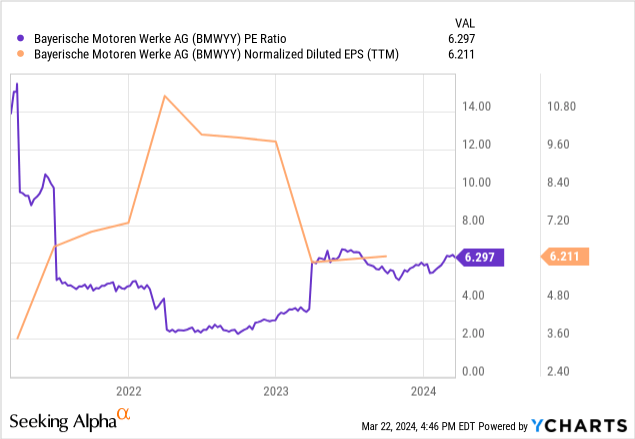

When comparing BMW Group’s 2019 and current P/E ratios (2020 and 2021 were chosen to exclude due to unusually high P/E ratios due to price declines during the COVID-19 pandemic), we can see that while the stock’s P/E ratios are similar (in 2019 6.78x in March and 6.297x currently), but earnings per share also increased significantly, from $4.234 to $6.211.

March 2019

Y chart

March 2024

Y chart

Furthermore, when looking at the price chart at the beginning of this article, we can see that current prices are still higher than the $24-30 range we observed in 2019. In that regard, I think the current price of $37 is a good reflection of fair value at this time.

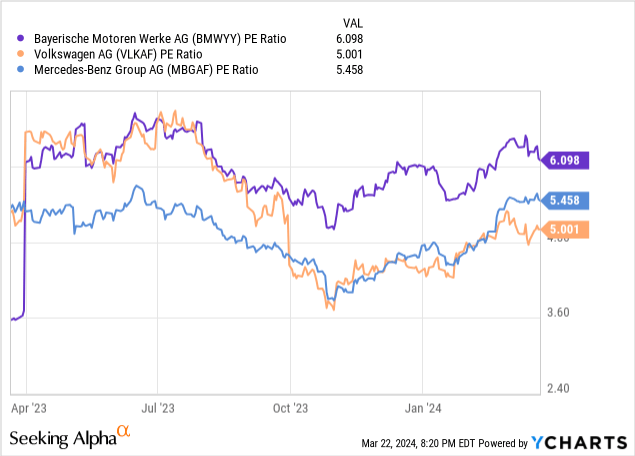

When looking at rivals Volkswagen AG (OTCPK: VLKAF ) and Mercedes-Benz Group (OTCPK: MBGAF ), we can see that while BMW Group has a slightly higher P/E ratio, all three companies trade at within a similar range.

Y chart

In this regard, I think BMW Group’s valuation relative to its peers is also quite reasonable.

Looking to the future, the BMW Group will continue to place the Neue Klasse at the center of its strategy – its launch is planned for 2025. Specifically, Neue Klasse covers the new generation of BMW models, which are designed as fully digital, all-electric models with a focus on sustainability.

The BMW Group aims to launch six models of the Neue Klasse within 24 months, starting production in 2025. Starting in 2027, the BMW Group aims to produce electric vehicles only at its main factory.

Additionally, with plans to launch the first X Model The Neue Klasse will be launched in 2025 and is expected to be a significant improvement over the current iX and XM models, and I’m optimistic about the BMW Group’s ability to further boost its automotive division’s revenue in the future.

While I said before that the BMW Group’s free cash flow has been declining, this is largely due to increased investment in Neue Klasse, which has led to higher cash outflows.

BMW Group Report 2023

However, I think investors are ultimately willing to tolerate a temporary drop in free cash flow if it means Neue Klasse’s production targets can be met, as new generation cars are expected to be an important source of revenue for the group moving forward.

risk

I think the launch of the Neue Klasse and the BMW Group’s emphasis on significantly accelerating electric vehicle production is a good strategy in the long term. However, this is not to say that this strategy does not carry risks in the short to medium term.

Electric cars much more expensive than conventional cars, rivals Mercedes warn It will be many years before we see anywhere near price parity between these two groups.

In fact, while Mercedes originally set a goal of becoming an all-electric car company by 2030, those plans have now been scaled back – it’s now estimated half Its sales are expected to be electric at this time.

If demand for electric vehicles grows significantly by 2027 (when BMW plans to go all-electric), this may put BMW ahead of its competitors, but it may also cause BMW to limit its market size. At this time, the consumer market for traditional luxury cars may still be large, and if the market becomes too small, BMW may lose revenue.

in conclusion

All in all, the BMW Group’s car sales continue to grow significantly, and the expansion of the Neue Klasse generation of its electric vehicle fleet has the potential to significantly increase revenue. While the company’s all-electric vehicle strategy is not without risks, I remain bullish on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.