SHansche

investment thesis

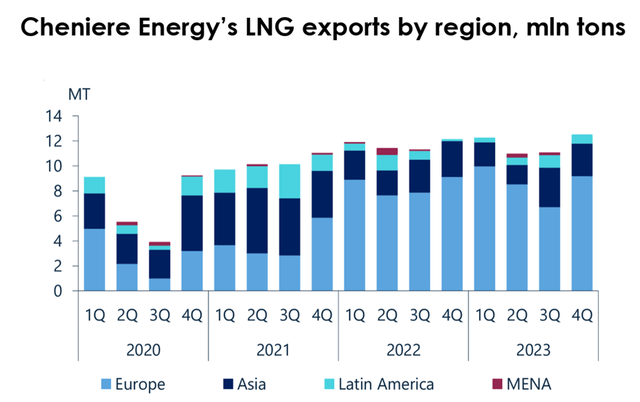

LNG sales in Q4 2023 totaled 12.5 million tonnes (our forecast was 11.3 million tonnes, a variance of 10.6%). The average LNG sales price across all segments was US$384/ton, down 6% from our forecast of US$409/ton.

2023, LNG sales exceed capacity by 6%, reflecting Cheniere Energy’s high efficiency (NYSE: LNG) terminals and strong demand for the company’s natural gas. In view of the seasonal increase in production efficiency, we raise our LNG sales forecast in 2024 to 47.6 million tons (-0% year-on-year). We expect Corpus Christi Phase 3 to begin operations in the first quarter of 2025, allowing the company to increase capacity to 49.3 million tons (up 4% year-over-year) at 100% terminal utilization.

Speaking of Corpus Christi expansion, Biden decides to stop issuing new permits to Corpus Christi U.S. LNG exports to countries outside the free trade agreement have no impact on the expansion of Sabine Pass Liquefaction and Corpus Christi liquefaction projects, although it does create regulatory uncertainty for the industry as a whole.

We’ve covered the stock before and do so regularly, so here’s a new report covering the company’s fourth-quarter 2023 financial results as well as key news and LNG market updates. Rated as Hold.

Major LNG import markets

More than two-thirds of Cheniere Energy’s LNG is shipped to European countries. Ranking second in terms of shipments is Asia.

Cheniere Energy

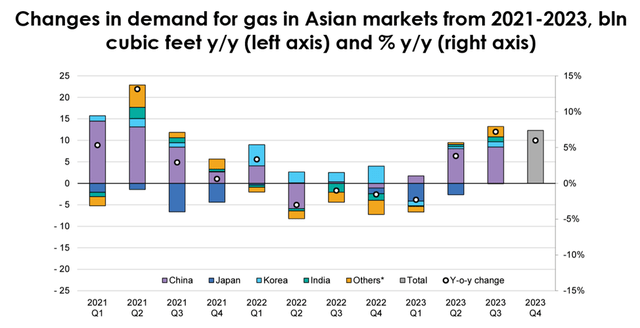

In Asia, the main importers of natural gas are ChinaManufacturing industry recovers, natural gas consumption in energy sector rises; India’s natural gas demand continues to expand, mainly due to manufacturing activities (fertilizer production and other industries) and energy production in the development of national pipeline network and urban natural gas infrastructure. In 2023, China’s LNG imports will increase by 14% annually (8.3 million tons), and India’s imports will increase by 11% (2.2 million tons) compared with the same period last year. It is also worth noting that Thailand’s natural gas demand increased by 40% year-on-year (2.9 million tons), Bangladesh by 20%, and Pakistan by 5% (the latter two countries’ LNG imports increased by 1.2% cumulatively). million tons).

The IEA predicts that China’s LNG imports will increase by 10% annually in 2024, and India’s imports will grow by 7%, which means that Asia will continue to account for the majority of global LNG demand growth.

International Energy Agency, Natural Gas Market Report

European LNG imports reject The annual growth rate in the fourth quarter of 2023 was 1.5%. Here’s why:

- measure The target adopted earlier was to reduce demand in EU countries by 15% annually by the end of the 2023/24 heating season.

- high inventory In underground storage facilities.

- Economic activity weakens: Eurozone manufacturing PMI the following 50 (consistently below 45 in Q4 2023), indicating a decline in the number of new orders in the industry, leading to a contraction in natural gas demand.

The above reasons have also caused LNG prices in European natural gas centers to be lower than Asian spot LNG prices in the second half of 2023. Platts JKM’s average premium to the European TTF benchmark is US$2/MBTU, leading to a diversion of spot LNG shipments from the European market to Asia, according to the IEA. This trend is expected to continue in 2024, but with the spread between prices narrowing compared to the second half of 2023.

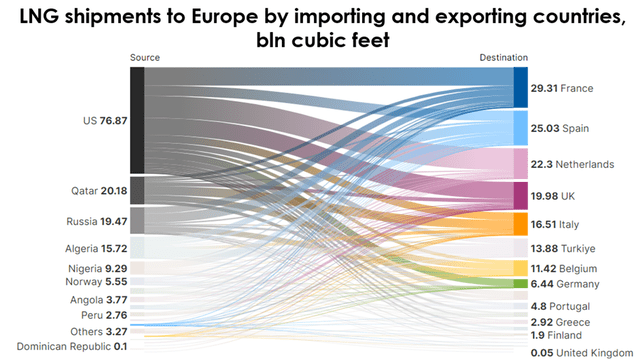

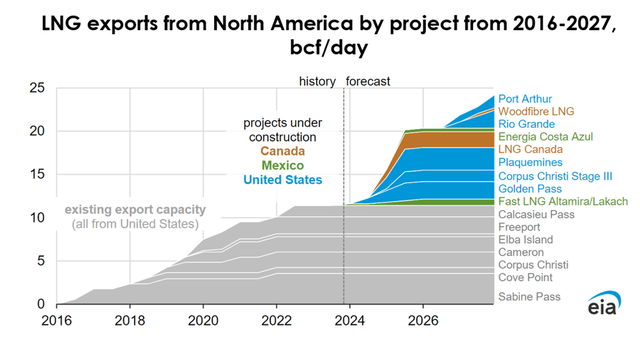

USA continue Becoming Europe’s largest LNG exporter: Its LNG supply share reached approximately 50% in 2023 and is expected to continue to rise. Natural gas demand in European countries is expected to grow by 3% annually as manufacturing demand for natural gas is rebounding and economic activity in Europe is expected to increase.

jeffa

Cheniere will produce more than half of the LNG exported by the United States in 2023.

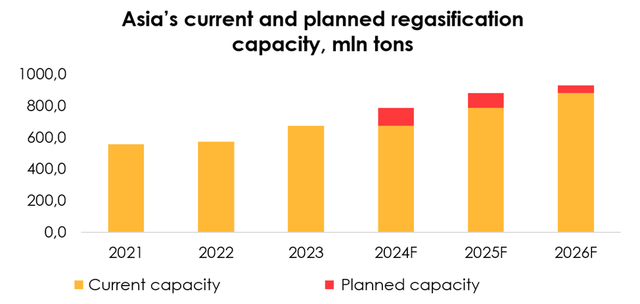

Regasification capabilities in Cheniere Energy’s key markets

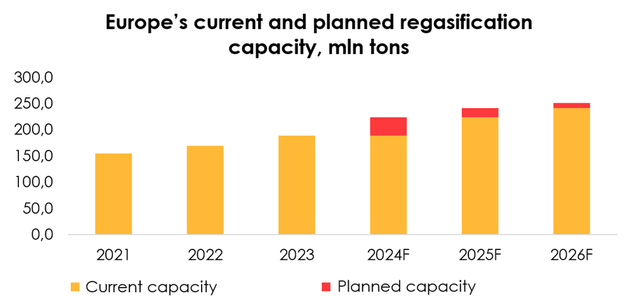

Regasification capacity in Europe and Asia is expected to expand significantly in 2024, which will be necessary to meet their growing LNG demand.

Europe 2023 accelerate Production capacity increased from 170 million tons to 189 million tons (annual growth of 11%), and future expansion is expected to be even greater, with production capacity reaching 224 million tons in 2024 (annual growth of 18%) and reaching 241 million tons in 2025. Production will increase 8%, which will increase to 251 million tons in 2026 (annual increase of 4%).

Investment Hero

Asia will promote Regasification capacity will increase from 675 million tons in 2023 (+18% year-on-year) to 788 million tons in 2024 (+17% year-on-year), 882 million tons in 2025 (+12% year-on-year), and 928 million tons in 2025. tons in 2026 (annual growth of 5%).

The largest capacity expansion will occur in China and India: these countries are likely to make up ca. 35% and twenty two%respectively account for the proportion of total production capacity growth in the region. More than two-thirds of the new capacity will come from new terminals, with the remainder coming from the expansion of existing terminals.

Investment Hero

LNG export approvals and Corpus Christi Phase 3

U.S. President Joe Biden has decided to suspend the issuance of new approvals for U.S. exports of liquefied natural gas to countries that do not have free trade agreements due to his administration’s concerns about the economic and environmental impact of liquefied natural gas exports.

This restriction will last at least until the next US presidential election, which is November 5, 2024. During this period, the U.S. Department of Energy will analyze the impact of the LNG program on energy costs, U.S. energy security, and the environment.

Cheniere Energy management said the decision has no impact on the Sabine Pass Liquefaction and Corpus Christi Liquefaction expansion projects for the time being, although it does create regulatory uncertainty for the industry as a whole. Cheniere Energy is confident that it will obtain all necessary regulatory approvals as needed in a timely and seamless manner. Currently, construction work is ahead of schedule.

Given that construction progress is ahead of schedule, we expect the Corpus Christi Phase III project will be completed By early 2025.

Environmental Impact Assessment

unit economic benefit

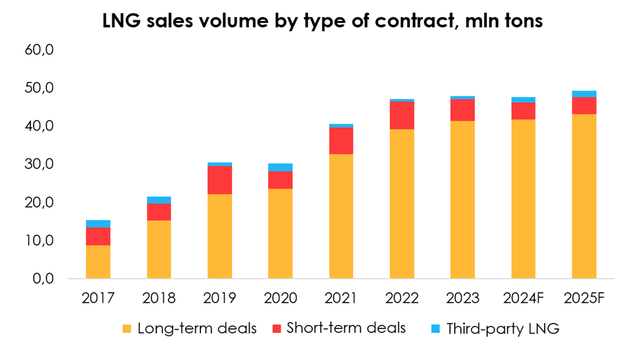

LNG sales in the fourth quarter of 2023 totaled 12.5 million tons, and full-year sales in 2023 were 47.8 million tons (+2% year-on-year), higher than our forecast of 46.5 million tons (-1% year-on-year). LNG sales exceeded production capacity by 6% in 2023, reflecting the high efficiency of Cheniere Energy’s terminal and strong demand for the company’s natural gas.

In view of the seasonal increase in production efficiency, we raise our LNG sales forecast in 2024 to 47.6 million tons (-0% year-on-year). We expect Corpus Christi Phase 3 to begin operations in the first quarter of 2025, allowing the company to increase capacity to 49.3 million tons (up 4% year-over-year) at 100% terminal utilization.

Investment Hero

LNG sales under long-term contracts, which typically account for the majority of the company’s sales, will reach 41.3 million tons in 2023 (up 6% annually), accounting for 86% of total sales. We expect this number to rise to 41.7 million tonnes in 2024 (1% annual growth) and to 43.1 million tonnes (4% annual growth) in 2025 when the new Corpus Christi terminal becomes operational.

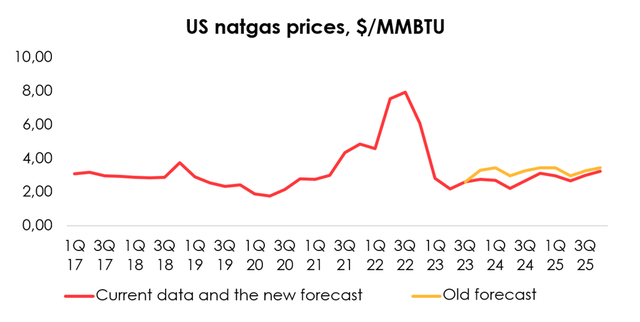

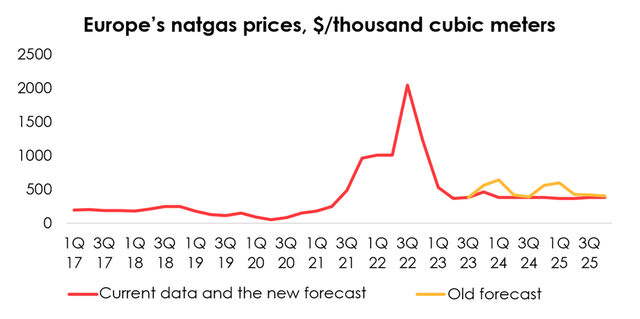

Regarding gas sales prices under various contracts, our forecasts rely on international benchmarks: Henry Hub and TTF.

Henry Center benchmark forecasts are given by U.S. Energy Information Administration. The agency lowered its short-term price forecasts as mild weather conditions are expected to continue into the early second quarter of 2024. Medium-term forecasts have also been revised downwards, which we believe is because production will remain high. Henry Hub’s 2024 price forecast is lowered from US$3.26/MMBTU to US$2.65/MMBTU, and its 2025 price forecast is lowered from US$3.26/MMBTU to US$2.94/MMBTU.

Given the rising proportion of gas-fired power generation (42%+3 pp y/y), with above-average price volatility throughout the year.

Environmental Impact Assessment

Based on the above macroeconomic environment, we have lowered the TTF price forecast in 2024 from US$503/thousand cubic meters to US$382/thousand cubic meters, and lowered the TTF price forecast in 2025 from US$464/thousand cubic meters to US$377/thousand cubic meters. .

Investment Hero

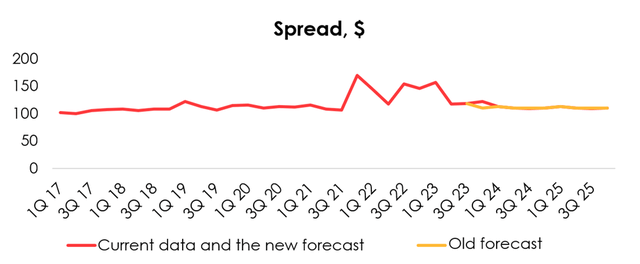

In the fourth quarter of 2023, Cheniere Energy’s LNG average selling price across all segments was US$384/ton (-49% year-on-year, +4% quarter-on-quarter), down 6% from our forecast of US$409/ton. During the same period, the price of LNG under long-term contracts reached US$310/ton (-40% year-on-year, +5% quarter-on-quarter), down 3% from our forecast of US$320/ton.

The spread to Henry Hub reached $122, up 11% from our forecast of $110. We maintain our previous assumption that spreads will fall to historical averages. The growing number of regasification terminals in Europe and Asia will help meet growing demand without putting the market at risk, thereby reducing gas price volatility.

Given the lower Henry Hub price forecast and the unchanged outlook for the spread in 2024 and 2025 at $111, we lower our LNG price forecast under the long-term contract in 2024 from $321/ton to $290/ton, and In 2025, it will be US$321/ton to US$304/ton.

Investment Hero

In view of the lower TTF price forecast, we also lowered our LNG price forecast under short-term contracts from US$894/ton to US$601/ton in 2024 and from US$863/ton to US$595/ton in 2025.

As a result, we lower our 2024 average selling price forecast for all Cheniere Energy divisions from $398/ton to $346/ton and 2025 from $392/ton to $358/ton.

We expect LNG prices under long-term contracts to reach $293/ton in the first quarter of 2024, with the average LNG price across all Cheniere Energy divisions to be $349/ton.

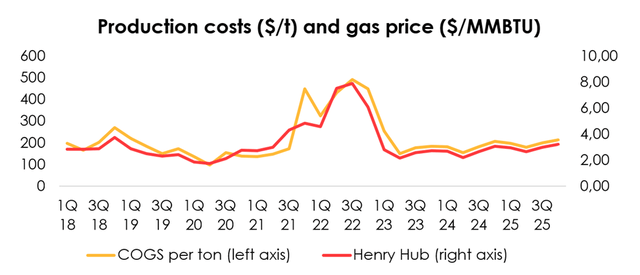

cost of goods sold model

The company’s total costs are quite volatile, ranging from 52% of revenue to as high as 152% of revenue when it loses on derivatives trading, but it still manages to keep the spread between selling price and cost at an average of about $200 per 1,000 cubic meters. .

We still stand by the rationale that net cost of goods sold per ton performance is tied to Henry Center natural gas prices. We expect this approach to provide a closer approximation of costs to domestic market prices.

Given the lower U.S. natural gas price forecast, we lower our total cost forecast from an average of $215 per ton of product to $180 in 2024 and from $216 to $198 in 2025. Our estimates of production costs are adjusted for derivatives trading.

Investment Hero

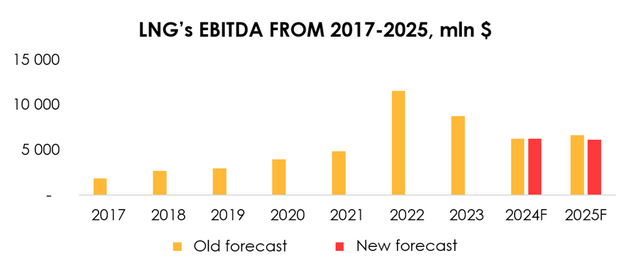

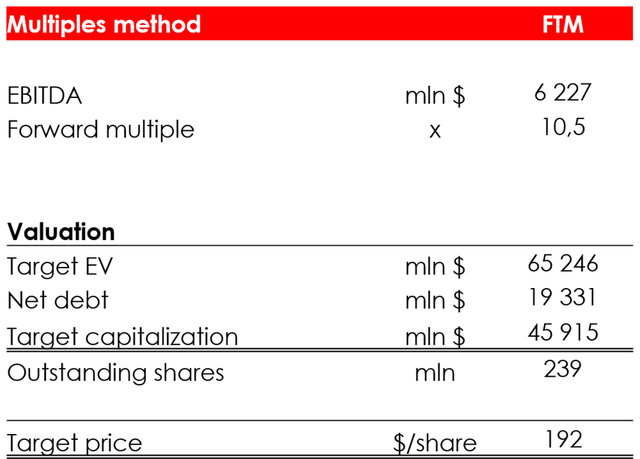

We lower our 2024 EBITDA forecast from US$6.261 billion (-29% year-on-year) to US$6.227 billion (-29%), and lower our 2024 EBITDA forecast from US$6.645 billion (+6% year-on-year) to US$6.134 billion -1% annual growth in 2025 due to:

- Average selling prices for LNG across all Cheniere Energy divisions will fall to $346/ton from $398/ton in 2024 and $358/ton in 2025 from $392/ton, with lower production cost per ton forecasts, This impact is partially mitigated in 2024 and 2025.

Investment Hero

Cheniere 2034 banknote

The issuance of the senior notes will not have a significant impact on LNG’s balance sheet as the company will repay the CCH 2025 issuance through the issuance of Cheniere 2034.

However, due to the lower coupon rate (5.650% p.a. vs. 5.875% p.a.), the company will pay less interest, which will have a positive impact on its net profit and earnings per share, and may attract new investments By.

The issuance of the senior notes has no impact on the company’s fair share price valuation using the EV/EBITDA method.

Valuation

We lower our stock price target to $192 from $198 for the following reasons:

- 2024 EBITDA forecast lowered.

- Shift in FTM evaluation period.

Based on assumptions, we rate the stock a Hold.

Investment Hero

in conclusion

We maintain our HOLD rating as the company’s future sales volumes remain comparable to current levels and HH and TTF price forecasts have been revised downwards. In order to manage your positions, we recommend that you monitor Cheniere Energy’s earnings releases and LNG market updates.