David Becker

Since I last wrote about Chinese e-commerce giant Alibaba Group Holding (NYSE:Baby), its shares went nowhere in December and are down about 2% since then. Year-to-date (YTD), its decline has been even steeper (see chart below).it’s hard This is surprising considering the company has since released third-quarter (Q3FY24) numbers that were still not promising.

However, the company’s bet on artificial intelligence to propel it forward certainly has potential. Here, I’ll consider the impact this has on the rest of the business to determine where the stock will trend next.

Focus Artificial Intelligence

Especially since ChatGPT became popular around the world in 2022, the huge potential of the artificial intelligence industry has been increasingly recognized.In China alone, the artificial intelligence market is expected to grow at a compound annual growth rate (CAGR) about 18% Between 2024 and 2030, the scale will reach approximately US$105 billion.

I pointed out last time that Eddie Wu’s promotion from chief technology officer to the top position was in line with this focus. Using artificial intelligence tools to improve merchant efficiency is also part of the growth strategy of Taobao and Tmall Group. Taobao and Tmall Group are Alibaba’s largest sources of revenue, contributing 44% as of 2023, and are also an example of focus (see “Growth”) “Segment Strategy” linked above for more details).

Now, artificial intelligence could even breathe new life into its fading cloud intelligence group, which Alibaba tried to spin off last year but later changed its mind.

Cut prices and invest in startups

The recent price reduction for its cloud services is Is considered A way to capture the artificial intelligence software developer market. The company expects the prices of its products to be reduced by an average of 20%, but some are expected to cost as much as 55%.

Investing in artificial intelligence startups is another way Alibaba is venturing into the field. The most recent highlight was its $1 billion investment in February in Moonshot AI, the company best known for its Kimi chatbot, China’s version of ChatGPT. Recently, it invested $600 million in Minimax, another generative artificial intelligence company. These investments could not only create early demand for its cloud services among AI developers, but also support the company’s own use of AI in its business, as outlined in Taobao and Tmall Group’s strategies.

Cloud services lag behind, but EBITDA grows amazingly

The unit is still small compared to Alibaba’s total revenue. It accounted for just 11% of the company’s revenue through the first nine months of the company’s fiscal year ($9 million in fiscal 2024, the year ending March 2024). But it’s also growing quite slowly. Revenue of 9 million in fiscal 2024 increased by only 3% annually, while total revenue grew by 9%.

But it’s not without potential, and it’s not just artificial intelligence. During the period, the segment’s adjusted EBITDA grew 51%, while total adjusted EBITDA grew 15%. If the company’s bets on artificial intelligence do lead to the growth of its cloud services, over time it could be just the recipe for the comeback Alibaba is looking for. The company’s average operating margin has declined by about 15% over the past five years, from about 34% in the previous five years.

Of course, for now, the recent price cuts may impact the segment’s very healthy EBITDA margins, but they’re likely still ahead of the company as a whole.

Big players in China market

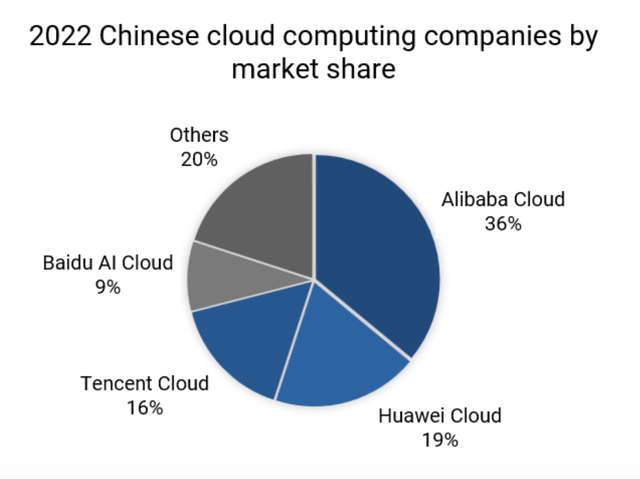

In addition, Alibaba is the largest player in China’s cloud services market, accounting for 36% of the entire cloud services market share as of 2022. Huawei, the second largest, lags behind significantly, with a share of 19% (see figure below). This gives Alibaba an advantage in growing this segment, although there’s obviously plenty of competition here as well, which begs the question of whether Alibaba can actually improve margins.

Source: College Counseling

Taobao and Tmall Group’s performance is worrying

However, with the biggest growth relying on e-commerce units Taboo and Tmall Group, it remains a key area to watch for investors focused on short- to medium-term investment time frames. And it doesn’t look good. After revenue growth of 8% in the first half of fiscal 2024, revenue growth of 9 million fell to 6% in fiscal 2024 due to weak performance in the third quarter of fiscal 2024. Its EBITDA growth rate is also much lower than Alibaba’s overall 4% growth rate of 15%.

Competitive market multiples

Meanwhile, the stock’s market multiples remain attractive as shareholder net profit has grown a healthy 56%, partly due to better operating performance but also due to smaller investment losses.

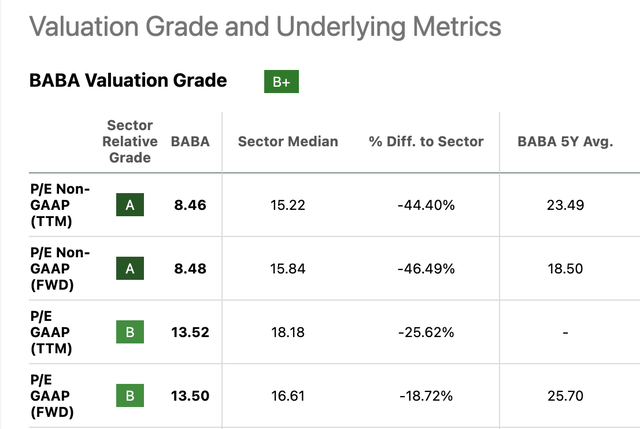

If it continues to grow at this rate in the fourth quarter of fiscal 2024, the forward GAAP price-to-earnings (P/E) ratio for fiscal 2024 will be 11.7x, which is higher than the 11x estimate the last time I checked. However, it’s still well below the Consumer Discretionary industry’s 16.6x and well below the industry’s five-year average of 25.7x. In fact, all current P/E ratios are lower compared to past averages (see chart below).

Source: Seeking Alpha

What’s next?

I maintain my Buy rating on Alibaba based on its continued attractive market multiples, continued strong position in the e-commerce market, and growth potential of its cloud services business.

However, I am increasingly concerned about the weak performance of its e-commerce units Taobao and Tmall Group, especially as China’s economy performs less well than expected. Increased competition from the likes of Temu owner PDD Holdings (PDD) isn’t helping either. The company does have a revival strategy, but it would be better to see some results sooner rather than later.

If there are no signs of improvement in the next earnings report, especially with revenue from cloud services following recent price cuts, it would be a good idea to reassess the rating. This would be the case even if the market multiples were attractive, because it means the stock’s valuation is lower for a reason.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.