dark

Regarding our last report on Global Net Lease, Inc. (NYSE:GNL), we talked about the reasons why we exited the common stock in a timely manner. We also discuss preferred stocks, listed below.

- Global Net Lease, 7.25% Series A Cumulative Redeemable Preferred Stock (NYSE: GNL.PR.A)

- Global Net Lease 6.875% Series B Cumulative Redeemable Perpetual Preferred Shares (NYSE:GNL.PR.B)

- Global Net Lease, Inc. 7.50% Series D Cumulative Red Perp Preferred Stock (NYSE:GNL.PR.D)

- Global Net Lease, Inc. 7.375% Series E Cumulative Preferred Stock (NYSE: GNL.PR.E)

We ultimately recommend investors stick to bonds, as they may be the best option.

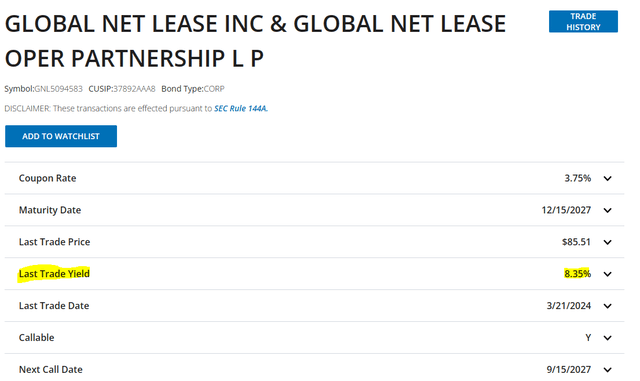

That said, if you really must invest in GNL, bonds are still the best relative choice.Their current yield to maturity on 2027 notes is around 8%, and we think GNL should be able to weather the storm (the company, not the current Dividend) without any problem. That’s what we’re going to focus on.

Source: 15.66% for common stock or 8.50% for preferred stock?

In two and a half months, the company plummeted, resetting its dividend rate and AFFO expectations.

Seeking Alpha

We tell you why investors are facing increasing risks.

Q4 2023

GNL recently completed its merger with RTL and is having an extremely noisy season. Still, the company reiterated its pre-merger strategy.

GNL demo

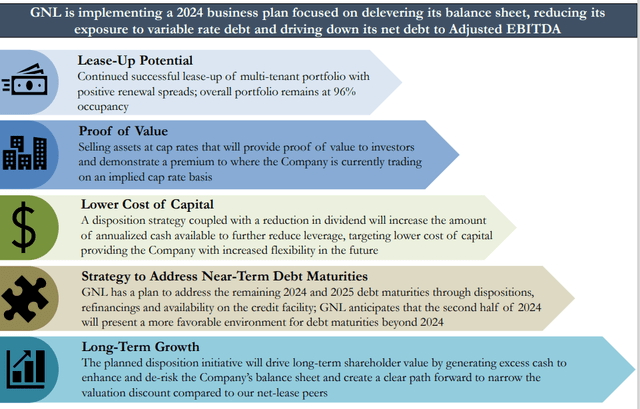

One thing worth noting here is that GNL is now looking to sell assets after years of unapologetic acquisitions. Overall, we believe these transactions will cause significant value destruction throughout the cycle. Most of these properties were acquired by GNL or RTL during the ZIRP (Zero Interest Rate Policy) period and will now be sold at much lower prices. GNL confirmed that the cash cap for these funds will be in the range of 7-8%.

So why, after a decade-long buying spree, have attitudes changed?

When you read that statement, you probably already understand why.

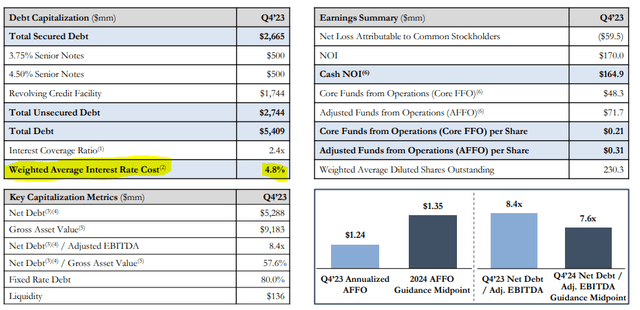

Our net debt to adjusted EBITDA ratio is 8.4x. We ended the quarter with net debt of $5.3 billion, a weighted average interest rate of 4.8%, liquidity of approximately $135.7 million and a credit facility of $206 million. The weighted average maturity at the end of the fourth quarter of 2023 was 3.2 years, with the minimum debt maturity due in 2024. Our debt consists of $1.0 billion of senior notes, $1.7 billion of multi-currency revolving credit facility and $2.7 billion of total outstanding mortgage debt. Our debt is 80% fixed rate, including floating rate in-place interest rate swaps, and our interest coverage ratio is 2.4x.

Source: GNL 2023 Q4 Conference Call Transcript

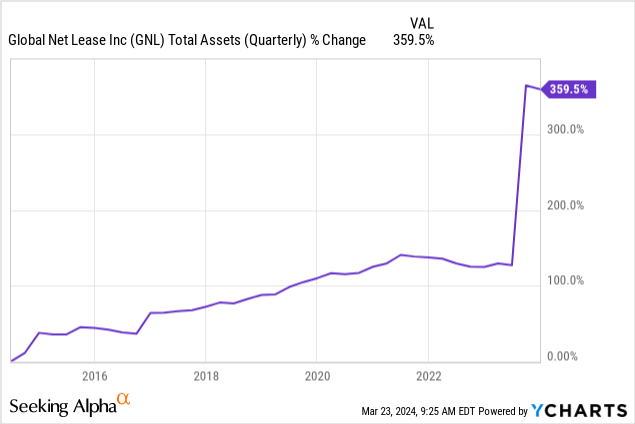

3.2 years is where the problem lies, and it will be a bigger problem for its assets in the single-tenant office category.

GNL demo

GNL certainly disagrees that this should be a problem.

One of the metrics that differentiates GNL’s single-tenant office portfolio is that it is comprised of 70% mission-critical facilities, which we define as headquarters, labs, or R&D facilities, and is anchored by 68% investment-grade or implied investment-grade tenants. Features, which we define as investment grade or implied investment grade tenants. Believed to provide rental stability and lower default risk for our portfolio. Given GNL’s successful record of renewals, the single-tenant office segment also includes limited near-term lease terms, minimizing vacancy risk.

Source: GNL 2023 Q4 Conference Call Transcript

But when your EBITDA debt is in this range, you don’t need a lot of vacancies to shift the pressure.

Outlook 2024

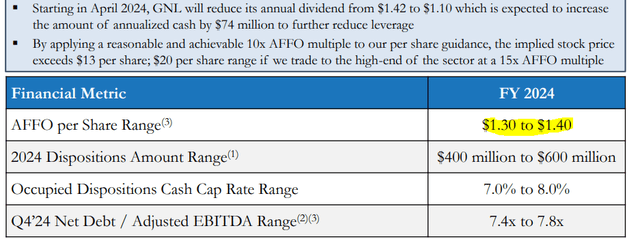

AFFO is currently expected to be approximately $1.35.

GNL demo

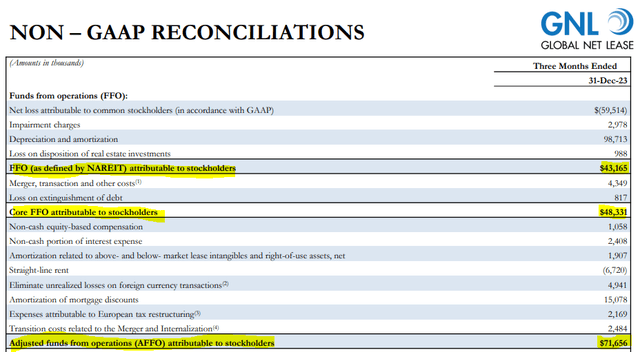

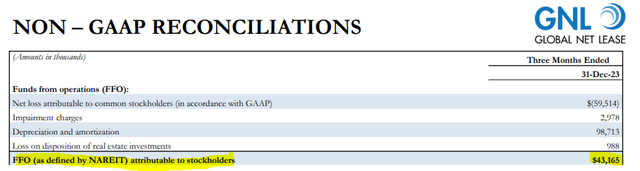

Interestingly, most analysts still believe the expected price for FFO is around $1.10 per share. This usually doesn’t make sense because analysts wouldn’t be so oblivious to management’s guidance. But the confusion among investors (not analysts) stems from the fact that GNL is talking about AFFO, while analysts focus on FFO. In most REITs, AFFO tends to be lower than FFO. While there is no standard definition of AFFO in the U.S. (Canadian REITs are more consistent with this), generally speaking AFFO involves reducing FFO through maintenance capital expenditures and straight-line rents. In the case of GNL, as shown in Q4 2023, AFFO was significantly higher than FFO.

GNL demo

GNL expects similar increases throughout 2024. We will leave it up to the reader to determine the actual measure of owner equivalent income, but these “one-time” adjustments have become a regular feature of GNL.

Our outlook

GNL believes 15x AFFO is possible.

As we take a conservative approach and our deleveraging strategy aims to be earnings neutral, we expect our net debt to Adjusted EBITDA ratio to decrease by approximately 1 full week. By applying a reasonable and achievable 10x AFFO multiple to our per share guidance, if we trade to the high end of the industry at a 15x AFFO multiple, the implied stock price would be over $13 per share, or $20 per share .

Source: GNL 2023 Q4 Conference Call Transcript

In fact, when you own WP Carey Inc. (WPC), Agree Realty Corporation (ADC), and Realty Income (O), trading at an average of 13x FFO, we’d be paying about 7x FFO for GNL after winning, before is 5 times. Note that we said FFO, not the obscure AFFO number. So at $7.50 (considering we haven’t won the lottery yet), the GNL seems expensive. The new dividend of $1.10 is close to a 100% payout ratio of current expected FFO. Presumably, this FFO will be boosted by various expected synergies. But the only thing investors need to pay attention to here is that the weighted average interest rate is still from the ZIRP era.

GNL demo

Any reasonable repricing over the next three years could cause a lot of problems for the company. Investors may think we are being overly cautious, but look at the facts. We have experienced the largest easing of credit conditions since the end of the global financial crisis. Nonetheless, GNL’s recent bond yield to maturity is 8.35%.

FINRA

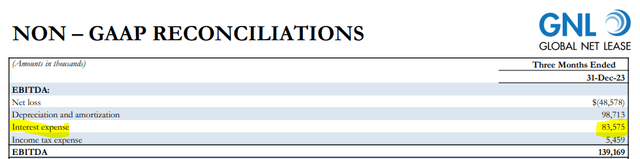

GNL certainly paid a coupon rate, but imagine if you repriced the entire deck from 4.8% to 7.2%. That’s 50% growth, but that’s a pretty reasonable assumption unless we go back to ZIRP. It’s not hard to find or do. There is interest expense for the fourth quarter of 2023.

GNL demo

50% of this amount is approximately US$42 million. So if you take $42 million out of existing FFO, you’re not going to be left with much.

GNL demo

judgment

Of course, the reset will take a long time, but everything we’ve seen suggests that GNL’s FFO base rate will decline over time. So by the time 2027 matures, things may look even worse. GNL needs to reduce leverage, and Fitch’s bottom line will require significant FFO to reduce asset sales.

Factors that could, individually or collectively, lead to negative rating action/downgrade:

–Lack of material improvement in EBITDA and reduction in debt, Fitch expects the combined entity’s leverage to remain above 8.0x on a sustained basis;

–In the absence of meaningful improvements in governance, Fitch expects the combined entity’s capital access to remain restricted and the rating level is ‘BB+’.

source: Fitch

Amid all of this, our preferred shares are actually trading higher than they were the last time we wrote this. Their total yield is currently about 8.3%. We believe they represent very high risk relative to that yield. As we recently showed, you can earn a 7%-8% yield over a 5-7 year period with virtually zero credit risk. In our view, GNL’s credit risk is significantly higher than its credit rating implies. So the yield rate of 8.3% is too low. If we get 10%-12%, that’s a different story. Investors could lose substantial amounts of preferred stock. People using CorEnergy Infrastructure Trust Corp. (OTCPK:CORRQ) and its preferred stock CorEnergy Infrastructure Trust Corp. DEP SHS REPSTG (OTCPK:CORLQ)’s one-line paper “Regulated, Human and Machine Safety” found a 96% loss. But here we downgrade all preferred stocks to Sell.

Please note that this is not financial advice. It looks like it, sounds like it, but surprisingly, it’s not. Investors should conduct their own due diligence and consult with professionals who understand their objectives and limitations.