Andrew

When people think of a small company involved in space, data and artificial intelligence, profits don’t usually come to mind. Spire Global, Inc. (NYSE: SPIR).stock has been in the absolute lead, with a chart similar to that of NVIDIA Corporation (NVDA) and all the other followers of artificial intelligence during the extreme industry bull run of the past few months.This is a Announcement of cooperation with NVDA That pushed the stock into meme-level oversold territory last week.The company is timely Funding announced for $14.00, which may have temporarily halted the stock’s rise. However, I believe Friday’s closing price around $12.00 represents an ideal buying level, as this represents a 14% discount to funding, which may be the result of momentum traders exiting at $12.00. Loss.

As the effects of climate change become more apparent, the value of climate and weather pattern data collected from SPIR will only become more valuable. However, there were two articles last month about the company’s Seeking Alpha. If readers want to get an overview of the company, they can read these two articles. My analysis will focus on capital raising and its positive impact on future stock valuations. While two other authors give SPIR a Hold rating, the recent pullback and balance sheet improvement lead me to believe the stock deserves a Strong Buy rating.

This financing and its impact on future finances

Spire announced a direct registered offering of 2,142,858 shares of Class A common stock at a purchase price of $14.00 per share, raising total proceeds of approximately $30 million. The financing also includes 2,142,858 warrants expiring on July 3, 2024, with an exercise price of $14.50. If exercised, the warrants will generate an additional $31 million in revenue. This is a fairly unusual deal, as warrants typically have terms of one year or more. The fact that it’s structured with such a close expiration date leads me to believe that whoever wants to invest in the company on these terms, the SPIR will be well above $14.50 within the next three months in order to exercise the warrants. Otherwise, they will take longer to mature.

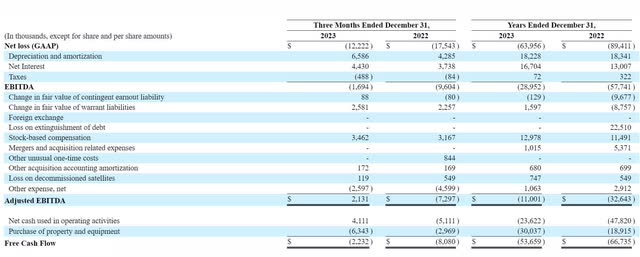

Assuming the warrants are exercised, the number of outstanding shares will increase by 19% from 22.1 shares to 26.4 million shares. It will also bring nearly $60 million in cash to the company, net of expenses. SPIR has an outstanding $118 million loan from Blue Torch, which comes with covenants and a SOFR interest rate currently as high as 13.6%. This results in the company’s net interest expense in 2023 being $17 million. Fourth quarter financial results Show the impact of interest expense:

SEC.gov

When a company shows large-scale negative operations no matter what metric is used, interest expense is just one expense among many. At that point, maintaining the company’s solvency becomes more important than optimizing the balance sheet. That’s why SPIR must accept Blue Torch loans in the first place. The fourth-quarter data, however, paints a different picture. Fourth quarter adjusted EBITDA was $2.1 million, operating cash flow was $4.1 million, and free cash flow was -$2.2 million. If the company hadn’t incurred $4.4 million in interest expenses, it would have had positive free cash flow in the quarter.

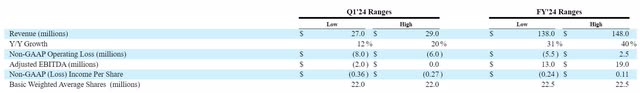

The 2024 guidelines also paint a positive picture:

SEC.gov

Midpoint revenue for the first quarter and full year were $28 million and $143 million, respectively. Midpoint Adjusted EBITDA for the first quarter and full year was -$1 million and $16 million, respectively. Unfortunately, SPIR doesn’t forecast FCF, but management said on the conference call that the company expects FCF to be positive this summer. Assuming capital purchases are aligned with depreciation, FCF should track Adjusted EBITDA reasonably closely. The main difference between them should be the interest expense. Interest expense is expected to be $18.2 million in 2024, so subtracting this total from the midpoint Adjusted EBITDA of $16.0 million yields free cash flow for the year of -$2.2 million. This is consistent with management’s statement about being positive on free cash flow this summer. When the first and second quarters were negative, the breakeven was slightly positive in the third quarter, and the fourth quarter was positive, with the annual data slightly below the breakeven point.

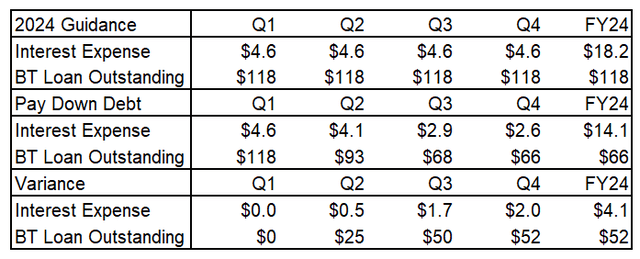

If SPIR uses the $50 million cash infusion from this financing to pay down debt, I recommend the following payment schedule.Early Termination fee Currently repayment is 2% of principal, but will drop to 1% after June 13, 2024.

SPIR 2024 Guide; My Own Estimates

For Q2, I’m assuming a $25 million payment at the beginning of the quarter. If a $0.5 million penalty was included in the interest expense item, the expense would be reduced to $4.1 million. Assuming the warrants are exercised before the end of June, another $25 million could be paid out early in the third quarter. Interest expense will decline to $2.9 million in the third quarter, including a 1% early termination fee of $250,000.

Since management expects free cash flow to be positive in the third quarter, the $1.7 million in interest expense savings can be used to further pay down debt in the fourth quarter, reducing outstanding loans by another $2 million. The end result was $4.1 million in interest expense savings and $52 million in loan repayments for the year.

Returning to the full-year forecast, the company expects non-GAAP operating results to range from a loss of $5.5 million to a profit of $2.5 million. Based on the weighted average of 22.5 million shares outstanding for the year, non-GAAP earnings per share will range from -$0.24 to +$0.11. Savings of $4.1 million in interest expense will result in improved operating performance, with losses ranging from $1.4 million to gains of $6.6 million. Taking into account financing, warrant exercise and any potential stock compensation, the weighted average number of shares outstanding this year is assumed to be 25 million. This would result in non-GAAP earnings per share in the range of -$0.06 to +$0.26.

If the company plans to use most of the cash raised in the financing to pay down debt, a 19% stock dilution has the potential to virtually eliminate the risk of a full-year operating loss while more than doubling earnings per share. Blue Torch’s outstanding loans will increase from $118 million to $66 million by the end of the year. An increase in interest expense of $2 million per quarter from Q1 to Q4 2024 will result in an increase in free cash flow of $8 million in 2025 compared to the base case, further enabling SPIR to pay down more debt faster. With its balance sheet and credit rating likely to improve significantly, the company will be able to refinance the remainder at lower interest rates and more favorable terms.

SPIR may raise cash with no intention of paying down debt. However, just looking at the timing of the warrant expiration to coincide with the 1% reduction in the termination fee, it seems to me that this financing is primarily to pay down debt. Investors may invest with this in mind. Knowing that their cash infusion will help improve their balance sheets will increase the value of their investments by reducing the risk of bankruptcy.

Conclusion: SPIR is a Strong Buy at $12.00

Unlike my colleagues on Seeking Alpha, who rated the stock at $12 following the funding announcement, I think that’s a good Buy rating level. First, the $14 funding deal shows that investors committing $30 million at that price are bullish. Even assigning a value of $1.40 to the $14.50 warrant expiring in early July (extrapolated from price data for the May and August SPIR $14 and $15 calls) still leaves a net cost of $12.60, just for to the investor’s shares. Presumably their purpose of buying is not just to break even.

Second, despite the potential for a 19% share dilution, if the company uses a majority of net proceeds to pay down debt, it would actually have a significant anti-dilutive impact on the 2024 EPS figure. On March 7, the day after the financial data and guidance were released, the stock rose 9%, from $12.50 to $13.62. Clearly, the market likes this guidance, and this upgrade would put the company comfortably above the high end of non-GAAP EPS estimates.

Third, the act of paying down debt, which is essentially toxic debt given to nano stocks in a desperate state, will greatly improve SPIR’s balance sheet risk. The company’s image will improve, making it more popular with a wider range of institutional investors.

The main negative impact of dilution will be that earnings per share and price-to-sales metrics will take a hit. Considering midpoint 2024 revenue guidance of $143 million, a $15 share price represents a revenue multiple of just 2.8x on 26.4 million shares outstanding. That’s not entirely a high number for a company growing over 30% annually, and the industry is expected to grow significantly for the foreseeable future.

Over the long term, one could argue that the company is permanently diluting itself by 19% unnecessarily. But if that dilution allows it to generate greater free cash flow faster, that means it can always implement share buybacks to offset it. Let’s not pretend that 19% is a terrible level of dilution for a stock with a market cap of less than $500 million. Companies of this size, especially those in speculative and forward-looking industries such as artificial intelligence, data and space satellites, tend to have dilution rates much higher than this due to severely negative operating conditions. It seems those days are behind us. As funds have been raised, the timeline for the boom has accelerated.

I bought SPIR stock and call options last week.