photography storm

paper

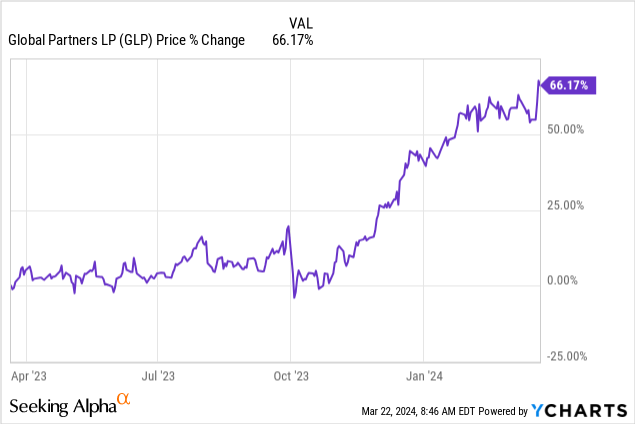

Global Partners (GLP) is a U.S. master limited partnership (“MLP”) that functions as an owner, supplier and operator of gas stations and convenience stores. MLP common stocks have soared over the past year on better-than-expected results. Expected profitability and expansion plans:

As an MLP, the company carries a significant amount of debt, structured as a revolving credit line, bonds and preferred stock.The Company currently has two series of preferred shares outstanding, of which Series A will be retired April 15, 2024. We covered GLP.PR.A in a separate article here, outlining why we expected debt collection to occur.

For retail investors who missed out on the common stock rally, there is now only one series of preferred shares outstanding, the Series B (NYSE:GLP.PR.B). In this article, we’ll look at preferred stock structure, analysis and why we think they are attractive, both from a corporate and macro perspective.

MLP Preferred Stocks – What You Should Watch Out for

MLPs, or Master Limited Partnerships, represent corporations that do not pay federal income taxes but instead pass their profits and losses on to investors, who then pay taxes on their share of the earnings. This “pass-through” model is suitable for businesses that generate stable, predictable revenue streams. As a result, many multi-tier partnerships are involved in the energy sector, owning assets such as pipelines, storage tanks, and even oil and gas.

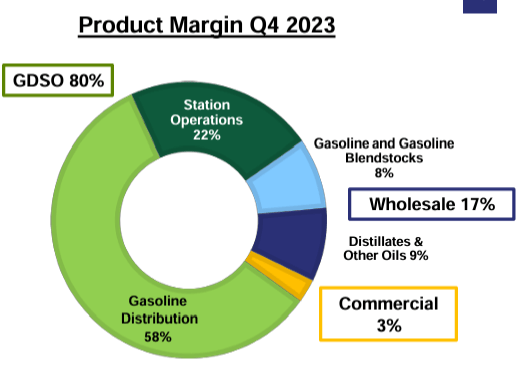

GLP is one of the largest gas station and convenience store operators in the Northeastern United States and derives most of its product profits from gasoline distribution:

Product profit (company introduction)

The MLP model relies on stable cash flow and relatively high debt levels. Before the COVID-19 crisis, many MLPs had debt/EBITDA ratios in excess of 4x, but these numbers have declined after many businesses experienced potential bankruptcies.

When preferred stock is perpetual, the preferred stock is classified as equity on the balance sheet and therefore is not included in the debt/EBITDA ratio. GLP issued two series of preferred shares, particularly since they do not impact debt/EBITDA.

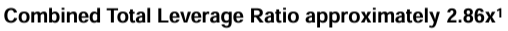

However, the company has experienced growth and its EBITDA numbers have increased, which has brought its debt ratio down to very conservative levels:

Leverage ratio (company profile)

When investing in MLP preferred stocks, investors need to be aware of one significant risk factor, namely Chapter 11 reorganization/bankruptcy. Outside of bankruptcy proceedings, preferred stock can be treated like long-term bonds.

Many multi-tier partnerships experienced difficulties during the COVID-19 crisis because revenue figures fell, but more importantly because the debt on the balance sheet was not structured appropriately, with much of the debt coming due in the short term. Companies used to favor bonds with short maturities because the cost of capital was cheap. They understand there are business costs to doing so during the coronavirus pandemic.

Issue new debt to repay preferred shares

GLP has a keen understanding of smart balance sheet management and has $400 million of 7.00% senior notes due 2027 and $350 million of 6.875% senior notes due 2029. In addition to the above-mentioned term debt with maturities exceeding 3 years, the company also recently issued in January 2024, $450 million of 8.250% senior unsecured notes due in 2032:

The company said it intends to use the net proceeds from the offering to repay a portion of its outstanding borrowings under its credit agreement and for general corporate purposes.

While part of the proceeds were used to repay outstanding amounts under the credit facility, part of the bond cash was used to return GLP.PR.A preferred shares, given the current yield is over 10%.

Note the attractive bond yields, the company was able to issue an 8-year bond at Treasuries +3%. The reason for this issuance is to exit expensive capital in the context of low leverage.

Given its conservative balance sheet management, continued growth and long-term bond maturity profile, we do not expect GLP to issue preferred shares in today’s environment, leaving only GLP.PR.B outstanding.

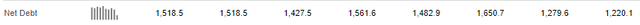

balance sheet position

Retail investors can access GLP’s balance sheet and income statement through the Seeking Alpha platform in the Financials tab. If one looks at the historical progression of net debt on GLP’s balance sheet, they’ll notice a constant figure of around $1.5 billion:

Net debt (seeking alpha)

The above are annual figures and have remained fairly stable. But EBITDA changed, it grew significantly:

EBITDA (Seeking Alpha)

While the debt numbers have remained fairly stable, EBITDA increased by 40%, making the company’s debt coverage ratio more attractive and reducing the need for preferred equity utilization in the capital structure.

How GLP.PR.B compares to other preferred stocks

Unlike ETFs or CEFs, which have similar requirements, individual companies are not fungible, especially in the MLP space. We’re not aware of any other gasoline distributor MLPs that have preferred stock outstanding, so GLP is a fairly unique company that needs to be evaluated for its own risks and rewards. Comparison using transportation MLP is incorrect because pipeline companies have different revenue stream models compared to GLP.

When will our interest in purchasing GLP.PR.B decrease?

As discussed in the yield analysis section below, we expect the preferred stock to have a term of 3 years and currently value it from a yield perspective at T+4.5%. Given that the high-yield spread is 300 basis points, relative to general high-yield collateral, the spread is back to 150 basis points. This spread is reasonable given the capital structure allocation and the payment waterfall in the event of bankruptcy. Spreads below 100 basis points are considered too tight for us, so we would not buy GLP.PR.B at current yields below 8.5% in the current spread environment.

Forward-looking expectations for the company

The company’s EBITDA expansion, supported by continued debt utilization, has proven to be a savvy operator. This growth has been fully reflected in its common equity, as demonstrated by its 66% increase last year.

For preferred stockholders, the company’s growth is less important because there is no upside to the redemption price of $25 per share. However, as the article describes, it is the entity’s ability to pay its debts that is most important. Since future debt maturities are layered (the first bond matures in 2027), there is nothing to act as a tripwire in the near future from a balance sheet perspective.

Profitability will be monitored through net profit data as well as debt service coverage and free cash flow operating data to ensure adequate debt service coverage.

Series B preferred shares offer attractive yield

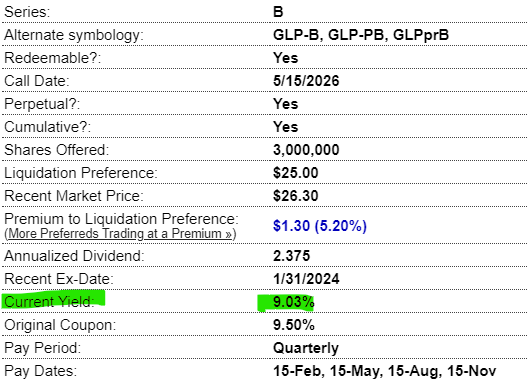

Series B are fixed-rate cumulative preferred units issued at a 9.5% coupon rate, but currently yield 9%:

Yield (PreferredStockChannel)

The series has prepared for a macro environment in which the current rate hike is behind us, and the Fed is now discussing when to start cutting interest rates in 2024. As the Fed lowers federal funds, fixed-rate debt will benefit.

It’s worth noting how the market views GLP, given that the spread between debt and preferred equity is very narrow at about 100 basis points in 2032. The wider this spread, the higher the issuer’s perceived risk. Why? Because in a Chapter 11 reorganization of an asset-rich company like GLP, debt holders will receive very high recovery rates, while the preferred stock will likely be wiped out entirely.

While the common stock carries growth prospects, and we’ve seen significant gains in GLP’s common stock, the preferred stock is like debt to a healthy company. In today’s macro environment, preferred shares with a projected maturity of 3 years and a yield of 9% are an attractive risk/reward proposition. Although the first call date is only 2 years away, we believe GLP will not call the series immediately but wait for a lower risk-free rate, so we add a 1-year term to the initial call date.

in conclusion

GLP is an MLP that operates gas stations and convenience stores in the northeastern United States. The company’s EBITDA grew, lowering its debt ratio and increasing its common equity. The company is a very smart balance sheet manager and has paid down its debt as it comes due, with its latest offering due in January 2024. A portion of the proceeds from the latest bonds will be used to retire Series A preferred stock on April 15, 2024. Investors who missed out on the common stock rally can focus on the last remaining group of preferred stocks, GLP.PR.B. The shares yield 9%, have a first redemption date of 2026, and our base case forecast is for actual retirement/redemption in 2027. With the current balance sheet structure, we believe there is no risk of GLP being included in a Chapter 11 restructuring prior to the expected redemption of GLP.PR.B, making the remaining preferred shares very valuable in today’s rate-cutting macro cycle Attractive risk/reward recommendations are expected.