champpixs/iStock via Getty Images

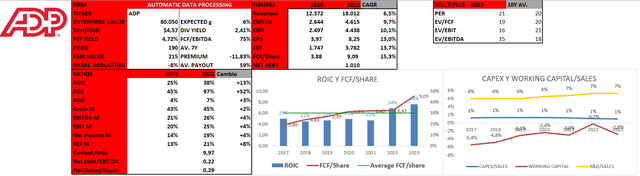

Automatic Data Processing Company (Nasdaq: ADP) was established in 1949. ADP is the world’s largest provider of payroll and human capital management services.The company offers a wide range of products and services to businesses All sizes, from small businesses to large corporations. It enjoys a recurring and capital-light business model, with revenue growing at a modest pace but operating leverage leading the way. I believe ADP is a good choice as a stable company for any portfolio, especially if those portfolios focus on a dividend growth investing strategy. In fact, total shareholder return over the past 10 years has grown at a compound annual rate of 16.5%, down 40% from its all-time high.

business model

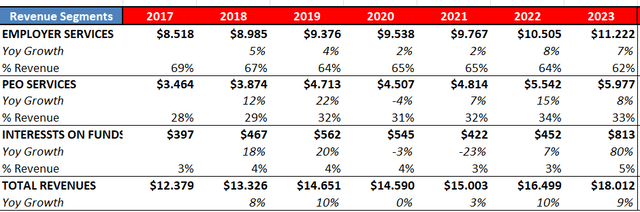

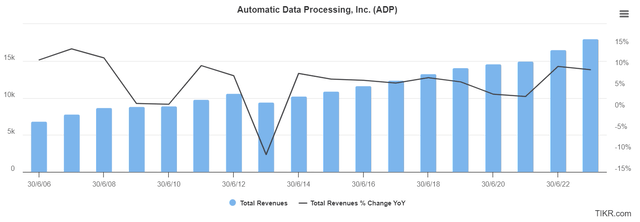

ADP’s total addressable market is $150 billion. In 2023, the company generated $18 billion in revenue, roughly equivalent to With a market share of 12%, it is expected to grow at an annual rate of 5%-6%. The company is highly diversified both in terms of its customers and their types (it has more than 1 million customers and 41 million employees) and geographically (it operates in more than 140 countries, but almost 90% of its sales are in the United States). This reduces the risk of competitor disruption and builds a strong brand image across many industries and types of customers. Customers rely on ADP services for a variety of reasons, which we will discuss later.

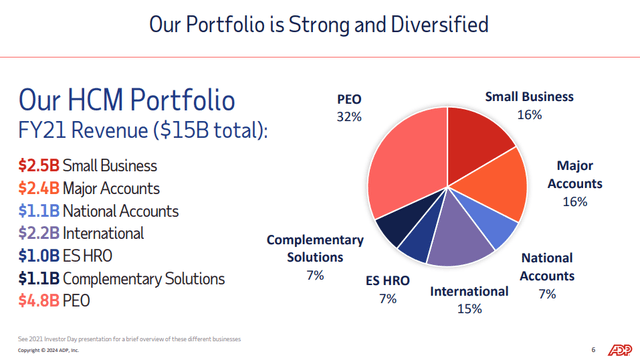

Source: ADP Investor Presentation Slide 6

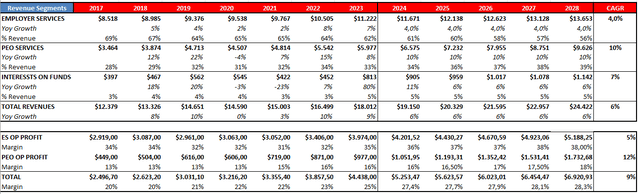

ADP divides its business into 3 segments:

1. Employer Services (62% of sales): This segment covers various business sectors, including the public services sector. Products include payroll, benefits administration, talent management, human resources management, workforce management, insurance, retirement and compliance services. It involves cloud-based software installed by companies, running on a subscription model with high repeatability, scalability and huge switching costs. These factors contribute to the segment’s operating margin of 35%.

This is the slowest-growing segment, but it also receives the most innovation in the form of new products.This could lead to higher growth, thanks to higher value-added products, e.g. ADP Next Generation.

2. Professional employer organizations (33% of sales): This segment involves human resources outsourcing. ADP provides benefits, protection and compliance, talent acquisition, general outsourcing and recruitment process outsourcing services. This is also a recurring segment, but with lower profit margins due to higher labor intensity (16% EBIT margin). It’s also an industry with less technological innovation, as it relies more on ADP employees than software.

3. Interest on funds (5% of sales): ADP earns interest on funds collected from customers for providing services. Due to higher interest rates, this option becomes more attractive as it can generate higher returns on deposits. The average interest rate for funds in recent years has been 1.9%, although in 2023 it is already 2.4%. I estimate that future numbers will be higher than the last one because I believe we will still be in a period where interest rates are higher compared to the past decade.

Source: Author’s statement

Competitive advantage

Despite their simplicity, these SaaS models often enjoy strong competitive advantages.

Switching costs: Along with accounting and cybersecurity, a company’s payroll processing is one of the key areas where it must not fail. ADP has long-standing relationships with many of its customers and the fact that it is part of the company has little incentive to innovate (e.g. I know that if a company finds a better alternative, it may have a greater incentive to change product design software, despite the costs involved, makes it a recurring product (90% of revenue is recurring) with high switching costs (90% of Retention).

Pricing power: Switching costs allow revenues to be recycled, and this recycling makes them vulnerable to price increases. ADP ended up with a few regular customers who had no incentive to change software that worked well but had little value to the company’s operational business. Therefore, customers tend to accept price increases.

Brand image: As a company with a history of nearly 75 years, it has established a good reputation. Large companies trust it to manage their payroll because they represent a marginal expense in their accounts (approximately $3 per payroll), and the consequences of failure on this part would be severe.

competitors

Despite ADP’s competitive advantages, it is worth discussing its competitors, although comparisons are not entirely equal.

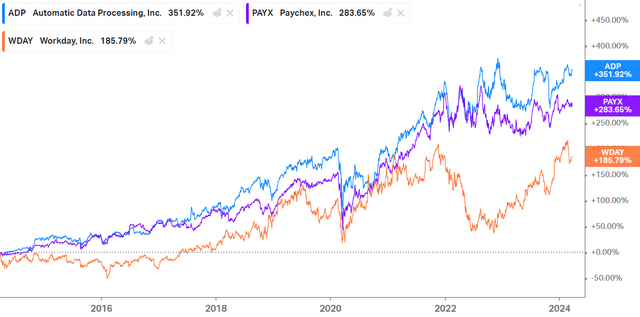

The first competitor is Paychex (PAYX). Paychex offers a very similar solution to ADP, but for smaller clients. This results in lower profit margins because these smaller clients typically sign up for more services than larger companies, which prefer to control certain services. Paychex also has a smaller weighting in the Professional Employer Organizations sector, which, as we’ve seen, has lower margins. Despite this, it has provided lower returns to shareholders over the past decade.

Another competitor that is more focused on large enterprises and is experiencing rapid sales growth (24% compared to ADP’s 6.5%) is Workday (WDAY). Workday’s product line is more similar to ADP’s employer services arm, the difference being that all of Workday’s products are cloud-based, while ADP offers some on-premises solutions. In addition, Workday does not have a PEO department like ADP. Workday made a profit for the first time this year, with an EBIT margin of 2.5%. However, if we exclude stock-based compensation (SBC), they have been free cash flow positive since 2016. Personally, I prefer subtracting SBC from FCF.

Still, ADP posted its best performance in the past decade. If we zoom out and compare performance over 20 years, the difference is even more dramatic.

Source: Coyfin

capital allocation

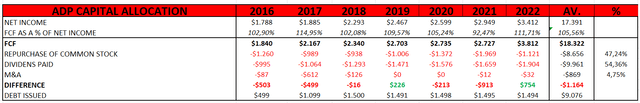

ADP is a capital-light company (capex/sales 1%) with negative working capital and does not require significant reinvestment in its business. In fact, this happens more in R&D (7% of sales) and marketing (18% of sales). If we look at where the company is allocating all its excess free cash flow, we can see that 47% is spent on buybacks, 54% is spent on dividends, and the remainder is spent on small acquisitions. The conversion rate from net profit to free cash flow exceeds 100%. The company’s high dividend yield is noteworthy. The average payout ratio is 59%, the growth rate over the past six years is 13%, and the current yield is 2.2%, which is in line with the 10-year average. I’m not a DGI investor, although I think this is one of the best stocks in this type of portfolio.

Source: Author’s statement

finance

As a recurring, capital-light model with pricing power, ADP has many of the characteristics I look for in a business. The growth rate has been stable and operating leverage is significant (sales CAGR of 6.5%, free cash flow CAGR of 15.3%). This happens because margins expand, and I believe they can continue to do so because the marginal cost of providing such services is low compared to marginal revenue. In fact, the company expects revenue to grow at a rate of 6%-7% (faster than the market) and profits to grow at a mid-to-low double-digit rate.

The return on investment is very high (38%), but the ability to reinvest is almost zero. So, as we’ve seen, they typically return all their money to shareholders, resulting in a 5% yield. Capital expenditures are only 1% of sales, working capital is negative, and there is virtually no debt (0.22x net debt/EBITDA). ADP has all the ingredients to continue creating long-term value.

Source: Author’s statement

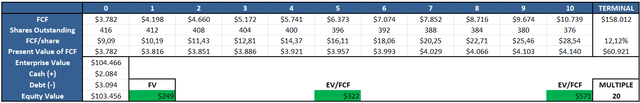

Valuation

To value ADP, I estimated the growth rates and potential profit margins its business segments could achieve. I believe that the employee services segment will likely continue to grow at similar rates to the past (4%), although they may even be higher due to higher value-added products. I believe the growth rate of the professional employer segment will increase slightly, up to 10%, as I believe companies will allocate resources to continue technological innovation and outsource low value-added tasks to avoid wasting time and resources on these tasks. Finally, I would increase the interest received on client funds to 2.5% (the average in recent years is 1.9%), resulting in a 7% CAGR for the interest portion of the fund. All this resulted in sales growth of 6.3%.

I believe this scenario is feasible because: Its scale and operating leverage come from the increasing digitization of its services. Cost reduction measures. Increases in fees charged to customers, and existing customers migrating to more advanced platforms, such as the more expensive ADP Next Gen. Combined with a higher free cash flow conversion rate and an annual repurchase rate of 1%-1.5%, this could lead to free cash flow per share growth of 11%-12%. Using a multiple of 20x (which I think is fair for the company’s quality and expected growth rate), we get a return of 8% + 2% dividend yield.

Source: Author’s statement

On the other hand, if we want to perform an inverse DCF at current prices, it turns out that the market is discounting about 11% growth using a discount rate of 10% (the minimum discount rate I usually require to discount cash). traffic model. ) and a terminal growth rate of 3%. In my opinion, it trades at fair value, which is why I waited for the price to drop to buy it. Therefore, I rate the stock a Hold.

Source: Author’s statement

risk

While we might think of ADP as somewhat cyclical, as rising unemployment during a crisis typically leads to a decline in employment, that’s not the case for this company. Its recurring model and switching costs insulate it from this impact. In fact, it only experienced a sales decline in 2013 (-10.9%).

Source: Tikr

I think there are two risks that are more important than this. One is that competitors can cause technological disruption, which can be difficult to monitor for those unfamiliar with the product. However, as we have seen, there is no significant incentive to abandon these types of software solutions. ADP also invests 7% of its sales in research and development, reaching $1.3 billion by 2023, demonstrating its commitment to staying competitive. Another risk could be that parts of the workforce in many industries are replaced by artificial intelligence. It is even conceivable that companies could develop their own human resources software. However, I also don’t think this is a significant risk given the marginal cost savings versus the fees involved and the vast amount of data and information ADP has.

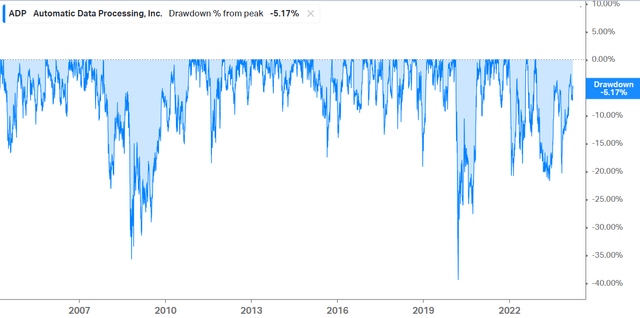

Still, one thing I like about the company is the stability of its share price. Over the past 20 years, it has never fallen more than 40%, making it easier to hold it in a portfolio. Additionally, retracements of 15% to 20% from highs have proven to be good buying opportunities.

Source: Coyfin

in conclusion

I believe ADP is a good company at a mature stage, but with stable future growth prospects and substantial shareholder returns. The business model is solid, and so is all the data. However, I believe the stock is trading at fair value, so I would wait a bit before adding to my position in this great company. Regardless, I think this is an excellent choice as a portfolio anchor or dividend growth investor.