ceramic graphics

The S&P 500 Index (SPY) broke out decisively higher again this week. This follows weeks of stagnancy and shifts in market behavior (lower weekly closes, weak Friday moves) but failure to achieve a decisive breakdown.As in last weekend’s article It concluded: “The chart shows indecision rather than a strong signal…the odds are still slightly in favor of the bulls.” As we will see later in the article, the rebound continues to remain within the trend channel.

This weekend’s update will look at a higher time frame view, new upside targets, and move the bearish inflation point further upwards. Various techniques will be applied across multiple timeframes in a top-down process, while also taking into account key market drivers. The purpose is to provide actionable guidance with directional bias, significance levels, and expectations for future price movements.

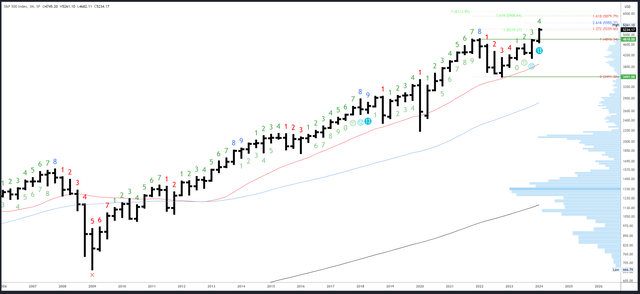

S&P 500 Monthly/Quarterly

Next week will be the last week of the first quarter and it is important to always keep the higher time frames in mind (I am also monitoring the yearly bar that happens to complete the exhaustion signal in 2020). On March 3, I commented on how bullish the quarterly bar chart was, speculating that it “could end strong (which obviously means March also ends strong).” This looks to be playing out and the end-of-quarter window dressing will contribute to the bullish view.

The Q2 bar will likely continue to move higher into early April, and while I still think we may see a correction, I’ll take any guesswork out of my analysis. The first step in the reversal will be to trade back to the first quarter range.

SPX Quarterly (Tradingview)

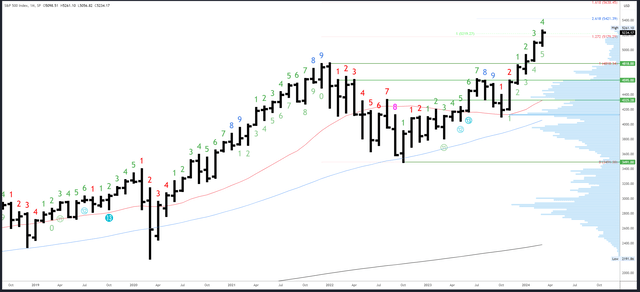

On the monthly chart, the March bar may form a continuation bar to April. Currently, the rebound has broken through the 5219 level as measured, and the current rebound from the October 23 low is the same size as the rebound from October 22 to July 23. The next significant Fib extension will be a sharp move higher at 5421, but more importantly, the measured move may still react.

SPX Monthly (Trading View)

There has been little reaction to the previous Fibonacci targets so far, which speaks to the strength of the trend. 5421 is the 261% extension of the July-October 23 retracement, but is not a key indicator and is not consistent with any other indicator. The other major targets are much higher, which makes me think we could still see the 5200-300 area reacting to the major metric moves mentioned earlier.

The March range will be important once it is determined at next week’s close. February’s high of 5111 is also potentially important.

The wait for the next monthly Danish signal will be long. March is the 4th bar (possibly the 9th bar) in the new upside exhaustion count.

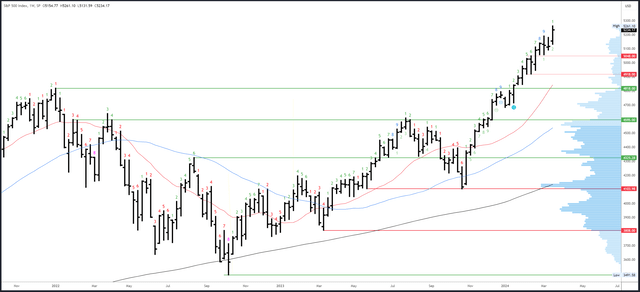

S&P 500 Index Weekly

After two weeks of “Doji” bars, the uptrend is back active.As highlighted last week, a “Doji” simply indicates indecision – it able leads to a reversal, but is certainly not bearish in itself.

The formation of a continuation bar this week suggests that the S&P 500 could rise further above 5,261 next week.

SPX Weekly (Trading View)

The 5261 high is the only real resistance.

The gap of 5117-5131 is the first support area, while 5048-5056 is the key turning point area.

Denmark’s upside exhaustion signal has been activated. This has led to stagnation in recent weeks and could still lead to a reversal, but time is running out.

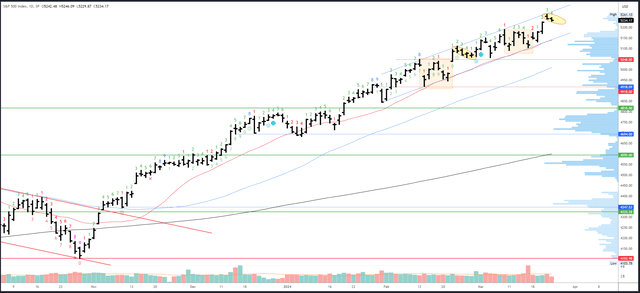

S&P 500 Daily Index

Last week’s article highlighted a repeating pattern that predicted a strong move to new highs. This appears to be continuing on the small daily bars on Thursday and Friday (similar to February 23rd and 26th – see chart below). This suggests a slow consolidation will form in the first half of next week, leading to further highs before reversing again.

The daily channel is now well formed and will be closely watched, which could lead to some erratic action on the next test of support.

SPX Daily (Trading View)

Thursday’s move was mildly bearish, with resistance at 5261. The channel rises about 10 points each trading day and may also act as resistance. Cautious movement occurs at 5371, with the rebound from the January lows equaling the Oct-Dec 23 rally.

Gap filling at 5226 is initial support. The breakout area of 5179-89 is more important and is likely to be aligned with channel support and the 20-day moving average, which will be at 5151 on Monday, with a daily gain of about 10 points.

The daily Danish Exhaustion signal will appear on Monday at bar 5 (out of 9 bars). Reactions are usually seen on bar 8 or 9, so a pause is possible Thursday/Friday. Since this signal has to compete with the end-of-quarter window dressing, I’ll be writing about the larger reaction in the first week of April.

Driver/race

Although the dot plot predicts only three rate cuts instead of four in 2025, the FOMC meeting is still considered dovish. Markets are more concerned about the here and now, with Powell asked whether the strength of the labor market would allow the Fed to delay a rate cut. His answer was “not necessarily,” which relieved doves and gave the rally the green light.

Next week’s calendar is much quieter. Gross domestic product data, jobless claims, pending home sales and consumer sentiment data will be released on Thursday. The stronger the stock, the better. The main event on Friday is the release of the core PCE price index, which seems irrelevant given the Fed’s comments and market reaction to CPI/PPI. That said, reactions depend on sentiment and position, so it depends on how the S&P 500 is trading when it’s released on Friday, for example, if it’s at this week’s lows and hot data comes out, it could cause a big move to the downside.

Possible changes next week

End-of-month/quarter window dressing and last week’s breakout suggest that the rally should continue to new highs above 5261, with the daily channel likely to act as rising resistance toward 5300. The first quarter is likely to end near the highs and March is expected to be followed by the second quarter.

Initial support is at 5226, but more importantly 5179-89. This marks a breakout zone, below which a fall could lead to a period of weakness, with a breakout of the daily channel/20-day EMA likely on a fifth test. Bulls can bet that this won’t happen next week, and if the comparison highlighted on the daily chart comes to fruition, the slight decline in the first half of the week should hold 5179-89 and move to new highs.

The daily channel will eventually collapse, and since it’s becoming a bit obvious, I’m speculating that it will collapse in early April. If this happens, 5048-5056 will become critical and an inflection point for 4818.