High/E+ via Getty Images

If you’re a concentrated investor like me, you’ll want to choose industry leaders rather than unnecessarily expose yourself to lower quality companies.

Booking Holdings (NASDAQ: BKNG) is one of the most famous names The online travel market, I think, is an attractive way to capitalize on the growing demand for experiences as the world’s GDP continues to grow and people’s desire to travel is insatiable.

Is Booking the best horse to choose in this race? let’s see.

Online travel market

Travel is arguably the most desired experience that people crave. It’s the best way to create happy memories, and despite its casual nature, I wonder how many people regret spending their hard-earned money on travel.

It is therefore not surprising that travel as a share of global GDP has risen over the long term as people Become richer and have more spare money to spend on travel. In 2019, tourism accounted for a record high proportion of GDP 10.4%it is expected to exceed this level in 2024.

To understand the industry’s potential growth drivers, I’ll quote Booking CEO Glenn Fogel:

If we agree that world GDP will continue to grow over time, and GDP per capita will continue to grow, then as people become wealthier they will spend more money on services or experiences, which is quite logical . Once you’re rich enough to own an apartment, or own a couch, you don’t buy a couch or a condo every year. All you have to do is travel more frequently or travel to a higher level, or both. We see time and time again that as GDP per capita rises, so does travel.

— Booking Holdings Q3’23 Earnings Conference Call (Edited by the author).

Generally speaking, the tourism value chain consists of transportation, accommodation and attractions. Each link in the chain represents a highly fragmented and competitive market with a diverse customer base from all income levels and varying preferences.

For example, transportation includes dozens of airlines, some low-cost, some luxury, some business-oriented, and some a mix of all. Accommodation is similar, including hotels, hostels, camping, apartments, etc.

In today’s connected world, marketplaces like Booking offer unique opportunities to capture value from many parts of the value chain, as they offer a range of accommodation options, transportation and a variety of attractions.

Not only does Booking have the broadest reach in the value chain, but unlike an actual provider of end products, it is technology-driven, has low capital requirements, and has relatively high profit margins.

So, as a basis for discussion, I think it’s a great tool for investing in the tourism industry.

Business overview

Booking Holdings owns multiple brands in the online travel agency market, including Booking.com, Priceline, Agoda, Rentalcars.com, Kayak and OpenTable. Booking.com is the most important part of this business.

Booking Holdings 2022 10-K

Booking operates as an online agency through which travelers can book accommodation, and over the past few years the company has expanded its services to include flights, attractions and transportation.

Expedia and Airbnb are consistent share recipients

For the purposes of this section, I compiled data on Airbnb (ABNB), Booking, and Expedia (EXPE), three of the world’s largest online travel marketplaces, which also happen to be publicly traded companies. Therefore, this is entirely based on their public data, rather than third-party data, which lacks consistency and is difficult to rely on.

Another important note is that if you listen to their earnings calls, you’ll see that their respective management say they are taking market share and leapfrogging their competitors. This might be true if we include smaller players in the space, but if we focus on just these three players, obviously, they can’t all be share gainers.

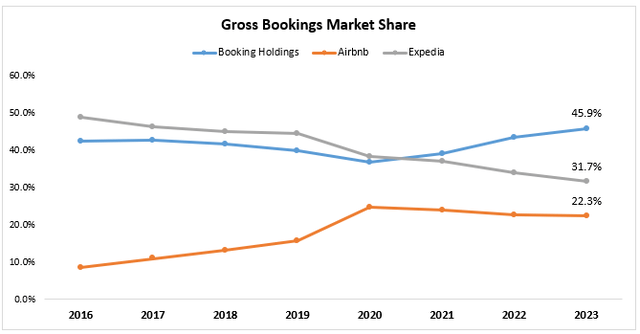

total bookings

In 2023, Booking’s total bookings were $150.6 billion, Airbnb’s $73.3 billion, and Expedia’s $104 billion, for a total of $328 billion.

Established by the authors using data from company financial reports.

We can see that Booking’s market share is 45.9%, an eight-year high, while the market shares of Expedia and Airbnb are both declining. Looking at the longer timeline, we can see that between 2016 and 2019, Airbnb took share from Booking and Expedia, with the latter being the main loser. Then Covid-19 hit and most hotels were closed, leading to an unusual year for the industry.

After the epidemic, Airbnb’s market share has been hovering in the 22%-23% range from 2021 to the present, while Expedia’s market share continues to be occupied by Booking.

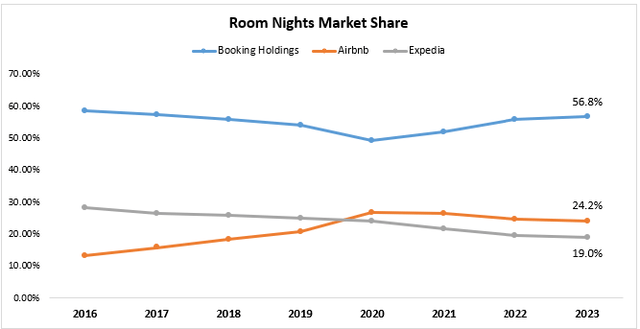

Room nights

Total bookings include all types of bookings made on the platform and, for Expedia and Booking, flight and transportation bookings. Therefore, the number of room nights should provide another perspective on the company’s market position, especially in terms of accommodation, and make up for the price difference.

In 2023, the total number of room nights booked on the three major platforms will reach 1.84 billion, of which Booking’s room nights will be 1.05 million, while Airbnb and Expedia’s room nights will be 448 million and 351 million room nights respectively.

Established by the authors using data from company financial reports.

Similar to the trend in gross bookings, Booking’s market share hit a seven-year high at 56.8%, compared to Airbnb’s 24.2% and Expedia’s 19.0%. While Airbnb has returned to pre-pandemic trends, Expedia has been losing market share since 2016.

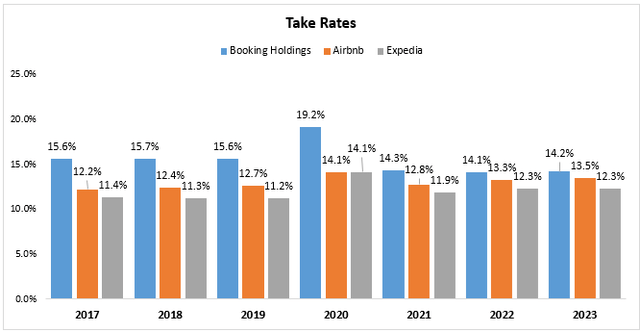

take price

As Booking’s share grows significantly, one can expect adoption to decline, meaning the platform is giving up revenue to acquire customers. However, it is not.

Established by the authors using data from company financial reports.

Calculating total revenue divided by total bookings, we can see that Booking has historically had the highest acceptance rate of the three. That being said, Booking is the only one of the three that has a lower acceptance rate in 2023 than in 2021, albeit by a very small margin.

In my opinion, Booking’s adoption decline is primarily due to the addition of products like flights, which have lower adoption rates.

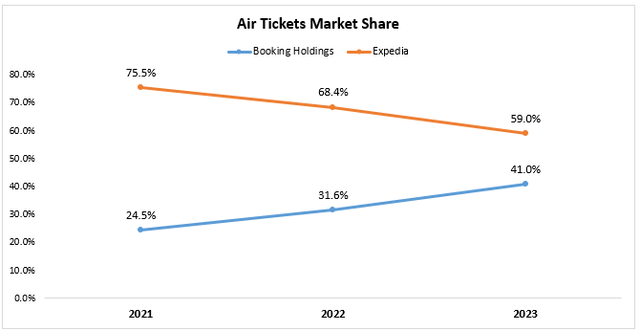

flight

This is only relevant to Booking and Expedia.

Since Booking started reporting the number of flights booked on its platform in 2021, we’ve seen significant growth in this area. In 2023, bookings facilitated 36 million air ticket transactions, more than double the booking volume in 2021.

Established by the authors using data from company financial reports.

During this period, Expedia’s growth slowed significantly, resulting in significant share losses. In 2021, Booking’s share will be less than 25%, and in 2023 it will reach 41%.

Despite being the leader, booking deals are still cheaper than Airbnb

From an operational perspective, I think we can conclude that Booking is the number one player in the market. The company consistently captures market share in every product line while maintaining industry-leading share.

It also has the highest operating and free cash flow margins of the three, and has had the highest growth rate over the past three years (based on 2020).

Considering everything we discussed above, I expect Booking to trade at a premium. However, it is not.

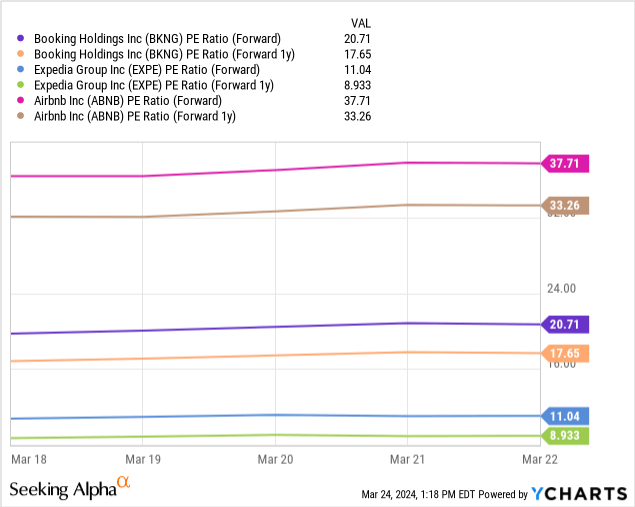

As we can see, Booking trades at 20.7 times projected 2024 earnings per share and 17.7 times projected 2025 earnings. Airbnb’s price-to-earnings ratios are 37.7 times and 33.3 times 2025 estimates, reflecting premiums of 82% and 88%, respectively.

Expedia’s valuation is much lower than Booking’s, but as it continues to lose market share, I find its lower valuation justified.

Importantly, Booking’s earnings per share are expected to grow 17.3% and Airbnb’s are expected to grow 14.1% by 2025, with PEG ratios of 1.0x and 2.4x respectively.

Valuation

Therefore, I find Booking very attractive relative to its peers. We still need to evaluate whether Booking is an attractive investment.

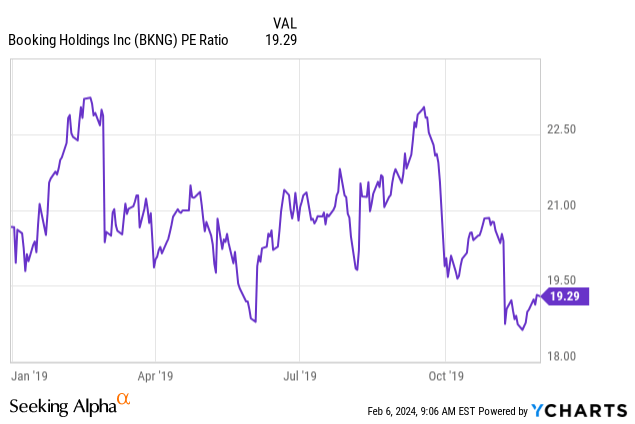

The current price-to-earnings ratio of 20.7x is a historically low level for the company. Before the pandemic, the only relevant year to watch in terms of Booking’s historical valuation was 2019. We can see that the stock was trading between 20x and 23x at the time.

Arguably, this suggests that Booking is trading at the lower end of its valuation range. But there’s more to this story.

Booking today is a different company.

It has more influence in the value chain such as flights, transportation and alternative accommodation. It has a stronger brand, with more than half of its bookings coming directly from its app, and a broader customer loyalty program. Additionally, it has built a comprehensive payment processing system, which helps it get more value from every transaction.

Therefore, I think Booking should recover to the high end of this range in the near term. Based on forecast 2024 earnings of $175.0 per share, I estimate Booking’s fair value at $3,940 per share, which gives us 9% near-term upside based on a P/E ratio of 22.5x.

risk

As I said, I expect Booking to return to the high end of its valuation range by the end of the year. That said, there are some risks that could prevent this from happening, which are currently weighing on the stock.

First, the economy is slowing down. The looming recession was already two years ago, and while it hasn’t arrived yet, we’re already seeing signs of consumers becoming more price-sensitive. Travel is a discretionary expense that can easily be crossed off your expense list. We haven’t seen this in the company’s results so far because demand is so strong post-pandemic, but the company’s 2024 guidance suggests a return to normal levels.

Second, geopolitical tensions have increased. The company said the conflict in the Middle East had a negative impact on 4Q23 results, and they expect it to be a 1% drag on revenue growth in 2024. As the crisis continues to unfold, the impact may be more severe than initially thought, although Booking’s management has a track record of being very cautious in its guidance.

Finally, regulation.Booking is face Spain was fined US$530 million for anti-competitive behavior, and Italian antitrust authorities are also investigating. Additionally, the company has a history of acquisitions, prohibited The EU recently attempted to acquire online flight agency Etraveli.

Overall, I think these risks are the main reason Booking trades at 20x earnings, which means they are priced in and I find them transitory.

in conclusion

I find the travel industry an attractive area to invest in because it is much less cyclical than people think. I would say that this is an industry that continues to grow, and with the growth of wealth and digitization, it will occasionally go through cycles.

I think Booking is the clear leader, with continued market share growth and industry-leading profitability.

With concerns growing over a slowing economy, heightened geopolitical tensions, and increasing regulatory pressure, I think it’s reasonable for the company to trade at the lower end of its valuation range.

However, I believe Booking is well-positioned to capitalize on the industry’s growth as we emerge from the temporary downturn.

Therefore, I rate Booking a Buy and encourage investors to start accumulating shares at these levels.