Afternoon pictures

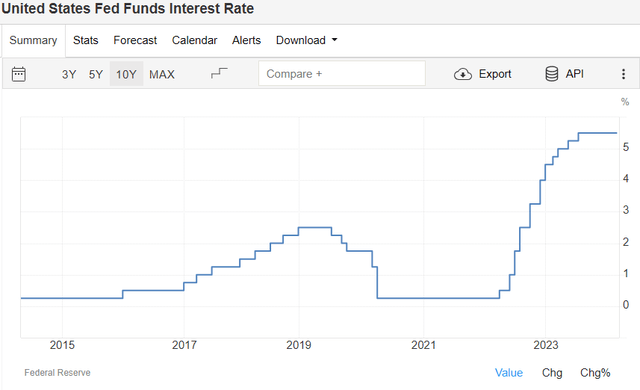

One of the biggest questions is what happens to business development corporations (BDCs) when the Fed begins its rate-cutting cycle. BDCs become increasingly popular during rate hike cycles because they deliver greater returns to shareholders, and The rate of return on its distributed income compared to a risk-free asset. I think many popular BDCs will do well in a lower interest rate environment, especially Ares Capital (NASDAQ:ARCC), often called the gold standard in the BDC field. price Remaining at multi-decade highs, the reduction cycle is not expected to reach 3% until after 2026. I don’t think it’s time to give up on quality BDCs, especially ARCCs. Historically, Asian Studies Center Having maintained its larger dividend through different interest rate environments, I believe a slowly falling interest rate environment could be beneficial for ARCC As the cost of capital falls, expansion opportunities become more attractive to lower- and middle-market companies. I think top BDCs will remain strong income investments, with investors likely to flock in as capital flows back into the market from the sidelines. ARCC may not be as good a buy today as it was last year, but I still like ARCC as an income investment and look forward to reinvesting the dividends and adding to my position in 2024.

Seeking Alpha

Following my previous article on ARCC

I have been bullish on ARCC for some time and gave ARCC a very bullish rating in my last article published on October 22, 2023 (which can be read here). Since then, ARCC’s stock price has increased by 7.01%. Counting dividends, the total return rate is 12.21%. ARCC’s return trailed the S&P 500’s return by 24.32%, but it didn’t compete with the market. In that article, I discussed why I am a buyer heading into Q3 earnings and why I think ARCC can continue to benefit from current interest rate conditions. I’m following up on this investment idea as a lot of macroeconomic data is released and we get a clearer picture of where interest rates will go in the future. I’ll take a look at how ARCC finishes fiscal 2023 and offer my thoughts on why I’m bullish on ARCC entering a declining rate environment.

Seeking Alpha

Risks to My ARCC Investment Thesis

ARCC will either remain a strong investment or deteriorate based on its underwriting capabilities. The biggest risk to ARCC’s investment thesis is not when interest rates will fall or how fast they will fall, but whether their investments hold up. As a BDC, ARCC holds equity in companies or provides capital in the form of different types of debt to companies in the lower and middle markets. If a company to which ARCC lends or has a stake suffers unexpected losses or changes in the operating environment, causing its performance to fail to meet expectations, ARCC may be seriously affected. The ability to pay interest and repay the loan was called into question, and the equity was worth less than the assets they had acquired. ARCC’s strength depends on the companies it does business with and its underwriting team’s ability to model the future landscape. If we enter a recession that ends up being prolonged, companies doing business with ARCC face greater risk than large-cap stocks, which could impact ARCC’s returns. Investing in ARCC can generate capital appreciation and huge dividend yields, but it also carries a lot of risk because the overall economy is unpredictable and there is a lot of trust placed in the ARCC team to strike strong deals that will survive a recession. Mitigating economic downturns when they occur.

ARCC is on track for strong performance in 2024, and I believe it can continue to maintain financial strength in a falling interest rate environment

2023 is shaping up to be ARCC’s strongest year in the past decade. ARCC had revenue of $2.61 billion and operating profit after operating expenses was $1.87 billion. ARCC’s net profit after interest expense and taxes was $1.52 billion. ARCC’s operating profit margin for fiscal year 2023 was 71.46%, and its profit margin was 58.23%. ARCC’s revenue increased by 24.71% year-on-year, and its operating income increased by 16.6% compared with the same period last year. 2024 marks 3RD Its revenue has grown year after year as its metrics continue to improve. On a per-share basis, ARCC’s GAAP net income for the fourth quarter of 2023 was $0.72. Its core earnings per share increased to $0.63 per share from $0.59 per share in the third quarter of 2023. On an annualized basis, ARCC’s core earnings per share were $2.37. In fiscal year 2023, the annual increase is $0.35 (17.33%), and the net asset value (NAV) increases from $18.40 to $19.24.

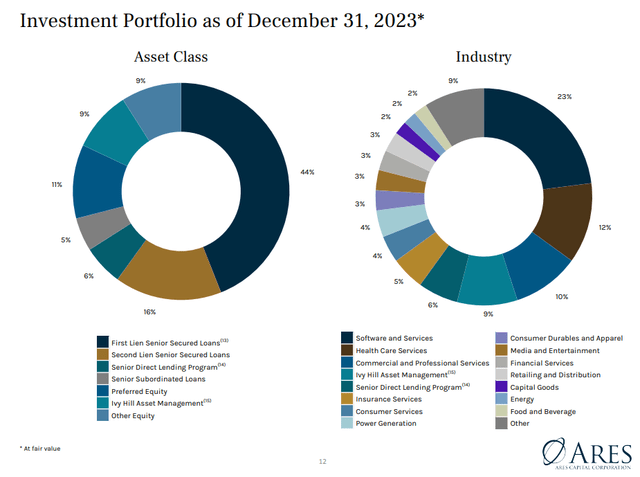

In 2023, ARCC’s portfolio will grow to 505 borrowers, an 8% annual increase and 47% growth over the past five years. Only 2 investments represent more than 2% of the portfolio, with the top 10 investments accounting for 12% of ARCC’s portfolio on a fair value basis. Throughout 2023, ARCC secured approximately $6 billion in new investment commitments across 200 transactions. In the fourth quarter, ARCC secured $2.4 billion in investment commitments from 74 borrowers, indicating that the origination markets in which they operate remain healthy. In 2024, ARCC collected 99% of contracted interest on its underlying investments, demonstrating the strength of its underwriting team. This enabled ARCC to generate net investment income (NII) of $1.27 billion, resulting in a net profit of $1.52 billion when net realized and unrealized gains are taken into account.

Ares Capital

this Fed It was not until the first quarter of 2022 that interest rates began to be raised, with interest rates raised by 25 basis points in the past two years. The Federal Reserve raised interest rates from 25 basis points to 550 basis points in a year and a half. In 2021, ARCC generated $1.82 billion in revenue and $1.14 billion in operating income, shaking off rates that were more than half of 2020 and essentially non-existent for all of 2021. ARCC has 69% of its interest income tied to floating rate debt and 12% to fixed rate debt. Its debt and other income-producing securities have an average yield of 12.5%.this Fed Rates are expected to fall to about 460 basis points in 2024, 360 basis points in 2025 and 310 basis points in 2026. ARCC’s investments are a long way from generating significant investment income, and their ability to issue fixed-rate debt is at its highest level in decades. Interest rates are not expected to fall below 300 basis points until at least 2027, and ARCC will continue to make loans at these levels. Going forward, I believe ARCC can actually do better than its 2023 results as it becomes a mass-produced game. As the cost of capital falls, businesses will be more likely to expand, and ARCC may see an influx of new startups, which could push NII levels higher. Companies in which ARCC’s equity investments are invested may also perform better, causing the fair value of ARCC’s equity investments to increase. The Fed is not expected to cut rates as fast as it raises them, and I don’t think a slowly declining interest rate environment will have a negative impact on the ARCC.

trade economics

ARCC can continue to be an income champion for investors

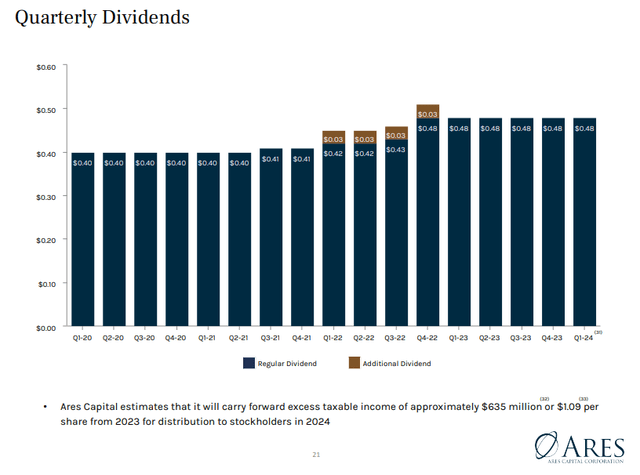

In a largely non-existent interest rate environment, ARCC did not cut its dividend and, in fact, increased it. In 2021, the quarterly dividend increased from $0.40 to $0.41, and in 2022, ARCC increased the quarterly dividend all the way to $0.48, while paying special dividends every quarter. Today, ARCC shares are trading at $19.99, with an annual dividend of $1.92 and a yield of 9.6%. ARCC’s dividend income has been reliable during the pandemic and throughout the low interest rate environment.I expect ARCC to continue to be a high dividend payer, especially because BDC They can avoid paying corporate tax if they distribute at least 90% of their taxable income through a dividend plan. The quarterly dividend of $0.48 is currently supported by NII of $0.60 per share and core EPS of $0.63. ARCC has plenty of room to continue paying its current dividend.

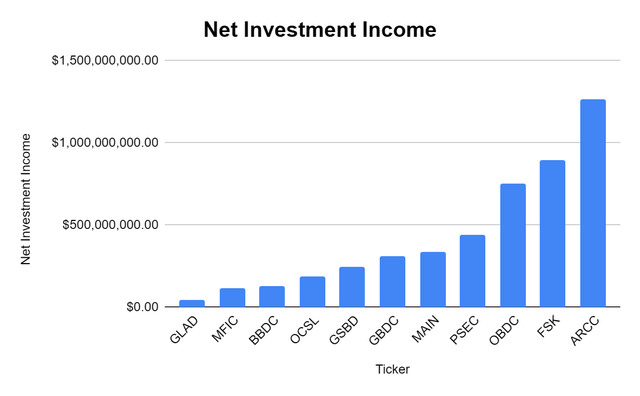

Currently there are $6.36 trillion Remain on the sidelines in money market accounts, regardless of capital tied to certificates of deposit and Treasury bills maturing next year. As the risk-free rate of return begins to decline, I think BDCs will become more popular as an alternative to Treasury bills and cooling methods for generating income. Asian Studies Center Considered the gold standard as it has the largest net assets and generates the most NII in the BDC industry. As interest rates start to come down, I think a significant amount of capital will return to the equity market and we will see income investors looking to recreate income through their portfolios, which will include BDCs. I believe ARCC will be at the top of the list because its dividend record is similarly stable, and when investors look at the underlying financials, ARCC appears to be well-positioned to maintain its dividend at current levels.

Ares Capital

ARCC compared to peers

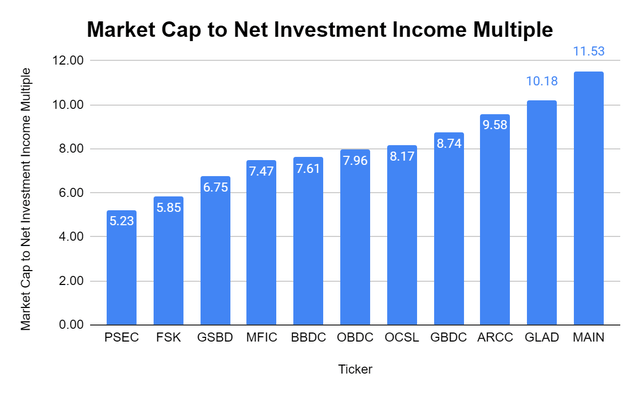

I track 12 BDCs so I can compare how the peer group trades and how a single BDC is valued. The peer group I compared ARCC to consists of the following BDCs:

- Main Street Capital (MAIN)

- Prospect Capital Corporation (PSEC)

- Barings Bank BDC (BBDC)

- Blue Owl Capital Corporation (OBDC)

- Medium Financial Investment Company (MFIC)

- Goldman Sachs BDC (GSBD)

- Oak Tree Specialty Lenders (OCSL)

- Golub Capital BDC (GBDC)

- FS KKR Capital Corporation (FSK)

- Gladstone Capital (GLAD)

- Sixth Street Specialty Lending (TSLX)

ARCC is the largest BDC in terms of NAV and the amount of NII it generates. I’m always tempted to pay a premium for BDC’s NII, but I do think a premium should be given to good companies. Today, ARCC generates $1.27 billion in NII, and its market capitalization is 9.58 times that of NII. 8.1 times higher than the industry average. Of the 12 BDCs I track, only 3 have NII generation in excess of $500 million, so paying slightly above the peer average for ARCC seems reasonable to me. I’m happy with where ARCC trades and think it deserves a higher premium due to its quality.

Steven Fiorillo, “Searching Alpha” Steven Fiorillo, “Searching Alpha”

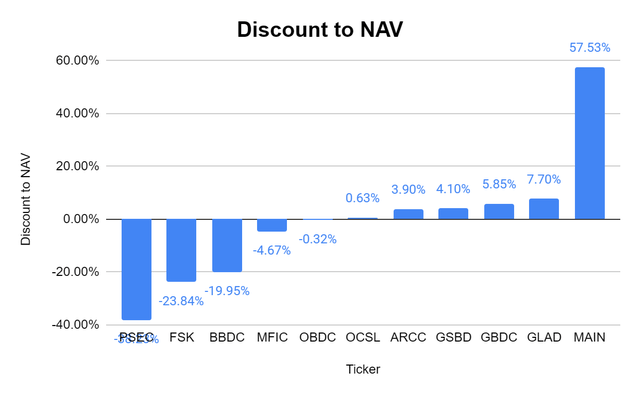

In addition to market cap at NII multiples, I often look at how much of a discount or premium a BDC trades at compared to its NAV. ARCC trades at a premium of 3.9% to its NAV compared to a discount of -0.66% to its peers. I feel comfortable with ARCC’s premium when I see BDCs like MAIN continuing to trade at more than 50% above their NAV. I think a 3.9% premium is reasonable and I wouldn’t be surprised if it trades at a premium between 5-10% in the future.

Steven Fiorillo, “Searching Alpha”

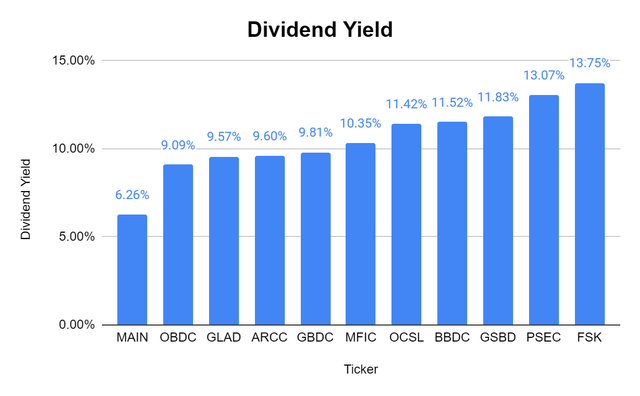

BDC is known for generating high dividend yields, and ARCC’s current dividend yield is 9.6%. While this is lower than the peer average of 10.57%, I have no complaints about investing with a 9.6% yield. I think some BDCs with double-digit yields are undervalued, which results in ARCC being below peer average.

Steven Fiorillo, “Searching Alpha”

in conclusion

Even though ARCC is up 15.58% over the past year, I think the stock is still a buy for income-focused investors. The odds of ARCC outperforming the market are slim, but compared to its core EPS and NII, its ability to continue generating dividend income of $1.92 per share looks safe. I think ARCC shares will move higher over the next year, and entering a lower interest rate environment won’t hurt the investment thesis. Today, investors can lock in a 9.6% dividend yield on cost, while the shares trade at a slight premium to NAV. As we enter a falling interest rate environment, I think the top BDCs will become magnets for capital seeking to recreate income from Treasury bills and cold snap movements. I’m long ARCC and still see this as an opportunity to generate above-average yields and capital appreciation.