Pasha Petchenkin

last summer i believe Aspen Aerogel (NYSE: ASPN) It doesn’t keep investors out of the cold like its product should.The company then talked about its commitment, but it didn’t convince investors because it took so long shown in the results.

With the business’s sales growing rapidly and operating leverage improving in recent quarters, investors have grown more confident in the story, and for good reason.

I like the business and the prospects, which appear to be supported by fundamentals at the moment, even after the impressive run up.

About business

Aspen Aerogels is an “energy” technology company specializing in high-performance aerogel insulation materials for use in large-scale energy infrastructure.

Compared to traditional thin blankets, these insulating blankets and related products provide superior thermal performance and save energy consumption while providing Better protect workers and assets.

The products, labeled Pyrogel and Cryogel, are used by companies such as oil producers, refineries and the wider petrochemical industry to maintain pipelines and other equipment in high and low temperatures.

The company went public in 2014 at $11 a share as it targeted a niche market estimated at around $3 billion. Note that the business was still relatively small, with less than $100 million in revenue and huge losses at the time.

Over the next decade, dramatic fluctuations were observed. Since the public offering, shares have gradually fallen to lows around $1 in 2018. It’s easy to see why the stock is trading so poorly, with 2021 revenue stagnant at around $120 million (about the same as when it went public): The company continues to post huge operating losses.

Peaks driven by energy markets

The energy crisis following the war in Russia and Ukraine sent shares to a high of $60 per share, but then fell again to $8 per share in the summer of 2023.

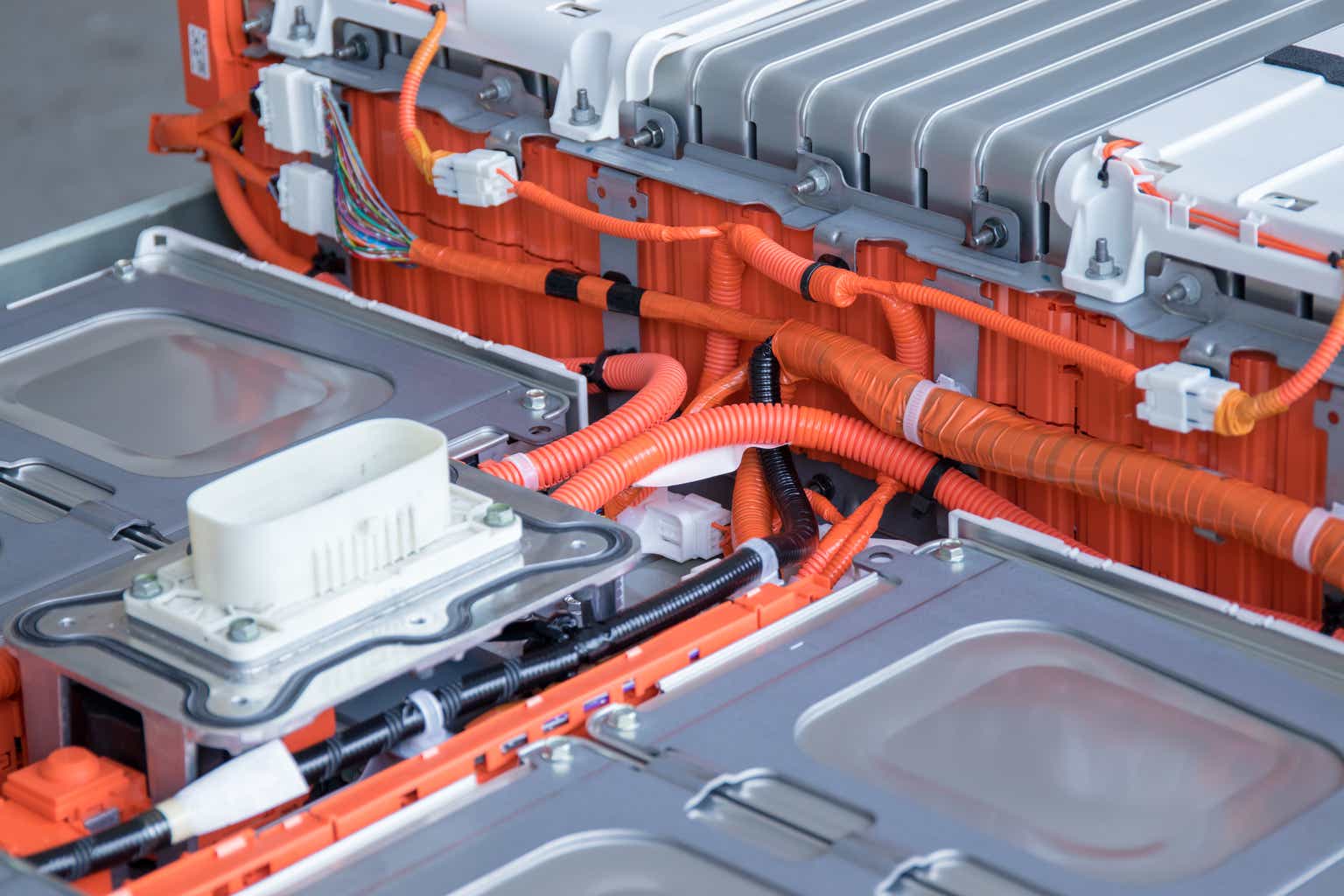

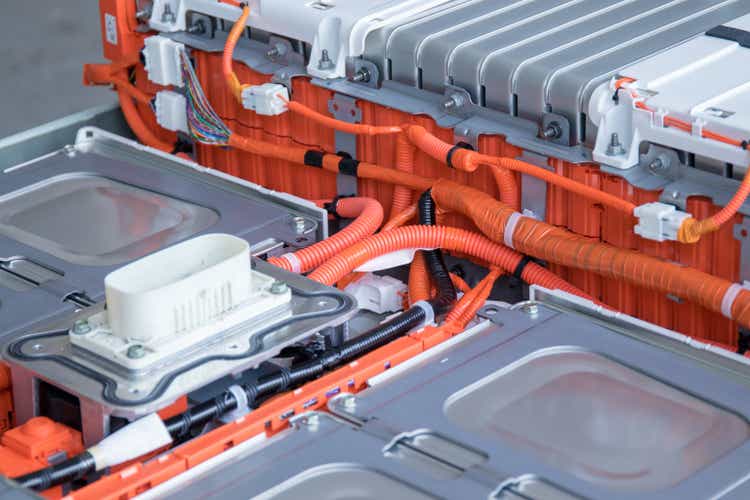

The company has developed another business line compared to when it was issued. In addition to its core energy industry business, the company has developed a thermal barrier business for electric vehicles. There is certainly a huge potential market in this market where Aspen offers lighter weight, thermally safe energy packaging solutions.

Revenue is up 48% in 2022, to $180 million, but that’s good news because gross profit of $5 million leaves little profit potential, and an operating loss was reported at $79 million.Although the company claims to be General Motors (GM) and German luxury OEMs, which still needs to translate into results.

Initially, the company expected 2023 sales to be in the range of $200 million to $250 million, but that growth was unimpressive and, of course, the projected $500-60 million EBITDA loss was compared to the $60 million reported in 2022. There was a slight improvement compared to the US dollar EBITDA loss.

These losses and substantial net capital expenditure requirements to expand capacity create a very uncertain roadmap in terms of cash flow and continued dilution going forward. Last June, Aspen’s operating assets were valued at $300 million. It’s easy to say that Aspen has experienced a lost decade. Although the commercial appeal is compelling, the loss problem and huge investment needs have left investors ( including myself) was very unhappy. cautious.

things have improved

August, Aspen Aerogel report Second-quarter sales grew only 5% to $48 million, and despite the soft sales, the company reported a significant improvement in gross profit and an improvement in operating losses to $17 million.

By October, the company declare Audi will use PyroThin solutions in its vehicle platforms by 2025. The company currently expects sales to exceed $225 million in 2023 and EBITDA losses to fall to $30-40 million.

In November, the company report Third-quarter sales grew 66% to $60.8 million, while operating losses fell to $14 million and changed.To address its dwindling cash balance and take advantage of rising stock prices, the company Sell A December offering of 6.1 million shares at $12.375 per share raised $75 million in proceeds.

In January, the company pre-announced full-year sales of $238 million, with fourth-quarter sales rising 38% to $84 million. Sales are expected to reach $350 million in 2024, and this momentum will continue, including potential upside in electric vehicle numbers.

In February, the company reported fourth-quarter sales of $84.2 million, but the company actually reported an operating profit of $1.2 million, and its net loss after interest expenses was still small. What’s more, fourth-quarter adjusted EBITDA was $9 million, while the company’s 2024 EBITDA guidance is around $30 million, suggesting the company will essentially break even in 2024.

The company needs to continue making these investments, as capital expenditures total $175 million in 2023, while depreciation and amortization expenses will be $15 million in 2023 (currently $20 million annually). This shows that even if it breaks even, which is great, the problem is that it requires a lot of capital expenditure. Note that capital expenditures this year are expected to drop to around $100 million, which will still significantly exceed depreciation expenses.

Now?

At the end of the year, the company had $140 million in cash and $115 million in convertible notes. The company owns 70 million diluted shares, valuing its equity at $1.05 billion. In fact, with the stock doubling from $8 last summer to $15, the gains despite the dilution may have been worth it, as the improvement in recent quarters has been very impressive.

The real potential has to come from PyroThin, a thin, lightweight, high-temperature insulation material that mitigates thermal runoff propagation in lithium-ion battery system architectures.Of its $350 million in 2024 revenue guidance, about $200 million is expected to come from this market, but Aspen believe The business, which could become a $3 billion business as early as 2027/2028, currently has the capacity to generate $650 million in revenue.

In this case, the potential is huge. Even if the business could grow to $2 billion in sales at some point in time, and operating margins might be around 10-20%, operating profits would be expected to be $200-400 million. If there were no interest charges due, and taking into account statutory tax rates, earnings per share would likely be $2-4. That’s assuming the company can self-fund the necessary expansion, which would require hundreds of millions of dollars.

Of course, future retained earnings also create borrowing capacity, so dilution may be limited in this case.

in conclusion

The truth is, the share price gains appear to be well-deserved, as Aspen’s performance here has really picked up. The company has experienced significant growth, but more importantly, operating leverage has been demonstrated, which helps a lot as capital expenditure needs decline.

This sets up a roadmap for significant improvement in cash flow, as even the 2024 guidance feels like an understatement, as the long-term potential is certainly there. If it lives up to its potential over the next few years, it could easily become a >$50 stock, which of course is still a big if, but recent developments are at least very encouraging.

In the midst of all this, I’m actually more optimistic now than I was at $8 in the summer because I’m now at $15 because I’m happy to be buying shares here, certainly on unexpected setbacks.