Sunshine Seeds/iStock Editorial via Getty Images

While I’ve done quite a bit of work in aviation (basically picking the right winners and losers in my April 2020 study of the industry) COVID-19 recovery environment), I have never had the pleasure of studying International Consolidated Airlines Group (OTCPK:ICAGY) so far.

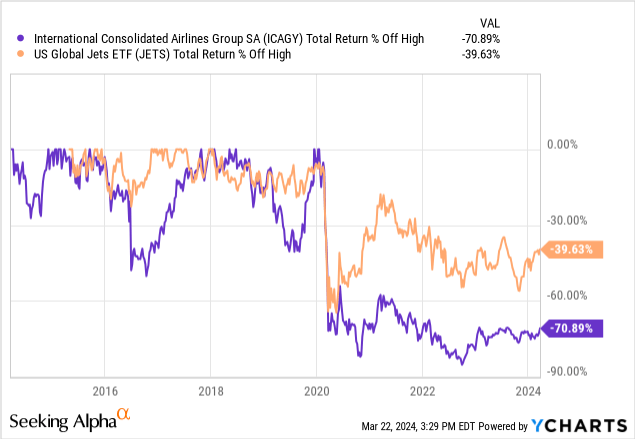

At first glance, two things stood out and immediately piqued my curiosity: (1) how far the stock has fallen from pre-COVID levels (see chart below), and (2) the company’s fundamentals How strong it is, at least relative to 2019, the rest of the aviation industry and itself will be affected. Based on my first assessment and understanding that this highly cyclical industry is a high-risk one, ICAGY looks like a reasonable buy-and-hold investment at current levels.

International Consolidated Airlines: Almost fully recovered

Today’s share price is down 71% relative to early 2020 levels, which may lead one to believe that International Consolidated Airlines Group (I’ll call it ICAG for simplicity) is far from recovering from the COVID-19 crisis. However, that doesn’t seem to be the case.

In its latest financial report, the airline reported full-year revenue of 29.5 billion euros in 2023, a significant increase of 6.4 billion euros from the same period last year and about 4 billion euros higher than 2019 sales. Strong revenue performance was first supported by the fact that in 4Q23, capacity has actually returned to pre-COVID-19 levels of 80.8 billion available seat kilometers, almost 99% of the company’s pre-pandemic capacity.

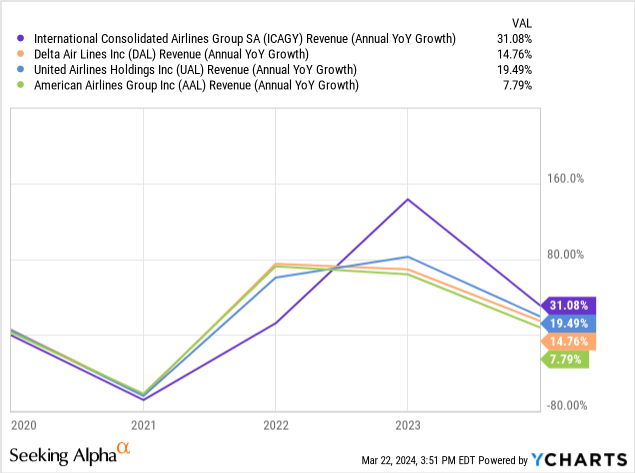

In 2023, passenger load factor will exceed 85%, a healthy jump of 3.5 percentage points year-on-year. This, coupled with revenue per revenue passenger kilometer growth of 8%, will help drive full-year revenue growth of 28% in euro terms (in euro terms 31%). Dollar). For reference, Delta Air Lines (DAL) and American Airlines (AAL) are seeing revenue growth of 15% and 8%, respectively, in 2023 (see below).

One of the key features of ICAG’s business model is the diversification across markets and verticals (e.g. European domestic and international; full-service and low-cost; leisure and business) offered by the airline portfolio, which includes British Airways and British Airways and other traditional brands. Iberia to ULCC brands such as Vueling and Level. Nonetheless, all airlines appear to be performing well, with each experiencing increases in capacity and occupancy in 2023 compared to 2022, and many also experiencing increases compared to 2019.

Although annual increases in fuel costs per unit of capacity were minimal, operating margin last year was nearly 12%, well above the 5.4% rate the year before. The margin improvement was driven by scale growth driven by surging revenue; a shift toward a mix of international and premium leisure; and the company’s efforts to control employee expenses “only” increased to 17%.

Granted, operating costs are expected to rise in 2024, even on a unit basis. But this appears to be the result of ICAG’s expanding footprint, as it launches new routes in North and South America and increases its fleet to capitalize on what the management team believes is “continued strong demand, particularly in leisure travel.”

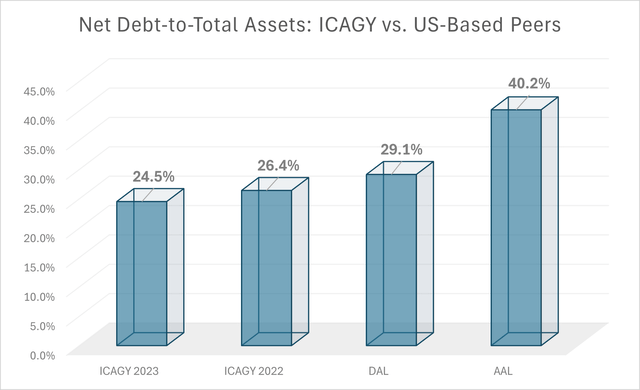

From a balance sheet perspective, ICAG’s fundamentals appear to be sound, too. Net debt (excluding intangible pension liabilities) has moved in the right direction: from €11.7 billion in 2021 to €10.4 billion in 2022 and €9.2 billion last year. ICAG’s net debt ratio relative to total assets is 24.5%, compared to 26.4% in 2022, and even compared to Delta’s 29.1%, which I consider a US airline with a solid balance sheet ( see below).

DM Martins Research

ICAGY’s low valuation is tempting

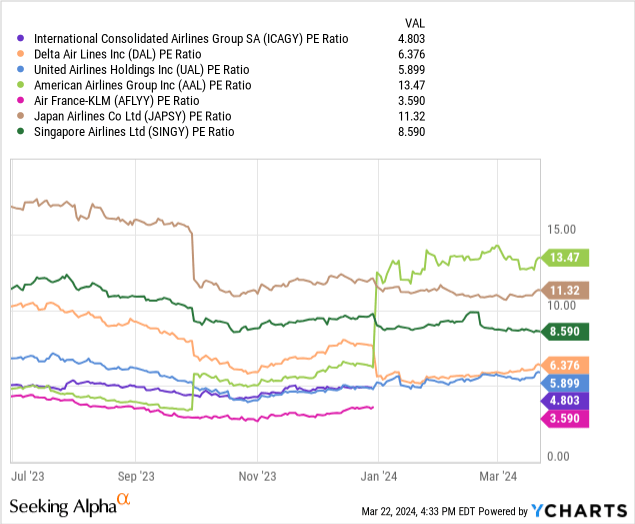

From my first review of the company, everything seems to be going well for International Consolidated Airlines Group, except for the stock. In my opinion (see below), this is reflected in a valuation that looks too de-risked, with a trailing P/E of just 4.8x.

That’s not to say investing in airline stocks isn’t without significant risks. Quite the contrary: Airlines face the effects of the economic cycle, mainly on the revenue side, but on the cost side they are affected by rising and falling fuel prices. For these reasons, airline stocks should, by design, trade cheaply.

However, I believe ICAGY trades at a steep discount relative to most peers, especially given strong fundamentals and encouraging 2024 growth prospects. Therefore, I think ICAGY is a buy relative to other global airlines.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.