creative studio

introduce

Flexsteel Industrial (Nasdaq ticker: FLXS), a household name in the furniture world, may be facing some bumpy roads. Although the furniture industry is showing signs of recovery in 2024 as interest rates fall and inventory management improves, Flexsteel still has some hurdles to overcome.they were Its profit margins are lower than those of its competitors and it has failed to keep pace with overall market growth. Ultimately, I consider Flexsteel a “Hold” and investors would be better off looking for other opportunities outside of furniture manufacturing.

Business overview

Flex Steel Industries, Inc. is a leading U.S. manufacturer, marketer and importer of residential furniture. The company designs, produces, imports and sells upholstered and wooden furniture under the Flexsteel, Homestyles and Charisma brands.according to its last 10K ReportIts extensive product portfolio includes various types of furniture such as sofas, chairs, recliners, rocking chairs, beds, tables, desks, storage cabinets and outdoor furniture. Eventually, the company distributed its furniture throughout the country. Sold in the United States through direct sales teams and e-commerce platforms.

Industry Outlook 2024

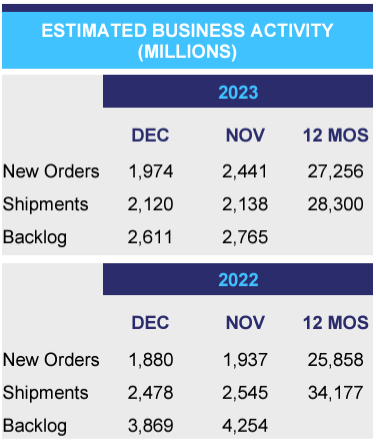

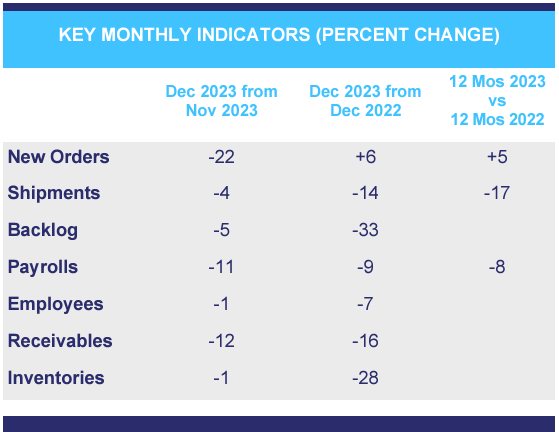

The furniture industry has had a rough year in 2023, with most furniture companies reporting declining sales or, at best, flat revenue. For example, Flexsteel’s revenue fell 27.7%, Purple Innovation (PRPL) fell 10.9%, Leggett & Platt (LEG) fell 8.2%, Mohawk Industries (MHK) fell 5.1%, RH (RH) fell 4.5%, Ethan Allen (ETD) ) rose 3.2% and Hooker Furniture (HOFT) rose 1.8%; while other companies experienced steady positive growth, such as Tempur Sealy (TPX) (0.1%), Dorel Industries (OTCPK:DIIBF) (1.6 %). However, contrary to the overall industry trend, Arhaus (ARHS), Williams-Sonoma (WSM) and The Lovesac Company (LOVE) grew 4.8%, 5.2% and 30.7% respectively, making them the only companies to grow in 2017.Actual prices are inflation rates in December 2023 3.4%. In addition, supply chain disruptions have resulted in lower profit margins for Flexsteel and Hooker Furnishings, as well as significant delays in delivering furniture to customers, with backlogs growing as demand exceeds supply.Nonetheless, supply chain issues have diminished in 2023, which, coupled with market softening, has significantly reduced backlog. For example, the backlog in December 2023 is 33% lower than in December 2022, while shipments are down 17.2%, indicating a severe decline in demand.

Smith Leonard

In this sense, as made in America The industry has continued to decline for 16 consecutive months, with the furniture and wood products industries experiencing the largest declines. The industry saw the largest decline in new orders and production in February 2024, while manufacturers purchased raw materials at higher prices than in January.

In my opinion, the reasons behind this negative momentum are weak demand due to rising interest rates in 2021 and 2022, as well as inventory accumulation. These two factors lead to higher prices but do not translate into all rising input costs so that old inventory can be removed from retailers’ floors and manufacturers’ warehouses.

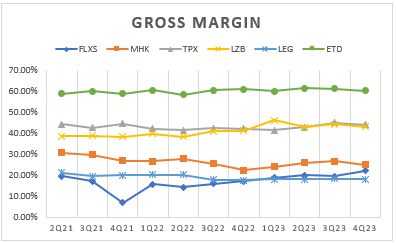

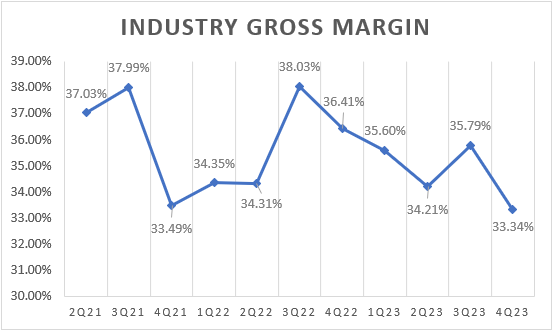

Author’s explanation based on data from SeekingAlpha

For example, the gross profit margins of FLXS, MHK, LEG and TPX will decline in 2021 or 2022, while the gross profit margins of ETD and LZB will increase steadily.Furthermore, according to CSI MarketMargins across the industry struggled in late 2021 and the first half of 2022, and have been shrinking since the third quarter of 2022.

CSI Market

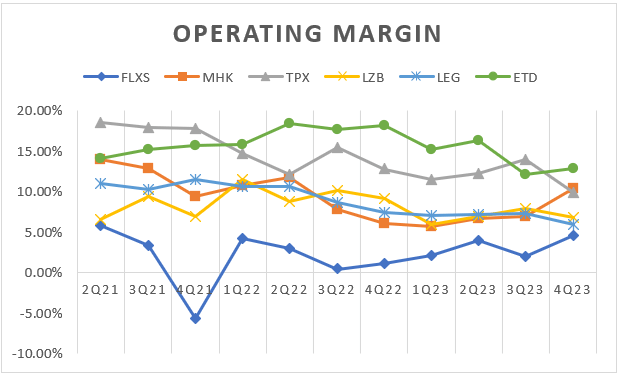

Additionally, I believe declining revenue and rising labor costs have eroded a significant portion of manufacturers’ operating profits in previous years. For example, public manufacturers’ operating margins have trended downward over the past two and a half years.

Author’s explanation based on data from SeekingAlpha

While the industry’s past and present circumstances vary, the future appears to be brighter.First, statistically, inventory levels (for manufacturers and retailers) have normalized Maison&Object Barometer, so most of the excess inventory has already been sold, meaning manufacturers will need to produce more inventory to meet demand.Secondly, according to Smith-Leonard CommunicationsNew orders increased by 5% year-on-year in December 2023, which is a positive sign of possible improvement. Still, it’s well below the double-digit year-over-year growth seen in recent months.

Smith Leonard

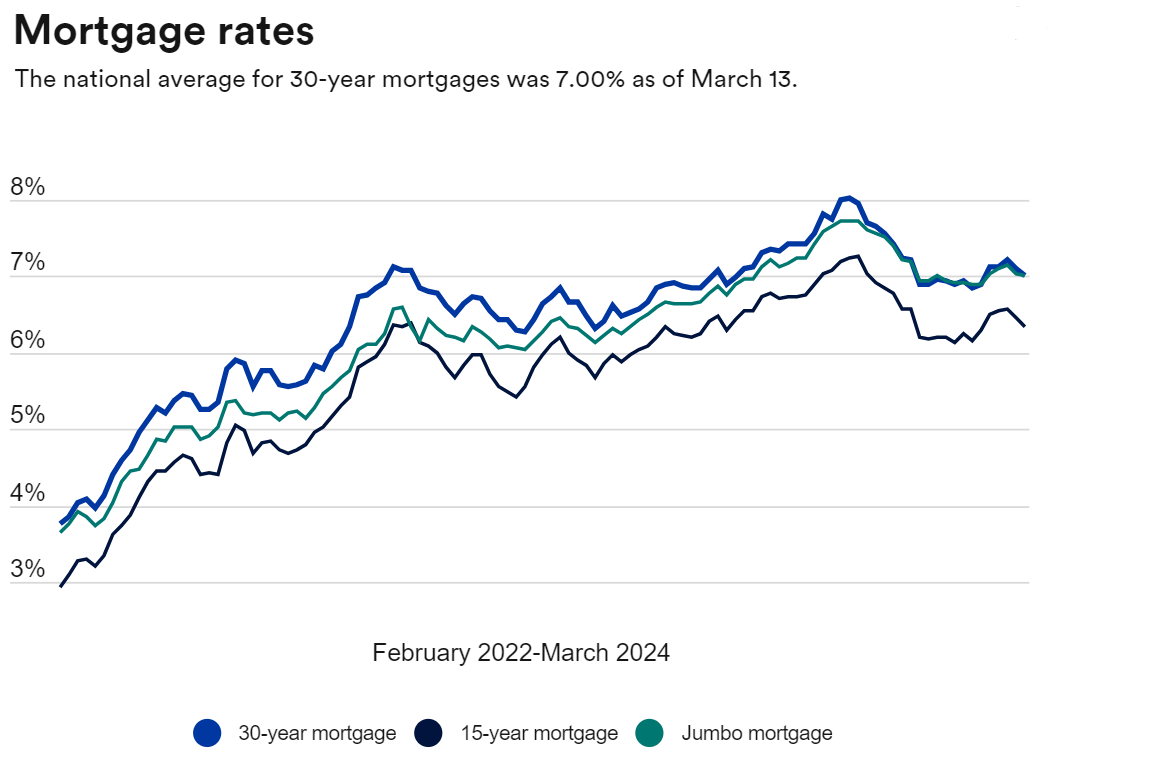

Third, mortgage rates are trending downward, and this trend is likely to continue as the Federal Reserve is expected to begin cutting interest rates in 2024.Additionally, the spread between 10-year Treasury bond yields and mortgage rates is approximately 280 basis points, while the typical spread is about 180 basis points. I believe the reason for the current spread is a “shift to quality” as macroeconomic uncertainty rose and persists over the last year.

bank interest rate

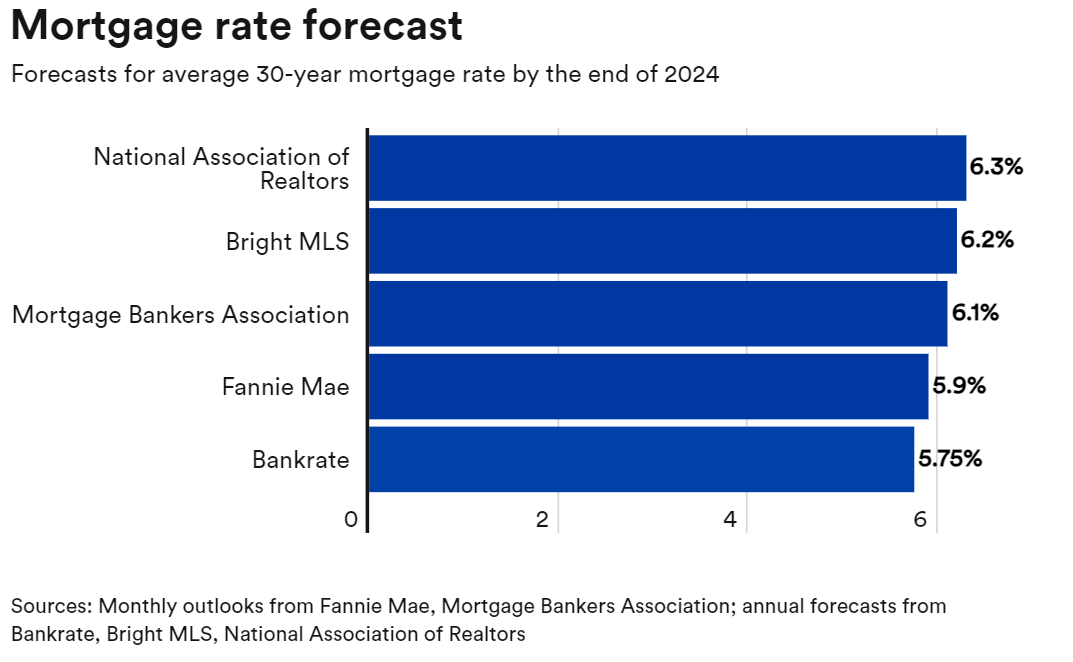

As inflation returns to the Fed’s 2% target, macroeconomic uncertainty and interest rates should decline. This could lower mortgage rates, allowing consumers to increase discretionary spending because mortgage payments are a lower proportion of income. In this sense, different forecasts point to a mortgage rate of 6% at the end of 2024.

bank interest rate

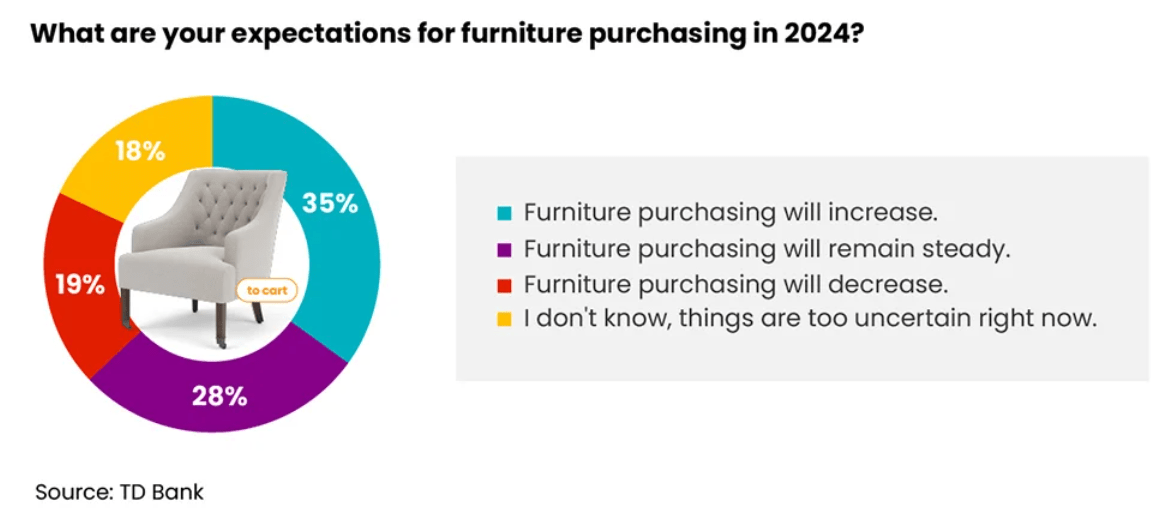

also, Industry experts Transitional changes are expected in the second half of 2024. They expect sales to start rising sharply as mortgage rates fall.This is consistent with the timing of interest rate cuts expected by financial market participants interest rate.Accordingly, 35% of furniture retailers expect furniture purchases to increase in 2024 TD Bank.

TD Bank

Meanwhile, 28% think it will remain stable this year and 37% think purchases will decrease or there is too much uncertainty in forecasting revenue. Based on this, many companies in the industry predict that revenue growth will grow from negative to mid-single digits. For example, Ahaus’ guidance Forecast revenue growth in 2024 is 4.81% (measured at the midpoint), williams-sonoma Between -4.5% and 1.5%, Tempur Steel’s growth rate is in the low to mid range, while Flexsteel’s is roughly the same 4% over the next few years.

Still, investors must consider that inflation is still far from 2%, and financial analysts continue to be wrong about when the Fed will cut interest rates. Additionally, new order growth has slowed, so the recovery may be delayed or overly reliant on lower mortgage rates going forward. However, positive sentiment abounds, with many furniture stocks nearly doubling since their October-November 2023 lows; for example, Flexsteel stock has a price return (not annualized) of about 106%, and Williams-Sonoma is at 96.67 %, Arhaus is 88.38%, Mohawk is 57%, Tempur Sealy is 44.96%, and LZB is 24.02%.

competition

The furniture manufacturing industry is highly competitive. Many companies produce similar goods and the barriers to entry are low. Companies compete on price, design, quality and durability, which forces them to always design attractive new furniture while maintaining the highest possible quality and durability at the lowest price. Therefore, it is difficult for manufacturers to maintain high returns over the long term.

In my opinion, this competition and slow industry growth (as the industry matures) hinders high investment returns, as most manufacturers’ stocks have been flat or even harmful over the past decade, despite the S&P 500’s returns The rate is approximately 177.95%. Taking Flexsteel as an example, the 10-year return on capital is -8.29%, while Ethan Allen is 53.68%, Hooker Furnishing is 48.35%, La-Z-Boy is 34.45%, Mohawk is -10.83%, and Leggett & Platt is -42.44% . One of them is Tempur Sealy, which has a return on capital of 323.26% over the past decade, outperforming the S&P 500.

At the same time, some luxury furniture retailers that have managed to stand out are seeing higher returns than manufacturers. For example, RH and Williams Sonoma have returned 288% and 325% respectively over the past decade.

Furthermore, according to spherical insight, there are some trends that will impact the industry in the coming years.1. Introduction Smart furniture, a piece of furniture with embedded sensors, wireless charging and voice control. Secondly, virtual showrooms were developed to market furniture through an immersive shopping experience without the need for a physical space.3. Implementation Automation and Robotics Fourth, people are more concerned about the environment, which will lead manufacturers to use more environmentally friendly materials and recycle them.

I don’t think these trends are disruptive; they’re just incremental improvements. However, because competition in the industry is fierce, companies that fail to adapt to these trends quickly may suffer losses in the coming years. In this sense, even if the company produces higher quality furniture with more efficient production systems, I believe investors will not benefit from these trends because competition will erode any high returns.

Finally, the U.S. furniture industry will grow at a CAGR 3.98% Until 2028. Therefore, the company will have little room to grow without taking market share from other companies in the industry, meaning intense competition is likely to continue. Therefore, I believe the environment is not favorable for Flexsteel and will hurt returns in the coming years as the industry will remain highly competitive, growth will be lower, company margins will be lower, and the company may not be able to adapt to new trends.

Valuation

The furniture maker trades at a lower price-to-earnings multiple than the S&P 500.S&P 500 Index FWD P/E Ratio 20.49, while Flexsteel is trading at 17.44, Ethan Allen is trading at 11.67, Mohawk is trading at 12.32, Tempur Sealy is trading at 19.39, Leggett & Platt is trading at 16.07, and La-Z-Boy is trading at 13.33. From my perspective, the valuation is fair as these companies (except for Tempurs) have underperformed the index over the long term and there is nothing that makes me think they will outperform the index over the long term . Still, Flexsteel’s valuation is higher than its peers, even though it has lower margins and has lagged most peers over the past decade. Therefore, I think its current valuation is urgent.

in conclusion

Flexsteel Industries faces a tough road ahead. While the industry may recover in 2024, the company’s lower margins and historical underperformance compared with peers have raised concerns. While Flexsteel’s stock price has soared, its valuation appears overpriced. Competition in the furniture industry is fierce and the space for high returns is limited. Adapting to smart furniture and sustainable development trends is still a question mark. Investors should be cautious about Flexsteel’s future prospects. For these reasons, I consider Flexsteel Industries a Hold.