shaped charge

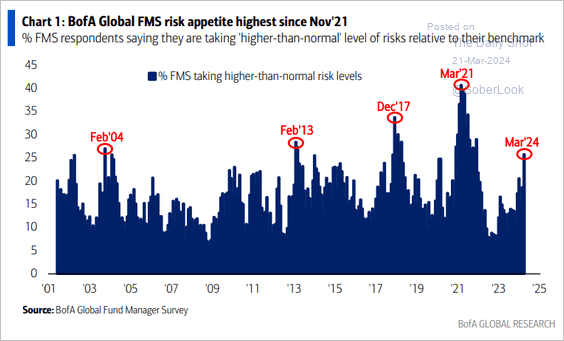

Technical indicators and valuations both suggest the market is expensive, overbought, and booming. However, none of that seems to matter as investors rush into stocks in pursuit of riskier assets.A recent Bank of America report showed rising risk appetite It is the largest since March 2021.

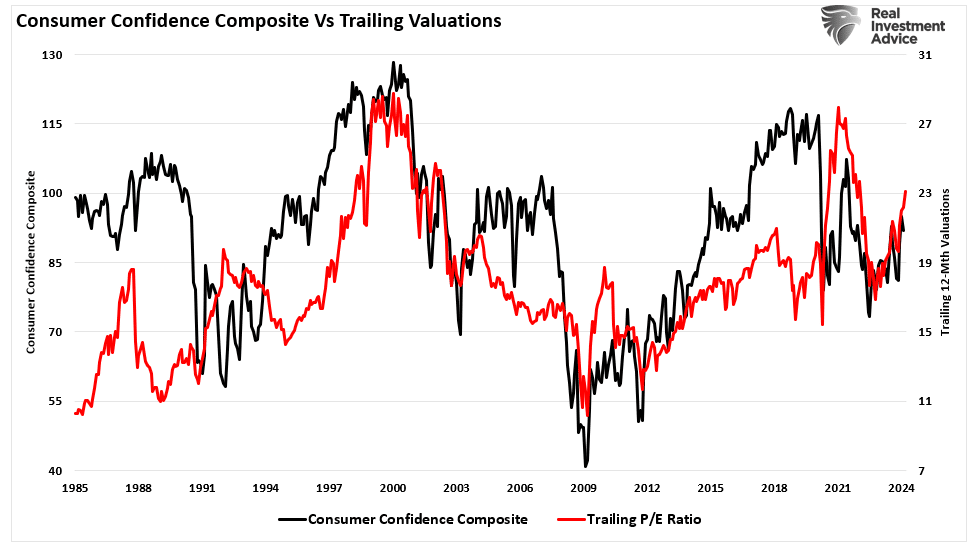

Of course, as prices rise faster than underlying earnings growth, valuations will rise as well.However, as discussed “Valuation advises caution” Valuation is a better indicator of short-term psychology. With wit:

“Valuation indicators are indicators of current valuation. More importantly, when valuation indicators are too high, it is a better measure of “investor psychology” and a manifestation of the “fool theory.” As shown, there is a strong correlation between our composite consumer sentiment index and the S&P 500’s valuation over the past year. “

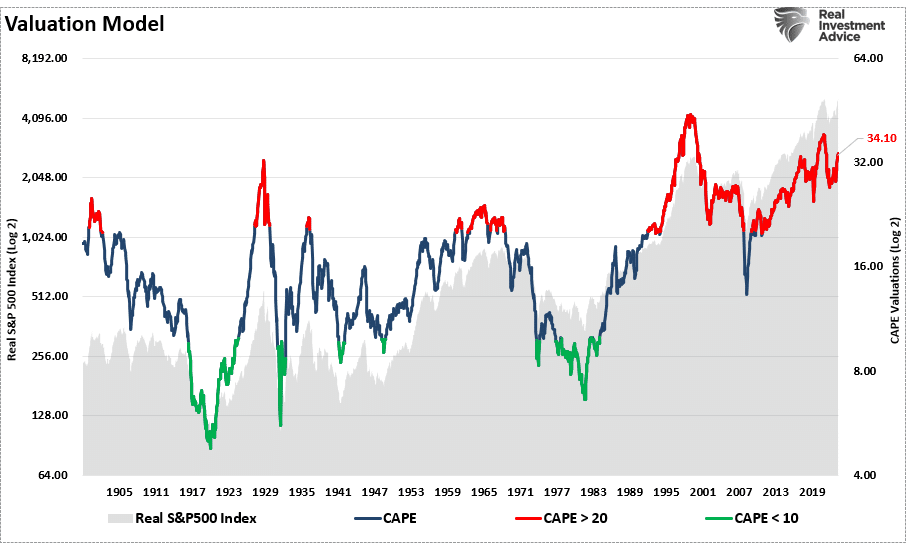

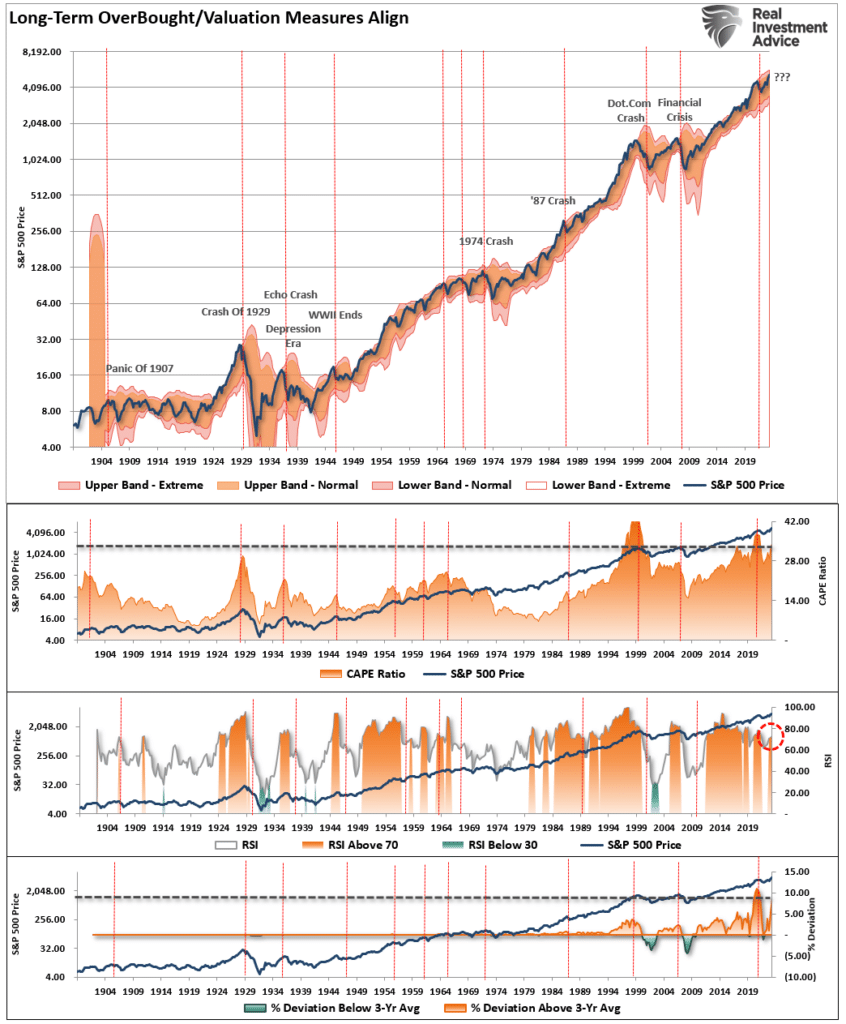

When investors are excited and are willing to pay an exorbitant price for future profit growth, valuations will rise.An increase in valuation, also known as “Multiple Expansions” It is an important support for the bull market. As the chart shows, increases in multiples coincide with increases in the market.Of course, the opposite is called “Multiple contractions” is also like this. The current valuation multiple of Shiller CAPE is 34 times price-to-earnings ratio, indicating that investor confidence has increased.

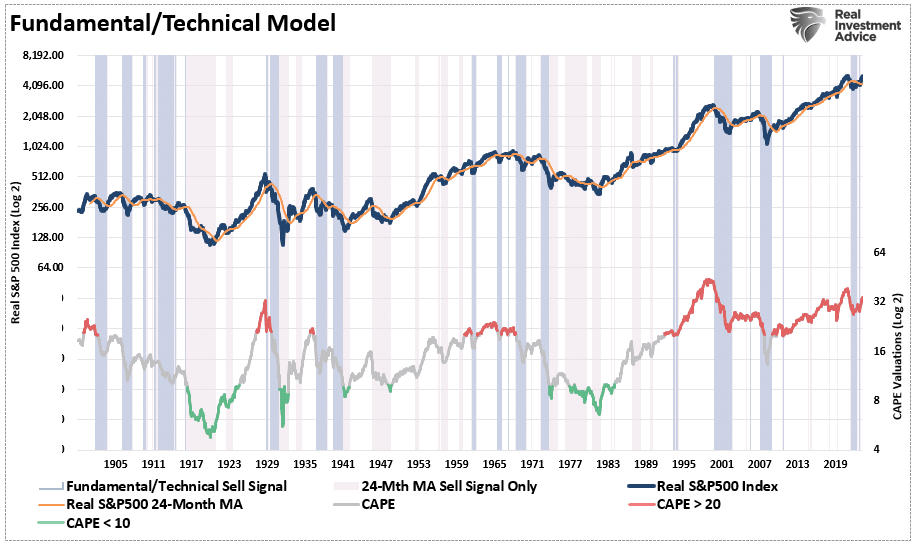

As mentioned before, valuation is a poor market timing indicator and should not be used as such. While valuations provide the basis for calculating future returns, technical indicators are more important for managing short-term portfolio risk.

Technical measures become extreme

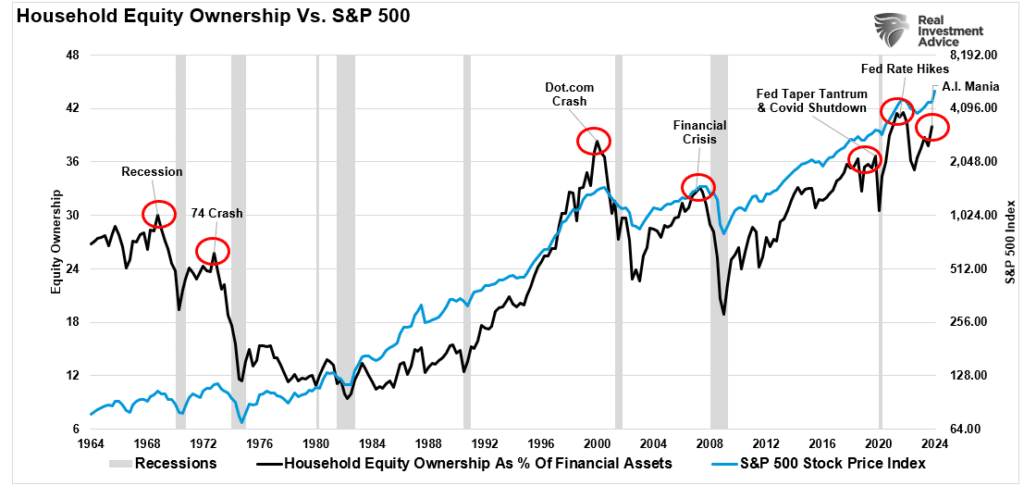

As mentioned earlier, investors are once again becoming enthusiastic about stock ownership. This is essential to create multiple expansions and drive bullish market progress. High valuations, bullish sentiment, and leverage mean nothing if you don’t own the underlying stocks. As ““Family Equity Allocation” Current levels of household equity have returned to near record highs. Historically, such exuberances have been a sign of more significant market cycle peaks.

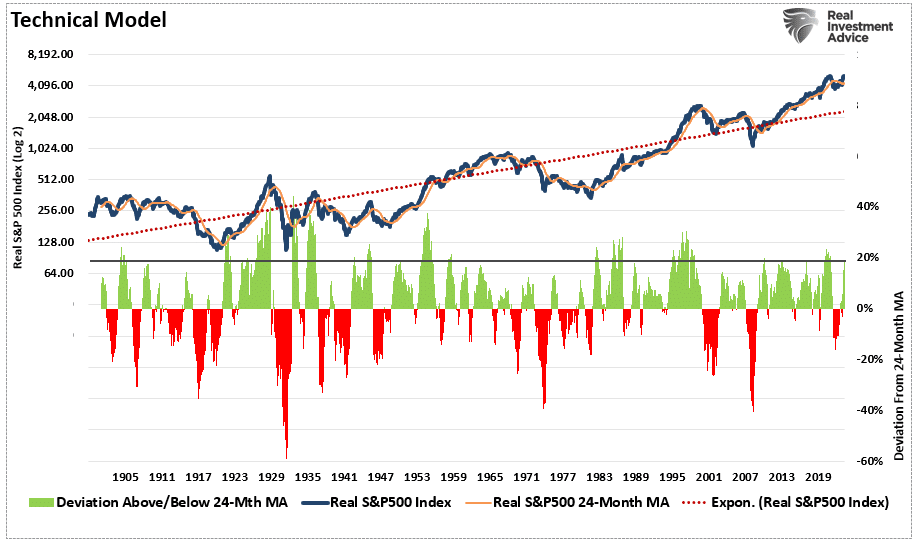

While household equity will be critical in expanding the bull market, technical indicators can provide a sense of when excess has been reached. One of the indicators we look at is price deviation from the long-term average. The reason is that over time, the market is bound to exist in long-term terms. In order for a “mean” or “average” to exist, the price must be above or below that price over time. Therefore, we can determine when deviations approach more extreme levels by looking at past deviations. Currently, the market’s deviation from its two-year average is the largest in history. It is worth noting that more significant deviations have certainly existed in the past, suggesting that current deviations from the mean may widen further. However, this deviation is crucial and is a precursor to the eventual mean reversion event.

The following analysis uses quarterly data and uses valuation and technical indicators to assess the market. From a long-term perspective, the market is reaching more extreme levels. The quarterly relative strength (RSI) indicator is above 70, the deviation is close to historical records, and the market is trading nearly 3 standard deviations above the quarterly average. As mentioned previously, while these valuations and technical indicators will undoubtedly become more extreme, the elements of an eventual mean reversion event remain.

Of course, the inherent problem with longer-term analysis is that while valuations and long-term technical indicators are more extreme, they could remain that way for much longer than logic would imply. However, we can use the above data to construct valuation and technical indicator models. As shown, the model triggered a “risk-off” warning in early 2022, when elevated valuations collided with the market’s extreme deviation above its 24-month moving average. This signal reversed in January 2023 as the market began to recover. Although the new signal has not yet been triggered, the factors of valuation and bias are already there.

Ingredient lacks catalyst

The problem with long-term technical indicators and valuations is that they are slow to change. Therefore, the general assumption is that if high valuations do not lead to an immediate market correction, then the measure is flawed.

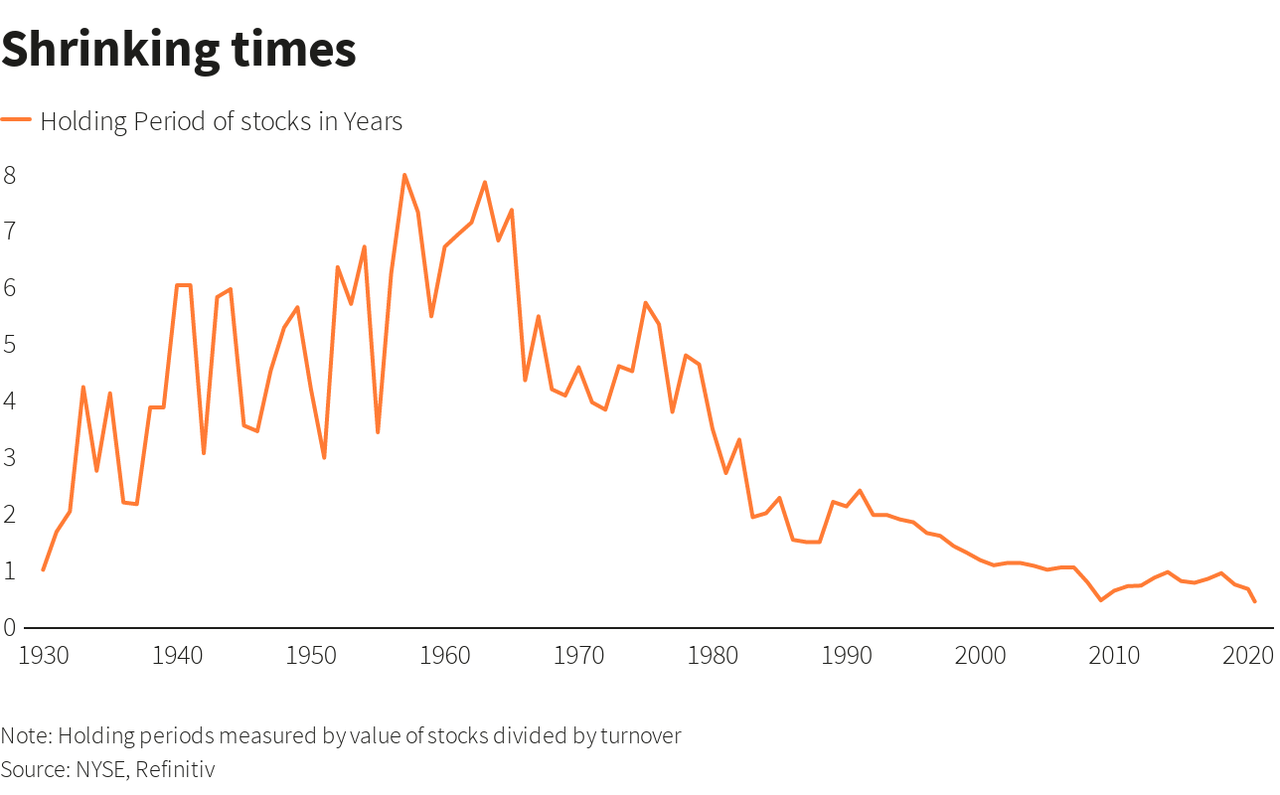

in short term, “Valuation” It has nothing to do with which positions you should buy or sell. All that matters is momentum, the direction of the price.money management, either “major” or “Individually,” It is a long and complicated process. In the short term, this seems very easy, especially amid the speculative frenzy. However, as with every bull market, a strong rising market will forgive investors many investment mistakes.The next bear market They were revealed with the most brutal and unforgiving results.

provide a clear advantage Risk Management Portfolio over time. The problem is that most people are unable to manage their money due to “short-termism.” As shown by the shortening of the holding period.

although “Short-termism” What currently dominates the mentality of investors is that there are factors for regression. However, that doesn’t mean that’s going to happen tomorrow, next month, or even this year.

Think of it this way. If I gave you a bunch of raw materials, like nitrogen, glycerin, sand, and shells, you would probably throw them in the trash without giving it a second thought. They are harmless ingredients and pose little real danger on their own. However, you can create explosives using a process of combining and gluing them. However, even explosives are safe as long as they are stored properly. Problems only arise when the explosive comes into contact with a suitable catalyst.

“means recovery event,” Bear markets and financial crises are the result of a combination of factors. Looking back through history, we find similar elements every time.

As with explosives, the individual ingredients are relatively harmless but can be dangerous in combination.

Leverage + Valuation + Psychology + Ownership + Momentum = “Mean Reversion Event”

Importantly, this particular formula still supports higher asset prices in the short term. Of course, the more prices rise, the more optimistic investors become.

Although the combination of ingredients is dangerous, they still exist “lazy” Until you come into contact with the appropriate catalyst.

What causes the next “liquidation cycle” Currently unknown. Events are always triggered by unexpected, exogenous events “Run for the exit.”

many people think “Bear Market” Given the massive support provided by central banks, these are now a thing of the past. Maybe that’s it. However, it is worth remembering that this belief will always be there until a more severe mean reversion event occurs.

To quote Irving Fisher in 1929: “The stock market is always high. “

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.