Keen 86

notes:

I’ve got it covered Westport Fuel Systems (NASDAQ: WPRT) previously, so investors should consider this an update from me Earlier articles About the company.

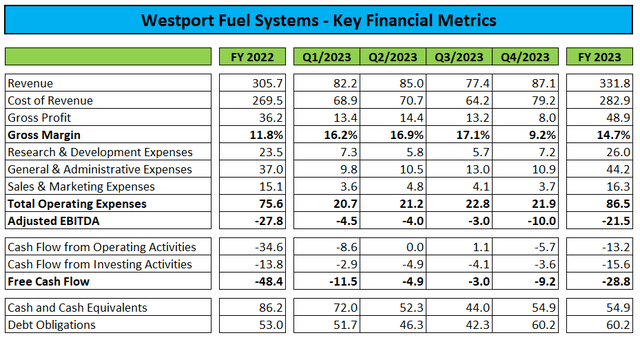

Following Monday’s regular meeting, Westport Fuel Systems Inc. or “Westport” report Fourth-quarter and full-year 2023 results were mixed.

Although revenue of $87.2 million was slightly higher than consensus expectationsgross margin was impacted by inventory write-downs totaling $5 million.

company press release

Adjusted for write-downs, fourth-quarter consolidated gross margin will be 14.9%, closer to the company’s performance in the first nine months of 2023.

While free cash flow was negative $9.2 million in the quarter, higher draws on the company’s revolving credit facility and the addition of a new term loan facility in Italy led to a $10.9 million sequential increase in cash and cash equivalents to $54.9 million.

After the quarter ended, the company secured an additional $3.8 million term loan in Italy.

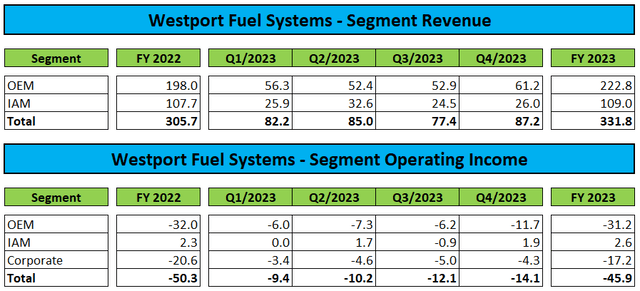

Westport’s fourth-quarter results showed the usual pattern of the smaller independent aftermarket (“IAM”) business operating at modest margins, while the larger original equipment manufacturer (“OEM”) business continues to suffer significant losses:

company press release

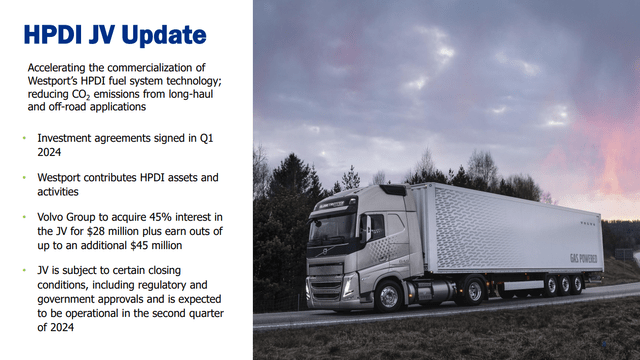

However, the company’s proposed high-pressure direct injection (“HPDI”) Joint venture Cooperation with major customer AB Volvo or “Volvo” (OTCPK: VLVLY, OTCPK: VOLAF, OTCPK: VOLVF) will have a significant impact on Westport’s financial position, operating results and future cash flows.

Company Profile

Two weeks ago, the company signed a final agreement to form a joint venture with Volvo, as described in Westport’s filing Financial Statements:

As part of the joint venture, the Company will contribute certain HPDI™ assets and liabilities, including related fixed assets, intellectual property and net working capital. The Volvo Group will acquire a 45% stake in the joint venture for an initial price of US$28,350. The joint venture, which will be jointly owned by both parties, aims to strengthen the commercialization of Westport’s HPDI™ fuel system technology and accelerate the decarbonization efforts of global OEM customers. After the completion of the joint venture with the Volvo Group, HPDI’s business will be operated through the joint venture.

The Company’s preliminary assessment of equity interests in joint ventures is accounted for using the equity method. Under this method, the Company’s initial investment in a joint venture is recognized at cost and is subsequently adjusted for the Company’s share of the joint venture’s net profit or loss and other comprehensive income and dividends or distributions received from the joint venture.

In layman’s terms: Westport will receive a $28.4 million cash payment from Volvo once the joint venture officially closes, currently expected in the second quarter. However, the positive impact on liquidity will be offset to some extent by the requirement to fund joint ventures on a pro-rata basis.

In addition, the company will no longer integrate its loss-making HPDI business, resulting in lower OEM revenue, higher segment gross margins, a significant reduction in operating losses, and a significant reduction in future cash outflows.

As a result, I expect the company’s liquidity to remain adequate until at least 2026, especially given new management’s stated focus on cost cutting, as discussed on the call:

In the short term, our focus is on cutting costs and optimizing operations. Everything is possible. We have begun identifying and eliminating layoffs and are considering expenses across the organization. Additionally, better inventory management is key. These are just a few examples of the areas we are targeting to improve Westport’s overall profitability.

Note also that HPDI revenue losses will be partially offset by incremental increases for larger businesses. LPG system supply contract Revenue contribution over the next four years is expected to be €255 million.

Perhaps most disappointingly, management has largely rejected or dodged all analysts’ questions for more information on the company’s expected near- and medium-term financial results, the expected impact of the HPDI joint venture and capital expenditure expectations.

However, management warned that the company’s new products would be delayed by about six months. manufacturing business in China:

In China, facility construction is underway and capital investments in assembly lines and other equipment are underway. Recent changes in Chinese regulations related to hydrogen content have resulted in a slightly longer time to complete certification for the first products we plan to launch in China. Therefore, we expect production to begin in the second quarter of 2025, rather than later in 2024 as originally anticipated.

All in all, new CEO Dan Sceli’s performance on the conference call left a lot to be desired, as he seemed unprepared for the Q&A session. However, after just two months at the helm, there should be room for improvement ahead.

bottom line

Westport Fuel Systems posted another dismal set of quarterly results, with heavy cash burn and inventory writedowns leading to profitability that fell short of consensus estimates.

On the other hand, the company managed to increase its liquidity and signed a final agreement with Volvo for the establishment of a new HPDI joint venture.

The new joint venture should provide material benefits to the company’s future liquidity, margins and cash flow. Therefore, I expect liquidity to remain ample until at least 2026.

However, management’s refusal to quantify the impact on the company’s future financial performance and dodging or outright rejecting a large number of analyst questions on conference calls isn’t entirely appropriate to instill confidence in the company’s ability to execute under new leadership.

At this time, I see no reason to launch or add to existing positions, but given the clear benefits of the upcoming HPDI joint venture with Volvo, I reiterate my “catch” Stock Ratings.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.