Antagaon

This article is part of a series providing an ongoing analysis of quarterly changes in Lone Pine Capital’s 13F portfolio.This is based on their supervision Form 13F Submission date: February 14, 2024.please visit our track Stephen Mandel’s Lone Pine Capital Portfolio Article to learn about their investment philosophy and ours Previous updates The fund’s performance in the third quarter of 2023.

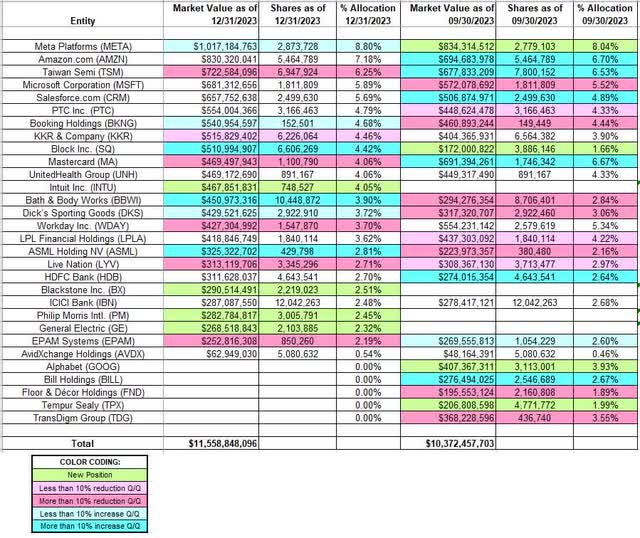

During the quarter, Lone Pine’s 13F portfolio value increased from $10.37B to $11.56B. Number of holdings reduced from 26 to 25. The top three holdings are approximately 22%, while the top five holdings are approximately 34% of 13F assets: Meta Platforms, Amazon, Taiwan Semi, Microsoft, and Salesforce.

Note: Stephen Mandel resigned from Lone Pine Capital investment management in January 2019, as previously announced (September 2017).He currently serves as the company’s Managing Director company. Starting in the late 1980s, Stephen Mandel worked for Tiger Management under Julian Robertson for eight years, making him a real tiger cub .To learn more about Julian Robertson and his legendary Tiger Management, check out Julian Robertson: Tigers in Bull and Bear Markets.

New bet:

Intuit Corporation (INTU): INTU represents about 4% of portfolio holdings established this quarter at prices between about $479 and about $629, and the stock is currently trading above that range at about $640.

Blackstone (BX), Philip Morris International Airport (PM) and General Electric (GE): BX represents 2.51% of portfolio shares purchased during the quarter at prices between approximately $90 and approximately $133, with the stock currently trading at approximately $128. The 2.45% PM position has ranged in price from approximately $87 to approximately $96 and is currently priced at $90.38. GE bought a 2.32% portfolio stake this quarter at prices ranging from about $106 to about $128, and the stock is currently well above that range at about $174.

Equity disposal:

Alphabet (GOOG): About 4% of the GOOG position was purchased last quarter at prices between about $117 and about $139. Prices for this season’s elimination range from about $123 to about $143. The stock is currently trading around $152.

Transdigum Group (TDG): 3.55% of the TDG position was purchased in Q3 2022 at prices between approximately $525 and approximately $677. Last quarter, the stake decreased by 25%, with prices ranging from approximately $813 to $882. Disposal prices this season ranged from approximately $812 to approximately $1,013. The stock is currently priced at approximately $1,223.

Bill Holdings (Bill): 2.67% of BILL shares were established in the first quarter of 2023 at prices between approximately $68 and approximately $129. Last quarter, positions increased 40%, with prices ranging from approximately $98 to $136. The shares sold this quarter at prices ranging from about $56 to about $116. Now selling for $66.43.

Tempur Sealy(TPX): TPX represents only about 2% of the portfolio positions established last quarter at prices ranging from about $39 to about $47. This season is on sale for about $36.50 to about $51.50. The price is now $56.07.

Flooring & Decoration Holdings Inc. (FND): 1.89% of FND shares were purchased during the three quarters ending in Q2 2023 at prices ranging from approximately $65 to approximately $104. Last quarter, the stake fell 42%, with prices ranging from about $90 to $115. Prices for this season’s elimination range from about $77 to about $116. The price is now about $128.

Share increase:

Meta Platform (META): META is the largest 13F position in the portfolio, accounting for 8.8%. It was established last quarter at a price range of about $283 to about $326, and is currently trading well above that range at about $496. Equity increased slightly by approximately 3% during the quarter.

Booking Holdings (BKNG): 4.68% of the BKNG position was purchased in the second quarter of 2022 at prices between approximately $1,749 and approximately $2,375. The two quarters ending in the first quarter of 2023 saw a cut of about 20%, followed by a modest gain of about 3% in the following quarter. Last quarter, the stake decreased by 29%, with prices ranging from approximately $2,633 to $3,243. The stock is currently priced at approximately $3,661. Equity increased slightly by approximately 2% during the quarter.

Bullock Corporation (SQ): 4.42% SQ shares were purchased during the last quarter at prices ranging from approximately $44 to approximately $81. The stake was increased by approximately 70% during the quarter at prices ranging from approximately $39 to approximately $80. The stock is currently trading slightly above its purchase price range at $83.80.

Bath and Body Works (BBWI): BBWI currently accounts for 3.90% of the portfolio. It was purchased in the first quarter of 2020 for a price ranging from about $9 to about $25. For the five quarters ending in the second quarter of 2023, sales volume was approximately 26%. Sales then fell by about 47% last quarter, with prices ranging from about $31.50 to about $39. During the quarter, shares increased by approximately 20%, with prices ranging from approximately $28 to approximately $45. The price now is about $48.

Note 1: The cost basis implicit in the above price is understated as they received approximately $14 per share through the Victoria’s Secret spin-off transaction in July 2021 (1 VSCO share for every 3 shares held) value.

Note 2: They own approximately 4.6% of the company.

Dick’s Sporting Goods (DKS): 3.72% of DKS shares were purchased in the first half of 2022 at prices between approximately $71 and approximately $118. In the second quarter of 2023, prices fell by approximately 30% between approximately $122 and approximately $149. This was followed by a cut of about 11% last quarter. The stock is currently trading at around $219. Slight growth this season.

Note: They have approximately 5% ownership stake in the business.

ASML Holdings (ASML): ASML represents 2.81% of portfolio positions established in the first half of 2023 at prices between approximately $379 and approximately $697, and currently trades at approximately $971. Last quarter, it reduced its holdings by about 17%, while this quarter it increased its holdings by about 13%.

Share reduction:

Taiwan Semiconductor Manufacturing Company (TSM): TSM represented a large portion (top five) of portfolio positions purchased in Q1 2022 (6.25%) at prices ranging from approximately $99 to approximately $141. Equity increased by approximately 30% in the three quarters ending in Q4 2022, at prices ranging from approximately $60 to approximately $105. In the first half of 2023, approximately 40% sold at prices ranging from approximately $74 to approximately $107, while last quarter, equity increased by approximately 22% at prices ranging from approximately $84 to approximately $105. The stock is currently trading at around $139. This quarter saw a cut of about 11%.

KKR Corporation (KKR): KKR represents 4.46% of portfolio positions purchased in Q1 2023 at prices between $46.70 and $59.10, with shares currently trading around $101. It was down about 5% this quarter.

MasterCard (MA): MA represents approximately 4% of portfolio positions purchased in Q4 2021 at prices between approximately $306 and approximately $370. In the first half of 2022, positions were reduced by approximately 70%, with prices ranging from approximately US$309 to approximately US$397. The price subsequently fell by a third in the first half of 2023, with prices ranging from about $283 to about $382. Last quarter, open interest increased by approximately 50%, with prices ranging from approximately $388 to approximately $417, while this quarter, open interest decreased by approximately 35%, with prices ranging from approximately $365 to approximately $426. The stock is currently trading at around $477.

Weekday company (WDAY): WDAY currently accounts for 3.70% of the portfolio. It was founded in 2021 and prices range from about $221 to about $301. In the six quarters ending in the second quarter of 2023, prices fell approximately 55% between approximately $133 and approximately $244. Subsequently, approximately 40% of sales this season were priced between approximately $205 and approximately $279. The stock is currently priced at about $277.

Live Country (LYV): LYV represents 2.71% of portfolio positions purchased in Q2 2023 at prices between approximately $65 and approximately $92. The stock is currently trading around $104. It has been cut by about 18% over the past two quarters.

EPAM System(EPAM): 2.19% EPAM shares are down about 20% this quarter.

keep it steady:

Amazon(AMZN): AMZN currently ranks second at 7.18% of the portfolio. It was founded in the fourth quarter of 2017, with prices ranging from about $48 to about $60. The position has been shaken. Recent activities are as follows. In the first quarter of 2022, positions were reduced by approximately 30%, with prices ranging from approximately $136 to approximately $170. Subsequently, sales volume increased by approximately 25% in the third quarter of 2022, with prices ranging from approximately US$106 to approximately US$145. The next quarter saw an increase in shares of approximately 45%, with prices ranging from approximately $82 to approximately $121, while the first half of 2023 saw a decrease in shares of approximately 50%, with prices ranging from approximately $83 to approximately $130. The stock price is currently around $178. The holding increased by about 12% last quarter.

Microsoft Corporation (MSFT): MSFT currently accounts for 5.89% of the portfolio. It was established in the second quarter of 2017, with prices ranging from $65 to $72.50. The stakes have been shaken. Recent activities are as follows. In the two quarters ending in the third quarter of 2022, prices fell approximately 43% between approximately $233 and approximately $315. The next quarter, the stake increased by about 23%, and the first quarter of 2023 saw a similar decrease in stake. Last quarter, the stake declined 28%, with prices ranging from about $312 to about $358. The stock is currently priced at approximately $422.

Sales Personnel (Customer Relationship Management): CRM, which represents 5.69% of the portfolio equity, was established during the two quarters ending in Q1 2023 at prices between approximately $128 and approximately $200. Shares decreased by approximately 17% next quarter, while shares increased by approximately 47% last quarter, with prices ranging from approximately $203 to approximately $234. The stock is currently trading at around $306.

PTC Corporation (PTC): PTC represents 4.79% of portfolio positions purchased in Q3 2022 at prices between approximately $100 and approximately $126, with shares currently trading around $190.

UnitedHealth Group (UNH): About 4% of UNH shares were established in the second quarter of 2017 at prices between $164 and $187 and increased by about 160% the following quarter at prices between $185 and $200. The position has been shaken. Recent activities are as follows. In the second half of 2022, the stake increased by a third, at prices between about $500 and $555, while about 16% was sold in the next quarter. The current share price is approximately $492.

LPL Financial Holdings (LPLA): LPL represents 3.62% of portfolio equity established during the second quarter of 2022 at prices ranging from approximately $168 to approximately $219, with shares currently trading at approximately $260. It was cut by about 8% last quarter.

HDFC Bank(HDB): HDB represents 2.70% of portfolio positions purchased in the second half of 2022 at prices between approximately $55 and approximately $71. In the second quarter of 2023, shares increased by approximately 35%, with prices ranging from approximately $64 to approximately $71. Then last quarter it grew by about 14%. Now selling for $54.53.

Industrial Bank of India (IBN): The 2.48% stake in Portfolio IBN was established during the third quarter of 2022 at prices of approximately $18 to $23 and is currently priced at $25.90.

AvidXchange Holdings Inc. (AVDX): A minuscule 0.54% stake in AVDX remained steady during the quarter.

The spreadsheet below highlights the changes in Mandel’s 13F stock holdings during the fourth quarter of 2023:

Stephen Mandel – Lone Pine Capital – 2023 Q4 13F Report Quarterly/Quarterly Comparison (John Vincent (Author))

Source: John Vincent. Data constructed based on Lone Pine Capital’s 13F filings for Q3 2023 and Q4 2023.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.