all children

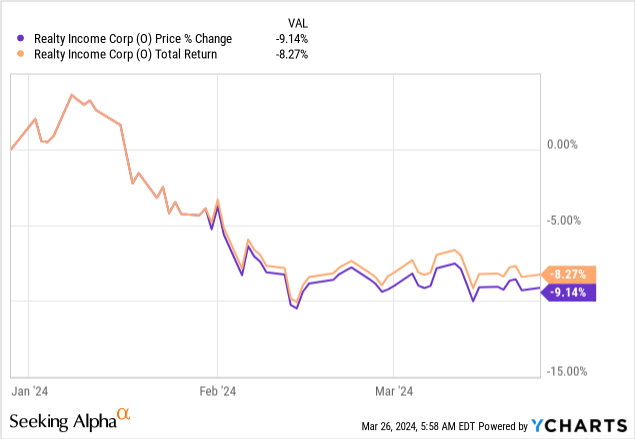

Real Estate Income Corporation (NYSE:O)Shares of the company, also known as a monthly dividend company, have fallen nearly 10% since the beginning of the year, leaving its investors in unfamiliar territory.

REIT withdrawals are not unwarranted Because there are clear indicators that its poor market performance is long overdue. However, the question is: Can Real Estate Income recover from its poor performance?

Let’s get out of the way by looking at some of the core themes of real estate income companies.

Revisiting the Fundamentals of Real Estate Income Companies

systemic resistance

It’s easy to look at Realty Income Corporation’s performance in isolation and attribute its lackluster market performance to its idiosyncrasies.However, the fact is that U.S. REITs fell more than 3% Since the start of the year, systemic headwinds embedded in the asset class have been communicated.

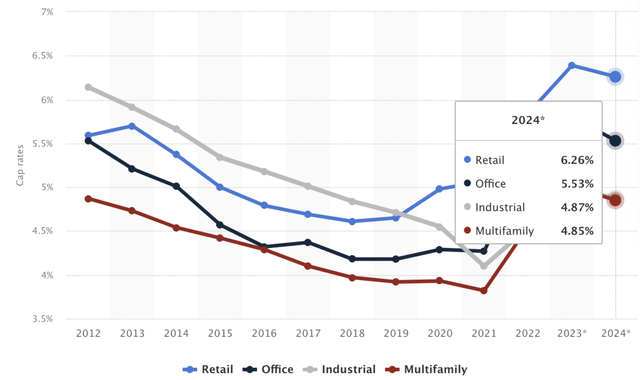

As shown below U.S. REIT capitalization rate forecasts illustrated. Although the chart’s sample data is not necessarily accurate, it provides a baseline for qualitative analysis.

politician

Capitalization rates are likely to fall this year due to annual declines in inflation and a softer overall economic environment. Additionally, property values may change for the same reasons coupled with flexible mortgage rates.

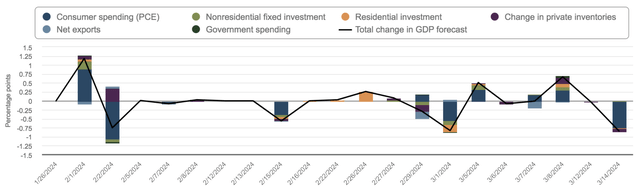

Who said the economy was weak? While many believe the U.S. economy is stable, the Atlanta Fed’s GDPNow forecast suggests the economy will likely experience a modest decline in the second half of the year due to lower government spending, lower residential real estate investment and sluggish trade. Although the GDPNow indicator is not completely reliable, it provides a solid guideline.

Federal Reserve Bank of Atlanta

Weak profits

A more bottom-up view of Realty Income Corporation might indicate whether its systemic headwinds are interconnected with its real estate portfolio.

Realty Income Corporation reported fourth-quarter earnings last month and posted disappointing numbers after occupancy fell 20 basis points. The REIT’s funds from operations normalized to $1.00 per share, missing Wall Street’s target of $1.04. Additionally, Realty Income Corporation issued full-year guidance in a range of $4.17 to $4.29, deviating from the estimated guidance of $4.25.

Despite the delivery Annualized fund 5% Judging from its operating growth rate since 1996, Realty Income Corporation’s medium-term prospects are questionable. We believe funding from operating growth will be difficult to sustain in today’s macroeconomic environment, especially on the non-investment grade end of Realty Income Corporation’s net lease portfolio, which represents 60% of its asset base. Additionally, unless severe rental inflation occurs, flex rates are likely to devalue the asset base of real estate income.

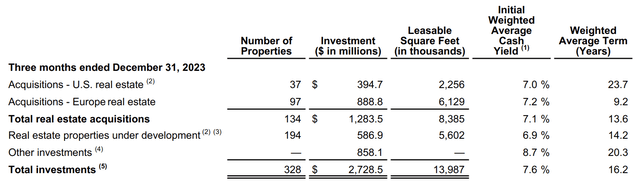

Recent acquisitions and developments

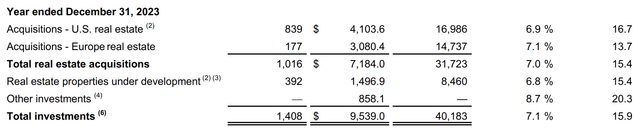

Real Estate Income Enters into an Additional Agreement 134 acquisitions In the fourth quarter, the weighted average lease term was 13.6 years and the weighted average capitalization rate was 7.1%. The REIT’s acquisition data shows it took advantage of compressed buying conditions as its weighted average cash yield exceeded the aforementioned U.S. retail cap rates. Additionally, the lease terms negotiated are excellent and add consistency to Realty Income Corporation’s earnings.

Acquisitions (Real Estate Income Company)

Additionally, Realty Income Corporation has an exciting development pipeline, with a particular focus on developments in Europe and the UK. The REIT had 164 properties under development in the fourth quarter, most of which were pre-leased, with a weighted average lease term of 14.2 years. Additionally, the weighted average cash yield on developed properties is 6.8%, which is respectable for newly developed and redeveloped units.

Development Case (Real Estate Income Company)

Realty Income Corporation’s top fourth-quarter numbers illustrate how the REIT’s massive clout allows it to lock in best-in-class deals and deliver a bright future for its shareholders.

Financing and structuring

Realty Income Corporation issued $1.6 billion of common stock in the three months to December 2023. In addition, the company also issued 300 million pounds (approximately US$382 million) of senior unsecured notes with an interest rate of 5.75% and a term of 8 years.

Realty Income Corporation continues to issue £450 million of 6% unsecured notes due December 2039 and $1.25 billion of unsecured notes with yields ranging from 4.75% to 5.125%.

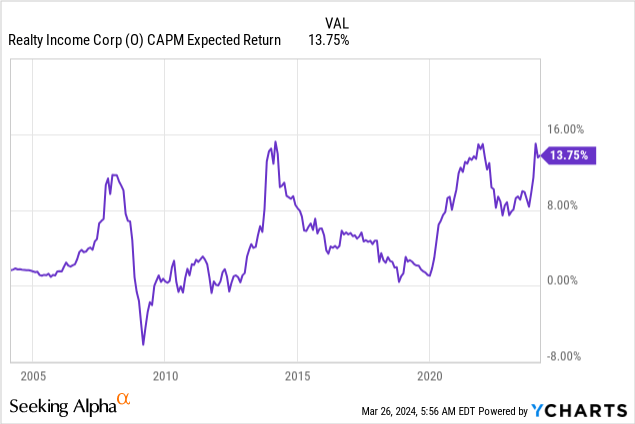

Real Estate Income’s debt issuance isn’t concerning. As mentioned, the company’s weighted average cash yield on recent acquisitions is over 7%, which means reinvesting debt can be accretive. However, we are concerned about its equity issuance as shares typically trade at a premium to debt, giving market participants a reason to withdraw capital from REITs.

Note: Note the general cost of income equity in real estate (called the cost of equity in CAPM) in the chart below.

Valuation and Dividends

Realty Income Corporation closed 2023 with adjusted funds from operations of $4 per share. The REIT’s closing market price on March 25 was $52.17, thus providing the REIT with a trailing price-to-earnings ratio of approximately 13 times.

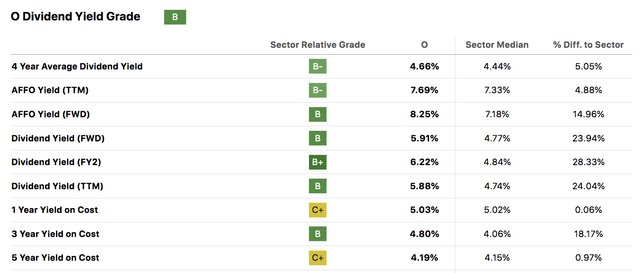

The industry’s median price to adjusted funds from operations ratio is 13.6x, which means Realty Income Corporation is relatively undervalued. However, the difference is very slight. Therefore, Real Estate Income’s dividend prospects are crucial.

Realty Income Corporation’s forward dividend yield is 5.91%, which is not ideal for a REIT. However, Realty Income’s Dividend Aristocrat status adds to the appeal. The fund has raised its dividend for 26 consecutive years, making it a seemingly excellent income-based opportunity.

Seeking Alpha

technical analysis

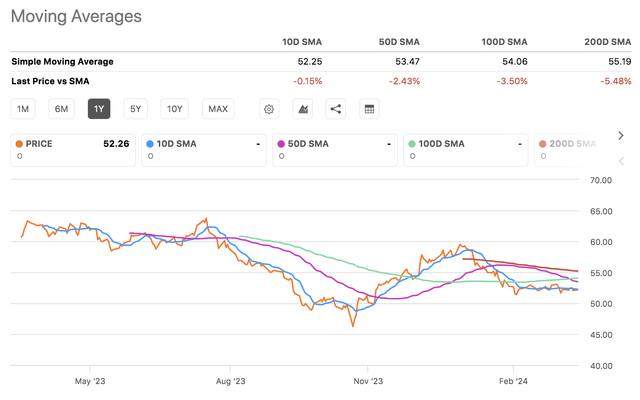

Baseline technical analysis paints a bleak outlook for real estate income. The REIT is trading below its 10-day, 50-day, 100-day, and 200-day moving averages. These numbers can create counter-trend opportunities. However, we believe the lack of structural changes means a trend reversal is unlikely. Additionally, Realty Income Corporation has an RSI of 44.49, showing that it has not yet reached the oversold zone (RSI Under 30 years old Usually considered oversold).

Seeking Alpha

The last sentence

The future for real estate income companies is uncertain. REITs face significant macroeconomic headwinds, and their valuations suggest little untapped value. However, Realty Income Corporation has a solid portfolio, and its recent acquisitions are likely to be value-added given its favorable trade-off between cash yields and financing costs.

Essentially, Real Estate Income is unlikely to recoup its year-to-date losses, but its stock price is also unlikely to fall further. Therefore, we maintain our HOLD rating.