hh5800/iStock via Getty Images

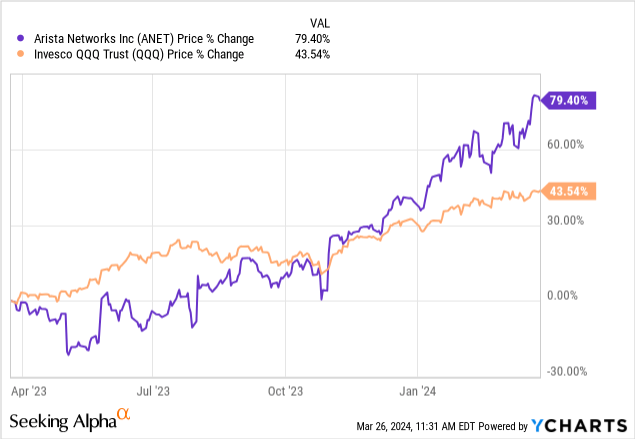

Since I introduced Arista Networks (NYSE:ANET), the stock has soared over 40% through November 2023, and my neutral stance is largely based on normalization of supply chains, which could create pricing pressure.In addition, if As you can see in the chart below, the stock is up more than 79% in the last year to $303.14, outperforming the Invesco QQQ ETF (QQ) exceeds 35%.

At the time, I did not see any opportunities related to Generative Artificial Intelligence (Gen AI), however, that has recently changed and this article is intended to provide an update on potential sales of $750 million. Amid all the hype, however, it’s important to distinguish between the artificial intelligence companies are already using to enhance their products and the sales opportunities that can arise from the network’s demand for artificial intelligence models.

First, analyzing gross margin and comparing it to competitors shows that after recovering from supply chain woes, Arista now faces an uncertain demand outlook, with sales up from $2.3 billion in the company’s latest fiscal year of 2023 More than doubled to $5.8 billion three years ago.

Adapt quickly to take advantage of digital transformation

這是一家網路設備和服務公司,主要設計和建構核心和邊緣基礎設施,也開發管理一些最大的CSP(雲端服務供應商)和企業(主要是電信公司)的網路基礎設施所需的配套software. Its impressive revenue growth is four times that of rival Cisco Systems (NASDAQ: CSCO ) and outperforms the IT industry median by a whopping 687%, suggesting it has been benefiting from the underlying need to move data from enterprise databases to the public cloud. Long-term trends in digital transformation.

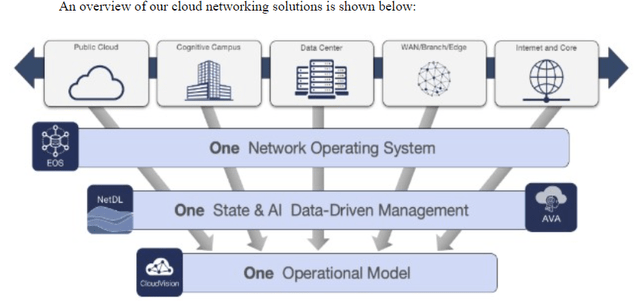

Explaining this success is its rapid evolution from a manufacturer of routers and switches to a platform-oriented company with just one operating system, which simplifies the lives of network administrators facing more complex IT infrastructures.

SEC Filing (seekingalpha.com)

In addition, it provides a wide range of services around security topics, including threat detection and response, identity management, and observability. It also differentiates itself by being an early adopter of software-driven architecture, treating the switch as a platform and adding services incrementally without having to change the hardware each time. This approach resulted in a higher gross profit margin of 64.87%, which is 27.5% higher than the industry median.

Uncertainty about the demand outlook

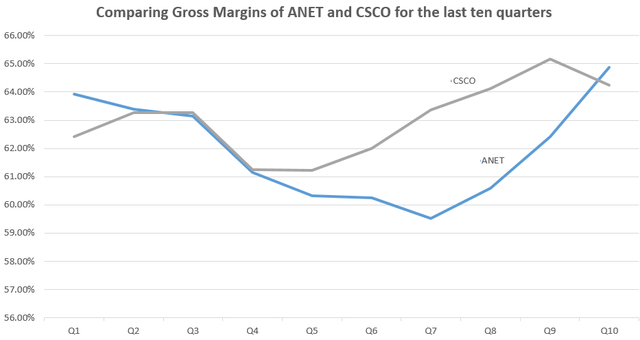

However, historical data shown in the blueprint below shows that gross margin fell below 60% in early 2023 as supply chain disruptions led to increased component costs. Margins eventually rise as supply chains normalize.

Chart constructed using data from (seekingalpha.com)

The chart above also shows that Cisco’s margins have improved due to its software and subscription strategy and a higher revenue base used to spread fixed costs. Notably, as I explained in a previous paper, the internet giant also began to experience supply chain constraints in 2022, leading to higher shipping costs. As a result, its gray chart declined before eventually recovering, even faster than Arista’s, whose chief financial officer said on a 2023 fourth-quarter (Q4) earnings call that margin growth was partly due to “better supply.” Chain costs”.

Another reason for higher margins is a better enterprise mix or more business from telcos compared to large CSPs or hyperscalers. That’s because the company squeezes out better pricing from telcos than hyperscalers, which buy in larger volumes and benefit from relative product discounts. Therefore, the gross margin growth is more due to changes in customer dynamics than demand-led higher product pricing, as was the case with the Nvidia H100 GPU.

Likewise, management mentioned that they must hold additional inventory as customers “refine their forecasted product mix,” suggesting demand may be soft heading into 2024. This could be due to inventory digestion or customers consuming products in a hurry first before placing orders in a tight supply environment. “Limited visibility” has also exacerbated demand uncertainty. Revenue is expected to reach US$6.5 billion in 2024, an annual increase of 10%-12%, almost one-third of 2023.

Cisco, by comparison, also faces demand headwinds and is expected to see lower revenue next fiscal year, which may be why it acquired Splunk (SPLK), as I laid out recently. Arista, on the other hand, is expected to continue growing organically due to its ability to build an ecosystem of products and services using a single platform to facilitate deployment and operations. But the question is whether it can quickly adapt to the reality of interconnect-generated AI workloads.

Distinguish between legacy and generative AI to identify potential opportunities

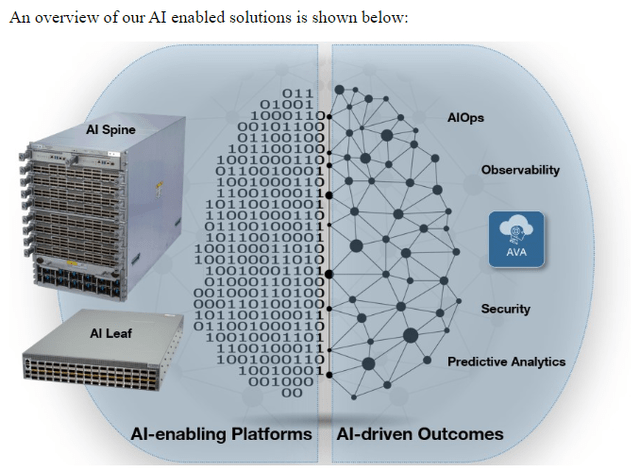

In this regard, it is important to distinguish between traditional artificial intelligence (such as machine learning or machine learning, which has been around for many years) and generative artificial intelligence (generative artificial intelligence), which drives complex language processing and image generation applications, e.g. Chat GPT. To this end, Arista’s solution (below) leverages AIOps (artificial intelligence for IT operations) and predictive analytics, both powered by ML, to extract insights from data to automate and enhance certain platform capabilities.

Seeking Alpha.com

However, while its innovative artificial intelligence platform can manage complex network traffic, a different approach is needed to support the workloads required by Gen AI.

In such a scenario, in addition to the accelerated computing capabilities provided by Nvidia GPUs, Gen AI’s software algorithms also need to access a large amount of enterprise data, and the more, the better. The challenge here is that data doesn’t always reside in one place, as companies distribute their IT in the public cloud, with the rest sitting in legacy systems somewhere in private data centers. To address this challenge, the solution is fast interconnects that connect data from anywhere to the GPU.

Now, one of the quick ways to do that is to buy Nvidia’s proprietary technology Unlimited bandwidth Its packaged switch DGX H100 supercomputer, but the problem is that it costs approx. $270,000 Each, this is beyond the reach of small businesses. For some of the larger players, InfiniBand may simply not meet the standards used by their data centers.

So those who want the option of a more open interconnect backend can opt for Arista’s proposed Ethernet-based AI, which could mean $750 million, according to its CEO during a fourth-quarter earnings call last month of pipelines. Across the industry, Cisco could get even more, $3 billion, not including the additional opportunity to work with Nvidia to quickly and securely deploy AI infrastructure at scale.

No chance at the moment

However, these are just pipelines or opportunities, and the two companies must work closely with Nvidia and potential customers to design and test Ethernet and InfiniBand artificial intelligence network clusters. As for production, both Cisco and Arista are targeting 2025.

Meanwhile, Broadcom (NASDAQ: AVGO ) is also a network switch In addition to semiconductors and software, the manufacturer already reaped $2.3 billion in AI-related revenue last fiscal year and expects to earn about $10 billion this fiscal year, according to the CEO. As such, it appears to benefit hyperscale enterprises that are trying to figure out how to incorporate Nvidia’s GPUs into their data centers without buying InfiniBand technology.

In comparison, Arista’s percentage of total revenue from hyperscalers Meta Platforms (NASDAQ: META) and Microsoft (NASDAQ: MSFT) will decline from 42% in 2022 to 39% in 2023, while both Corporate capital expenditures increased. This may indicate that they are reallocating capital to network equipment from companies other than Arista.

In this case, unless you have a very long-term investment horizon, it’s best not to invest in Arista solely for its AI-related revenue, which won’t flow through fiscal 2024. Additionally, the demand outlook remains uncertain.

Instead, more focus will be placed on testing this year, as it tweaks the 7800R AI spin and 7060X AI leaf switches to train AI models with Nvidia’s GPUs. Thinking out loud, with its ability to adapt quickly, Arista can benefit. Additionally, given that the company has consistently beaten revenue and profit expectations, the CEO may have sounded cautious when talking about opportunities in the AI training network earlier this month.

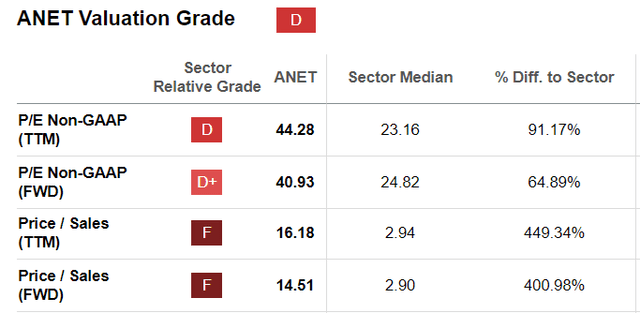

Nonetheless, the stock is not a buying opportunity as it is overvalued by more than 400% relative to the industry median at 14.5x forward sales, likely driven by the artificial intelligence hype.

Seeking Alpha.com

This suggests that the stock could still rise due to its high momentum score, especially after the Fed appeared to shift to a more dovish stance on March 19-20 Meeting This means interest rates may be lowered soon. Interestingly, the prospect of easy monetary policy has been generally positive for stocks, providing the catalyst for Arista’s stock price to rise nearly 15% since the Fed meeting.

Therefore, the risk of volatility if the Fed does not cut interest rates quickly and high expectations for AI opportunities explain my cautious stance.

Finally, after Nvidia’s InfiniBand switches grabbed most of the AI training networking opportunity in 2023 (largely due to bundling it with the H100 GPU), 2024 will be a critical year for Arista because It is adapted to the specific requirements of Gen AI. This means any positive update on progress in Ethereum’s artificial intelligence testing could cause the stock price to surge, while any progress made by competitors could trigger volatility risks. Therefore, it is better to wait.