Photoservice/iStock Editorial via Getty Images

Andrew Prochno

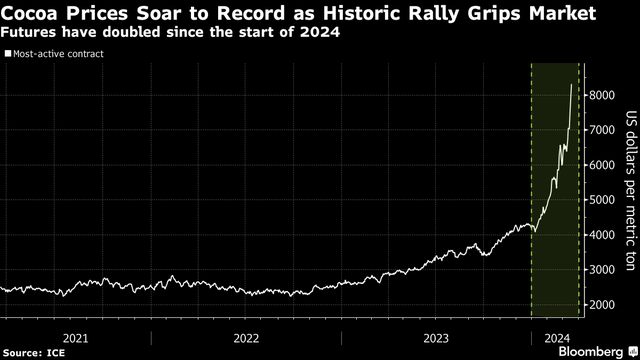

The surge in cocoa prices during the first 2.5 months of trading in 2024 has been impressive.

So far this year, cocoa prices have doubled.However, the true scale When viewed from a broader perspective, the cocoa rally is even more shocking.

Just in 2022, Cocoa is trading Prices were around $2,200/ton, but today they are closer to $9,000/ton, meaning this particular commodity has increased by more than 300% in less than two years. To understand why this market is booming, it’s important to understand the broader dynamics of the cocoa industry.

The word “cocoa” is often used interchangeably with “cocoa”, but technically “cocoa” refers to the cacao tree (Theobroma cacao) and its beans, while “cocoa” usually refers to the processing of the cocoa beans extracted from them. Products such as cocoa powder, cocoa butter and chocolate.

The cacao tree grows optimally only in certain parts of the world – usually around 20 degrees north and south of the equator.

As a result, only a few countries produce most of the world’s annual supply. These include Côte d’Ivoire (ie Côte d’Ivoire), Ghana and Indonesia, which together account for about 60% world annual production.

Several factors contribute to the prominence of these countries in cocoa production. Most important is their climate suitability, as cacao trees thrive in warm, humid climates and well-drained soil.

Each of these countries has an equatorial climate with ample rainfall and stable temperatures, which in theory should help optimize the production of healthy beans.

Unfortunately, cocoa production is concentrated in a few countries, leaving the industry vulnerable to the geopolitical complexities that occur in these regions.

For example, adverse weather conditions, disease outbreaks, and sociopolitical instability can severely impact output. As the recent surge in cocoa prices illustrates, major disruptions can also have profound effects on global cocoa supplies and related prices.

Bloomberg

Ongoing supply crunch triggers strong price rise in cocoa market

The cocoa industry is undergoing unprecedented upheaval as harsh weather conditions wreak havoc on cocoa-producing regions, particularly Ghana and Côte d’Ivoire.

In December, heavy rains inundated West Africa, causing massive flooding and causing severe damage to cocoa forests in Ghana and Côte d’Ivoire. Not only did the flooding cause immediate crop damage, it also facilitated the spread of black pod disease, which often destroys pods on cocoa trees.

Speaking about the catastrophic rains that occurred late last year, Siaka Sylla, president of a trading cooperative in Côte d’Ivoire, said:Observed“, “I have never seen such a harvest in 20 years. The rain destroyed all our crops. “

As if that wasn’t enough, an extreme heat wave exacerbated the situation. Since 2024, West Africa has experienced several periods with temperatures exceeding 40 degrees Celsius.

This means that the cocoa forest has transitioned from excess rainfall to drought-like conditions, which has severely disrupted cocoa bean growth and, in turn, affected harvest expectations for the 2023-2024 harvest.

Take Ghana as an example, recently cut Its cocoa production forecast for the current growing season was lowered to 650,000 tons from 850,000 tons. Côte d’Ivoire faces similar challenges and is also lowering expectations for the upcoming harvest.

within the globe, just food expected Net cocoa production in the 2023-2024 growing season will fall to around 4.5 million tonnes, about 350,000 tonnes less than the total harvest in 2022-2023.

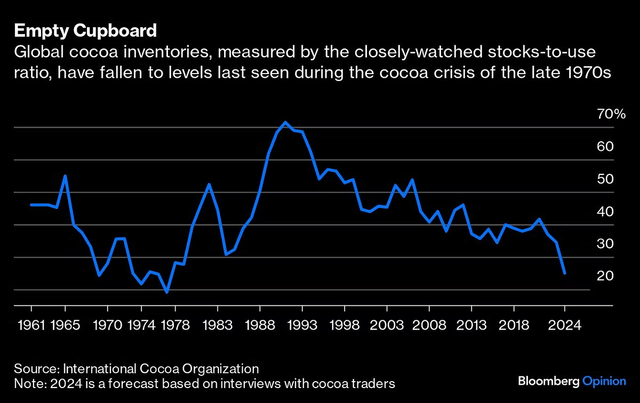

Not surprisingly, the lower-than-expected harvest has reduced global cocoa stocks to critical levels, as shown in the chart below.

Bloomberg View

Chocolate makers grapple with soaring cocoa prices

According to the International Cocoa Organization (ICCO), about 70% of global cocoa production is used in the chocolate industry.

Cocoa butter is obtained by grinding and processing cocoa beans and is a key ingredient in chocolate, accounting for about one-fifth of the average chocolate bar. Composed of cocoa butter.

As cocoa prices skyrocket, the world’s chocolate producers are forced to accept a painful truth. The cost of its key raw materials has been rising steadily for more than 18 months, posing significant challenges to their business operations. Therefore, the surge in cocoa prices has profound implications not only for chocolate producers but also for chocolate consumers around the world.

Michele Buck, president and CEO of The Hershey Company, stressed the importance of historically high cocoa prices and stressed Net profit fell 11.5% Season 4, 2023.

If prices continue to rise, consumers expect chocolate prices to rise sharply, exacerbating rising inflationary pressures.Retail price of chocolate in the United States last year Expected to rise 10%.

In response to the changing landscape, chocolate manufacturers have been forced to take strategic steps to mitigate the impact on their bottom lines.

For example, Hershey recently Due to deteriorating financial conditions, the company announced that it would lay off up to 5% of its workforce.

In addition to cutting operating costs, chocolate companies are trying to maintain existing revenue by promoting new products with lower chocolate content and redesigning the size and packaging of some chocolate products. Mars, for example, tweaked its Galaxy chocolate bar, reducing the size by 10 grams and offering it at the same price.

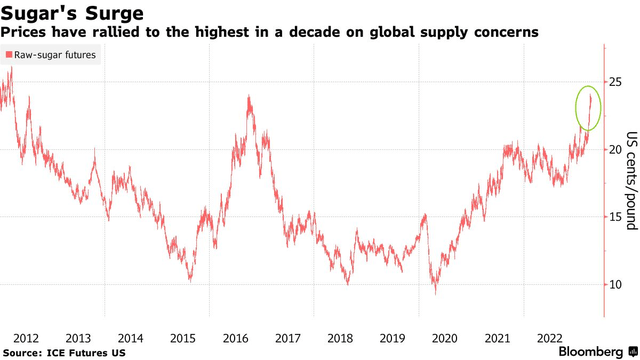

Other manufacturers have responded by adding additional ingredients, such as caramel, nuts and fruit, in an attempt to replace other flavors with increasingly expensive cocoa butter. Unfortunately, the value of another key ingredient in chocolate making—sugar—has also increased significantly over the past few years.

Bloomberg

Commenting on these industry-wide difficulties, Billy Roberts, senior food and drink economist at CoBank, said:recently told Food Engineering Journal”, “The cocoa issue comes at a particularly challenging time for manufacturers, given that they have been dealing with rising sugar prices for the past three years. “

Not surprisingly, current challenges are expected to persist, mainly because the cocoa and sugar markets are not expected to cool down anytime soon.

Currently, many analysts expect the cocoa market to remain unbalanced Throughout 2024 and possibly into 2025. This is because the El Niño weather pattern – thought to be the main cause of severe weather conditions in West Africa – is also set to persist.

Taken together, this means chocolate makers may not see relief anytime soon.It is worth noting that a A recent study Chocolate buyers are expected to cut back on spending if prices rise further, a consumer confidence survey by NIQ found.

The findings suggest that the delicate balance between profitability and consumer expectations continues to narrow and will put pressure on chocolate makers for the foreseeable future.

Worryingly, cocoa prices rose another 8% on March 25, stabilizing above US$9,600/ton. To track and trade this unique niche of global markets, investors and traders can add Cocoa Futures (CC1:COM) to their watchlist.

Additionally, some of the most prominent publicly traded chocolate companies include Chocolate factory Lindt & Sprüngli AG (OTCPK:CHLSY), Hershey’s (HSY), Mondelēz International (Mondelez International) and Nestle (OTCPK:NSRGY).

Andrew Prochno Has over 15 years of experience trading global financial markets, including 10 years as a professional options trader.Andrew is a frequent contributor lucky box Magazine.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.