bjdlz

Source Exploration Company (OTCPK:CDDRF) just finished a stellar year. The exit rate in the fourth quarter was not far from the average exit rate in the new fiscal year.However, it seems to the management Be very concerned about cash balances and debt-free balance sheets. With commodity prices lower, it’s better to take conservative guidance rather than need to cut prices later.

The market likes increases in capital budgets. But that same market really hates lower budgets this fiscal year. So despite slow growth going forward, as I noted before, an expanded budget to address flooding issues may be the reason for no change in guidance for now. Water injection often has delayed positive production effects.

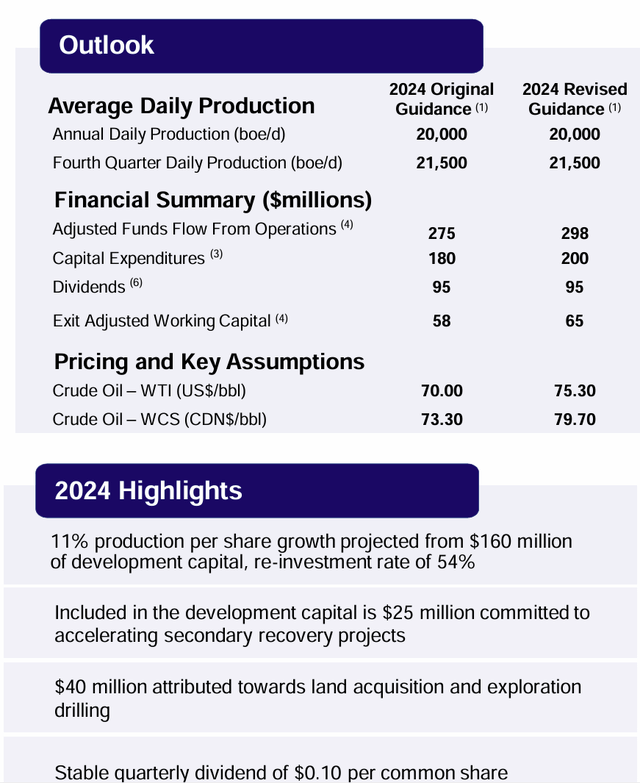

Budget 2024

implicit in The guide is the relationship between WTI pricing and the prices received by heavy oil producers. The budget may change if the heavy oil price discounts received widen.

(Note: Unless otherwise noted, this is a Canadian company and reports are in Canadian dollars.)

2024 Revised Guidelines for Water Source Exploration (Source Exploration Company Briefing, March 2024)

one of the things Impacting this year’s budget is rapid growth in fiscal 2023, when average productivity growth More than 40%.

Rapid production growth from organic growth (as is the case here) is due to the greater decline rate in the first year for many brand new wells (whether conventional or unconventional). This means that more capital will be used to maintain production next year as new production declines rapidly in the previous year.

This effect is amplified by the fact that assumed pricing is slightly lower than past fiscal 2022 price declines from highs. Now they have leveled off. But it’s nothing like what the company has been producing lately. There is a budget to maintain production starting this fiscal year. However, this could easily change if commodity prices continue their current rally.

Now, once there is enough old production and the corresponding reduction in production due to slower growth, then the same capital will fund faster growth at some point in the future.

capital cost

Another consideration is the falling cost of capital. One side effect of low natural gas prices is an overall decline in industrial activity. This contrasts with the post-COVID-19 period, when rapid industry growth led to bottlenecks and unusually high prices. Supply and supplier costs are now becoming very competitive.

That’s great for the few companies like this low-cost operator that can still aggressively try to increase production. Please note that the company regularly reviews its budget and provides “updates” throughout the financial year. In fact, if this trend continues, it could mean capital budgets are much further ahead than currently expected. Technological changes seem to regularly shift maintenance budgets into low growth budgets. Therefore, I am optimistic about increasing production through the official production maintenance budget.

exploration

The situation is the same for most Clearwater exploration wells. The company has yet to find the show’s niche. So there are still efforts to acquire land in the area that could be very lucrative. Since this is Canada (Unless otherwise stated, the Company reports in Canadian dollars), land acquisition costs are much lower than in the United States.

What’s changing is that the company is now applying the knowledge gained in Clearwater to a number of other areas, anticipating success not only in finding oil, but also in keeping costs low (and profits skyrocketing) success.

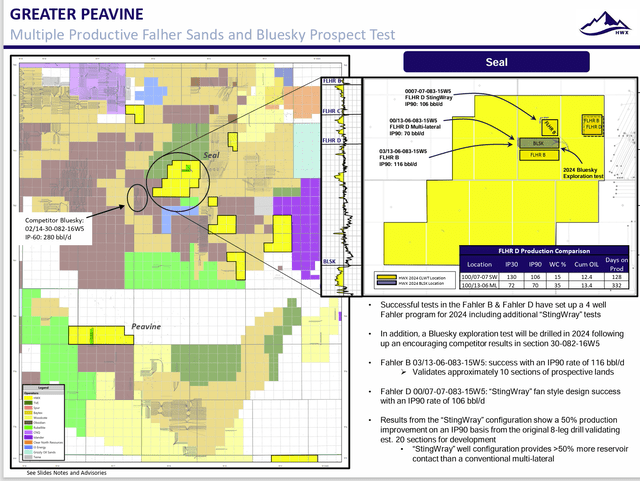

Greater Peavine water exploration prospects in fiscal year 2024 (Source Exploration Company Briefing, March 2024)

One thing that’s still worth noting is how much oil and gas has changed since I started looking at it. One of the key areas is that now companies “know” where the oil is. As a result, the risk of dry holes has been significantly reduced in many cases.

This happens here too. Management did report that one well in one of the areas had high water content. But they might go back and drill in a slightly different location (and maybe even complete a slightly different completion) to potentially successfully expand the area.

Another thing to consider is that as technology advances, there are stacked games “everywhere.” As a result, many basins continue to expand their intervals, incurring commercial costs.

Regardless, the company is well on its way to expanding production and increasing production in another area outside of the main Clearwater gaming area.

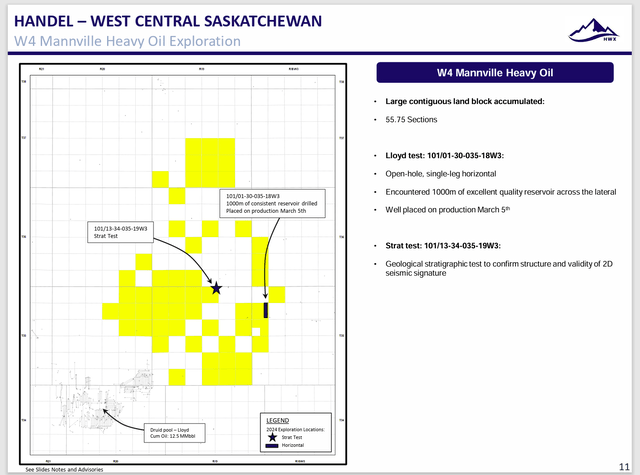

Handel-West Water Exploration Overview (Source Exploration Company Briefing, March 2024)

The slide above represents a significant departure from anything nearby that company management has indicated in some form. This may represent a completely different area of the game, and management intends to see how available technology can handle this game.

Many companies “find” oil in an area and only need to cost it over time (and complete wells) before the entire area’s budget becomes competitive. Time will tell how well the region currently understands the heavy oil zone.

financial

The balance sheet remains debt-free and the cash balance is sufficient. This eliminates a lot of new risk for the company. Companies that operate in a financially conservative manner rarely get into serious trouble.

In any cyclical downturn, management is likely to make maintaining a strong balance sheet a top priority. The good news is that any dividend cuts will be restored quickly when prices start to recover.

generalize

The main story here about extraordinary profitability and achieving growth remains the same. Now the story will expand to other realms and other time intervals. This will be a big change since the last post. Even with repairs budgeted for this fiscal year, the long-term growth story is likely to remain the same. With commodities, sometimes growth skips a period until circumstances become friendlier.

Management is the same one that built Raging River and sold it to Baytex Energy (BTE). This management experience also greatly reduces the risks of new companies.

So far, it looks like a lot of low-cost growth is on the horizon. How long this situation will last, no one can tell. For heavy oil, the well breakeven point is very low. This is a huge competitive advantage compared to heavy oil competition in other basins. This hasn’t changed since the first post.

This company remains a strong buy with higher risk for those who can handle newer smaller companies. As mentioned, management has reduced many of the risks, but it’s still relatively new and small. Still, I like the chances of success and the opportunity for this company to make more money in the future.

For those interested in upstream companies, Headwater Exploration Inc. is a good buy-and-hold idea. I probably won’t sell stock unless management sells the company like they have in the past.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.