asikkk/iStock via Getty Images

Inari Medical Co., Ltd. (NASDAQ: NARI) is a leader in the treatment of VTE, or venous thromboembolism.For those with a high risk tolerance, Inari is one of the best medical device stocks to own in 2024 because High growth rates and now cheap valuations.

Inari’s stock price has fallen sharply recently amid a Justice Department investigation into physician payment practices. Those caught by this suspense should abandon NARI until we get clearer information, but this is unlikely to result in huge fines. This creates an excellent buying opportunity for investors who are willing to take risks and seek long-term growth in excellent industries. Inari develops mechanical thrombectomy products for pulmonary embolism (“PE”) and deep vein thrombosis (“DVT”).Now they have dedicated products for other similar indications Increase their total addressable market (TAM) and revenue.

The company has excellent gross margins and long-term potential operating margins as it builds this new segment and improves patient outcomes. They compete with Penumbra (PEN) in this market, with both companies showing strong growth and vying for leadership. Digging deeper into recent results and upcoming new products makes Nari’s bullish thesis very strong.

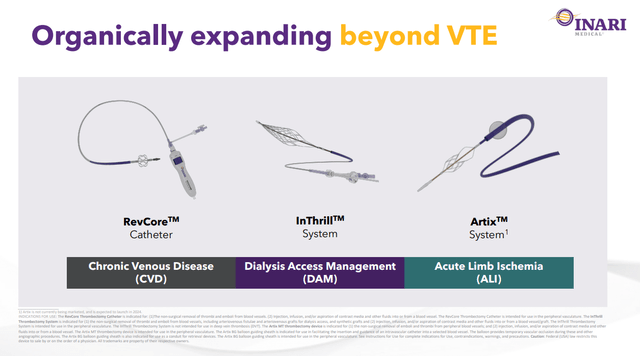

NARI new products (NARI February 2024 speech)

Add TAM in 2024

NARI’s key products include the ClotTriever and FlowTriever systems, which can easily remove venous thrombi in PE and DVT. They have strong growth momentum and their different variants together account for more than 90% of NARI’s revenue.Strong fourth-quarter revenue $132.1 million, an increase of 22.6% compared with the previous year. GAAP loss for the fourth quarter was $9.3, which suggests the company’s cash burn rate is low, but profitability is poor as they lean toward growth initiatives and additional sales reps.

Nari’s profit margins are also high, with a gross profit margin of 87.1% in the fourth quarter of 2023, indicating that they have the potential to increase operating margins to higher levels. NARI’s guidance for 2024 is a stable 19%, and it is understood that management’s target is relatively conservative. Considering fourth-quarter revenue, that’s solid growth and shows that growth can continue even as competition from new products intensifies. In the long term, with the further expansion of manufacturing scale, gross profit margin can increase to about 90%.

However, Inari’s suite of new products is helping to improve the potential for future revenue growth. RevCore is a product specifically designed to US$500 million Potential market for treatment of venous stent thrombosis in the United States. RevCore allows clots around the stent to be removed in a 1-hour outpatient procedure, which should provide a reliable option for doctors without competing products. This is a significant issue for physicians, and RevCore should see steady revenue from NARI over the next 2 years.

InThrill has been generally available for a few quarters and is starting to gain traction. The product helps with dialysis access management by targeting blood vessels in the upper extremities or below the knees. It targets small vessels with a total market potential of $1 billion, or more than 250,000 surgeries per year. The third is the return of previously released Artix products in 2022. This product combines mechanical thrombectomy and aspiration to assist in the treatment of acute limb ischemia cases.

Currently, 50% of these cases require surgery, demonstrating that NARI can meet a strong unmet need. The product gives Inari another $600 million in addressable market.These, combined with recent Linliu The acquisition gives the company a lot of work to do in 2024 to stimulate revenue growth.

This new set of products developed over the past few years will be critical to growth in 2025 and beyond, although their percentage contribution in 2024 will still be small. The three products mentioned above are Inari’s in-house designed products, specifically tailored for use cases where there are no good alternatives. They delivered $5.4 million in revenue in the fourth quarter, up from $1.8 million in the same period last year. They will continue to be shown separately in Inari’s future earnings because they believe they indicate the company has another growth lever beyond international sales.

Margins will be lower initially on these new products, but as they gain scale over the next few years, margins should improve again. International sales will grow from 6% by the end of 2023 to over 20% in the long term, but this growth will be slow and steady due to reimbursement challenges.

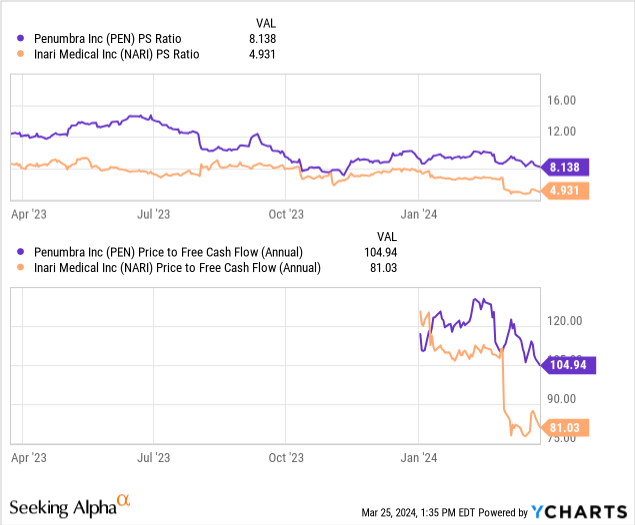

Although they have similar growth profiles and both hold a large share of the market, NARI currently trades at a significant discount to Penumbra (PEN). Penumbra does have another neurological issue, however, that makes direct comparison difficult.

That being said, NARI’s current valuation discount relative to its own history is large enough that I would prefer NARI to PEN. Penumbra has the scale and profitability advantages that the current market favors, but NARI will be consistently profitable in the first half of 2025. It is expected that the growth of the two will be in the 20% range by 2024, and the VTE market will continue to grow in the future with the ten-year tailwind of these two stocks.

Buy when valuations are depressed

As you can see above, NARI trades at 4.9x sales, well below its valuation a year ago. The company’s acquisition of Limflow will delay its profitability from 2024 to 2025, but should improve the business’s long-term earnings. With 200,000 people dying from these preventable problems each year, demand for Inari’s products will continue to grow. The current legal issues shouldn’t scare you away, as the sharp drop in stock prices has impacted these issues. Therefore, those with a 3+ year outlook would be wise to add to their positions with NARI below $50, where they are currently trading, for impressive long-term capital appreciation potential.