Kosig

Written by Nick Ackerman and co-produced by Stanford University chemists.

BNY Mellon High Yield Strategy Fund (NYSE:DHF) is a diversified, high-yield closed-end fund.In our previous report, we compared this fund to Credit Suisse High Yield Bonds fund(Dishi), given its many similarities. We note that DHF looks better value and has stronger distribution coverage – enough coverage to seem to warrant a raise. Well, that’s exactly what happened: Since that update, they’ve increased distribution.

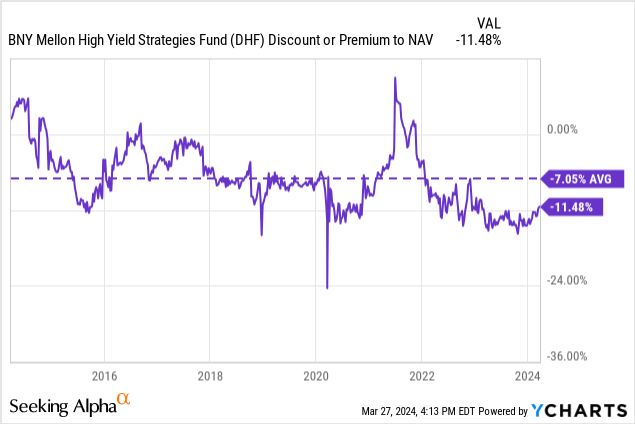

The fund is still trading at a pretty attractive discount and is now generating higher payouts for its investors. What’s more, new payouts are still based on their latest earnings. If that’s why people want to deploy some extra capital, that could make the fund an attractive option in the high-yield CEF space.

DHF basics

- 1 year Z score: 2.41

- Discount: -11.48%

- distribute Yield: 8.94%

- Expense ratio: 1.33%

- Leverage ratio: 28.77%

- Assets under management: $274.551 million

- Structure: permanent

DHF investment objectives It is “the pursuit of high current income.” They will attempt to accomplish this by investing “at least 65% of their total assets in income securities of U.S. issuers rated below investment grade quality or in unrated income securities of comparable quality as determined by the Fund’s subadviser, Alcentra NY, LLC.” A goal. “

DHF is a leveraged fund, which always adds additional risk that needs to be considered. Volatility is high as both upward and downward movements are amplified. Given that it is a high-yield focused fund, this makes this fund less suitable for risk-averse investors; instead, one will need to be comfortable with a higher risk spectrum.

Additionally, leverage adds additional costs that need to be considered. When those costs are factored in, the fund’s total expense ratio climbed to 3.96% as of the latest report. Semi-annual report. This is due to the much higher interest rate environment we are in now. In fiscal 2023, the total expense ratio reached 2.9%, and in 2021 it dropped to 1.71%. In essence, this is a “free” money environment, and the fund’s largest expense is operating expenses, including advisory fees. On the other hand, DHF also has some floating rate risk, which helps limit some losses from higher interest payments.

Performance and Valuation

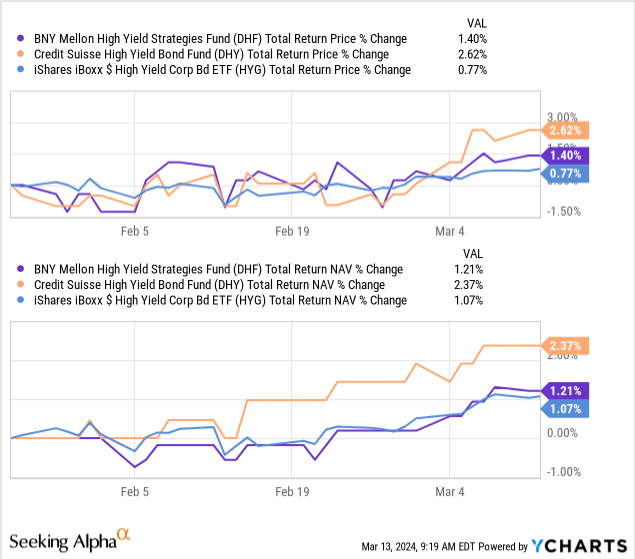

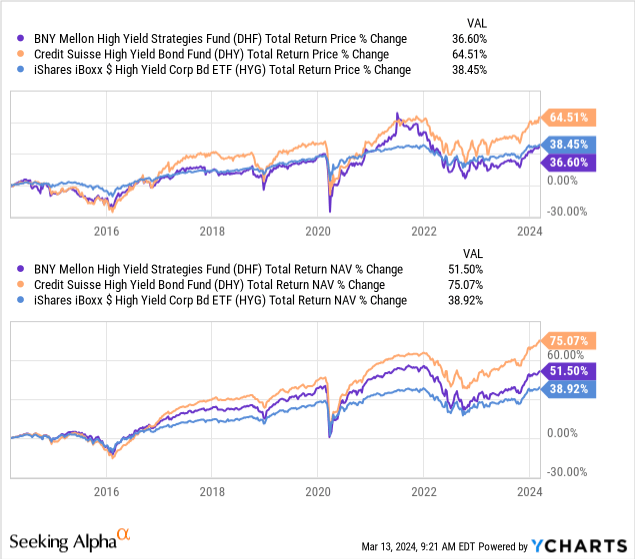

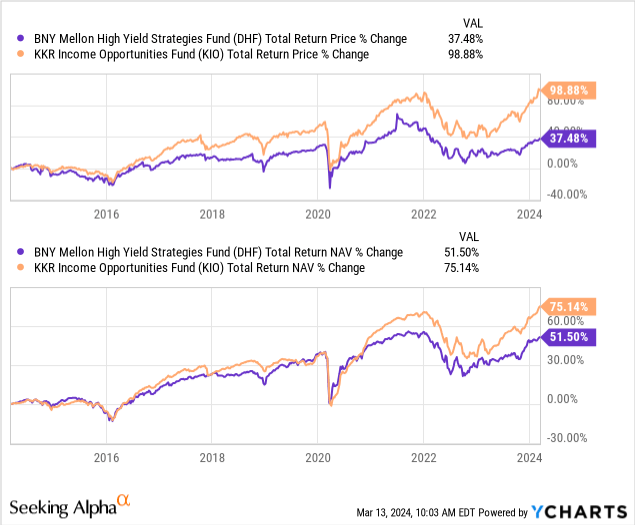

Since our last update, DHY has significantly outperformed DHF in both total NAV and share price returns. DHF’s performance has mostly been in line with the iShares iBoxx $ High Yield Corporate Bond ETF (HYG), or more accurately, DHF has performed slightly better over the past few months. HYG is a non-leveraged, passively managed ETF that can provide some insight into the dynamics of the broader industry.

Y chart

DHY’s stellar performance is nothing new, either. Here’s another thing we noticed when comparing these two funds in a previous update: DHY has historically performed much better.

This doesn’t mean DHY will always outperform the market, but the track record is definitely in the fund’s favor.

Y chart

Despite this, DHF’s own performance against HYG was quite impressive. The fund has outperformed by a wide margin over the past decade. During Covid and the market crash of 2022, we naturally saw the performance of both DHF and DHY decline sharply. That’s the leverage that comes into play.

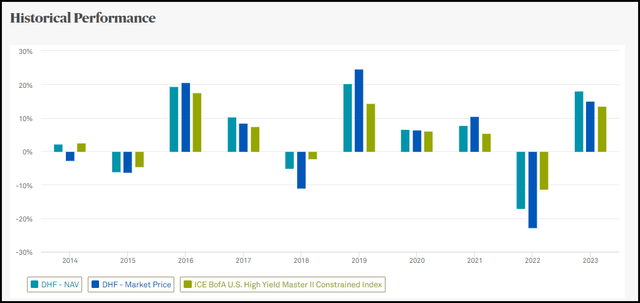

Looking at it another way, we can see the fund’s annual performance compared to its benchmark. During crashes, the fund crashed more severely, while during booms, the fund performed as expected.

DHF historical performance (Bank of New York Mellon)

Most people expect rate cuts in the future; whether that’s this year or next, that’s a bone of contention. Overall, this should help leverage continued funds as borrowing costs come down.

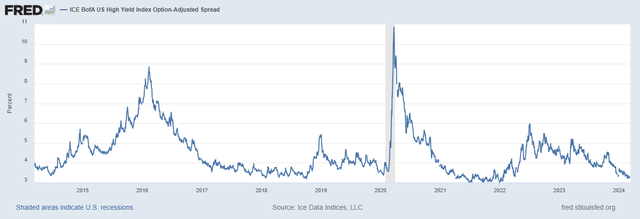

On the other hand, it depends on the reason for the rate cut.The high yield credit spread is historically narrow. This could mean that high yields will fall, raising yields and therefore spreads. This is certainly something to consider at this time, as leverage will make both upward and downward moves more dramatic.

Rather, it does suggest that markets are quite optimistic about financial conditions and expect defaults to be minimal, so they are willing to take on more risk for a little more yield.

high yield spread (Fred)

This is where CEF’s discounts can come in, helping to soften the blow somewhat. Not only does the fund invest in underlying debt instruments that trade below face value, but the fund itself also trades below “face value.”

The average bond price in the fund’s portfolio is $95.18, according to CEFConnect. At the same time, DHF’s discount to NAV is attractive from an absolute and relative historical perspective.

Circulation surges

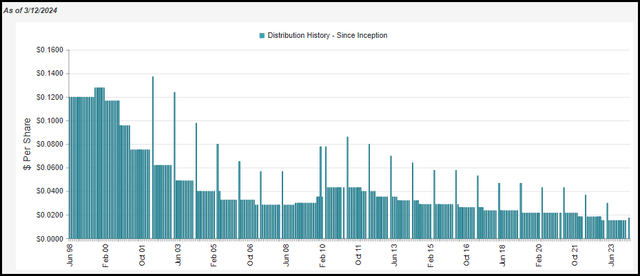

The fund has some history, dating back to 1998. When they initially launched, the timing was terrible and the fund’s share price and NAV fell sharply. The fund also took a huge hit during the global financial crisis, as well as during the COVID-19 pandemic and throughout 2023. Yields have also fallen during much of this period, meaning the portfolio’s ability to generate income has also declined. So the combination of lower yields and severe erosion of fund assets ultimately results in significant allocation cuts over time.

That means the latest allocation increase may bring too much enthusiasm from investors, but it’s at least moving in the right direction.

DHF distribution history (CEF connection)

Such a distribution history certainly doesn’t inspire shareholder confidence in the long run. HYG’s own dividends have also been declining for much of the past decade; only recently, in the current higher interest rate environment, has HYG’s monthly distributions also begun to trend higher. This is actually more a reflection of the space than a serious mistake made by DHF.

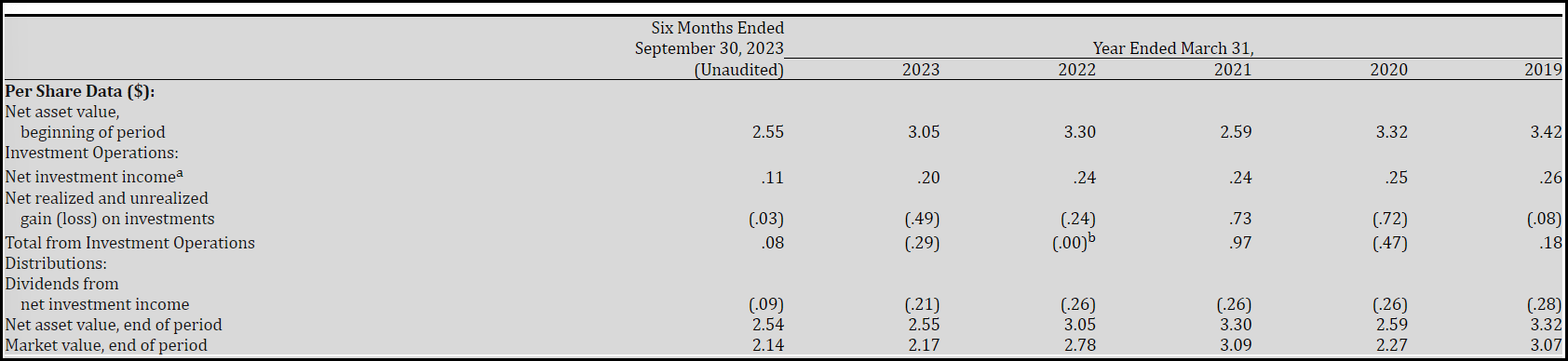

National information infrastructure coverage also reflects that even after the increase, it currently appears to be sustainable. According to the last semi-annual report, the fund’s annualized net investment income was $0.11 or $0.22. This puts it on track to continue rising in fiscal 2023. This also means that even after the significant increase in allocations, the fund’s NII coverage will still be nearly 105%.

DHF Financial Statistics (Bank of New York Mellon)

Combined with this increase and the fund’s discount, the distribution ratio reaches an attractive 8.94%. In net terms, it still fell to 7.78%.

DHF’s product portfolio

The fund recently reported a turnover rate of 56.62%; however, this is not annualized, meaning that FY2024 turnover could reach over 100%. It’s not unheard of for the fund either, as FY23 revenue is approaching 120%. This means we could see a lot of movement in the fund’s portfolio, as it appears to be quite active.

Nonetheless, the latest data shows that among the 326 funds held, the average duration of the fund is 3 years. This is fairly consistent with what we would expect from a high-yield fund. Because of their higher yields and shorter maturities, they are generally less sensitive to interest rates. The fund has an average maturity of 4.62 years. When you invest in a riskier company, you want to get your money back quickly. The sooner the better, because the longer you have to borrow money from a financially distressed company, the greater the chance of some kind of recession.

Investing in high-yield areas means knowing that you will see defaults and bankruptcies, and you will incur losses. The idea is that you end up with more winners than losers. As a result, funds in this space typically invest in hundreds of different holdings and companies to help achieve significant diversification. This diversification is also reflected in the fund’s top 10 holdings. Sometimes a fund can hold hundreds of positions and still significantly overweight its largest position. For DHF, the portfolio appears to be fairly diversified.

DHF Top Holdings (Bank of New York Mellon)

But it’s worth noting that bonds don’t completely disappear when these events occur. Instead, it’s thanks to capital stacking above equity.The degree of recovery depends on many factors, but Normally there will be some recovery.

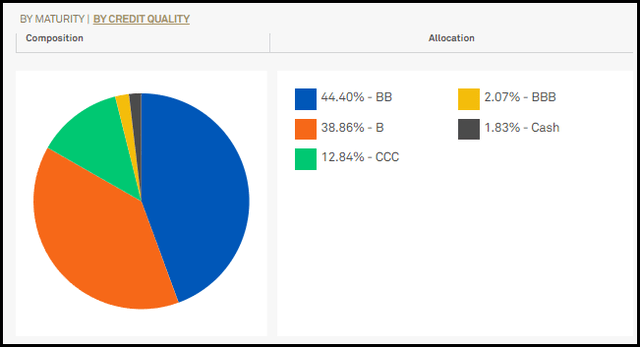

In terms of DHF’s credit quality, it’s not necessarily an overly junk portfolio, with most of the weight allocated to BB and B.

DHF Portfolio Credit Quality (Bank of New York Mellon)

They hold 12.84% of their shares with CCC, which are already in default just a notch or two above.

In some cases, I view KKR Income Opportunities Fund (KIO) as a high-yield bond fund that fully embraces junk bonds.them carry almost 35% of their portfolio is rated CCC, 6% is rated BB, and about 42% is rated B. However, this is not necessarily a problem. In fact, KIO has historically crushed DHF in terms of total returns. Just know what you’re holding, when KIO goes down, it tends to go down even harder, as we would naturally expect.

Y chart

in conclusion

DHF remains a reasonably valued fund in the high-yield CEF space. The fund’s distributions have been boosted due to its strong distribution coverage. What’s more, the fund’s coverage remains strong even after the capital raise. Interest rates are expected to fall over the next year or two, which could help provide more distribution coverage as borrowing costs fall. For these reasons, DHF still appears to be a fairly attractive fund to consider if you are looking for this type of investment. Spreads above risk-free rates have historically been narrow, and expectations that default rates will rise this year will be areas that require careful attention. Leveraged funds will also become a problem if there is no generally optimistic outlook on the overall financial health of the economy.