Exterior of the TD Bank Building. Marvin Samuel Tolentino Pineda/iStock Publishing via Getty Images

All else being equal, I particularly like investing in businesses with a proven track record of paying dividends. The longer a company continues to pay dividends, the It was more that it caught my attention.

In my opinion, nothing reflects a company’s commitment to shareholders more than maintaining and/or increasing a dividend over decades or even centuries.

That’s why Canada’s major banks stand out to me as an interesting option for a reliable income. Last week, I took another look at Scotiabank (BNS).

Today, I’m going to focus on its larger peer Toronto-Dominion Bank (NYSE:TD), and why I started with a Buy rating.

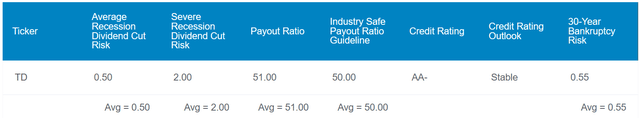

Dividend Wang Zen Research Terminal

TD’s forward dividend yield of 5% is significantly higher than the financial industry The median forward dividend yield is 3.4%.That’s why Seeking Alpha’s quantification system wins Class B+ Provides forward dividend yield to the company. Additionally, the company’s dividend payment consistency (more on that later) is enough to earn an A grade for dividend consistency from the quantitative system.

TD Bank’s 51% earnings-per-share payout ratio is broadly in line with the 50% earnings-per-share ratio favored by ratings agencies in the banking sector.

The company’s leadership position in Canada’s integrated banking industry and solid financial position have earned it an AA- credit rating from Standard & Poor’s with a stable outlook. This means that the probability of TD being zero in the next 30 years is 0.55%. In other words, the company will continue to operate in 181 of 182 30-year simulations.

For these reasons, Zen Research Terminal has a 0.5% chance of cutting its dividend in the next average recession. In the next severe recession, this number will grow to 2%. For context, these are the lowest values possible within the Zen Research Terminal.

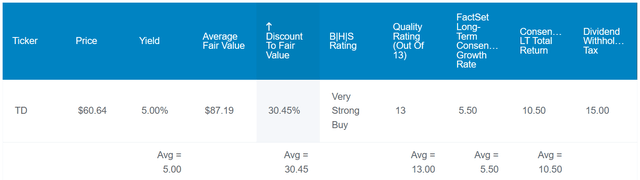

Dividend Wang Zen Research Terminal

If TD Bank’s promising fundamentals weren’t enough, the stock also looks like a solid value. Its five-year average dividend yield is 4.1%, which suggests a value of $73 per share, according to Dividend Kings’ automated investment decision-making bot. Since the company’s fundamentals appear to be intact, I don’t think it’s unreasonable to expect an eventual return to this dividend yield.

My inputs to the dividend discount model show a value of $76 per share: an annualized dividend of $3.026 per share (annualizing the last two dividend payments), a discount rate of 10%, and an annual dividend growth rate of 6% (more on this Will be introduced later) I use it as DGR).

Averaging Zen Research Terminal’s overall fair value of $87 with my fair value of $76, that would be an average fair value of $81 per share. This could mean the share price is 26% below fair value at the current share price of $60 (as of March 28, 2024).

If TD reaches the Growth Consensus and returns to fair value, the possible total returns over the next 10 years are as follows:

- 5% yield + 5.5% FactSet Research annual growth consensus + 3% annual valuation multiple rise = 13.5% annual total return potential or 255% 10-year cumulative total return versus the S&P 500’s annual Total return potential of 9.8%) or 155% 10-year cumulative total return

TD is a financial giant

due to its Founded 1855TD Bank has grown from a single bank branch serving grain millers and merchants to a dominant financial services company.As of January 31, TD Bank’s more than 2,200 retail banking branches were entrusted by more than 27 million customers to manage total assets of C$1.9 trillion (information from TD Q1 2024 Overview PDF).

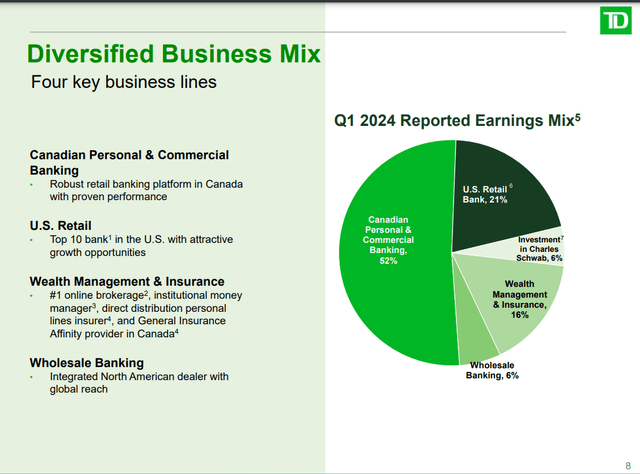

TD Bank First Quarter 2024 Investor Presentation

In recent years, TD Bank has steadily transformed from a bank into a comprehensive financial services company. In fiscal 2018, the company’s Canadian Retail and U.S. Retail Banking segments accounted for 86% of its reported earnings mix (9 of 34 per slide) TD Bank First Quarter 2019 Investor Presentation). As of the first quarter of 2024, this proportion has dropped to 79%.

The company also owned about 12% of Charles Schwab (SCHW) as of Jan. 31. This represents another 6% of its profit portfolio in the first quarter of 2024 and is part of its U.S. retail banking business.

Regardless of location, these segments offer consumers products such as mortgages, auto loans, and credit cards. Other products include savings accounts, checking accounts, certificates of deposit and small business banking.

TD has recently been leaning into wealth management and insurance. In the first quarter of 2024, the wealth management and insurance business accounted for 16% of its profitable portfolio. These include estate and trust planning annuity products, insurance products and asset management services.

Finally, the company’s wholesale banking unit accounted for the remaining 6% of the earnings mix in the first quarter of 2024. The business serves more than 17,000 corporate, government and institutional clients in global financial markets. Whenever corporate, government or institutional clients need capital, the firm’s capital markets and investment banking services can meet their needs.

Although TD continues to strive to expand its business, this has not harmed the company’s development direction. Its total assets increased by nearly 50% from C$1.3 trillion in 2018. This means the company has maintained its ranking as the sixth-largest bank by assets in North America during this period.

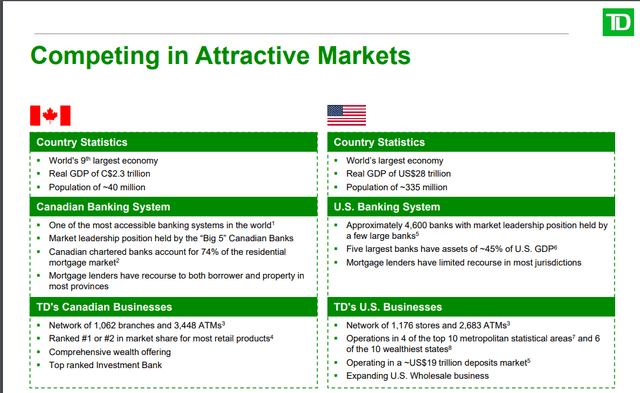

TD Bank First Quarter 2024 Investor Presentation

Looking ahead, TD’s outlook remains positive.

For one, the company is Canada’s second-largest bank, behind Royal Bank of Canada (RY). The Canadian market is very concentrated, with chartered banks accounting for 74% of the residential mortgage market. In Canada, TD’s network consists of more than 1,000 branches and more than 3,400 ATMs, ranking first or second in total market share for most retail products.

TD Bank’s U.S. dominance doesn’t compare to Canada’s, but it’s still pretty solid for a non-domestic bank. The company’s network consists of nearly 1,200 branches and nearly 2,700 ATMs located around the world. Top 10 banks Domestic by assets.

In addition to TD’s industry leadership, the macro environment in these two major markets is also quite positive. According to statistics, U.S. real GDP The annual compound growth rate from 2024 to 2028 is expected to be approximately 2%. Statista’s forecast for Canada’s economy Much the same.

Customers overall are getting wealthier every year and total assets should continue to grow in the coming years as TD Bank continues to adapt to their preferences. This should also drive the company’s revenue and profits higher over time.

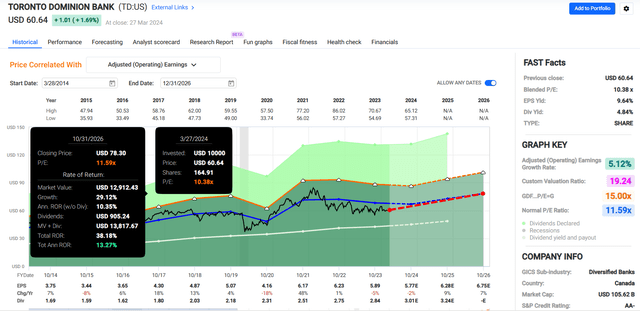

FAST Graphs’ consensus is that fiscal 2024 earnings will decline 2% to $5.89 (USD). But after that, earnings are expected to grow 8.8% to $6.28 in fiscal 2025 and another 7.5% in fiscal 2026, according to FAST Graphs.

TD’s financial position is also relatively strong, with its common equity tier 1 capital, or CET1, capital ratio improving to 11.5% in the first quarter of 2024 from 11% in the first quarter of 2023. That’s why, in addition to an AA- rating from Standard & Poor’s, the company also has an AA2 rating from Moody’s (AA equivalent) credit rating and an AA credit rating from Fitch Ratings. The ratings also carry a Stable Outlook (Unless otherwise noted or hyperlinked, all details are from TD Bank’s Q1 2024 Quick Fact PDF, TD Q1 2024 Investor Presentation, TD Q1 2019 Investor Presentationand TD First Quarter 2024 Earnings Press Releaseand TD’s 40-F Filing).

Safe dividend and room for additional growth

TD has paid dividends for 167 consecutive years, making it an excellent dividend stock. The Canadian dollar has grown at an annualized rate of 10% since 1998, which is even more remarkable (Slide No. 28 of 88 in TD’s Q1 2024 Investor Briefing).

Even taking into account the Canadian dollar’s weakness against the U.S. dollar in recent years, the dividend growth remains compelling. According to information from Seeking Alpha, the company’s dividend per dollar has accumulated a compound annual growth rate of 39.5% from 2018 to $2.8414 in 2023, a compound annual growth rate of 6.9%.

For fiscal 2024, the dividend yield is expected to be approximately 52% (annualized dividend per share of $3.026 divided by estimated earnings of $5.77 per share). This is very close to the company’s target payout ratio range of 40% to 50%. That’s why I expect annual dividend growth to continue to be near the high single digits over the next few years.

Risks to consider

TD is an outstanding company, but investing still carries risks.

As I highlighted in my recent Scotiabank article, the biggest near-term risk to the company is the state of Canadian consumers.Income growth outpaced debt growth in the latest quarter, helping household debt as a share of disposable income Increased to 178.7%. However, if consumer conditions worsen, it could have a negative impact on the company’s near-term financial performance.

Another risk facing TD (and all companies with large amounts of information valuable to hackers) is the possibility of a large-scale and successful cyber breach. The company takes a variety of countermeasures to prevent this from happening. But if that happens, its sensitive customer and proprietary data could be compromised. This could lead to a loss of competitive position and litigation, damaging the growth story.

Summary: World-Class Earnings Stocks at Great Value

Quick charts, fact sets

TD’s reputation as a company is admirable. The company’s brand is one of the best-known and most respected in the industry, its balance sheet is a fortress, and its dividend payments are healthy.

On top of that, TD Bank’s consolidated P/E ratio is 10.4, which is slightly lower than the 10-year normal P/E ratio of 11.6. If the company performs as expected and returns to this valuation, it could generate annual total returns of 13% between now and October 2026. That’s why I’m starting to give it a buy rating now.