Shawner

notes:

I covered Borr Drilling Limited (NYSE: BORR) previously, so investors should consider this an update from me Earlier articles About the company.

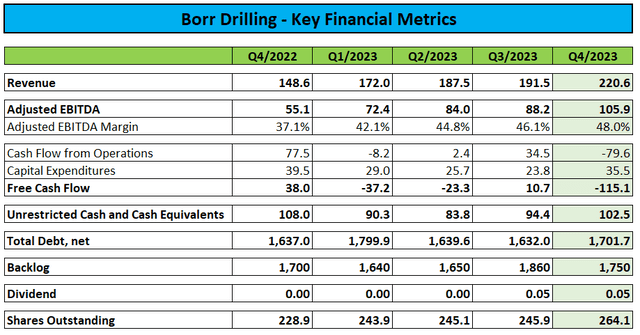

Last month, leading offshore drilling company Borr Drilling Limited or “Borr Drilling” report Fourth quarter 2023 better than expected Revenue and profitability hit all-time highs:

company press release

While the company’s revenue and profits were supported by strong revenue efficiency of 98.7%, free cash flow was negative $115.1 million, primarily due to company-related half-year interest payments of nearly $100 million. New Senior Secured Notes.

Borr Drilling ended the year with $102.5 million in unrestricted cash and cash equivalents and approximately $1.8 billion in principal outstanding debt.

The company also declared a second consecutive quarterly cash dividend of $0.05 per share, payable on March 18.

Backlog of $1.75 billion A slight decrease from the previous month.

During the fourth quarter, the company repurchased 125,000 shares for a total consideration of $800,000.

After the year ended, Borr Drilling issued just over 400,000 shares after exercising employee stock options.

Earlier this month, the company also release An additional US$200 million of 2028 10.0% senior secured notes were issued at an issuance price of 102.5% of the face amount, raising total proceeds of US$211.9 million.

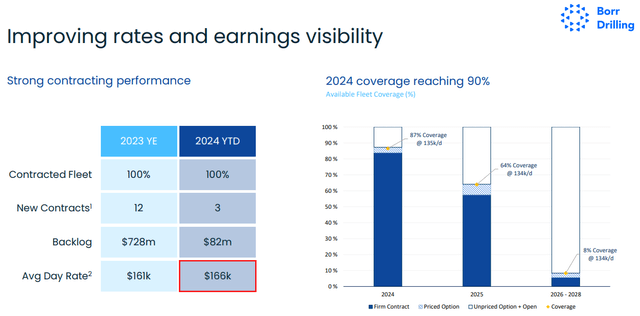

According to management’s statement on the conference call, 87% of available rig days (including pricing options) this year have been fixed at an average day rate of $135,000, while contract coverage for 2025 is currently at 64% with an average day rate of $135,000. $134,000:

Company Profile

Year to date, Borr Drilling has secured an additional backlog of $82 million, with average daily production of $166,000, and 2023 backlog totals $728 million, with average daily production of $161,000.

However, the company still has many drillers operating at extremely low traditional rates, while customers hold additional options priced well below current market rates.

Given higher contract coverage in 2024, management reiterated its expectation that adjusted EBITDA will increase from $350 million in 2023 to $500 million to $550 million this year.

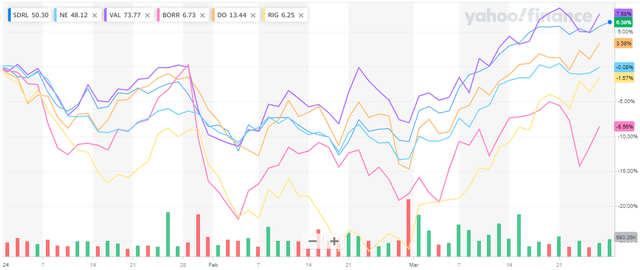

Despite Borr Drilling’s reasonably strong performance in 2023 and its subsequent success in raising additional funding, the company’s share price performance has significantly lagged its industry peers this year:

Yahoo Finance

The only reason for the disappointing performance was the surprise in Saudi Arabia Decide Maintain maximum oil production capacity at 12 million barrels per day and no longer pursue an increase to 13 million barrels per day.

In response, state-controlled Saudi Aramco (ARMCO) reduce The upstream capital expenditure budget for the period 2024-2028 is reduced by 20%, or $40 billion. This reduction is expected to be achieved by deferring planned field developments and reducing infill drilling activity (onshore and offshore).

While Saudi Aramco expects its rig count to remain roughly flat, the company said it would release some offshore oil rigs while increasing its natural gas rig count (natural gas drilling in Saudi Arabia is still mostly onshore activity).

As a result, market participants expect Saudi Aramco’s jack-up rig count to decrease in the future, and according to DNB Markets, the company has begun calling for the suspension of contracts for some offshore rigs, although the scale and companies involved remain unclear.

It’s fair to say that recent developments in Saudi Arabia have created considerable uncertainty about the near-term direction of the jackup market, especially after worrying early data emerged last week.

On March 24, ADES Holding, a leading domestic enterprise declare An 18-month letter of intent for a jack-up drilling contract offshore Thailand is expected to have daily rates of only US$115,000, a far cry from the current market rates of US$160,000 to US$180,000.

It is generally believed that the drill in question was Navy 502A modern asset previously owned by Seadrill (SDRL), it is scheduled to sign a contract with Saudi Aramco in the second quarter.

While low day rates may be partly attributable to ADES Holding’s aggressive international expansion efforts, the news is certainly not suitable to instill confidence in the jack-up driller’s near-term bidding discipline.

If other competitors follow suit, day rates could come under considerable pressure in the short term, especially if Saudi Aramco moves quickly to suspend the contract.

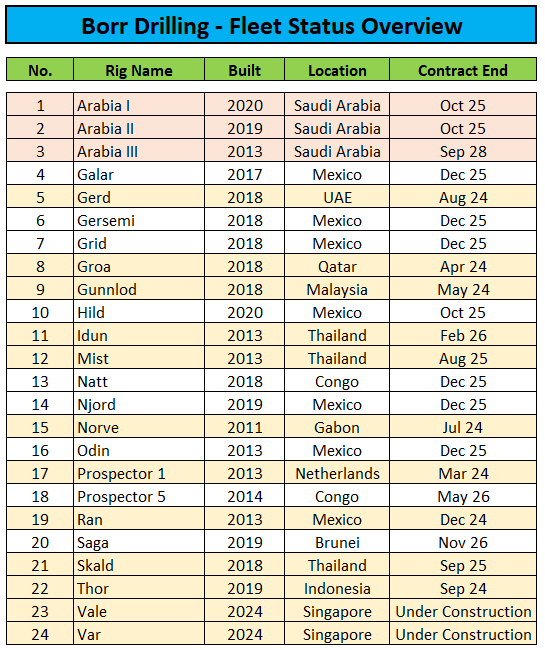

While Borr Drilling’s direct investment in Saudi Aramco is limited to three rigs under long-term contracts, the company also has a number of jack-up rigs in Southeast Asia (including three rigs in Thailand). Additionally, Borr Drilling still needs to fill a number of gaps in 2025 and beyond:

Fleet Status Report

To make matters worse, the company has delayed delivery of its two remaining newbuild rigs from the second half of 2025 to late 2024/early 2025, and has yet to secure first contracts for these rigs.

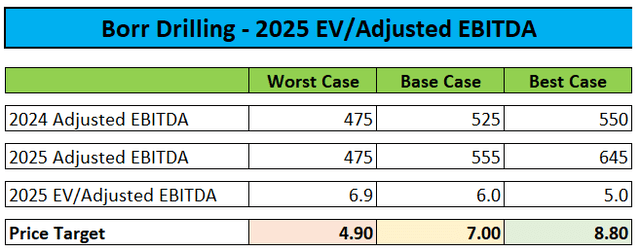

Significant uncertainty about the near-term day rate environment for jack-ups has prompted me to introduce a new base case for 2025, which is based on very modest year-over-year adjusted EBITDA growth assumptions:

Author’s estimate

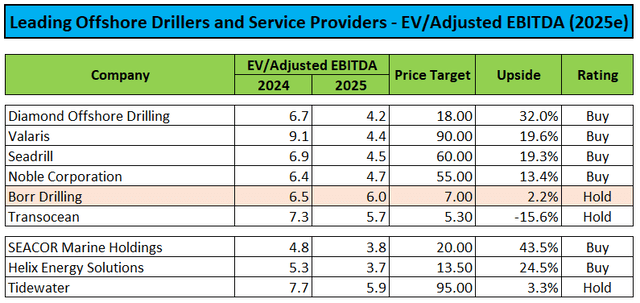

Assigning a constant EV/Adjusted EBITDA multiple of 6x my new base case Adjusted EBITDA estimate would result in a price target of $7.

Given limited upside from the new base case, I rate Borr Drilling’s stock from “purchase” arrive”catch”.

Author’s estimate

I will update my assumptions in due course as more data points emerge over the remainder of the year.

bottom line

Despite Borr Drilling’s strong fourth quarter results, with record revenue and profitability, recent developments in Saudi Arabia have cast a shadow on the near-term outlook for the jackup market.

Due to significant uncertainty and very negative early data points, I am lowering my rating on the company’s stock from “purchase” arrive”catch”, with a revised target price of $7.