Hiroshi Watanabe/DigitalVision via Getty Images

Introduction and Papers

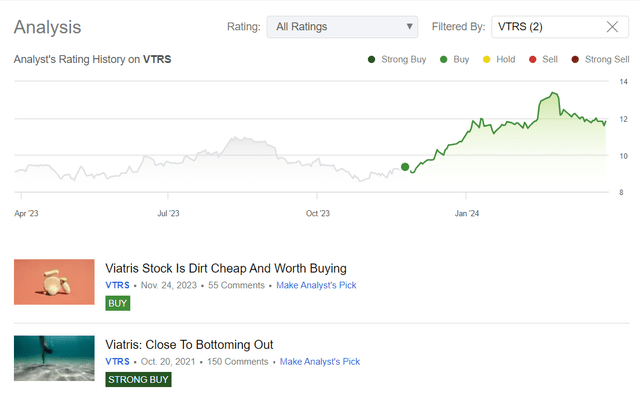

I initiated a report viateris (NASDAQ: VTRS) in October 2021 and then updated my bullish thesis a few months ago to note that the stock looked extremely cheap.this Since our last update, VTRS stock has surged 26.7%, outperforming the S&P 500 (SPX) (SP500):

Seeking Alpha, author’s coverage of VTRS stock

Since a wealth of new data has emerged since last November (the time of my last article), I think there’s reason to take another look at the company and assess the stock’s medium-term growth potential.

Latest financial and development review

Let’s first understand what Viatris’ business looks like. It is a global pharmaceutical company with approximately 38,000 employees in 165 countries and organizes its operations into 4 reportable segments:

- Developed market (mainly North America and Europe) – 60.12% Total fiscal year 2023 net sales;

- Greater China (China, Taiwan and Hong Kong) – 14%;

- Janz (Japan, Australia and New Zealand) – 9.25%, and

- Emerging Markets (>125 developing market and emerging economy countries) – 16.58%.

For fiscal 2023, Viatris’ total net sales were approximately $15.4 billion, a decrease of 5.13% annually, primarily due to the unfavorable impact of foreign exchange (approximately 77% of Viatris’ sales are generated outside the United States) and divestitures (which appear to be one-time )event). Adjusted EBITDA is down more than 11% year over year, but I like that gross margin expanded from 39.95% in fiscal 2022 to 41.74% in fiscal 2023. Due to the increase in research and development expenses and the resolution of legal disputes, VTRS’s operating costs increased significantly (+16.19% compared with the previous year), resulting in an annual decrease in EBT of 52.5%.

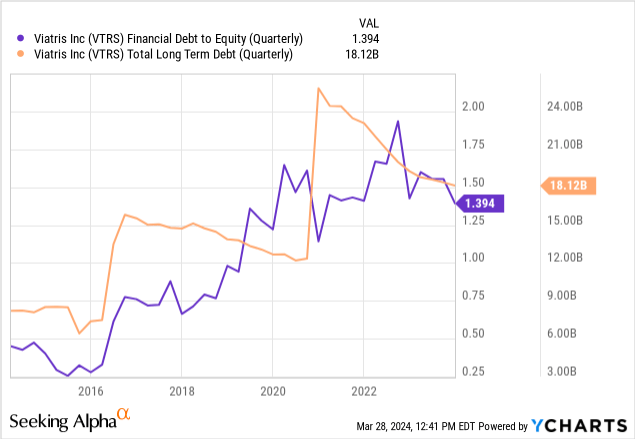

I also like that the company seems focused on maintaining an investment-grade rating and keeping its debt load tight: Since its inception in 2020, it has managed to reduce debt by $6.5 billion, meeting its 2023 target. There is still a lot of work to be done ahead, but judging from the latest developments, VTRS is moving in the right direction:

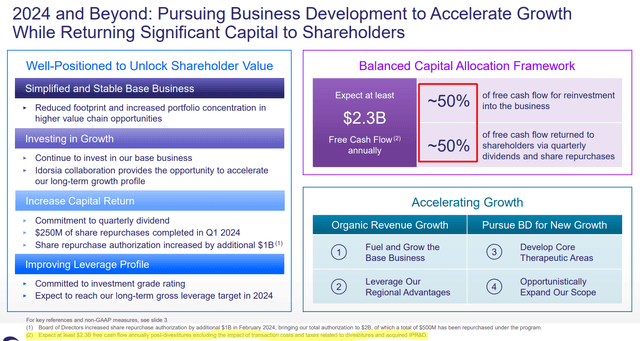

Nonetheless, a very bright spot in the company’s financial numbers is free cash flow of $2.4 billion, which represents about 17% of today’s market capitalization.Another point is very important: according to IR Presentation for Q4 FY23, the company expects annual free cash flow after divestitures to be at least $2.3 billion, excluding the impact of transaction costs and taxes related to divestitures and acquired IPR&D (approximately 16% of market capitalization). Management’s strategy of reinvesting 50% of this laudable free cash flow and the remaining 50% on buybacks and dividends seems fair and balanced to me:

IR materials for VTRS, author notes

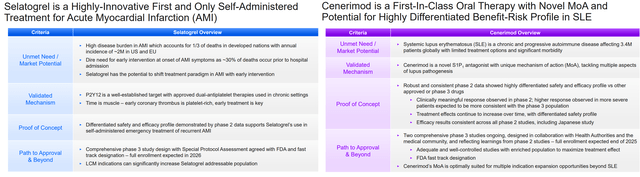

I think these plans are quite feasible as the company now has 2 new drugs ready to be commercialized to reignite business growth – Seratogre and Senemode. Recent R&D events were held specifically for them – Seeking Alpha provides a transcript for your convenience.

What I can understand without a medical education:

- Selatogrel was developed to prevent blood clotting and minimize damage to the heart muscle during a heart attack. It is characterized by subcutaneous injection and reversible effects. It has a quick onset of action and a short duration of action, making it suitable for emergency use in heart attack patients. Preliminary data from the Phase 2 study indicate that Selatogrel achieves strong platelet inhibition within minutes of administration and has a favorable safety profile, according to a record of development activity.

- Cenerimod is another asset with huge potential, particularly in the treatment of SLE, a chronic autoimmune disease that can affect various organs and tissues in the body. According to research by business research firmThe systemic lupus erythematosus treatment market (Cenerimod’s target end market) is growing rapidly, increasing from US$2.76 billion in 2023 to US$3.06 billion in 2024, with a compound annual growth rate of 10.7%. So I believe Viatris’ new drugs have great potential in the future.

Demonstration of R&D activities of VTRS, compiled by the author

Overall, I like the future vision and financial numbers for where I see the company going. There’s a reason why VTRS stock has continued to rally aggressively in recent months. I mean, from my analysis, there’s a fundamental reason for this. But are today’s prices reasonable? What is the foreseeable upside potential?

Viatris Stock Valuation Update

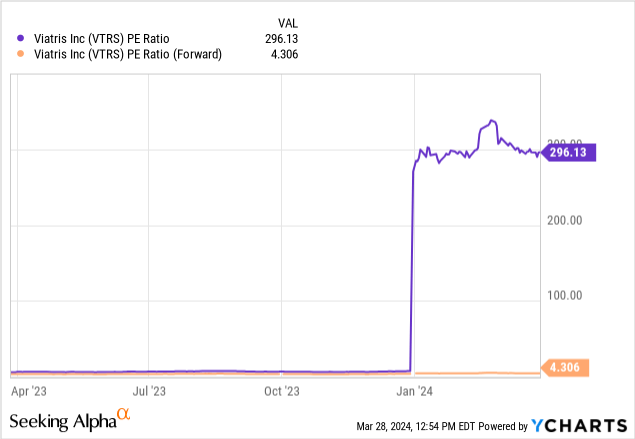

Back in November 2023, VTRS stock was trading at 3.2x P/E and priced at about a 49% discount to the then-current TTM multiple of 6.2x – in both cases, VTRS looked very cheap to me. However, in the fiscal 2023 report, we saw a rapid decline in net income due to what was essentially a one-time event, resulting in a TTM P/E ratio of over 296x. What saves the company’s valuation is the forward price-to-earnings ratio, which assumes the company will return to normal operating conditions soon.

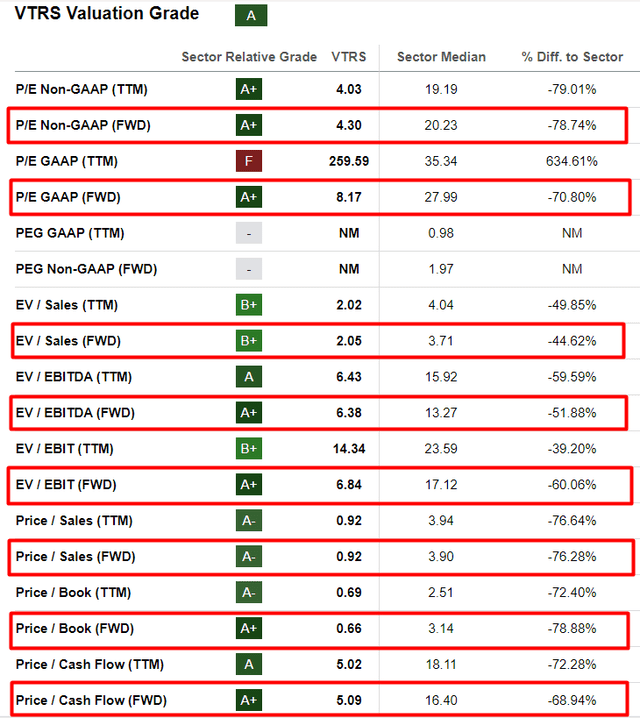

In fact, according to Seeking Alpha’s quantification system, VTRS is likely undervalued compared to the overall healthcare industry by 79-44%, depending on the metric chosen – and the TTM P/E GAAP ratio is the only “shocking” F grade Things in the indicator sample:

Seeking Alpha, VTRS, Author Notes

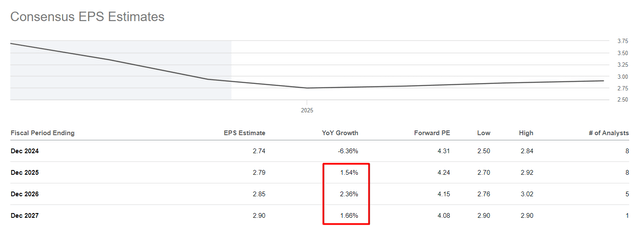

However, I don’t think VTRS will return to 8-10x P/E anytime soon – it will certainly be hampered by a lower EPS growth rate as patents become obsolete and cannot be covered by new drug sales, which will Appear. The consensus agrees with me:

Seeking Alpha, author’s note

However, I think VTRS should be trading at a P/E ratio of between 5-6x – in which case a fair share price should be around $15.3 by mid/late 2025. This gives us nearly 30% upside potential from the last close. Therefore, the growth potential I saw previously has become smaller (now 30%, compared to 55% last time), but I still think VTRS is still a good “buy” opportunity at this time.

Risk factors to consider

Of course, the risk factors I mentioned last time for readers to consider have not gone away. Factors such as patent expirations, pipeline setbacks, litigation, supply chain disruptions, currency fluctuations, and post-merger integration complexities all impact VTRS’s risk profile and will continue to play an important role in determining the stock’s future direction.

Here we also have to add the still quite high level of debt on the balance sheet: yes, it’s declining quarter-on-quarter, but a debt-to-equity ratio of close to 1.4 makes me a little concerned. Perhaps the 50/50 split of free cash flow that management talks about between reinvestment and shareholder returns should be revised more in the direction of deleveraging.

It’s also important to note here that my finding that Viatris is undervalued may be wrong, as the stock may maintain its current discount if the market doesn’t want to reward the company for insufficient deleveraging (or other reasons).

judgment

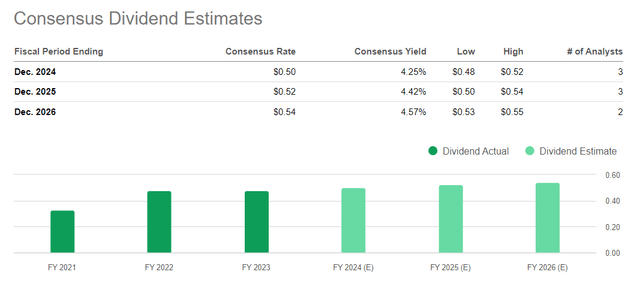

Despite the many risks, I like the way the company has been growing lately. While the latest financial results didn’t beat analysts’ expectations (Viatris’ sales and EPS missed consensus estimates), I think Viatris is headed in the right direction overall. The 55% growth potential I talked about earlier has now dropped to 30% – mostly because the stock has risen significantly during that time (roughly the difference between the two upside potentials). But an underestimation of 30% is still a lot. Additionally, the company pays a decent dividend – over 4%. What’s more, dividends are likely to rise further in the coming years:

Seeking dividend estimates for Alpha, VTRS

Therefore, based on the above factors, I reiterate my previous “Buy” rating on VTRS today.

thanks for reading!