gentlemen

In this post, I outline how I will allocate money from my retirement fund in April.I will use the 10-month exponential moving average (EMA) and the relative strength ratio to determine my money flow Four ETF options: SPDR S&P 500 ETF (New York Stock Exchange: Spy), Vanguard Extended Market Index Fund (VXF), iShares MSCI EAFE ETF (Electronic FF) and iShares Core U.S. Aggregate Bond ETF (AGG). I have two goals with this retirement account. The first goal is to make money, and the second goal is to outperform the SP 500 Index. I want to make achieving these goals as simple as possible, which is why I like to use the 10-month EMA crossover as my strategy. I want to go long ETFs trading above the 10 month price EMA and I want to exit ETFs that are trading below the 10 month EMA. This is a simple strategy that allows me to sustain long-term uptrends and keeps me out of long-term downtrends and avoids massive declines. This strategy is not guaranteed to work every time, but I don’t know of any that work every time. I use relative strength ratios to determine which ETFs are the strongest because that’s where I want to allocate funds. Let’s take a look at what the market is saying right now.

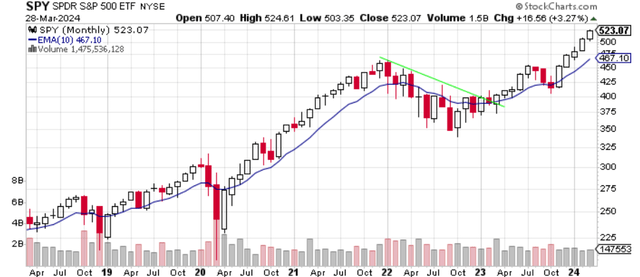

Figure 1: Monthly SPY and 10-month EMA

www.stockcharts.com

Looking at Figure 1, you can see that SPY continues to perform well. It rose 3.27% in March, reaching a new high. New highs are bullish. SPY is in a bullish trend. This is my term for a stock, ETF, or index that is trading above its upward sloping 10-month moving average, as shown in Figure 1. This is a constructive bullish view, and these are the types of stocks or ETFs I want to own. The opposite of a bullish alignment is called a bearish alignment, which is when an asset moves below its downward sloping 10-month moving average. I want to avoid owning these assets.

Figure 2: Monthly VXF and 10-month EMA

www.stockcharts.com

VXF had the best month among the ETFs covered in this article. VXF, which gained 3.41% in March, is also bullish. VXF is above its upward sloping 10-month moving average. A simple difference between Chart 1 and Chart 2 is that VXF has yet to make a new high. It looks like it’s coming soon, but currently VXF has yet to break out to new highs despite being in a bullish trend.

Figure 3: Monthly EFA and 10-month EMA

www.stockcharts.com

Figure 3 shows that EFA had a good month. It rose 3.38% and closed at a new high. For trend followers, new highs are always bullish. EFA has been above its 10-month moving average in 15 of the past 17 months, indicating a strong uptrend. EFA remains bullish and could go even higher in the future.

Figure 4: Monthly AGG and 10-month EMA

www.stockcharts.com

Looking at Figure 4, you can see that AGG is also in a bullish trend. March’s gain was just under 1%. Encouragingly for AGG bulls, AGG has now been bullish for five consecutive months. This is AGG’s longest bullish trend since late 2021. AGG has created a series of higher highs and higher lows, with the 10-month EMA trending higher. AGG says interest rates are falling.

Looking at the first four charts individually, I can allocate funds to each ETF. Using my price methodology and the 10-month EMA, they are both in a bullish trend. Now, I’ll look at relative strength ratios to determine which ETFs I should allocate funds to in April.

Figure 5: Monthly VXF:SPY Relative Strength Ratio and 10-month EMA

www.stockcharts.com

Reading a relative strength chart is easy. The black line in Figure 5 is the ratio of VXF to SPY prices. When the black line drops, it means VXF is performing worse than SPY. When the black line rises, it means VXF performs better than SPY. I’m using the blue 10-month EMA the same way I did in the first four charts. I want to own a bullish asset. Figure 5 shows that VXF outperformed SPY by 0.14% in March. Despite this success, the VXF:SPY ratio remains bearish. The ratio is below its downward sloping 10-month moving average. Therefore, I would rather have SPY than VXF now. It looks like things will change soon, but I’d rather wait until the charts show that has happened. The ratio appears to be making higher lows, which is bullish. I wouldn’t be surprised to see this ratio trending bullishly at the end of April. Currently, I would not allocate funds to VXF in April as the ratio remains in favor of SPY.

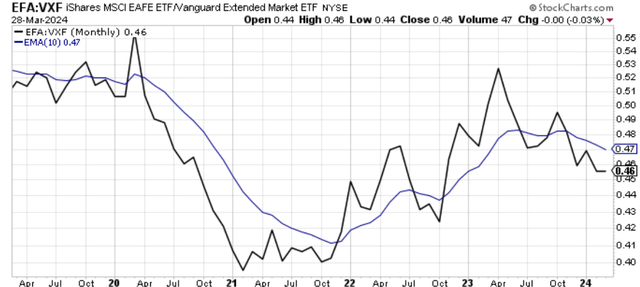

Figure 6: Monthly EFA: SPY Relative Strength Ratio and 10-month EMA

www.stockcharts.com

Figure 6 shows that EFA slightly outperformed SPY in March by 0.11%. However, this outstanding performance did not change the trend. The EFA:SPY ratio remains bearish, indicating that I will not allocate funds to EFA in April. On the positive side of the ratio, it appears that the ratio is trying to push the lows higher, which is how a bearish trend turns into a bullish trend. We’ll have to see how April handles this ratio.

Figure 7: Monthly EFA: VXF Relative Strength Ratio and 10-month EMA

www.stockcharts.com

Figure 7 shows that EFA and VXF performed roughly the same in April. However, Figure 7 also shows that the trend over the last year has been in favor of VXF. The ratio makes a series of lower highs and lower lows, which is the definition of a downtrend. The EFA:VXF ratio is bearish, which means that if I had to choose between the two ETFs, I would allocate funds to VXF rather than EFA at this time.

Figure 8 – Monthly AGG:SPY Relative Strength Ratio and 10-month EMA

www.stockcharts.com

Just like the other charts, AGG itself is bullish. However, the AGG:SPY ratio chart tells a different story. From an opportunity cost perspective, I can’t allocate money to AGG instead of SPY. With Chart 8 reaching new lows in March, investors are favoring stocks over bonds, Cleary said.

In summary, Figures 1, 2, 3, and 4 all show a bullish trend for the ETF. Any of these ETFs would meet my minimum capital allocation requirements. They are both above the upward sloping 10-month moving average. These are ETFs that I want to own because they are ETFs that are in an uptrend. However, Figures 5, 6, and 8 helped me narrow down the ETFs that were both trending upward and outperforming other ETFs. SPY is the ETF I will allocate 100% of my retirement funds to in April. SPY is in a bullish trend itself, as shown in Figure 1, and is also in a bullish trend compared to other ETFs via the relative strength charts shown in Figures 5, 6, and 8. Next month I will go through the same process to see if I need to make any changes.