Maxim Safanyuk

For those who are bullish on oil, 2024 looks set to be a very solid year. Brent crude prices have risen 12.1% so far this year, while WTI crude oil prices have risen an impressive 15.6%.Recent rally driven by news In addition to OPEC+ extending voluntary production cuts, Russia also Committed to reducing production That will add about 500,000 barrels a day for the foreseeable future. While some may argue that these temporary measures will only result in short-lived price fluctuations, we may be prepared for continued higher prices. But at the end of the day, a lot depends on whose data is correct. If the data provided by OPEC is accurate, with some reasonable adjustments, the market outcome may be that oil prices will exceed $100 per barrel later this year.But even If the more conservative EIA (Energy Information Administration) is accurate, we could see prices hovering where they are, or moving slightly higher before leveling off.

Look at the bullish conditions

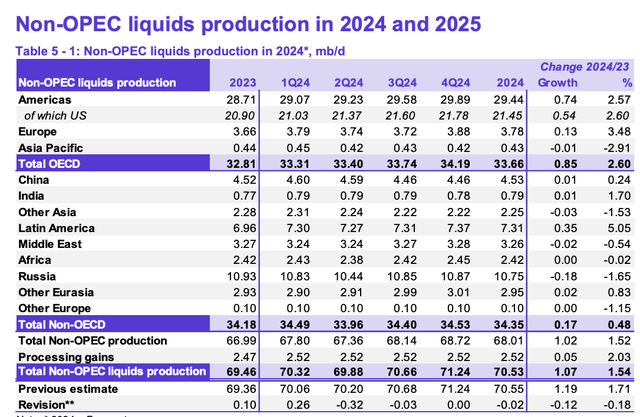

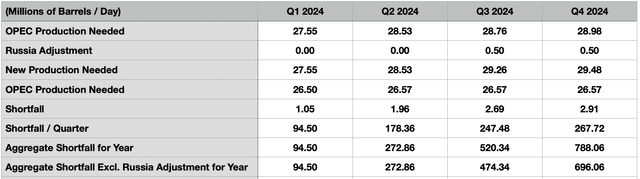

Best from OPEC and the data it provides. The organization publishes its own oil report every month. This looks at production in its member countries and provides a global supply and demand outlook. What’s interesting about the estimates provided by OPEC is that they already result in a sizable production shortfall without taking into account additional Russian production cuts. For example, OPEC is expected to need to produce 27.55 million barrels of crude oil and condensate per day in the first quarter of 2024 to meet global demand. However, it looks like their production is around 26.5 million barrels per day. The daily deficit was 1.05 million barrels, or 94.5 million barrels for the entire quarter.

OPEC

When you look at their forecast for Russia, you see a drop from 10.83 million barrels per day in the first quarter to 10.44 million barrels per day in the second quarter. That seems like a big gap compared to Russia’s plan to cut production to 9 million barrels per day. But remember, approximately 1.4 million barrels of condensate are produced per day. Subtract that number and we get a figure of about 9 million declared nationally. Therefore, OPEC seems to be considering the country’s above-mentioned production cuts. However, as the chart above shows, we saw a reversal in the third quarter of this year. But by then, Russia had just reached its 500,000 barrels per day target. I find it very possible that they can return production to these levels.

Author – OPEC Data

Instead, it might be wise to assume they continue to cut production for the rest of the year to keep oil prices high. As the table above shows, this can have a huge impact when it comes to additional production offline. By the last quarter of 2024, there could be a global shortage of 2.91 million barrels per day. Looking at the full year, crude oil storage capacity may be 788.06 million barrels less than currently. Even if we assume that Russian production returns to more normal levels in the third and fourth quarters of this year, the shortfall could still be as high as 696.06 million barrels.

According to OPEC data, commercial inventories in OECD countries were approximately 2.76 billion barrels at the end of fiscal 2023. This does not include the 1.44 billion barrels of offshore oil, most of which is simply oil in transit. Generally speaking, an oil surplus or shortage is defined based on the number of days of supply existing in commercial inventories across OECD countries. Using data for the end of 2023, we have 60.26 days’ worth. A typical number would be between 55 and 60 days. So if anything, we’re starting the year with very limited crude oil supplies. But even if half of the oil shortage ends up affecting OECD commercial stocks (excluding additional Russian production), we would be down 7.63 days. This will reduce our inventory to 52.63 days. To review, in 2016 when Brent crude oil prices averaged $43.64 per barrel, we only had approximately 3.91 days of excess inventory. Seeing the pendulum swing in the other direction, it wouldn’t be surprising to see prices rise significantly if any of the above scenarios materialize.

not that bad

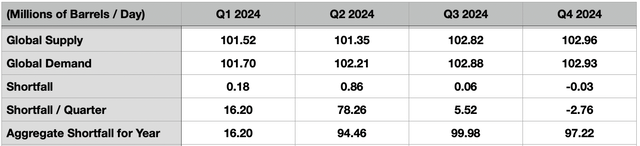

It’s worth noting that OPEC is not the only source of estimates in this area.We should also pay attention to data provider Environmental Impact Assessment. Interestingly, based on my own observations, they have factored in continued Russian production cuts for the rest of the year, with only a small increase in production expected by the end of the year. This means we don’t need to make any adjustments to their numbers. However, even in this scenario, we may see demand exceed supply. Yes, by the last quarter of the year, data showed a crude oil surplus of 30,000 barrels per day. But even so, we expect the total shortfall this year compared with last year to be approximately 97.22 million barrels.

Author-EIA

This does cause some confusion if you dig deep enough into the data provided by the organization. I say this because, although production is expected to be lower than demand, the OECD forecasts that commercial inventories will fall from about 2.78 billion barrels at the end of last year to 2.72 billion barrels by the end of this year. This suggests that all excess stocks, as well as some of them, will be transferred to non-OECD countries. More importantly, with days of supply at the end of last year at 59.64 days and this year at 58.59 days of supply, the EIA data seems to indicate that we are not going to have a production gap big enough to push us higher. In fact, the organization even predicts that Brent crude oil prices will average around $83 per barrel this year. That’s $3 a barrel higher than forecast before Russia decided to step up production cuts. And it’s also a bit cheaper than today’s prices.

Some important notes

For those wondering the difference between EIA and OPEC, it actually has little to do with expected output from OPEC+ countries. Instead, it’s about expected oil demand this year and next. Globally, OPEC expects oil demand this year to be an average of 2.03 million barrels per day higher than EIA’s forecast. Demand next year is expected to be 2.49 million barrels per day higher than the EIA’s forecast. Although the EIA is not as biased as OPEC, I would venture to say that OPEC may have a better understanding of what’s going on in the global oil market than the EIA. Either way, this seems to suggest that we may be more or less finding a case for a pricing floor, or a separate case where prices are expected to rise significantly from here. This means lower pricing may not materialize, which is a negative for many companies in the oil and gas space.

Environmental Impact Assessment

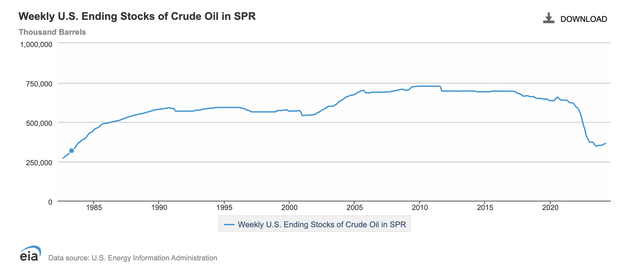

I would like to touch briefly on two other topics. The first thought is that some may believe that shale oil producers may increase production in response to higher prices. I won’t go into detail here as I wrote an article on this topic earlier this year that I believe you should read. But in short, a significant decline in DUC wells could mean it won’t be easy for the U.S. to achieve significant additional production. The second involves the possibility that oil prices could fall, at least temporarily. Given that this is an election year, it is not surprising that the Biden administration will use the SPR (Strategic Petroleum Reserve). The Trump administration did this, and other administrations have done this in the past. In the short term, this is possible. But I can’t imagine it lasting more than a few months.I say this because SPR has seen it Significantly reduced over the past decade or so. As early as 2011, SPR inventories once exceeded 725 million barrels. But even at the end of 2021, SPR inventories are in the range of 600 million barrels to 650 million barrels. As of the end of 2023, inventories were 426.4 million barrels. From a national security perspective, further exploitation of this, especially to a large extent, could be concerning.

take away

It seems to me that when it comes to oil prices, we are in a situation where heads I win and tails I don’t lose. Those who are bullish on oil may enjoy higher prices this year and possibly next. Based on currently available data, we are unlikely to see any meaningful pullback below $80 per barrel. But that’s under more conservative circumstances. Under freer circumstances, it is not inconceivable that prices could reach $100 a barrel or more. If the government decides to use the SPR, there may be a short-term reprieve. But beyond that, I think it would take a significant global economic downturn for Brent to fall below $80 a barrel and WTI to fall below $75 a barrel in any meaningful time window.

Editor’s note: This article covers one or more micro-cap stocks. Please be aware of the risks associated with these stocks.