Paul MacKinnon

Leading BlackBerry (NYSE:BB) In the third quarter results released in December 2023, investors paid attention to three things.Shareholders scrutinized the troubled company’s earnings, assessed new leadership under a new CEO and considered scrapping its IoT derivatives.

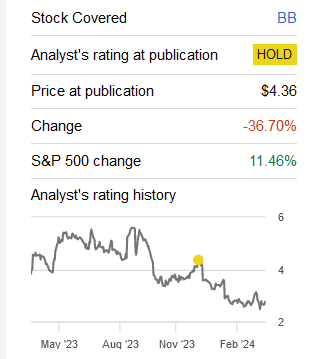

If readers use stock performance as the primary metric, the stock market voted against BB stock after last quarter’s results. Shares fell nearly 37%, while the S&P 500 index (SP500) rose 11.46% in that time.

Seeking Alpha

What should readers consider when BlackBerry reports results on April 3, 2024? How will the market react after the report is released?

There are five things readers should note.

1/ BlackBerry fourth quarter profit forecast

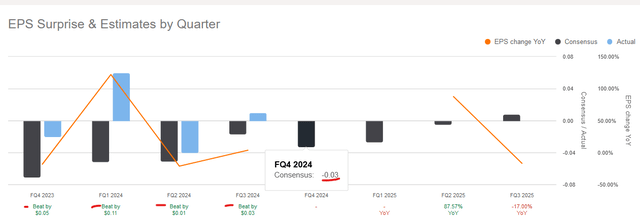

BlackBerry reported earnings of 1 cent per share, beating analysts’ consensus estimate of -$0.017. As you can see below, the company has topped analyst estimates for four consecutive quarters.However, it Reported losses half the time.The company has achieved Q1 2024 earnings per share modest $0.06 Reported revenue increased 122.0% year over year to $373 million. Upon closer inspection, the company booked a one-time gain of $218 million related to patent sales. The company reported just $45 million in IoT revenue and $93 million in cybersecurity revenue.

Seeking Alpha

In the third quarter, BlackBerry’s revenue increased 3.6% year-on-year to $175 million. Internet of Things revenue was US$55 million, an increase of 8% over the same period last year. The company achieved network security revenue of $114 million, an increase of 8% year over year.

Unfortunately, the company’s networking division has lagged behind its peers. CrowdStrike (CRWD) reported quarterly revenue of $845.3 million, up 32.6% year over year. Its annual recurring revenue increased 34% year over year to $3.44 billion. SentinelOne reported fourth-quarter revenue rising 38.2% year over year to $174.2 million. Its ARR reached US$724.4 million, an annual increase of 39%. Customers with ARR of $100,000 or more grew 30% to 1,133.

At the annual Needham Growth Conference, BlackBerry said its cybersecurity ARR is stabilizing. CEO John Giamatteo added that the company is “hopeful that we can achieve this goal and pivot to growth as we enter the next fiscal year.” The CEO did not provide the audience with any quantitative data to support the hopeful outlook.

2/ Mobility and QNX

At the Baird 2024 Automotive Technology and Action Conference, BlackBerry senior vice president and head of QNX John Wall discussed the company’s role in the automotive software market. He sees delays in software integration as one of the challenges facing the industry. Going forward, potential partnerships arise from companies considering using QNX to build their software platforms.

Wall cited QNX’s announcement with Stellantis (STLA) during the Computer Electronics Show. The auto giant is developing a digital cockpit that will be at the heart of its infotainment systems and cabin environment. By working in the cloud, Stellantis’ development efficiency increased by 100 times.

The executive focused on the new QNX 8.0 operating system. As vehicles introduce more powerful SoCs (systems on a chip) with up to 16 cores, QNX will rival Linux operating systems in performance. QNX scales efficiently as the number of SoC cores increases.

IVY is a product jointly developed by BlackBerry and Amazon’s (AMZN) AWS to establish a middleware layer within the vehicle. Executive Wall said this “helps standardize vehicle sensors and vehicle signals into something that can be used by apps or cloud applications.” This will result in vehicle data being processed at the edge rather than sending the data to the cloud. Through standardized data, any car brand can use IVY’s API.

Although BlackBerry won’t discuss the technical details of QNX, it is required to release revenue and profit guidance for sales of QNX-related software. Without this, shareholders have no reason to continue to hold their shares.

3/ January bill issuance

On January 23, BlackBerry announced its intention to sell US$160 million in principal value of convertible senior notes due in 2029 through a private placement. The company intends to use the net proceeds to repay $150 million of convertible senior notes due February 15, 2024, according to a news report from Seeking Alpha.

it Expand offering size to $175 million January 24th. The interest rate on the note is 3.00%. Its conversion premium is approximately 32.50% (based on the January 24 closing price of $2.93). An initial conversion price of $3.88 per share may cap the share price before the notes expire on February 15, 2029. At the time of writing, BB stock closed at $2.76.

4/ Quantitative Rating Warning on BB Stocks

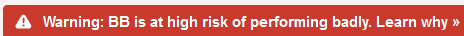

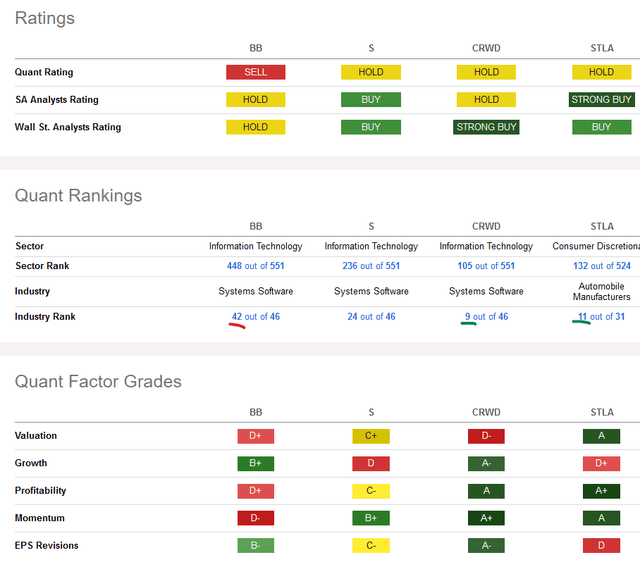

Seeking Alpha issued the warning on December 28, 2023, approximately two weeks after my last article was published, but before the Q3 report was released on December 20. Quantitative rating systems indicate that the stock is overpriced and that momentum is slowing. Additionally, “stocks rated Sell or worse by our Quantitative Ratings system have significantly underperformed the S&P 500.”

Seeking Alpha

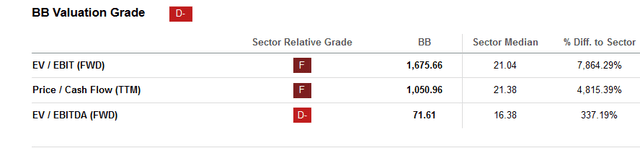

Among companies in the information technology industry, BlackBerry’s expected EBIT (earnings before interest and taxes) is weak, resulting in a relative valuation grade of D-.

Seeking Alpha

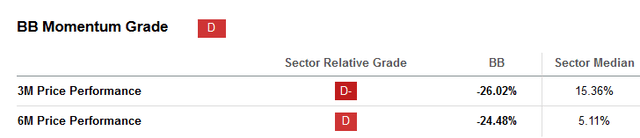

Needless to say, the downward trend in BB stocks over the past three months resulted in a “D” momentum.

Seeking Alpha

5/ Alternative investments

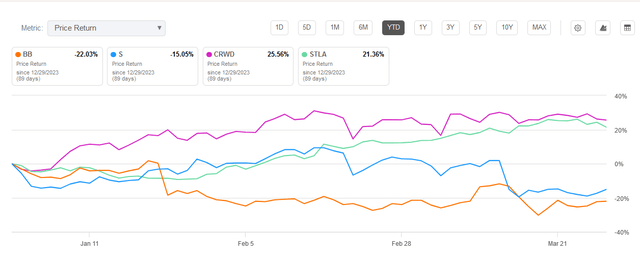

Readers should consider other options for holding BlackBerry stock ahead of the earnings report. The stock is down 22% so far this year, while cybersecurity software company SentinelOne is down 15%.

Seeking Alpha

Stellantis and CrowdStrike both rose more than 20%. CRWD and STLA stocks are particularly attractive alternative investment ideas. They ranked 9th out of 46 industries and 11th out of 31 industries.

Seeking Alpha

What you gain

Shareholders are unlikely to react to BlackBerry’s revenue and earnings results. Instead, they will review the company’s prospects for the rest of the year. Chief Executive John Giamatteo needs to map out growth plans for the company’s cybersecurity and QNX automotive divisions.