Michael M. Santiago

paper

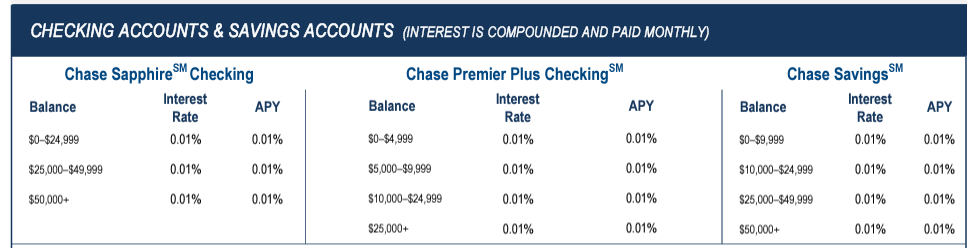

One of the main beneficiaries of last year’s regional banking crisis was JPMorgan Chase (JPM), a bank of international systemic importance.We think JPMorgan is one of the best-run banks and was able to achieve this rare feat Currently pays 0.01% on its checking and savings accounts:

Check savings (JPMorgan)

With the federal funds rate above 5% and their depositor base shifting toward money market accounts, many smaller banks have been forced to raise interest rates on savings and checking accounts, compressing net profit margins. Not JPMorgan Chase.

We believe JPMorgan is exactly what a large, important bank should be – a bedrock of stability and a counterparty whose long-term viability and business choices are unquestioned.

In this article, we will analyze one of the preferred stocks J.P. Morgan’s offering and set out why we believe this series is an appropriate vehicle to take advantage of the current high interest rate environment.

Stable institutions believe preferred stocks follow bond-like cycles

For banks, preferred stock issuance is a form of capital and therefore follows a non-cumulative structure and equity classification on the balance sheet. In fact, for systemically important, well-run banks, preferred shares without Tier 1 capital triggers follow a bond-like cycle and can therefore be priced as such.

JPMorgan is a bedrock of stability and its depositors are willing to give up any interest in the 5% federal funds environment in order to bank with JPMorgan. The author is a customer and JPMorgan Chase represents a “one-stop shop” for checking, savings and credit card accounts without having to worry about solvency or the bank’s ability to survive 50 years from now.

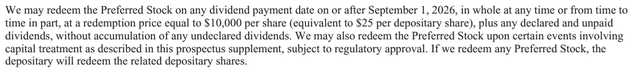

That stability translates into preferred shares issued by JPMorgan Chase, which can be thought of in terms of bonds. Even though these shares have an optional first call date in 2026, most of their past issuances have followed the first call date rules:

Redemption date details (Prospectus)

The shares are issued in the fall of 2021 and therefore follow the classic 5-year no-call period.

Let’s take a look at JPMorgan Chase’s recent preferred stock redemptions:

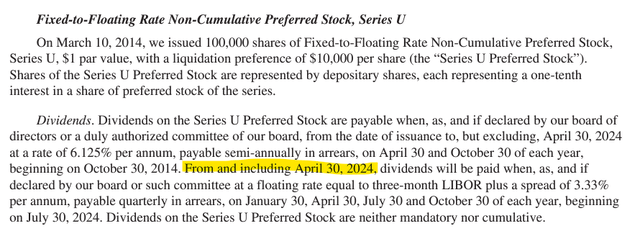

U series details (Prospectus)

In 2014, they issued a series of 10-year non-redeemable preferred stock, known as Series U. The first redemption date and interest change date are April 30, 2024.The bank is just declare The above shares are retired on their respective first redemption dates:

JPMorgan Chase & Co. (NYSE: JPM) (“JPMorgan” or the “Company”) announced that it will redeem all 100,000 fixed-rate to floating-rate non-cumulative Series U preferred shares on April 30, 2024 (“Series U Preferred Stock” ”) and will redeem all 150,000 outstanding shares of its Series Q fixed-floating rate non-cumulative preferred stock (“Series Q Preferred Stock”) on May 1, 2024, with fixed-rate to floating-rate non-cumulative All 150,000 outstanding shares of Series R Preferred Stock (the “Series R Preferred Stock”) and all 200,000 outstanding shares of its fixed-to-floating rate non-cumulative preferred stock, Series S Cumulative Preferred Stock (the “Series S Preferred Stock”) . The redemption price for the Series U preferred shares will be paid on the redemption date of April 30, 2024.

Banks like JPMorgan Chase, which are very stable from a credit perspective, will continue to rotate preferred stock series based on their first call dates. However, JPMorgan is not required by law to do so, and if the financing rate is particularly attractive, it may well choose to permanently roll over the preferred stock, even after the redemption date.

In our base case, we assume the M-Series launches in September 2026.

Analysis and Yield

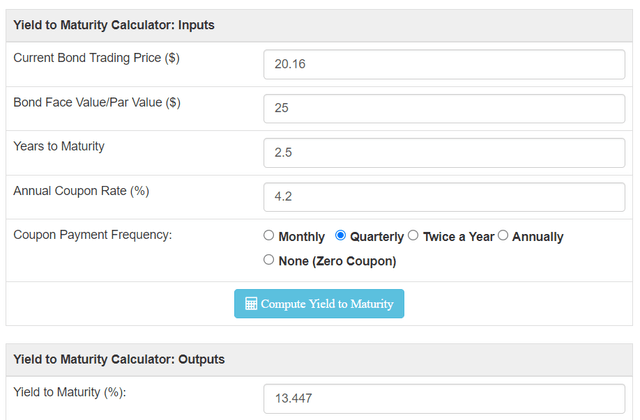

The series currently has a current yield of 5.2% and pays $0.2625 per quarter. The stock is currently trading at $20.16, with a redemption price of $25 per share. Taking into account the expected September 2026 maturity, we can obtain the implied yield for the series:

YTM (profit calculator)

The yield on the first redemption date is approximately 13%. Let’s do a quick sanity check on this – the series trades at around $20/share, so there’s room for $5 more upside to liquidation per share. This means that the principal has 25% room for growth. Divided by the remaining years to maturity of 2.5 years, we can get 10% yearly room for growth from “principal appreciation”. The mathematical results are thus verified.

However, the recovery will not be linear, as preferred shares trade at current yields, so principal is expected to increase only when the Fed begins lowering interest rates or is one year away from the series’ first call date.

If JPMorgan chooses not to redeem the shares, then the redemption yield calculation becomes meaningless because there is no clearer principal repayment date. This is the main risk to the deal’s returns, with interest rates remaining high until 2026 and banks finding the Series M’s coupon more attractive relative to issuing a new 5-year non-call bond.

retracement scenario

Preferred shares trade at current yields and have experienced pullbacks in the high-yield wide credit spread environment experienced in October/November 2023:

historical dividends (Seeking Alpha)

The one-year yield was 5.5% at the time, so the stock was 60 basis points above the one-year risk-free rate. Currently, their one-year yields are 20 basis points higher. We believe that in the next risk-off scenario, credit spreads will widen to the same 60 basis points, but risk-free rates will move lower as the Fed signals that it will cut interest rates next. Since the maturity is shorter at 2.5 years, the expected drawdown for the preferred stock will be less than -5%.

The only real risk scenario that’s acceptable here is another serious banking crisis, which would widen spreads even for the best institutions like JPMorgan, or if JPMorgan’s loan book is in complete trouble. We believe both scenarios are remote.

in conclusion

The high interest rate environment has created a wealth of fixed income opportunities. One area that could capture the higher interest rate environment is the preferred stock space. JP Morgan is one of the best banks and its preferred shares can be considered “bond-like” from a credit risk perspective. The bank has very strict rules regarding the redemption of its preferred shares on the first call date, and its credit risk is minimal. As we’ve seen with smaller or regional banks, preferred shares can disappear completely in the event of a liquidity event or default, so the stability of the underlying bank is critical. We find that JPM is the definition of bank stability, as is the Series M financing issued by the bank. The current yield on these shares is 5.2%, but under the base case scenario where the shares are redeemed on the first call date, investors can earn a 13% redemption yield if held until the first call date. The trade has a very small retracement and essentially represents a “lock-in” of the current high yield.