borchee/E+ via Getty Images

From 2024 to now, the market has proven to be a “winner takes all” game.While the S&P 500 is at all-time highs, this growth is driven by artificial intelligence stocks – and the opposite is true for many lesser-known companies The stock price fell sharply.

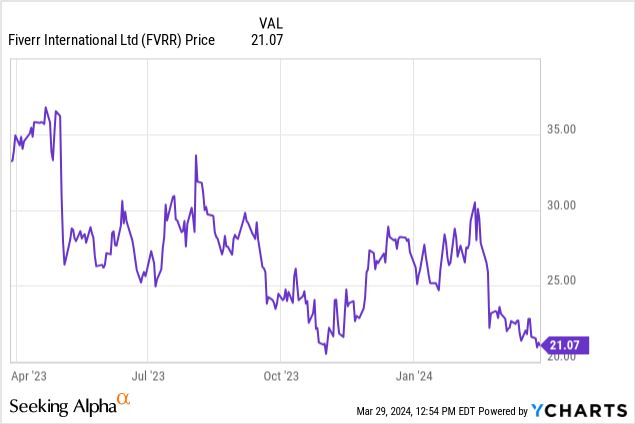

fifth(NYSE: FVRR) are losers here. Shares of the freelance marketplace company have fallen about 20% this year as growth slows and risks from artificial intelligence rise:

The last time I downgraded Fiverr to a neutral rating was in December, when the stock was trading as high as around $20. Fiverr has since fallen another roughly 20%, while releasing fourth-quarter results that failed to address any of its core issues.Active buyers continue to decline (the company argues it is simply moving upmarket), while AI risks remain Popularity.

this only I think the positive for Fiverr is the cheap valuation. At its current share price of nearly $21, Fiverr has a market capitalization of $815.4 million. Fiverr’s assets are minuscule, after we exclude the $745.7 million in cash and $455.3 million in debt on the company’s most recent balance sheet. Enterprise value is US$525 million.

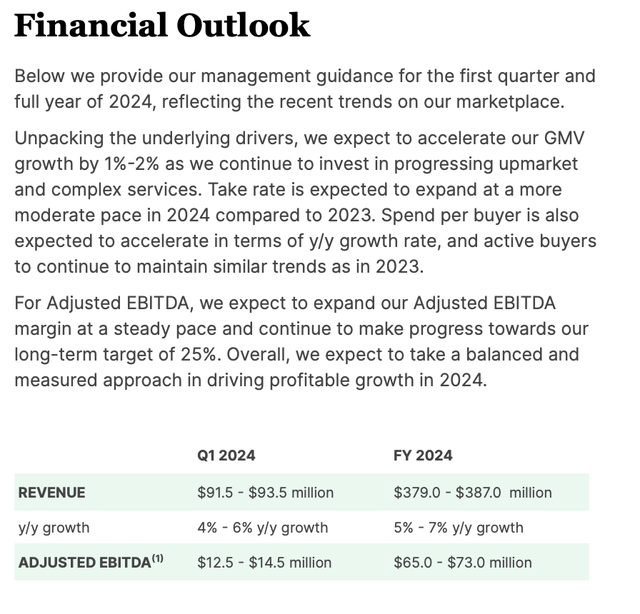

Fiverr Outlook (Fiverr Q4 shareholder letter)

At the same time, as shown in the chart above, Fiverr expects revenue to increase by 5-7% annually this year, with adjusted EBITDA of US$65-73 million, and a median adjusted EBITDA profit margin of approximately 18%. Fiverr’s valuation multiple is:

- 7.8x EV/FY2024 Adjusted EBITDA

- 1.4x EV/FY24 revenue

Fiverr is cheap… but it’s cheap for a reason. Here are the red flags that concern me the most:

- The active buyer base is shrinking. No matter how hard Fiverr tries to build it, it’s primarily an SMB platform rather than a meaningful enterprise business (as evidenced by the average spend per buyer being under $300 – no enterprise deal is that small). At the same time, this buyer base is shrinking.

- Artificial Intelligence Risks. While Fiverr also tries to emphasize that it is embedding artificial intelligence into its platform, there is no doubt that the increasing ease of use of artificial intelligence poses a threat to many of Fiverr’s core features. For example, there is now much less need to pay a logo designer on Fiverr when free artificial intelligence tools can produce professional-looking logos in seconds.

- competition. Fiverr isn’t the only game in town for freelancers, it also faces competition from companies like Upwork, Toptal, Freelancer, and Taskrabbit.

All in all, I’m not convinced that Fiverr’s low valuation adequately compensates for the myriad operating risks the company faces. I view the AI threat as an existential one: Although the company says “complex services” are growing by about 30%, in the long term I doubt companies will turn to freelance marketplaces like Fiverr to find AI talent. At the same time, the risk of artificial intelligence cannibalizing Fiverr’s core “simpler” services is much greater.

Continue to watch this stock as it falls, but don’t rush into buying.

Season 4 download

Now let’s take a closer look at Fiverr’s latest quarterly results. A summary of fourth-quarter earnings is as follows:

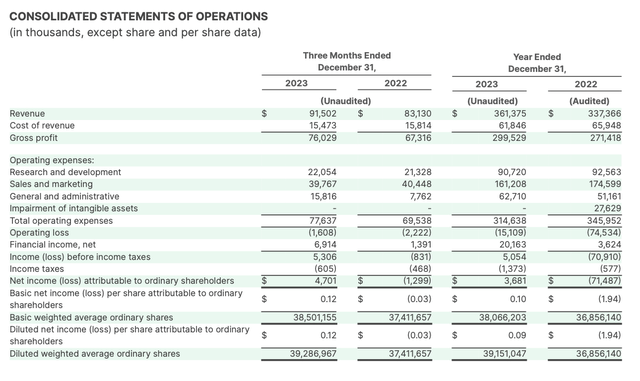

Fiverr Season 4 Results (Fiverr Q4 shareholder letter)

Fiverr’s revenue rose 10% year-over-year to $91.5 million, missing Wall Street expectations of $92.6 million (up 11% year-over-year) and down two percentage points from the third quarter’s 12% revenue growth rate.

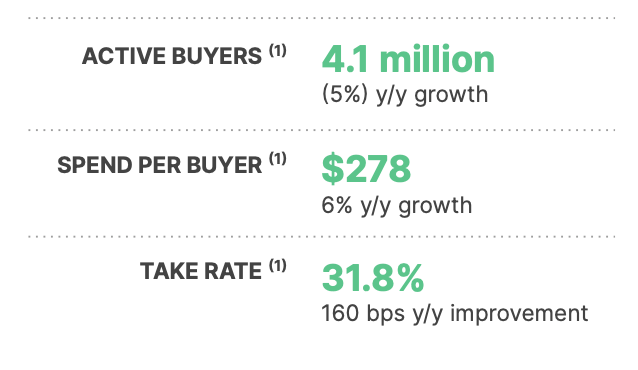

As shown in the chart below: Fiverr’s active buyer base has decreased by 5% year-on-year.

5. Key indicators (Fiverr Q4 shareholder letter)

At the same time, this was offset by increased adoption: up 160 basis points year over year to 31.8%. The company notes that adoption rates are affected by two factors: first, increased attachment rates for promotional listings (where sellers pay to be featured on the Fiverr marketplace), and increased subscriptions to Seller Plus – a monthly fee that allows sellers to add products faster collect payments, and use more advanced marketing and analytics tools.

However, in my opinion, higher usage will not be a long-term growth driver. Over the long term, Fiverr must grow revenue by increasing average spend per buyer (albeit in the single digits) and by growing its buyer pool.

The company still believes AI is a net positive for the company, and it drove 4% growth in the quarter, excluding cannibalization from “simple services,” which management said declined. By mid-teens. According to CEO Misha Kaufman’s speech during the Q&A portion of the fourth-quarter earnings call:

Artificial intelligence is a positive for us. I think we’ve discovered that there’s a difference between what we call simple categories or tasks and more complex categories or tasks. Within the complex group are actually those categories that require human intervention and human input to provide satisfactory results to customers. Within those categories, we’re seeing growth well beyond what we’re seeing overall. In fact, the simple truth is that technologies can actually do almost anything, in which case they are often associated with lower prices and short-term involvement. So essentially, we’re really focusing on these more complex services and doubling down on those categories. We think these categories have the potential to drive very good growth. The bigger they get, the more growth they drive. At the same time, we use artificial intelligence throughout the entire market and throughout the experience. Search experience, matching, personalization, the way our customers brief, the way our sellers meet customer needs. “

Still: I worry that Fiverr’s current growth in “complex” solutions is more of a temporary ride-along, while more companies embed AI skills into their salaried workforces (and AI becomes more accessible to smaller businesses ), Fiverr will see a net loss of simple services due to a significant reduction in demand.

focus

Fiverr’s cheap valuation is the only positive attraction for the stock, signaling a lack of confidence in a volatile freelance market that is facing a massive existential threat from the proliferation of generative artificial intelligence. I’d rather err on the side of caution and stay on the sidelines.