sweet bread factory

introduce

ABB (OTCPK:ABBNY) has seen its share price grow at a compound annual growth rate of 20% over the past five years. It seems to me that continuation of this performance is unlikely to be sustainable.Without further P/E ratios, shares may have peaked expansion. Using a discounted cash flow valuation, I believe ABB stock is now fully valued, with limited upside.

ABB has always been committed to adapting to the trends of technological and operational advancement in its respective fields.

Digging deeper into the business, it looks like artificial intelligence will be a key component of ABB’s future. In mid-2023, ABB announced Partnership with Microsoft (MSFT), which I will delve into later.

As an industrial supplier, ABB adopts a “pick and shovel” strategy on the trend of artificial intelligence.Management recently noted in its annual report that “we already have more than 100 projects focused on artificial intelligence. ABB Group project”.

I like the idea of becoming a “picks and shovels” supplier to follow the AI trend as the major AI players diversify. The use of artificial intelligence enables ABB to develop software and systems that enhance the functionality of its products. Looking at various operating areas, artificial intelligence robots and autonomous control systems are the two business sectors most likely to be positively affected by artificial intelligence.

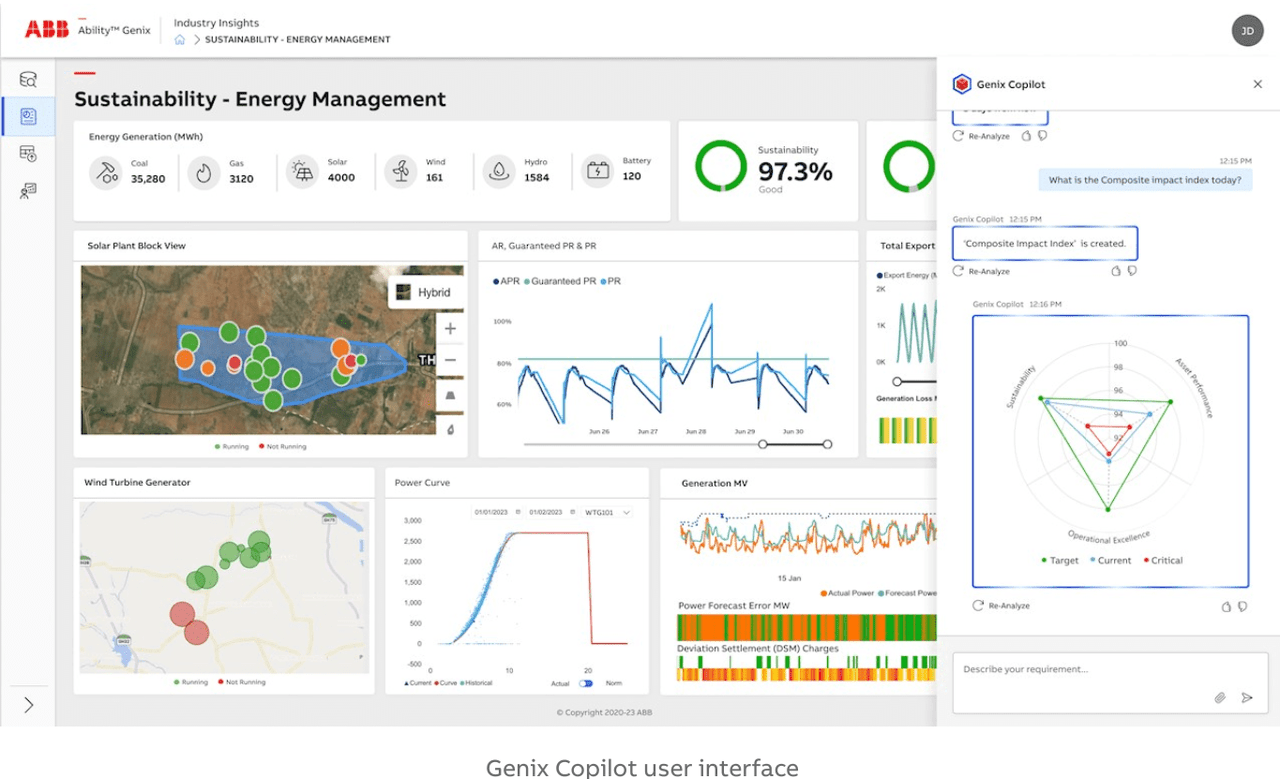

The cooperation with Microsoft aims to implement artificial intelligence functions in industrial applications and add value through insights from operational data. An early focus of this collaboration is to integrate Copilot into ABB’s “Ability Genix” product. The product is designed to enable users using data to make faster decisions, thereby increasing productivity and efficiency.

ABB partners with Microsoft (ABB Investor Relations)

The collaboration between ABB and Microsoft also aims to provide advanced monitoring and optimization insights into industrial greenhouse gas emissions and energy use. By analyzing data using generative artificial intelligence, ABB’s customers can identify specific opportunities to reduce emissions, optimize energy consumption and extend asset life.

income

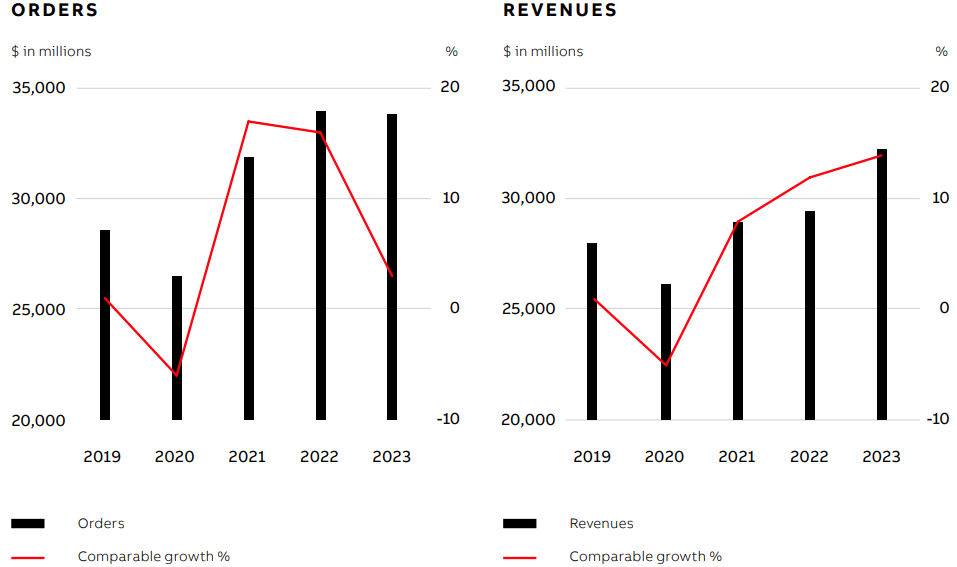

In my opinion, ABB’s management is conservative; when they provide future guidance, they generally proceed with caution. The guidance for 2024 is for overall business revenue growth of 5-7%. Slightly lower than last year’s performance of 9%. However, this guidance is consistent with an annualized revenue CAGR of 6.30% over the past five years. With a 2024 backlog of $21.6 billion, management should be able to comfortably meet this year’s guidance.

ABB orders and revenue (ABB investor presentation)

Strong order backlog across the business holds promise for 2024, showing resilience in weak sectors and strong growth elsewhere. As ABB continues to innovate and expand its products, it is well positioned to take advantage of emerging opportunities such as artificial intelligence. Robotics and discrete automation will perform poorly in 2023, with revenue falling 6% annually. However, going forward, I expect this business unit to show strong performance and potentially gain the most from AI integration.

grow

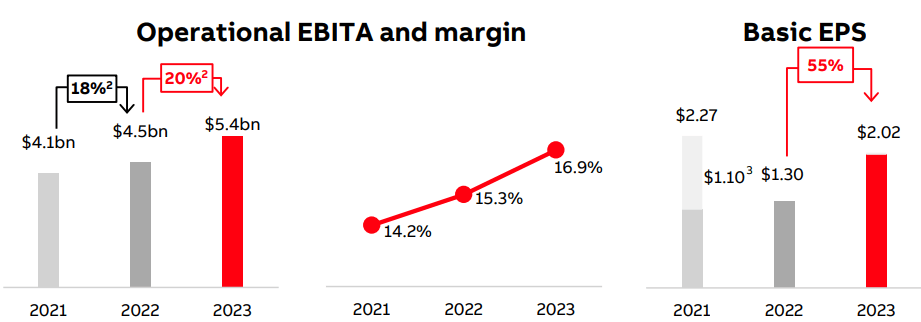

The ongoing bolt-on acquisition strategy continued in 2023, with multiple businesses acquired to drive growth across various business units.CEO Bjorn Rosengren pointed out that the main financial target for 2024 has been raised, with revenue growing to 5-7%, and the operating EBITA profit margin target has been raised to 16-19%. Margins and earnings per share clearly indicate the growth performance of the business.

ABB Margins and EPS (ABB Q4 2023 Presentation)

With the recent hype surrounding the growth of artificial intelligence and data centers; as a major supplier in this high-growth area, ABB is strategically positioned to seize the opportunity. Their ongoing involvement in data centers allows them to grow this business area through a variety of products.

In addition, artificial intelligence integration powered by Microsoft will become a key part of ABB’s story.recent interview ABB’s CEO reinforced the idea:

“We are convinced that generative artificial intelligence (AI) has huge potential for our business. We have identified more than 100 AI-focused projects within the group. For example, our Robotics division produces AI robots with integrated vision, can work safely and autonomously in the warehouse. In our Process Automation business area, we are continuously moving towards autonomous operations, of which artificial intelligence is an important enabler. We also use artificial intelligence for preventive maintenance and in line with our long-term strategy Partner with Microsoft to unlock further customer value from operational data.”

Valuation

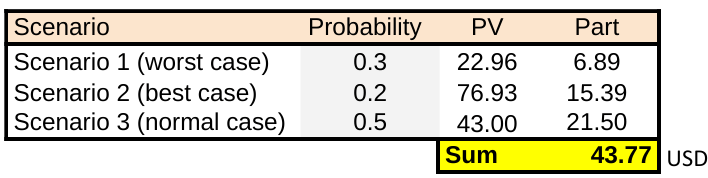

I will provide an analysis of ABB’s valuation using discounted cash flow. This valuation is based on a comprehensive consideration of normal, best and worst-case scenarios for cash flow growth.

Below is an overview of the assumptions I use in discounting cash flows.

In the worst case scenario, I assume a 2% growth rate over 10 years, a 10% discount rate, and a terminal multiple of 10. This gives an intrinsic value of $22.96 in 2033.

The best case scenario assumes 15% growth over the next 5 years, 10% growth from years 5 to 10, a discount rate of 10%, and a terminal multiple of 23. The intrinsic value in 2033 is $76.93 per share.

The normal scenario assumes 5% growth in the next 5 years, 10% growth in the 5th to 10th years, a discount rate of 10%, and a final multiple of 18. The normal scenario end value is $43.00 per share in 2033.

Applying probabilities to each scenario, the table below summarizes the data to demonstrate ABB’s discounted cash flow valuation of $43.77 per share. It said the current valuation is about 8% overvalued.

ABB share price valuation – DCF (author, Trading Economics data)

relative valuation

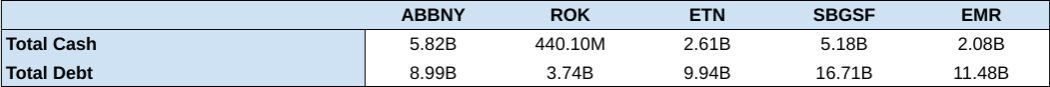

In terms of valuation, ABB is in line with its peers. Long-term trends in electrification and automation continue to drive the sector’s share prices to new highs. Cash flow is strong, and ABB is currently in a leading position with $5.8 billion of cash on the balance sheet. Furthermore, total debt of nearly $9 billion is very reasonable; this is typical of a diligent management team focused on top and bottom lines.

Peer Cash and Debt (Author, information from Seeking Alpha)

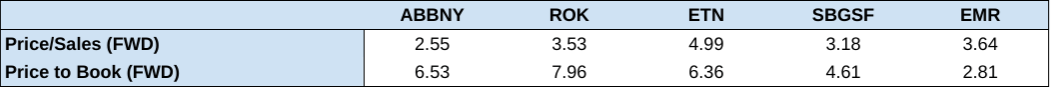

Looking at the forward P/E ratio, ABB’s P/E ratio is 2.55, which is the lowest among its competitors. ABB’s forward price-to-book ratio is 6.53, which is at a high level relative to its peers. However, the cyclical nature of the industry has led to higher peer valuations.

Valuation indicators and competitors (author, data from Seeking Alpha)

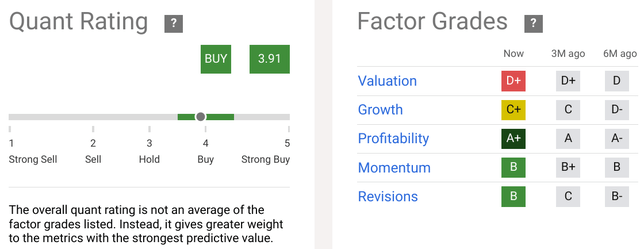

To tie the above information together and provide another reference point, I will use Seeking Alpha’s quantitative ratings. ABB currently has a buy rating and a significant A+ profitability rating. Supporting data for the latest fiscal year shows that the return on capital employed (ROCE) was 21.1%, which is at the leading level in the industry. However, both valuation and growth receive lower quantitative ratings, with grades of D and C+ respectively. The quantitative ratings are consistent with my valuation analysis.

ABB – SA Quantitative Rating (Seeking Alpha)

competitors

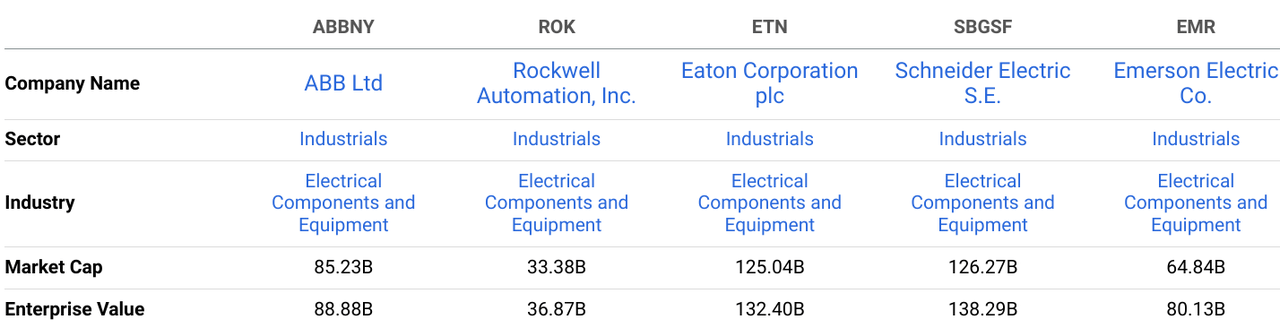

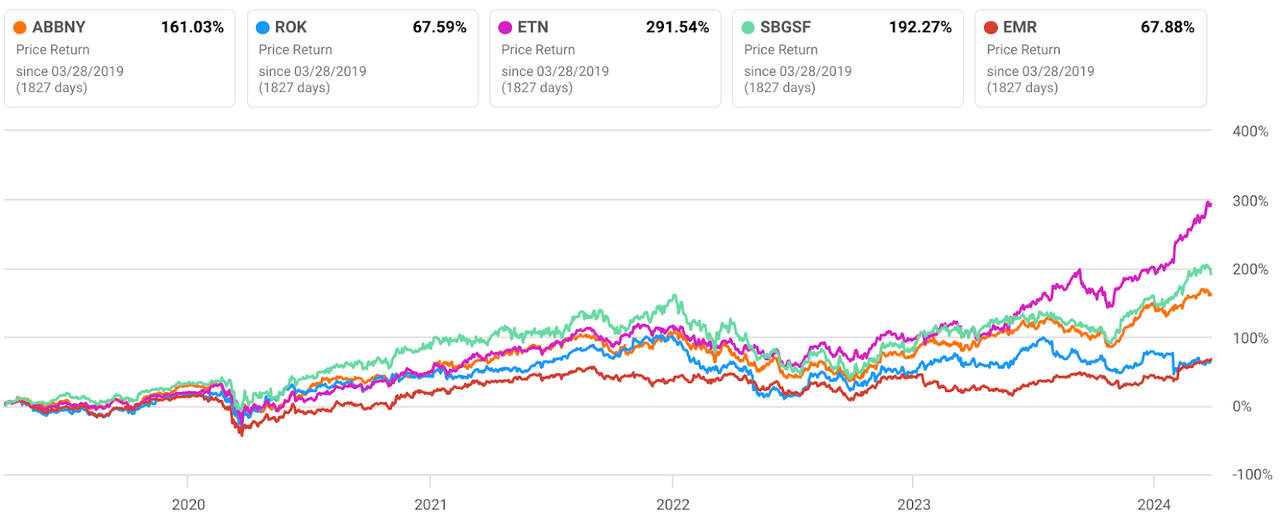

Competition in this industry is fierce. ABB and its competitors are constantly faced with the challenge of competing for market share. Healthy competition from companies like Rockwell Automation (ROK), Eaton (ETN), Schneider Electric (OTCPK:SBGSF), and Emerson Electric (EMR); some of the biggest players in the industry. Most companies have a rich history of technological advancement, capturing market share by segment or geography. All of ABB’s competitors operate internationally and to varying degrees in the same areas.

ABB Competitor Group (Seeking Alpha)

ABB’s share price performance has been strong compared to its peers. However, Eaton leads the way in this regard, with its share price growing 291% in five years.

Relative Stock Performance (Seeking Alpha)

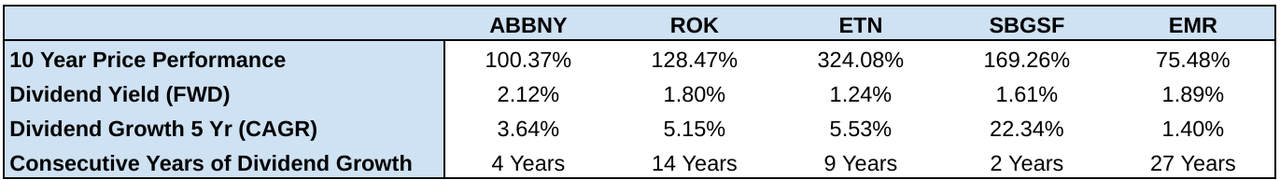

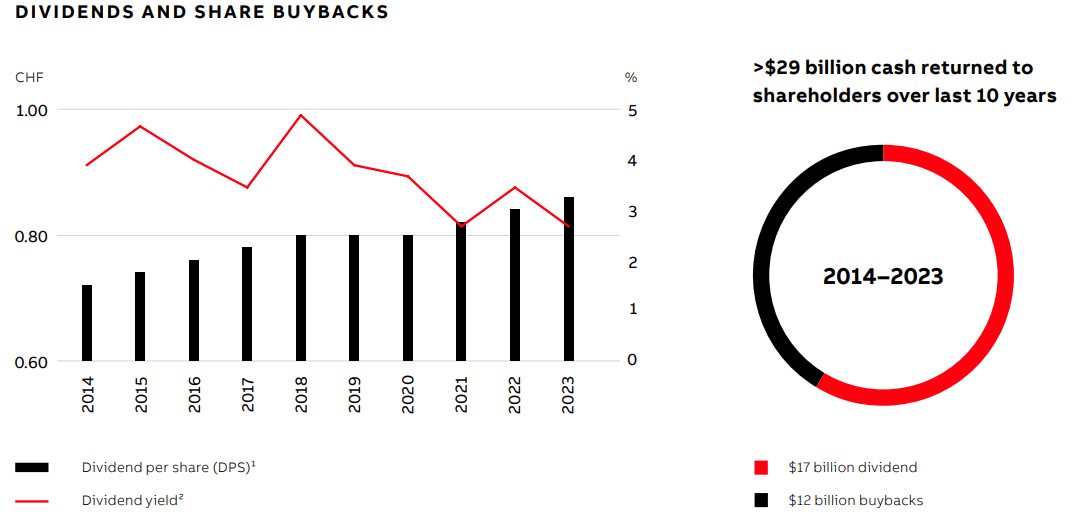

shareholder return

ABB’s stock price has grown by 100% in the past 10 years, and shareholders have received returns through buybacks and dividends.In addition, an additional $1 billion Share buyback Recently announced, continued management’s commitment to shareholder returns.

Shareholder returns (author, data from SA)

With a forward payout ratio of 48%, the dividend is fully covered, consistent with management’s progressive dividend policy. Stock buybacks are another way management chooses to distribute excess cash flow to shareholders. Over the past decade, management has returned more than $29 billion to shareholders through dividends and stock buybacks.

ABB Dividends and Buybacks (ABB Investor Relations)

In addition, ABB has previously expressed its intention to spin off ABB Mobility into a separate listed company. In February 2024, outgoing CEO Bjorn Rosengren (who retired in July 2024) stated on a conference call: “I would be surprised if we had an IPO this year. I think there’s some headwinds in the market. I think financial markets are not in a good place right now, and there’s some headwinds in the markets, especially in Europe.”

This delays any sudden potential windfalls that ABB and shareholders might be looking for in the short term.

risk

China is an important market for ABB and has been an important driving force for the growth of the entire business in recent years, but its prospects are deteriorating. Given the current macro conditions, China is expected to be a headwind.

For ABB, which has $9 billion in outstanding debt, the leverage risk is relatively small.

As a truly international business, and ABB a Swedish-Swiss company operating in Swiss francs, the business and its stock are subject to currency risk.

Industry Tailwinds: There’s no denying that the industry has performed well in recent years, which will likely continue to drive ABB’s growth beyond the conservative forecasts provided by management.

Resources – In particular, the lack of qualified and available human resources remains a challenge for ABB in the current low-unemployment economy.

in conclusion

Solid, reliable, and safe are the three words I use to describe ABB, but judging from the current stock price and the expected revenue growth of 5-7% per year, there is not much room for further growth in the stock price without expanding the price-to-earnings ratio. Considering The growth of the industry is very likely.

While the dividend yield is low at 2%, the trailing payout ratio is modest at 51%, which I expect will continue to grow based on management’s capital allocation strategy. Additionally, newly announced $1 billion available for share repurchases will enhance shareholder returns.

There’s not much to dislike about the ABB. They are clearly a well-run but conservative company. They operate in a growing industry with strong momentum. Artificial intelligence may become a key component of future growth; I believe the partnership with Microsoft is very positive. How artificial intelligence will grow the business for ABB remains to be determined. In my opinion, AI will provide iterative improvements to ABB’s existing business, but I remain unconvinced that AI integration will lead to any significant progress. As time goes on, I will continue to follow the progress of the artificial intelligence program and its various applications in ABB’s business.

The key takeaway for ABB investors is to understand current valuations when making new investments in the company. Existing shareholders should be pleased with the recent share price performance. Business continues to improve, and the long-term trend shows no signs of abating. I like ABB and plan to follow their progress. However, current valuations are less attractive. I rate the stock a Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.