Paul MacKinnon

FNB Corporation’s shares (NYSE:FNB) is trading near its 52-week high and up 19% from a year ago, lagging the S&P 500’s return of more than 30% over the same period.Given the challenges posed, most regional banks have underperformed over the past 12-18 months Although FNB performed reasonably well, the banking crisis in the first quarter of 2023 took a toll on it.Additionally, since the stock is recommended as a buy November, FNB returned more than 18%, slightly better than the S&P 500’s 15% return. I’ve been impressed by the recent management actions and continue to consider FNB a Buy.

Seeking Alpha

In the company’s fourth quarter, FNB’s adjusted earnings per share were $0.38, down from $0.44 a year ago. This was $0.03 above consensus. Full-year profit was US$1.57, an increase of 12% compared with 2022. Earnings per share will grow 12% in 2023, making FNB one of the few banks to be profitable The profit growth was due to its solid handling of the deposit crisis. Overall earnings per share were negatively impacted by about $0.25 in the fourth quarter as the company sold $650 million of securities in December, yielding 1.08%, for a loss of $67 million. It reinvested the funds in securities and will increase pretax income by about $20 million in 2024 as a result of the deal.

In my last article on FNB, I noted that the company had managed interest rate fluctuations fairly well over the past year, with unrealized losses on its portfolio of approximately $7.2 billion. This is a very conservative portfolio, with over 85% rated AAA and a maturity of just 4.2 years. This helps minimize losses compared to other banks that have larger or longer maturity securities portfolios. Still, almost any bond purchased before the Fed starts raising interest rates aggressively will likely suffer unrealized losses.

By selling this debt and reinvesting it in higher-yielding securities, FNB immediately boosted net interest income. In addition to the retirement of preferred stock, the company’s breakeven period is less than a year, while share buybacks take five years. FNB has also resized the sale, which represents approximately 9% of its portfolio, to maximize returns so further sales of securities are not possible.

FNB is able to do this because of its strong capital position. These unrealized losses flow into accumulated other comprehensive income (AOCI) in its GAAP financial statements. But currently, banks that are not systemically important are able to exclude these unrealized losses from their capital calculations. As a bank with assets below $100 billion, FNB will continue to exclude these unrealized losses even after the phase-in for mid-sized banks begins in late 2025. By selling these bonds and taking a loss, that loss now really matters against its capital position.

That’s why most banks continue to hold underwater low-yield bonds. Given the magnitude of interest rate movements, sustaining significant losses would significantly reduce capital positions. So they hold cheap bonds, earning lower interest, until they gradually accumulate to par value and can be reinvested. Ultimately, it’s a trade-off between current capital allocation and net interest income.

Because FNB is well capitalized, it can accept a modest capital hit from this transaction to enhance future interest income. FNB’s common equity tier 1 (CET1) ratio was 10%, down from 10.2% in the third quarter, but still strong. Even taking into account all remaining unrealized securities losses, its CET1 capital ratio is nearly 9%, well above the regulatory minimum of 7%. FNB can safely operate its business in the 9-9.5% capital area. Today it has some excess capital to compensate for the economic reality of these remaining unrealized losses.

But even with them, its capital position is essentially where it should be. As bonds mature, the impact of their AOCI losses will diminish. Because FNB has resized its portfolio to the entire bank’s balance sheet and has fairly short duration, its unrealized losses are manageable, and with its strong capital, FNB is actually able to further optimize its balance sheet and Increase net profit. interest income.

Importantly, the rest of the bank continues to perform well. As a reminder, FNB operates First National Bank, which has branches throughout the mid-Atlantic, primarily in Pennsylvania, Maryland, Washington, D.C., and the Carolinas. At the end of the year, the bank had $34.7 billion in deposits. Deposits increased by $96 million sequentially, up 1% from the same period last year, despite strong net deposit outflows from the industry. This is partly due to FNB’s fine-grained deposit base, 78% of which are insured or collateralized.

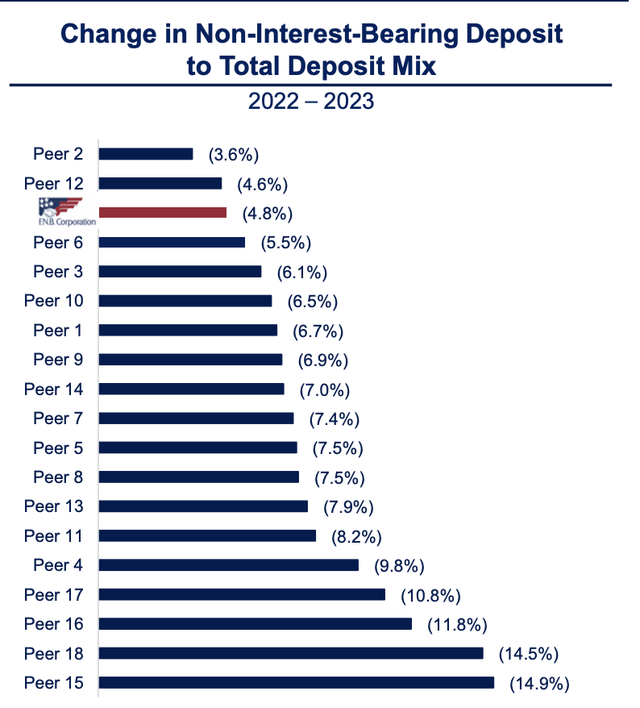

Now, while FNB has done a good job of retaining deposits, as interest rates rise, the cost of deposits has of course become higher. Funding costs increased by 21 basis points from the previous month to 2.14%, and by 134 basis points from last year. Additionally, as interest rates have risen, customers have moved funds from transactional, non-interest-bearing accounts to interest-bearing accounts. FNB has handled this transition well, with 29% of deposits being interest-free. Its losses here are minimal and its pace has been tame as of late. In the fourth quarter, NIB balances fell by an average of 3% quarter-to-quarter, while total deposits grew by 0.8%

Commonwealth Bank

Its net interest margin (NIM) has compressed due to rising financing costs, but the rate of decline is slowing. As net interest income (NII) declined $3 million from the third quarter and $11 million from last year, net interest margins fell 5 basis points sequentially and 32 basis points less than last year. With net securities sales of approximately $5 million per quarter, I expect NII to bottom out in the first quarter and gradually rise.

FNB has a relatively small securities portfolio and is primarily a lending institution with $32.3 billion in loans and a loan-to-deposit ratio of 93%. Loans increased by 1.7% quarterly and 10% annually. Since most of them are floating interest rates, the return on assets increased by 14 basis points from the third quarter of 2022 and 96 basis points from the fourth quarter of 2022.

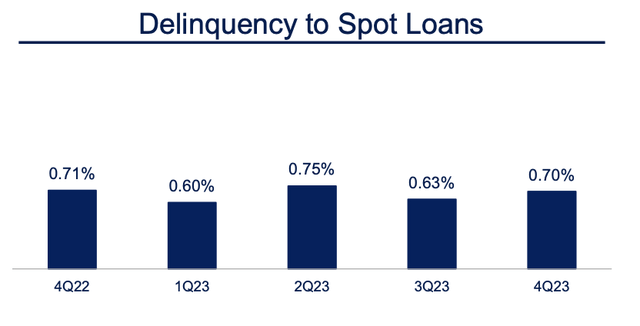

Importantly, I believe FNB is a differentiated underwriter that has returned to a history of strong credit performance after suffering a $32 million loss due to alleged fraud in the third quarter, which I thought investors should consider It is considered a one-time use. The charge-off rate is only 0.10%, and we have not seen credit quality deteriorate even as the economic cycle ages. Its delinquency rate of 0.7% was unchanged from 0.71% a year ago, while its nonperforming loan rate was 0.34%, down from 0.39% a year ago. There are no signs of material degradation. Most importantly, FNB is prepared for potential deterioration. It has set aside 1.25% of its loans for potential losses, and its nonperforming loan coverage ratio reached 378%, up from 354% a year ago. This is above my baseline health reserve level of 250%.

Commonwealth Bank

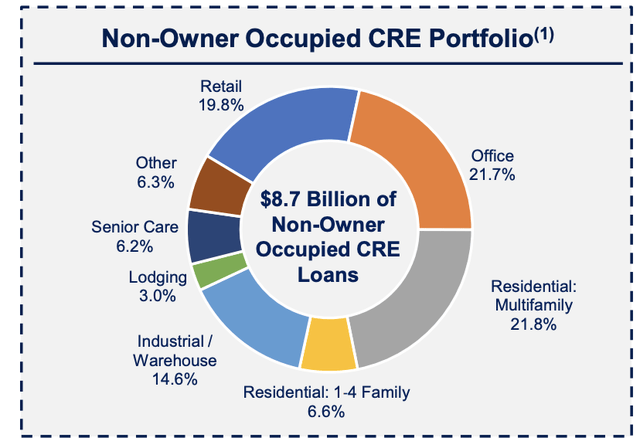

One reason for its stable credit profile is that, unlike many regional banks, FNB does not have significant exposure to commercial real estate (CRE) risk. Non-owner commercial real estate accounts for only 27% of its loan portfolio. As you can see below, only a small part of it is offices, which is the most troublesome department. Within the office, the delinquency rate is only 0.26%. Additionally, 20% of offices are due to expire this year. This will be key to watch. Given the low delinquency rates, I expect most of these to mature successfully, further reducing FNB’s exposure to the sector. However, investors should look to the next few quarters to see if there are any issues with this part of the portfolio. FNB can afford an increase in charge-offs given its excess reserve coverage ratio.

Commonwealth Bank

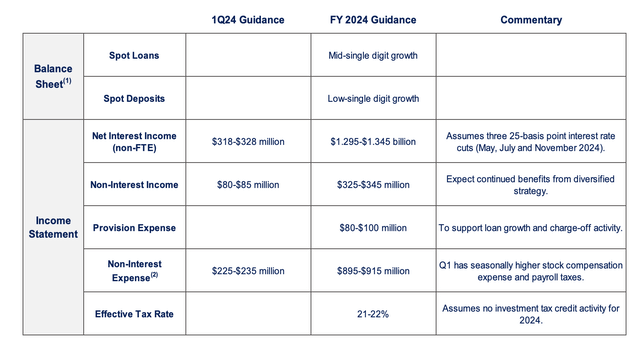

Here’s the company’s guidance for the year. The annualized amount of NII in the fourth quarter was US$1.296 billion. Therefore, assuming that the Federal Reserve will continue to increase deposits while cutting interest rates three times, FNB will guide its moderate growth. Given its securities sales, I expect interest income to be $13.2 to $1.35 billion. Management also guided that non-interest income would be flat to grow 6%. I think this is reasonable given the improvement in capital market activity.

Commonwealth Bank

Therefore, I expect FNB to earn approximately $1.50-$1.55 this year. This provides ample protection for its 3.5% dividend yield. Given that it used some excess capital to optimize its portfolio of securities, I would expect repurchase activity to be a bit less than before, especially since it sees its first use of retained capital to support continued loan growth. Still, after paying the dividend, FNB will still retain earnings of more than $1 per share. I expect 50-70% to be used to support growth, reducing the number of shares repurchased by about 2-3%.

With its strong balance sheet management and solid loan book, I think FNB is a solid long-term investment and offers an attractive 9x forward earnings. I expect shares to rise to around $15.50 next year, or 10 times forward earnings, offering ~12% appreciation potential, especially with buybacks accelerating further in 2025 as it recoups the capital impact of the December action. With net interest income bottoming out, the stock has room to rise further.