nycshooter/iStock via Getty Images

JBS (OTCQX: JBSAY) is the world’s largest meat protein company and the largest food company by revenue.

I wrote a buy article on the company in January.The reason is the company’s moat market, good capital allocation and returns, geographic and protein source diversification, long-term management and strong controlling shareholders, and the fact that its stock price is trading below historical earnings due to temporary headwinds.

In this article, I review the company’s fourth quarter and fiscal 2023 performance. Most of the company’s segments have recovered, while the primary segment (U.S. beef) remains at the low point of the cycle. The company reduced debt and extended maturities on attractive terms.

I think JBS is an opportunity at its current price, and there are some catalysts in the future that could close the valuation gap.

Fourth quarter and fiscal year 2023 developments

The company reported results this week. My main takeaway is that the company’s various segments have regained much of the profitability lost in late 2022 and early 2023. At the time, many were concerned that the company was facing problems, but management promised that low margins were cyclical and would recover, something that has proven true quarter after quarter.

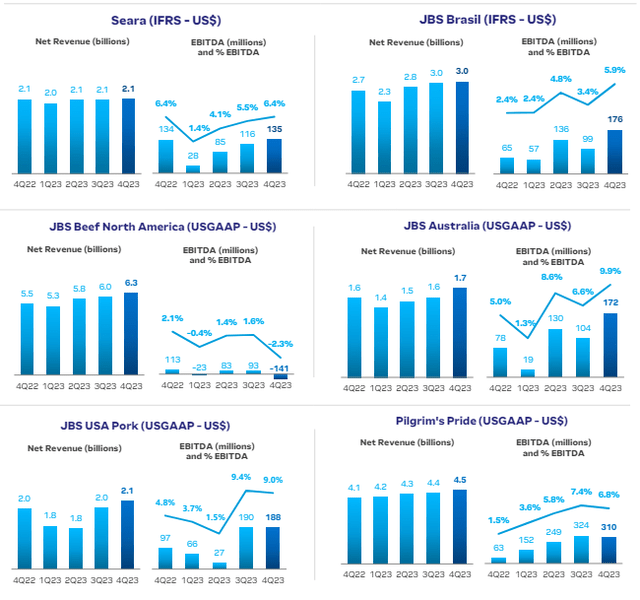

JBS Results by Segment (JBS fourth quarter financial report released)

As shown above (from the company Fourth quarter financial report release) has recovered after bottoming out in most of the company’s segments between Q4 2022 and Q2 2023.

The reasons are varied; in the case of Seara, the company’s factories experienced operational problems at the beginning of the year but recovered by the end of the year. In the case of JBS Brazil and Australia, this improvement comes from positive cattle circulation in those countries (an overabundance of dairy cows reduces the price at which JBS can sell at a premium abroad). In the case of Pilgrim’s (poultry and international pork) and JBS USA Pork, this improvement was made possible due to lower feed costs, especially corn.

One segment that is still struggling is JBS Beef North America. It’s one of the company’s largest divisions and, arguably, the most important in terms of EBITDA. U.S. Beef is personally run by Wesley Batista, one of two brothers who led the company from a local Brazilian operation to world dominance.

Management believes the current results are driven by the negative cycle in the U.S. beef market. In contrast to Brazil or Australia, the U.S. cattle herd is shrinking, resulting in reduced supply and higher dairy cow prices.

Cycle diversification: JBS has always understood market cycles, which is why it has a geographically diverse base (dairy cows from Brazil, the United States or Australia) and a protein-diversified base (dairy cows, but also poultry, pork and processed meats). One market will often produce small profits or losses for a period of time, but other markets can make up for it. This is particularly true for beef, while pork and poultry are more stable unless feed inputs fluctuate.

Ultimately, the quality of U.S. beef will improve, while the quality of Brazilian or Australian beef may deteriorate. This is a bigger problem because the United States produces more beef than Brazil and Australia combined.

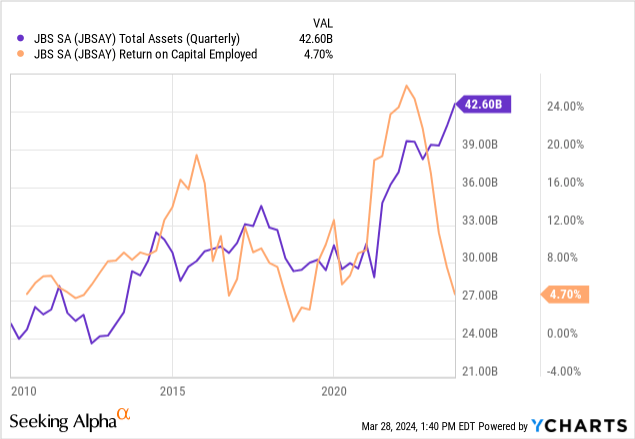

Continuous investment: One of the things I like about JBS is how successfully they have deployed capital into larger and larger businesses and increased profits. The company’s asset base and ROCE have grown in tandem, as more assets give it a greater cost advantage and enhance its market power.

This year, the company continues to expand (its capital spending is half on expansion and half on maintenance). The company has opened two automated Seara plants in Brazil, focusing on the production of prepared products such as breaded chicken and sausages. It also opened an Italian specialty factory in the United States. In my opinion, these are the most promising areas as JBS expands downstream, combining its upstream cost/manufacturing advantages with brand power.

it is also Start building Its first production-scale cultured protein factory in Spain. It will be the world’s largest factory, capable of producing 1,000 tons of cultured protein per year, with the potential to reach 4,000 tons.This is obviously just a drop in the bucket of ordinary meat, equivalent to 350 million tons per year. McKinsey Production in this market is expected to reach 40,000 tonnes by 2025, meaning JBS will be a small but noticeable player.

debt refinancing: JBS’s debt is rated investment grade, and financing costs are relatively low and fixed. 85% of the company’s liabilities are denominated in U.S. dollars (the remainder is in Brazilian reals), with an average cost of 6%. The average maturity of corporate debt is 11 years.

The company paid down some of its debt this year as declining EBITDA in early 2023 left it with a higher debt-to-EBITDA ratio. The company currently has about $4.7 billion in cash and securities, enough to cover all debt maturities until 2029. The company’s debt cost is about $1.4 billion, or about 7% of its total debt cost of $20 billion.

US listing progress: JBS is listed in Brazil and has OTC ADRs in the U.S., which has low liquidity for a company of its size and importance. The company announced plans for a full ADR listing in the United States and is moving in that direction. It issued its first 20-F this week. This would open stocks up to index funds.

Revisiting Valuation

JBS currently has a market capitalization of approximately $10 billion and an enterprise value of $25 billion ($20 billion in total debt minus approximately $5 billion in cash and securities).

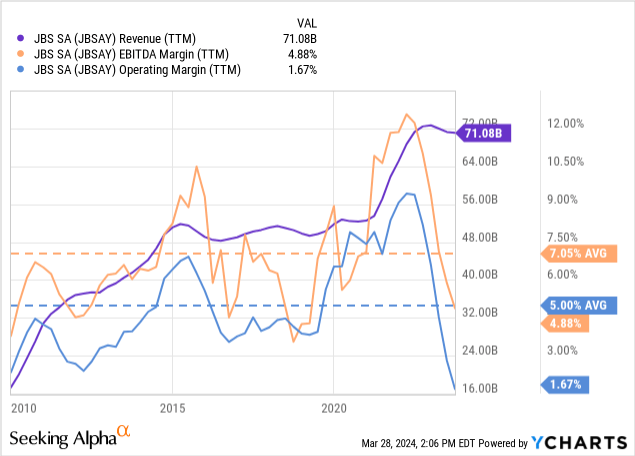

The company has revenue of $72 billion and its historical average EBIT and EBITDA margins are 5% and 7%, respectively. Margins for both types are trending upward ahead of problems in 2022/23, a combination of the meat market cycle, the company’s downstream moves (gaining share and profits) and returns on the scale of its asset base.

The company’s current EBITDA margins are sufficient to cover interest payments, which translates to an EBITDA of $3.6 billion. It could drop by half and still cover interest.

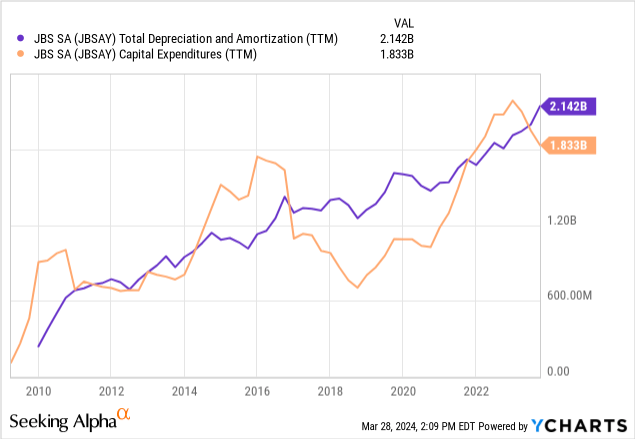

On the operating side, depreciation is a good reflection of the company’s cycle-average capital spending, although a large portion of that capital spending is expansion rather than current cost of sales.

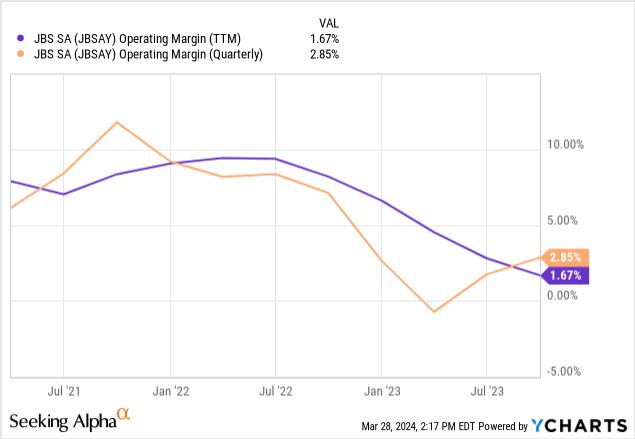

On top of that, as shown below, margins have been improving every quarter, with recent quarters already above their worst levels in the fourth quarter. TTM numbers continue to decline as Q3’22 numbers (nearly 8%) are not counted this season. Next quarter, however, the company’s negative margins in 1Q23 will also be replaced, so the TTM number should be closer to 3/4%. That doesn’t include improvements in U.S. beef, one of the main profit engines.

Looking at the valuation from an EV perspective, the current valuation requires $2.5 billion in NOPAT to generate a 10% yield, which I think is reasonable for a company of JBS’s size, moat, financial profile, and management capabilities. Adopting an effective tax rate of 25% (as guided by the company) would result in operating income of $3.3 billion, or an operating margin of 4.5%, below historical levels and close to current recovery levels.

Again, current levels include distressed operations in U.S. beef, and historical margins of 5% do not explain the relatively clear upward trend in JBS’s cycle average margins.

In order to achieve a 10% return on a market capitalization of $10 billion, the company would need to generate $1 billion in net income. Add taxes on $1.3 billion in pre-tax profits or $2.8 billion in operating profits to cover interest. The result is an operating margin of 3.8%. The equity figure is lower than debt because JBS’s cost of debt (6/7%) is much lower than its historical return on assets (at least 8/10%). This means that equity can benefit from leverage as long as interest rates are fixed over the long term.

Considering historical profit margins of 5%, the EV/NOPAT multiple is 9x and the P/E multiple is 6.3x. The EV/EBITDA number is 5x based on historical margins (7%).

I believe JBS’s history of expansion and the multiple cycles it has experienced in Brazilian, U.S. and global markets suggest that operating margins have reverted to the mean, with the potential for a positive trend deviation over time. An expected return of 20% below the historical average seems a bit conservative to me. The company’s financial profile is sufficient to warrant an investment grade rating for emerging market registered companies. For a company with the scale, moat, and management, a 10% yield is reasonable. I think JBS remains a Buy at current price levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.