Chip Somedevilla

Great performance from Berkshire

Berkshire Hathaway Company (NYSE:BRK.A) (NYSE:BRK.B) Since my update in early November 2023, the stock has performed well as the broader market recovers. BRK.B is also in line with the S&P 500 Index (SPX) (spy), even if Apple (AAPLSince the start of 2024, it has significantly underperformed the SPX. I assign a Hold/Neutral rating to BRK.B. Considering its performance relative to SPX, I think this rating is reasonable. CEO Warren Buffett’s annual letter The incident in February 2024 highlighted the enormous challenges facing Berkshire Hathaway as its market capitalization approached $1 trillion. As a result, even the Oracle of Omaha admits that future “jaw-dropping performances are not feasible” given current circumstances and market conditions.

It should be noted that Berkshire was a net seller of shares in the fourth quarter, despite its growing cash pile, which stood at nearly $168B as of last year.Therefore, I believe It is crucial for investors to consider that BRK.B’s market performance will become increasingly challenging. Buffett pointed out that “few companies in the United States can have a significant impact on Berkshire’s finances.” He also made it clear that meaningful overseas opportunities “are basically non-existent for Berkshire.”

With that in mind, should investors continue to chase Berkshire shares even as they near recent all-time highs?Although AAPL current account With more than 40% of Berkshire’s public stock portfolio, BRK.B has managed to keep pace with the broader market. However, Buffett also reminded investors to adjust their expectations for outperformance and aim for “moderate growth.” Therefore, it is different from the “early period of higher expectations”. In other words, Buffett’s well-known principles of prudence and capital preservation may lead to fewer opportunities to deploy capital in more expensive markets, as the S&P 500’s forward normalized EPS multiple has surged to over 21x (higher than 10-year average 17.5 times).

Beating the market will become more difficult

However, Buffett’s tendency to execute stock buybacks has not diminished. According to documents as of early March, Berkshire records $2.3B Share repurchases since the start of 2024 exceed last quarter’s $2.2B. However, with Berkshire’s market capitalization soaring to the $910B level, even a $10B annualized buyback cadence would have a 1% impact on its valuation, with little to no significant impact from stock write-offs. Therefore, I urge investors to consider whether the overall risk/reward of BRK.B still makes sense when they could invest in the S&P 500.

Additionally, Buffett reminded investors that his regulated utility businesses face unforeseen regulatory challenges. As a result, even Buffett admitted that he “made a costly mistake by failing to foresee adverse regulatory developments and their impact on returns.” Berkshire’s energy and utilities segment accounted for about 6% of its fourth-quarter operating profit. However, it also dropped significantly by 40%. Buffett made no attempt to hide his dissatisfaction with the unit’s performance, stressing that its “earnings were seriously disappointing.”

While Berkshire’s high-margin insurance (underwriting and investment) business boosted the group’s fourth-quarter results, market share losses Geico vs. Progressive Also noticed. Combined with the significant investment required to keep its capex-intensive rail business operating, Berkshire Hathaway’s headwinds are likely to intensify as it faces additional challenges in generating alpha for shareholders.

However, Berkshire stock is not assessed as a red flag

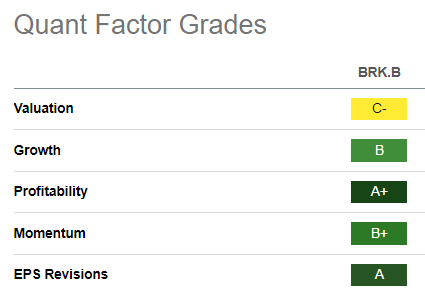

BRK.B quantitative grade (Seeking Alpha)

Despite my caution, I assess that Berkshire remains a fundamentally strong business and well managed by Buffett and his team. However, given Buffett’s advanced age, questions remain about his role as a “master of capital allocation.”While his designated successor (Greg Abel) is expected to be ready to step into the leadership role if needed, the question is “Would Greg Abel Leading Berkshire alone would likely face market scrutiny.

Nonetheless, BRK.B’s strong “B+” Momentum Rating suggests the market remains unconcerned about Berkshire’s execution challenges, given its track record and diversified operating model.

Is Berkshire stock a buy, a sell, or a hold?

I think Berkshire shareholders should hold on to their positions. Under the able leadership of Warren Buffett, the group has proven its track record over time.

However, as Buffett noted, generating alpha ahead of the S&P 500 is expected to become increasingly challenging. Therefore, investors should consider the possibility of lower returns in the future.

With this in mind, I think I should remain neutral on BRK.B at current levels.

Rating: Maintain Hold.

IMPORTANT NOTE: Investors are reminded to conduct due diligence and not to rely on the information provided as financial advice. Consider this article a supplement to the research you need. Please always think for yourself. Please note that ratings are not intended to refer to specific entry/exit times at the time of this writing unless otherwise stated.

I want to contact you

Have constructive comments to improve our paper? Spot a critical gap in our perspective? See something important we didn’t? Agree or disagree? Leave a comment below to help everyone in the community learn better!