smederevac

A few months ago, I wrote an introductory article on the Kraft China Internet and Covered Call ETFs (NYSE: CLIP).In my opinion, the limited up/infinite down structure of the KLIP ETF is unappealing, even though the fund’s Big headline issuance yield.

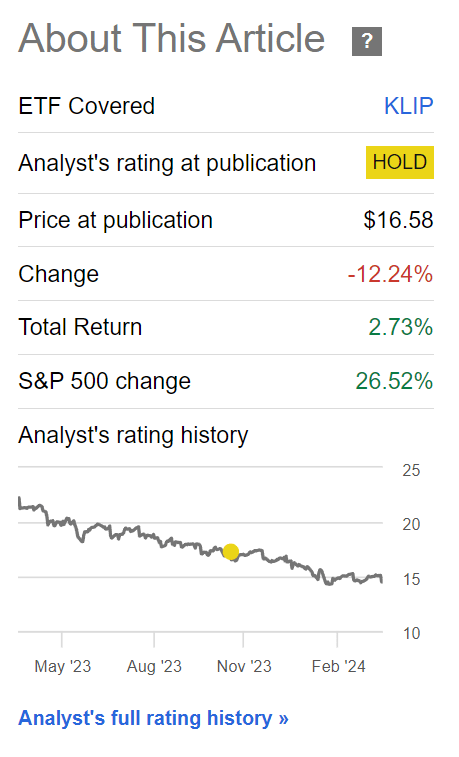

It’s been a few months since my launch article and I wanted to revisit the fund to see if my initial assessment was correct. The KLIP ETF has fallen 12% since my article was published, although the fund’s high distribution yield allowed the fund to deliver positive total returns (Figure 1).

Figure 1 – KLIP has returned 3% since October (Seeking Alpha)

Fund Introduction

First, an overview of KLIP’s investment strategy for those unfamiliar. Jin Rui China Internet and Covered Call Strategy ETF is Jin Rui’s attempt to enter ultra-high-yield ETFs.

actual strategy The strategy behind the KLIP ETF is relatively simple and has been adopted by many other asset managers, such as Global X and its highly successful (in terms of AUM) Global X NASDAQ 100 Covered Call ETF (QYLD) and J.P. Morgan and its J.P. Morgan Equity Premium Income ETF (often).

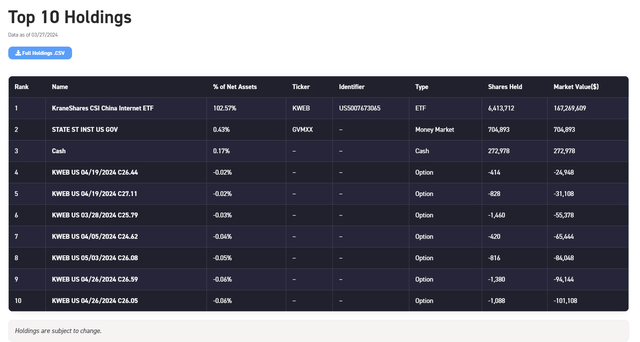

KLIP uses a “covered call” or “buy and sell” strategy. The fund owns the Kingsoft CSI China Internet ETF (KWEB) and sells call options on this long position (Figure 2).

Figure 2-KLIP shareholdings (kraneshares.com)

We can see in Figure 2 that KLIP wrote a series of short-term call options on its long position in the KWEB ETF. The primary objective of the KLIP ETF is to provide investors with an attractive current yield while retaining limited participation in the upside potential of the KWEB ETF.

KLIP delivers on production commitments

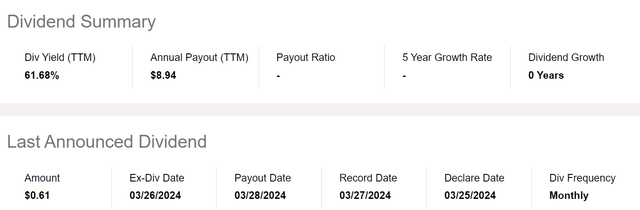

Looking at KLIP’s dual mandate of providing attractive current yield and upside participation, we can see that KLIP has certainly delivered on its yield mandate, as the fund paid $8.94, or 61.7%, on distributions over the past 12 months distribution yield (Figure 3).

Figure 3 – KLIP has paid a distribution yield of 61.7% (Seeking Alpha)

However, offsetting KLIP’s high returns was the continued decline in the fund’s net asset value (“NAV”), resulting in a 1-year total return of only 11.3% (Figure 4).

Figure 4 – KLIP’s total return is much lower than its yield (Seeking Alpha)

The upside is limited, the downside is unlimited

KLIP’s NAV amortization is partly due to poor performance of the underlying KWEB ETF. Since KLIP’s portfolio only holds KWEB in addition to put calls, when the value of KWEB declines, the value of KLIP also declines (Figure 5).

Figure 5 – KLIP tracks KWEB’s weaknesses (Seeking Alpha)

Due to the nature of the covered call strategy, the KLIP ETF limits the upside of the underlying asset without limiting its downside.

Heavy use of capital returns

However, the KWEB ETF’s decline does not explain KLIP’s entire NAV amortization, as KWEB’s price fell only 14.6% over the past year, but KLIP’s market price/NAV fell 34.1%.

anymore question?

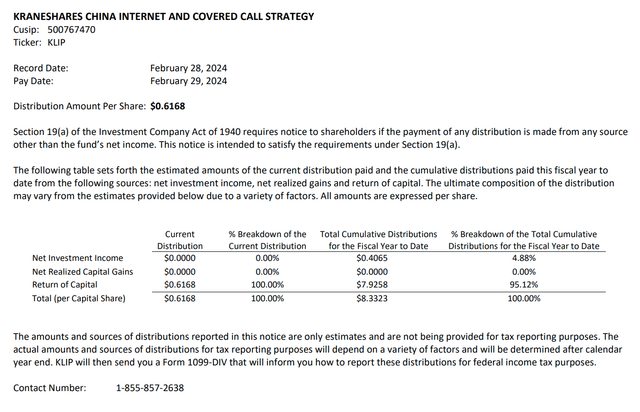

Take a look at the fund literature, another problem with the KLIP ETF appears to be that 95% of the fund’s year-to-date allocation is estimated to be return on capital (“ROC”) (Figure 6). The return of capital means the fund has been liquidating NAV to fund its distributions.

Figure 6 – KLIP distribution is mainly ROC (KLIP Section 19.a Report)

While it’s unclear why selling call options to generate premium income is classified as a ROC, for all intents and purposes, the investor is simply paying back his own capital and not creating much actual value.

Geopolitical risks remain high

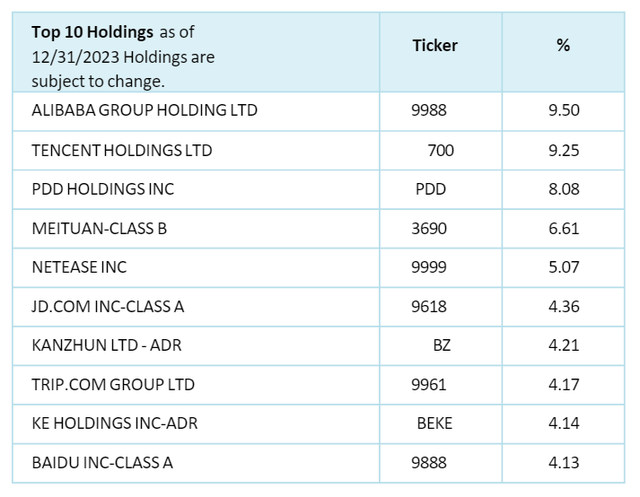

Looking at the underlying fund KWEB, geopolitical risk remains a top concern as the KWEB ETF is filled with leading Chinese technology companies such as Alibaba and Tencent (Figure 7).

Figure 7 – Top 10 KWEB holdings (kraneshares.com)

In recent weeks, the U.S. House of Representatives voted Legislation that could ban TikTok, the popular social media app that originated in China, unless its Chinese owners divest their holdings.

While the measure may seem draconian, it does underscore the growing animosity between U.S. lawmakers and Chinese technology companies. So it’s no surprise that the KWEB ETF continues to underperform, down 13.2% over the last year and down 3.4% year to date.

in conclusion

I believe my initial assessment of the KLIP ETF still stands, as KLIP’s 61.7% distribution yield seems too good to be true. The continued decline in NAV due to KWEB’s decline and capital returns offset KLIP’s distribution.

While it’s unclear why selling the call options would cause the distribution to be treated as a return of capital, the fund appears to simply return investors’ capital through the distribution and generate a modest total return. I continue to recommend investors avoid KLIP.