Darren 415

I wrote an article about Ascend Wellness (OTCQX:AAWH) in early November, saying it was no longer the cheapest MSO. The stock was trading at just $1.00 at the time and is now trading at a much higher price. But I love it!To be fair, I liked it at the time too, but I’m worried it won’t be as cheap as it once was to its peers.

In this follow-up, I review the fourth quarter and 2023 financial results, discuss the outlook and its changes, review charts, and assess valuation. Hopefully the analysis I’ve shared explains why AAWH currently represents 19% of my Beat the American Cannabis Operator Index model portfolio and now accounts for 6% of my Beat the Global Cannabis Stock Index model portfolio. I added it last week, including buying it on Friday for $1.30.

Improve health Improved in 2023

Ascend Wellness’ net revenue will grow 28% in 2023, reaching $518.6 million. Gross profit margin dropped from 33.1% to 29.9%. Fortunately, with no closing costs, its operating expenses increased by only 12%. After deducting a $5 million charge from 2022 results, operating expenses increased 16%. Adjusted EBITDA for the year grew 14% to $106.5 million. One of the biggest improvements was operating cash flow, which increased to $75.3 million from $38.4 million in 2022. Capital expenditures were $24.2 million, meaning the company generated free cash flow. For 2024, the company’s 10-K forecasts capital expenditures of $35-40 million.

I like that Ascend Wellness is not spread across multiple states like other MSOs because this gives them the opportunity to expand or potentially be acquired by a larger MSO. Many investors are unaware of the restrictions placed on operators in several states. Some limit the number of dispensaries, others limit the size of cultivation facilities.

Headquartered in New York City, Ascend operates in Illinois, Maryland (without cultivation), Massachusetts, Michigan, New Jersey, Ohio and Pennsylvania. It has a limited number of dispensaries in Illinois, 10, and faces some challenges in 2023 due to adult-use legalization in Missouri. Two of its stores are located near the Missouri border and benefit from tourist purchases.

New Jersey’s adult-use legalization in April 2022 has helped Ascend, and it has expanded beyond medical into adult-use with an acquisition in Maryland. Ohio will legalize it for adult use, and Pennsylvania may do the same.

One thing I don’t like about Ascend and many of its peers is that they have a lot of debt but negative tangible book value. I think the debt may be difficult to refinance. Ascend’s net debt at the end of 2023 was $236 million. Its tangible assets were -$126.1 million.

Ascend Health’s Future Bright

Sentieo said that ahead of the fourth-quarter report, analysts expected revenue of $576 million in 2024. They expect adjusted EBITDA to be $121 million. Now, analysts still expect revenue to grow 11% to $576 million, but they expect adjusted EBITDA to rise 17% to $124 million. Ascend Wellness’s projected growth this year is higher than its peers, as average revenue growth for Tier 1 and Tier 2 brands is just 4.5%, and Ascend’s projected growth is the highest among these companies. Ascend’s expected adjusted EBITDA growth rate ranks second, well above the 10% average.

Two of the nine analysts forecast 2025 revenue of $589 million and adjusted EBITDA of $139 million. Now, five analysts expect revenue to grow 7%, to $617 million.

Ascend Wellness’ Charts Are Attractive

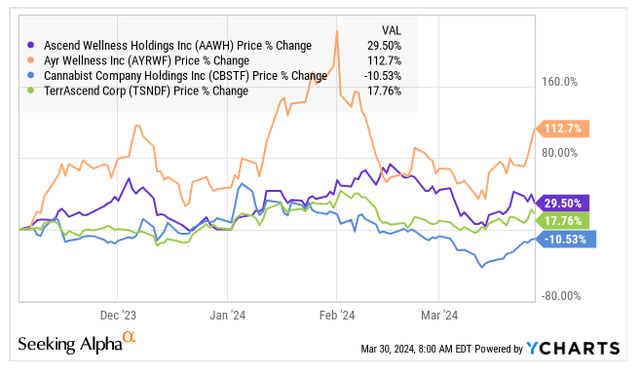

AAWH is up 29.5% so far in 2024. That’s slightly higher than the New Cannabis Ventures Global Marijuana Stock Index, which has gained 26.0% year to date. AAWH was not included in the index in the first quarter but was added in the second quarter due to higher trading volumes.

Ascend is lagging behind compared to MSO. The NCV U.S. Cannabis Operators Index, which includes this company and a dozen other MSOs, rose 34.9% in the first quarter of 2024.

Since early November, Ascend has lagged significantly behind AYR Wellness (OTCQX:AYRWF) in terms of its performance relative to the other 3 Tier 2 MSO names. It has surpassed the other two:

Y chart

I like Cannabist (OTCQX:CBSTF), which recently sold convertible notes, which put pressure on the stock. I wrote positively about TerrAscend (OTCQX:TSNDF), but I no longer include it in any of my model portfolios.

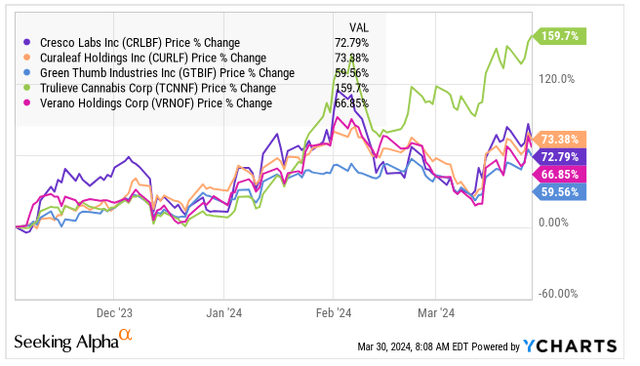

Looking at larger peers, all 5 Tier 1 names have performed significantly better than AAWH since 11/3. The worst name had returns more than double those of Ascend Wellness:

Y chart

The AdvisorShares Pure US Cannabis ETF (MSOS) has gained 70.2% since November 3. Then, the ETF doesn’t own AAWH. Currently, it holds 1.9 million shares, accounting for only 0.2% of the total fund. It first bought more than 1 million shares in early February, when the stock price was much higher than it is now.

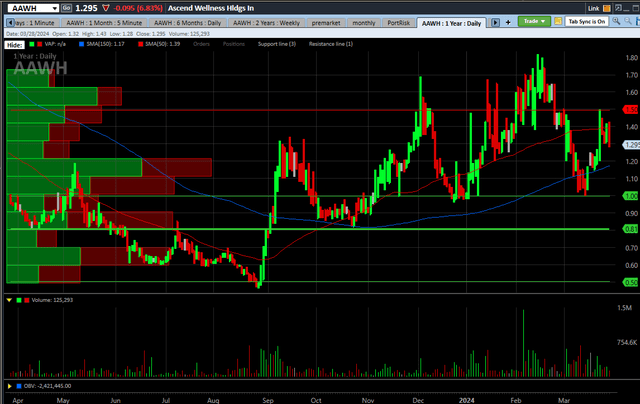

I think the uptrend chart is attractive because it shows higher lows and higher highs, and the volume has been very heavy recently:

Schwab

The big spike in volume in early February may have to do with MSOS buying, but volumes are still relatively high.

The stock hit an all-time low in late August, just before news of the possible restructuring broke. It peaked in February and fell back to $1.00, which currently appears to be solid support. Currently, I view $1.50 as potential near-term resistance.

Looking at the past two years, the stock has still fallen significantly:

Schwab

The stock has gained just 12.6% since the end of 2022, well below the 45.3% gain for the U.S. Marijuana Industry Index.

Ascend Wellness is cheaper again than MSO peers

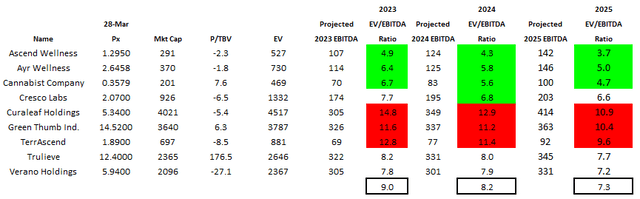

In November, I pointed out that the Ascend, while cheap, no longer stands out like it used to. The company’s enterprise value to projected 2024 adjusted EBITDA ratio of 3.7x is the second-lowest among nine Tier 1 and Tier 2 companies. The average for the group at that time was 5.5x.

Here are the updates for 2024 and 2025:

Alan Brochstein, using Sentieo

For 2024 estimates, Ascend is now the cheapest at 4.3x. The average is now much higher than before, at 8.2x. Estimates for AAWH have increased but remain below its price. However, its peers’ adjusted EBITDA expectations have declined, but prices have risen sharply.

In 2025, Ascend is also the cheapest at 3.7x. The average is 7.3X and if cannabis is re-listed to Schedule 3 then the 280E tax will be eliminated. This is a very good thing for MSOs and allows valuations to expand.

Ahead of the fourth quarter report, I shared a set of year-end 2024 targets with members of our investment team. Assuming 280E disappears, my optimistic target is $3.89 and my pessimistic target is $0.78. Updating these targets using the same metrics, I now have an optimistic target based on an enterprise value of 8x projected 2025 adjusted EBITDA, or $4.00. This would be a 209% gain. Based on a 3x decline, my pessimistic target is $0.84, which represents a potential decline of 35%. This is much better than its peers.

in conclusion

Ascend shares have risen sharply since early November, but at a slower rate than MSO peers. To them, the stock looks relatively cheap. The results of the rescheduling will greatly impact its returns, but I like it enough to include it in my model portfolio.

I’ve discussed the attractive chart and cheap valuation relative to peers. Right now, I’m trying to beat the Global Cannabis Stock Index in my model portfolio, and I’m a little overweight relative to the index.

The biggest risk facing AAWH and its peers is whether 280E doesn’t go away. As I discussed, AAWH has a negative tangible book value and a significant amount of debt, which should weigh on the stock. Another risk is that many expected Pennsylvania to move beyond medical marijuana to adult use, but it did not.

Two weeks after I wrote the Ascend article, I reiterated my bullish view on Trulieve (OTCQX:TCNNF), which was trading at $5.61, up from the $4.775 I valued Ascend at. It has more than doubled! I recently downgraded TCNNF to Sell. I think AAWH is a good alternative to TCNNF, which has fewer pros and more cons than Ascend Wellness.

So, while I’m not a big fan of MSOs right now because I worry about investors getting too excited about things that may not happen, I rate this MSO a Buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.