PHIVE2015

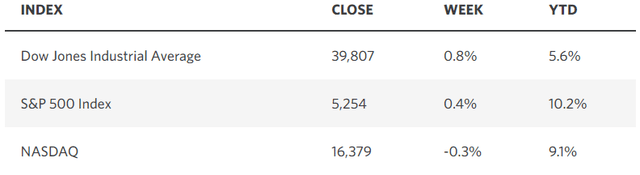

The stunning first quarter performance across major markets averages bodes well for the remainder of 2024. Barron’s Shows that when the S&P 500 rises 10% or more in the first quarter of a year, it can be traced In 1950, the index rose 91% of the time in the remaining three quarters, with an average gain of 6.5%. The good news on the quantitative front doesn’t stop there, but before I make the case for further gains in the market, let me review why I think the momentum behind this bull market is building.

Edward Jones

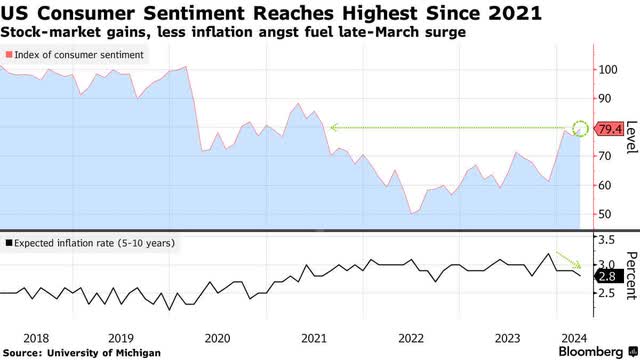

Financial conditions are easing again on multiple fronts, which should be very positive for risk asset prices in the coming months and support economic expansion.We are starting to see positive changes in manufacturing and the housing market, which is why The Conference Board’s leading economic index is starting to recover from deeply negative levels.This is also the reason for consumer sentiment Rose It rose sharply in March, reaching its highest level since 2021. Consumers’ inflation expectations for the next year fell to 2.9%, while the 5-10 year forecast was slightly lowered to 2.8%. The University of Michigan survey shows these are moving in the right direction with greater certainty, which is why consumers’ views on their personal finances and economic outlook have improved to levels not seen in two years.

Bloomberg

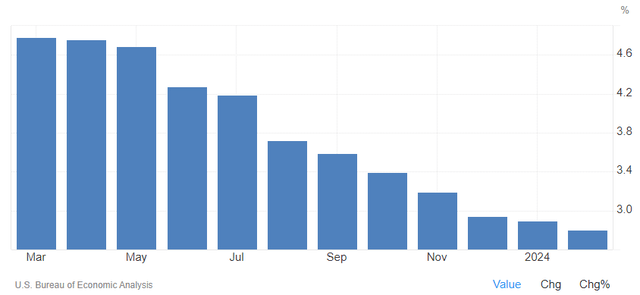

Confirming these views, we got more good news on inflation through the Fed’s preferred measures come down Annualized to the twelfth consecutive month. The core personal consumption expenditures (PCE) price index fell to 2.8% in February from 2.9% in January, the lowest level in three years. On top of that, the services super core rate, which excludes energy and housing, rose just 0.2% in February. Many analysts incorrectly asserted last month that January’s 0.7% rise in the Super Core index was the end of the deflationary trend. Rather, it is an anomaly due to the seasonality associated with the start of the new year. The deflationary trend is clearly intact, which is why Chairman Powell said on Friday that the latest report was “consistent with what we wanted to see.”

Trade and Economic

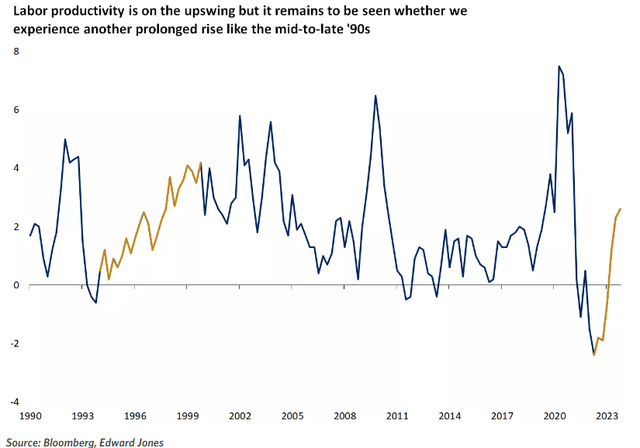

Because financial conditions are looser today than they were before the Fed began tightening short-term interest rates in March 2022, many investors are overly concerned about a rekindling of inflation. We need to ease financial conditions to allow the economy to soft land later this year, but I think those who are worried about inflation are not recognizing that rising productivity, which helps lower labor costs per unit of output and sustains economic growth, is also deflationary of. That’s what happened in the mid-1990s, giving us our last soft landing. I think artificial intelligence might serve us today in the same capacity that the internet did back then.

Edward Jones

These similarities, coupled with the outperformance of a handful of large-cap tech stocks, are raising concerns about a stock market bubble, especially among those who fail to see the 2023 bull market really starting. However, today’s market is anything but. Like it was in the late 1990s. It looks more like the mid-1990s. That doesn’t mean we might not be approaching bubble territory for part or all of the market by the end of this year or in 2025, but currently the breadth of the bubble is improving as more undervalued stocks start to join the bull market. This is a symbol of strength.

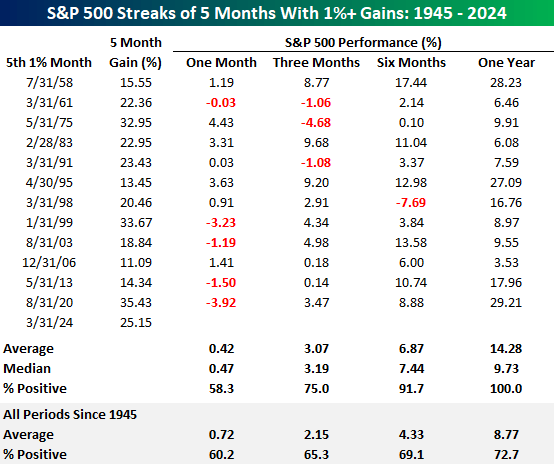

customized notes When the S&P 500 rises 1% or more for 5 consecutive months (as it has for the past 5 months), the forward returns for the following 6-month and 12-month periods are excellent. The potential for a pullback over the next 1 and 3 months is clear, but considering the S&P 500 is up 25% since October, this should come as no surprise. Most impressive is the 100% win rate within 12 months of this rare performance development, which has only happened 13 times since 1945.

customized

I couldn’t be more optimistic about the market and economic outlook at this stage of the cycle, but the opportunities for profit are clearly not as good as they were 12-18 months ago. As certainty increases, market prices reflect this development. One thing that keeps me optimistic is the still widespread pessimism among experts and strategists who are constantly trying to find holes in this expansion and the dynamism of the bull market. They clearly missed the forest for the trees. Until rates of change in high-frequency economic indicators begin to collectively act as headwinds, I expect a soft landing ahead and gains for major market indexes.