Justin Sullivan

The electric vehicle industry has had a rough year due to falling demand.Electric car makers surviving recession Rivian Motors (NASDAQ: RIVN) are poised to benefit from the next upcycle in EV demand without having to apple (AAPL) in the market.mine investment thesis Super bullish on Rivian, the company is rolling out new models at full speed while the competition disappears.

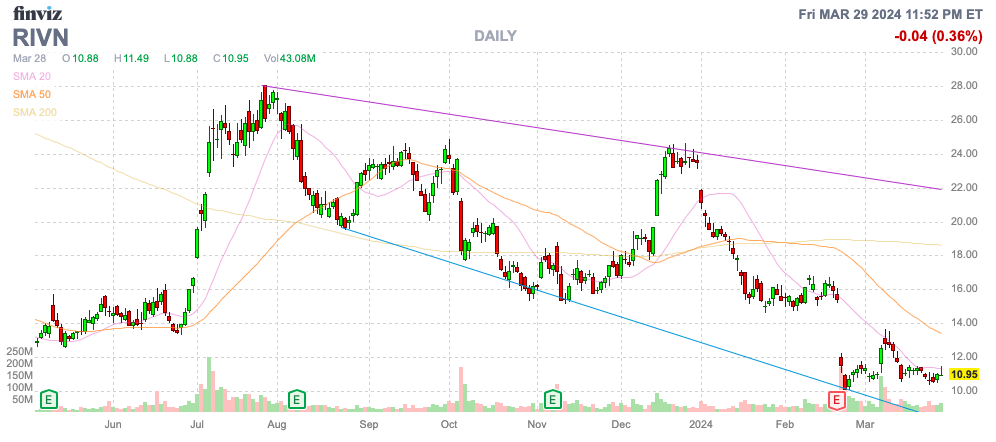

Source: Finviz

Apple car terminated

As Rivian goes full steam ahead with its new R2 model, rivals continue to shrink the market for electric vehicles. The latest company to exit the EV market has never officially entered the market.

As early as 2014, there were rumors that Apple was developing a self-driving electric car, known as “Project Titan.”The tech giant announced last month its plans to Terminate development electric car Conducive to promoting generative artificial intelligence work. The Apple Car project included 2,000 employees being reassigned to artificial intelligence or laid off.

The company spent years and billions of dollars on the car project. A concern for any EV entrant is that Apple will use billions of dollars in operating cash flow to fund the dominant entrant in the space, whose infotainment systems integrate with the iPhone and other Apple hardware and software.

Now, the tech giant has exited the space, likely due to issues finding manufacturing partners and scaling up electric vehicles to $100,000 apiece. Apple has turned mobile phones into pocket computers, and the average selling price of smartphones is getting higher and higher, but most consumers do not have the financial ability to buy high-end cars.

As discussed in the previous article, Ford (F) Halting electric vehicle development is a bullish development for Rivian. Now that Apple has exited the market, it’s starting to set up a grand scenario where Rivian will have significantly less competition when the EV market fully develops.

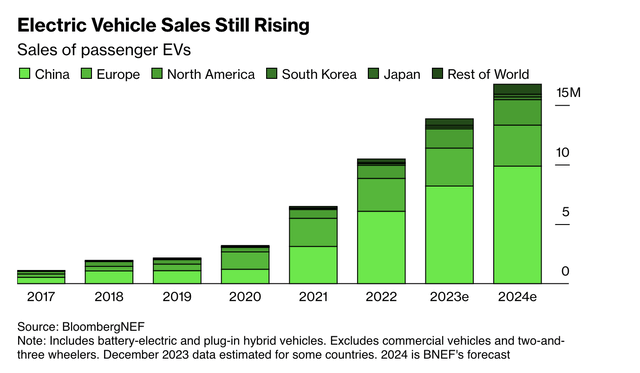

In 2023, U.S. electric vehicle sales will exceed 1 million for the first time, accounting for about 7% of the market.Electric vehicle sales are even expected to reach 1.9 million units This year it will account for 13% of total automobile sales, and global electric vehicle sales will exceed 15 million units due to China’s booming electric vehicle market and low-end products.

Source: Bloomberg

Rivian is expected to achieve positive automotive gross margins this year amid concerns that top rivals are exiting the market.

Full speed ahead

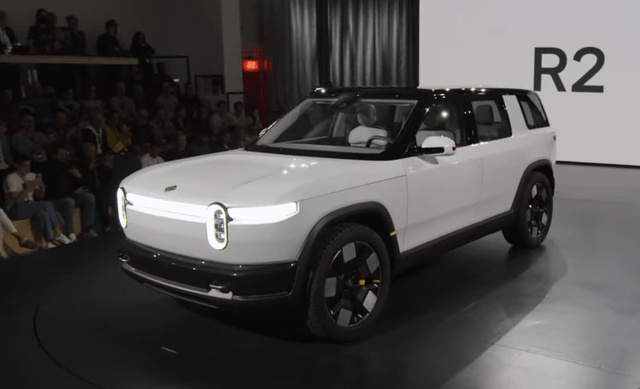

Just a few weeks ago, Rivian launched the R2 and R3 vehicles. As the electric vehicle market slows and competition decreases, the company has been able to postpone the huge cost of building a new manufacturing plant in Georgia and instead build the lower-cost R2 model, which starts at $45,000, at its current plant and move up its release date.

Source: R2 Reveal demo

Rivian predicts the R2 will launch in January 2026. The company will have the R1S, R1T, EDV and R2, offering a complete lineup of SUVs, trucks and work vehicles.

The R3 electric crossover and the premium R3X version will be launched shortly after the R2 enters production. The company expects to save $2.25 billion in capital expenditures and product development costs by starting R2 production at the Normal plant.

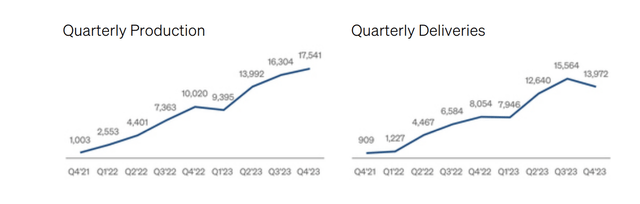

The company has been able to increase quarterly production to more than 17,000 vehicles, and factory renovations in the second quarter will help speed up production and significantly cut fixed costs. The current plant can produce 150,000 vehicles per year, giving Rivian ample room to grow from production levels in 2023 before it would require billions of dollars in new manufacturing plants. The new plan is to expand production at the Normal, Illinois plant to 215,000 units.

Source: Rivian Q4’23 shareholder letter

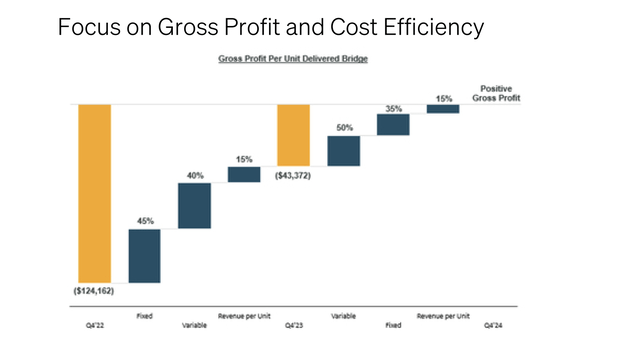

The stock has fallen due to EV demand dynamics and concerns that Rivian will never be profitable in a lower demand environment. The company lost $43,000 per vehicle in the fourth quarter, although that was a significant improvement from the same period last year.

Source: Rivian Q4’23 shareholder letter

Considering Rivian essentially sells vehicles for around $80,000, and each car costs more than $120,000, the losses are still substantial. The company expects to reduce losses by 50% through variable cost reductions through R1 engineering design changes, commercial supplier negotiations and lower raw material costs. The plant closures in the second quarter will cut fixed costs, reduce vehicle losses by 35%, and close the gap in positive vehicle gross margins.

Rivian ended 2023 with a cash balance of $9.4 billion, funding material progress toward positive gross profit. As the electric car company builds out its full lineup of EV models and manufacturing sites, other rivals are pulling back on electrification plans.

Considering the average price of the R1 is around $80,000, the company must have hit some speed bumps as demand for the R1 has bottomed out. News of advancing R2 with a starting cost of $45,000 and expanding production capacity in Illinois is a huge plus, but the stock is trading at a low.

Rivian aims to achieve sales of nearly $5 billion by 2024. With the launch of the R2 in 2026, the company has massive upside and could generate nearly $10 billion in sales from regular factory capacity alone (based on just $45,000 of vehicles sold), with the R1 selling at a much higher price.

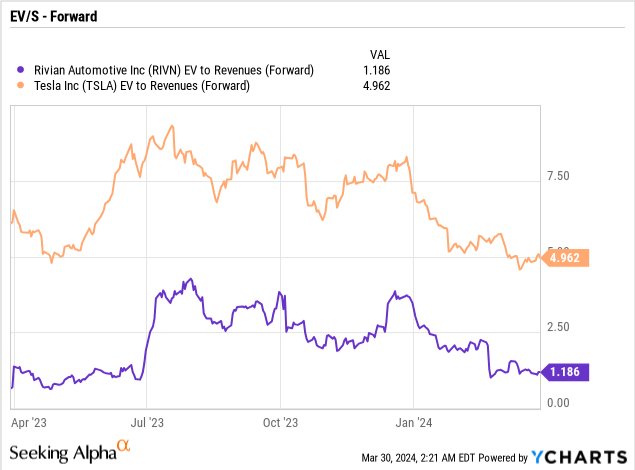

The stock’s current market capitalization is just over $10 billion.Even with recent weakness Tesla (TSLA), the stock trades much cheaper at an EV/S multiple of 1x, while Tesla still trades at 5x.

Investors must be cautious about upcoming second-quarter data due to factory closures. Considering that the factory closures will increase R1 production line output by 30% while lowering the cost per vehicle, any unwarranted weakness will provide a great opportunity to own Rivian. The company expects to post positive gross profits in the fourth quarter, while other EV makers are exiting the game or launching plans that leave Rivian as the survivor.

take away

The key takeaway for investors is that Rivian will survive and thrive during the EV downturn. Even as the long-term trend shifts toward electric vehicles, the company is moving full steam ahead while the industry as a whole is going backwards.

The stock trades at a significant discount to Tesla here, and any weakness in Rivian during the second quarter amid factory closures and production declines will provide a huge opportunity to buy the stock on weakness.