olrat/iStock via Getty Images

Malaysian Ringgit Group Limited (NASDAQ: MYRG) is a holding company of leading specialty contractors serving the electrical infrastructure, commercial and industrial construction markets in the United States and Canada.

The Company has two business segments: Transmission and Distribution (“T&D”) and Commercial and Industrial Sector (“C&I”).

In 2023, the MYR Group’s T&D division’s full-year revenue was US$2.09 billion, and the C&I division’s revenue was US$1.55 billion.

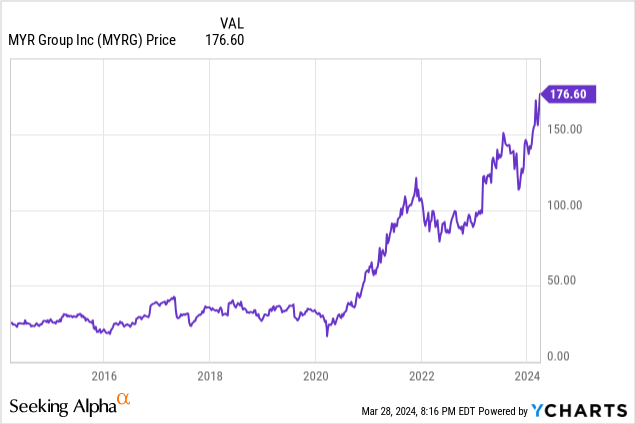

MYR Group’s share price has performed extremely well since 2020, rising from approximately $32.43 at the start of 2020 to approximately $176.60 as of March 28.

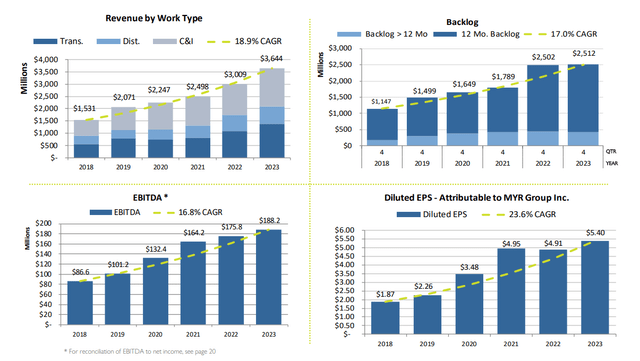

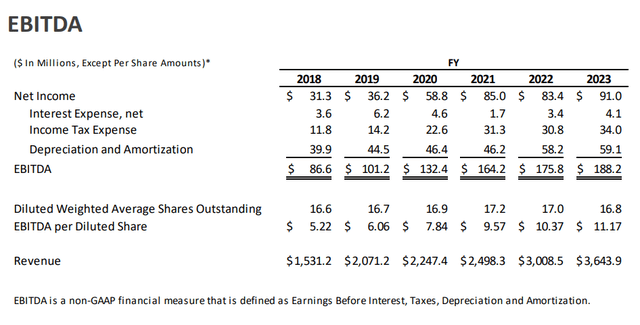

Since 2018, MYR Group’s financial position has benefited from growing demand from the clean energy transition and increased investment in grid upgrades and improvements.

Financially, Ringgit Malaysia Group’s diluted earnings per share more than doubled from $1.87 It will increase to $5.40 from 2018 to 2023. Meanwhile, revenue, EBITDA, and the company’s order backlog have also increased significantly since 2018.

MYR Group Investor Presentation

On February 28, 2024, MYR Group announced its full-year results for 2023, showing strong demand and continued financial growth.

2023

exist 2023Ringgit Malaysia Group’s revenue increased by 21.1% year-on-year to US$3.64 billion.

Revenue from the transmission and distribution segment increased 19.7% year-on-year to US$2.09 billion due to increased revenue from transmission and distribution projects. The growth in transmission project sales is primarily related to increased revenue from clean energy projects.

Revenue in the commercial and industrial segment increased 23.1% year over year to $1.55 billion, driven by higher revenue related to clean energy projects in certain regions.

Full-year EBITDA increases from $175.8 million in 2022 to $188.2 million in 2023.

MYR Group Investor Presentation

Net income this year increased to $91 million (or $5.40 per diluted share) from $83.4 million (or $4.91 per diluted share) in the same period in 2022.

MYR Group’s order backlog also increased slightly from US$2.5 billion at the end of 2022 to US$2.51 billion at the end of 2023. As of the end of 2023, the T&D backlog was $959.6 million and the C&I backlog was $1.55 billion.

In addition, MYR Group maintains a strong balance sheet, with a leverage ratio of funded debt to LTM EBITDA of 0.19 times as of the end of 2023. At year-end, MYR Group had $442 million in available funds under its $490 million credit facility, which provides management with flexibility in capital allocation decisions.

On the M&A front, MYR Group has seen tremendous organic growth in recent years, so management is willing to be patient on acquisition opportunities.

My conclusion is that 2023 is another year of strong financial growth for the MYR Group as demand continues to strengthen over the past few years.

Appearance

Speaking about the 2024 outlook, CEO Rick Swartz said during the fourth-quarter 2023 earnings call when asked about revenue trends based on the company’s awards,

I’d still be looking at high single-digit growth this year, maybe a little bit more, with a bigger portion in the second half.

Swartz added,

As we said before, this year, we really want to focus on that although we don’t mind increasing our revenue, we still see it growing in the higher single digits. We’re really focused on profit growth and it’s all taken into account. We want to ensure that the work we are doing and undertaking will be profitable in the future.

My conclusion is that 2024 is likely to be slower than 2023 in terms of revenue growth, given that demand fluctuates at times. Nonetheless, management is very positive about the existing workload, and given how much demand is driving it, I think MYR Group’s top and bottom lines will continue to grow at a pretty strong rate through the end of 2020.

tailwind

MYR Group benefits from increased electricity consumption and the transition to clean energy.

Over the past few decades, electricity use in the United States and Canada has not increased much due to improvements in energy efficiency.

In fact, total U.S. electricity use increased by just 6.1% over the past decade, according to the EIA 3832 terawatt hours From 2012 to 2022 it will reach 4067 TWh.

However, this trend may change as U.S. electricity demand is expected to increase from 2.6% to 4.7% over the next five years, with $630 billion in short-term investments likely to be needed to meet load growth, according to Clean’s December 2023 report. Grid Initiative.

For the future, given the huge growth potential of electric vehicles and data centers, I think electricity consumption will be significantly higher than expected. So I wouldn’t be surprised if electricity demand grows higher than the 4.7% upper limit projected by the Clean Grid Initiative over the next five years.

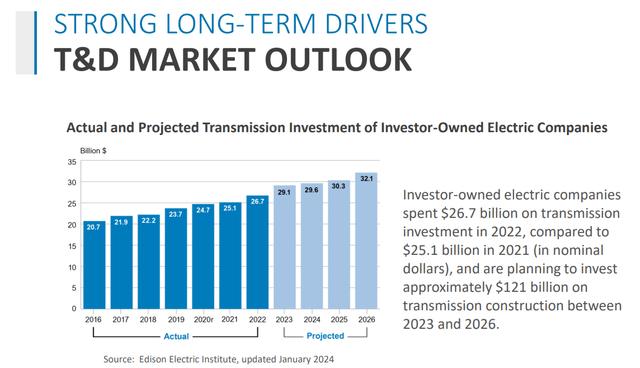

Investor-owned power companies are expected to invest US$121 billion in transmission construction between 2023 and 2026 as demand increases to meet load growth, which may help boost demand for the Malaysian Ringgit Group’s transmission and distribution business.

MYR Group Investor Presentation

After 2026, demand growth potential is even greater.

According to the U.S. Department of Energy’s forecasts, by 2023, the U.S. transmission system will need to grow significantly by approximately will reach 60% by 2030 That may need to triple by 2050 to meet clean electricity demand.

I wouldn’t be surprised if the U.S. transmission system also needs to grow by more than 60% by 2030 if electricity usage exceeds expectations.

In addition to private sector demand, government support is provided to help improve and expand the grid. In particular, the US$1.2 trillion Infrastructure Investment and Jobs Act (“IIJA”) is a strong driver of demand in the transmission and distribution sector of the Malaysian Ringgit Group, which includes US$73 billion for grid and energy infrastructure. According to MYR Group, planned federal energy spending between IIJA and the Inflation Reduction Act will total more than $300 billion over the next five to 10 years.

Likewise, MYR Group’s commercial and industrial sector also benefits from the Infrastructure Investment and Jobs Bill, helping to potentially increase demand in the sector.

risk

MYR Group has won significant business through a competitive bidding process. Therefore, its profit margins may shrink if competition intensifies.

Weak economic conditions may cause utilities and other customers to postpone some capital plans, which may reduce demand for the Malaysian Ringgit Group.

MYR Group could make a bad acquisition.

If demand for MYR Group weakens, its financial position may underperform.

My point of view

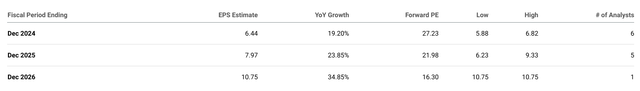

In terms of expectations as of March 28, analysts expect MYR Group’s earnings per share to continue to grow going forward, up from $5.40 per share in 2023.

Specifically, analysts on average expect RM Group’s earnings per share to rise to US$6.44 in 2024, US$7.97 in 2025, and US$10.75 in 2026, so the stock’s 2024, 2025, and 2026 The forward price-to-earnings ratios are 27.23, 21.98, and 16.30.

Seeking Alpha

In terms of its valuation, Ringgit Malaysia Group’s 5-year average forward P/E ratio is 18.53, compared with the industry’s forward P/E ratio of 19.03.

Looking at the 5-year average forward price-to-earnings ratio, RM Group’s valuation will not become attractive until 2026.

Furthermore, I believe the company’s forward P/E should not exceed 20 in a normal growth environment, as MYR Group has to bid for most of its projects and the company’s profit margins are relatively low.

Having said that, I think MYR Group has significant demand drivers that are likely to last for many years, which will help the company meet or exceed its 2025 and 2026 expectations. I’m more cautious on 2024 given management’s guidance for slower revenue growth in 2024, but I think the company still has a good chance of hitting this year’s EPS expectations.

In terms of demand tailwinds, I think MYR Group has enough visibility and growth potential in the medium to long term to achieve 19x 2026 EPS forecasts, hence my price target of $204.25 per share. I think given the company’s tailwinds, the stock could reach this price within a year or two as demand continues to strengthen.

Therefore, I rate MYR Group a Buy and I would include it in a diversified portfolio that includes the Top Seven. Having said that, I don’t view MYR Group as Overweight as the company is not a dominant company with many competitive advantages.

Going forward, I’ll be watching the earnings report to see if MYR Group’s revenue, EBITDA, EPS and backlog are growing.

Additionally, I keep an eye on electricity usage trends. If electricity consumption grows significantly faster than expected, I think the need for grid upgrades and maintenance may be even greater.