Nutthaseth Vanchaichana/iStock via Getty Images

After the first quarter’s moves, with a brief but weak pullback, one might think the stock market is having a blast like it’s 1995.While it would be foolish to extrapolate a quarter to a full year, I would think of 1995 because This is the only economic soft landing implemented by the Federal Reserve in modern U.S. history. The Federal Reserve began to cut interest rates one year after raising them, and the stock market rose sharply.

The S&P 500 returns in 1995? In price terms alone, +34.1%, or +37.1% with dividends reinvested. The interest rate cutting cycle that began in 1995 has seen a total of three interest rate cuts, which is basically consistent with the Federal Reserve’s plan for 2024.

S&P 500 since 1995 (adjusted for CPI)

Charts are provided for illustration and discussion purposes only.Read the big reveal at the end of this review.

While the last point on the chart represents the current level of the S&P 500, each point backward is inflated by the level of the Consumer Price Index (CPI). By this standard, the S&P 500 hit a record high at the end of 2021, reaching 5,304 points, so if adjusted for inflation, the actual current level of the S&P 500 is not a record high. If interest rates fall like they did in 1995, one could see stocks appreciate further from here.

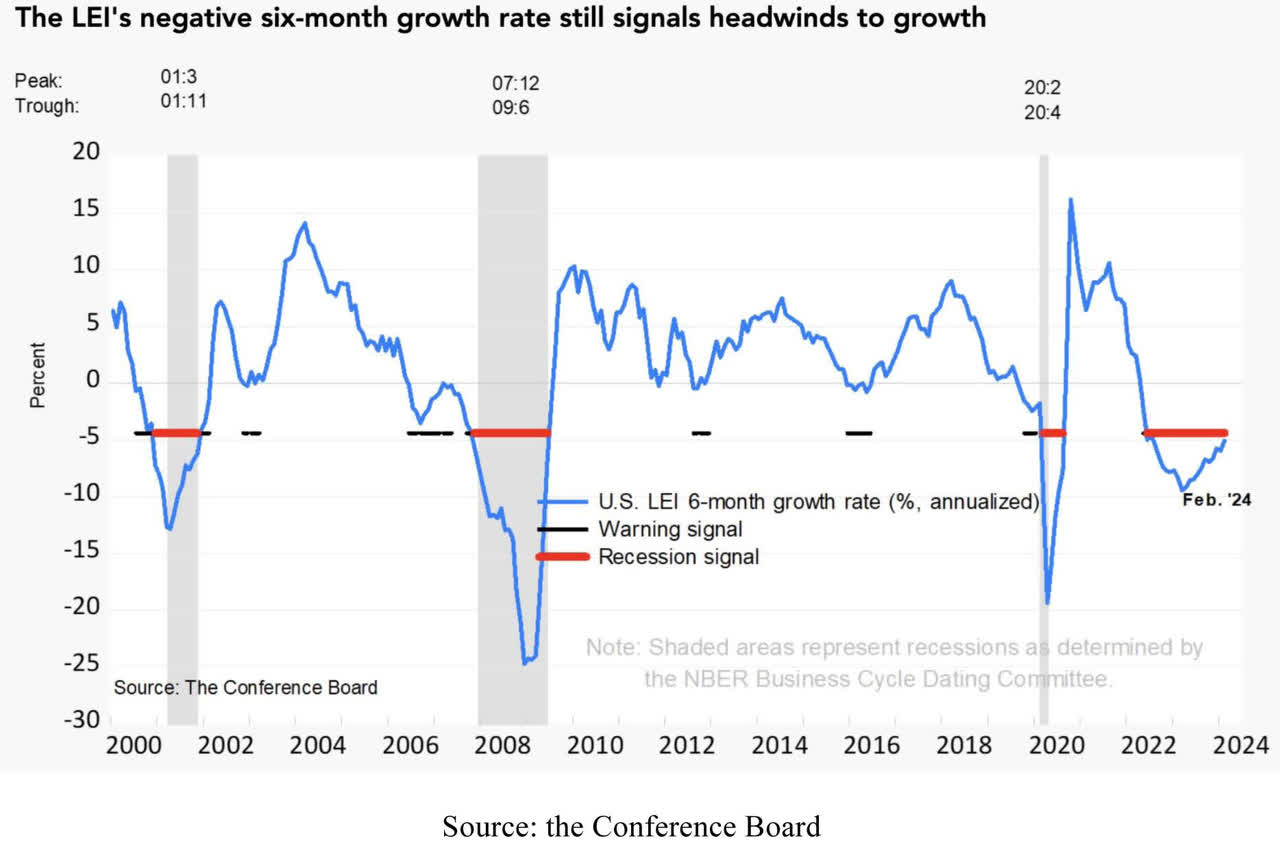

The Conference Board’s Leading Economic Indicators Index (LEI), which has long predicted a recession never came, finally turned positive last month. The index is still negative, but because it has risen so far from depressed levels, it has never fallen again in recent history.

Charts are provided for illustration and discussion purposes only. Read the important reveal at the end of this review.

In fact, a rise in the LEI actually signals the beginning of an economic expansion. We may encounter headwinds to economic growth, but a full-blown recession will be much more difficult than the one most people predicted this time last year. Maybe, just maybe, this is what a soft landing looks like for the economy.

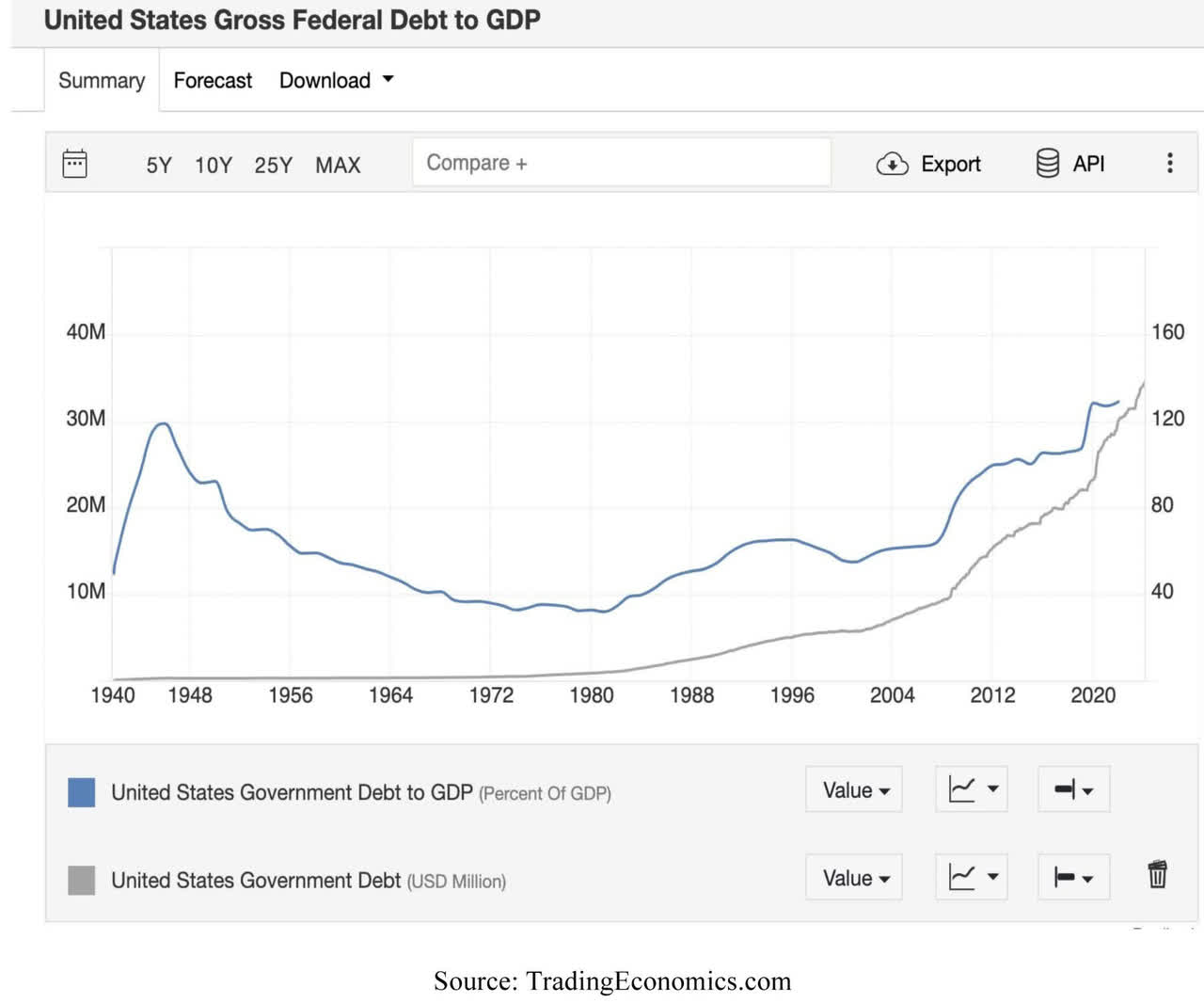

Government debt is relative—even if it’s out of control

The current U.S. government debt level is approximately US$34.5 trillion, increasing by approximately US$1 trillion every 90 days, and interest this year will reach US$1.6 trillion. The situation is clearly out of control and should be addressed. The problem, or some might say the solution, is that we’ve been in this situation before.

Charts are provided for illustration and discussion purposes only. Read the important reveal at the end of this review.

Government debt currently accounts for more than 130% of GDP. Right after World War II, it was about 120% of GDP, and then budget balancing brought it down again, but this time it’s hard to imagine that anyone would need to rein in deficit spending in an election year. If a new government emerges after the election, I think controlling the debt situation should be a top priority, even if it creates a recession.

Inflation over the past three years has reduced the real value of large amounts of existing debt. The United States did eliminate most of its World War II debt through inflation. While inflation was slowly declining over time at that time, it appears the federal government is now also using inflation to offset some of its COVID-era debt.

There is still time to resolve the debt problem, but not as much as most politicians imagine, as adding new debt on the current trajectory is certain to trigger another type of crisis in no more than five years.

All opinions expressed above represent the opinions of Ivan Marchev of Navellier & Associates, Inc.

Disclaimer: please click here For important disclosures, please see the “About” section of the Navellier & Associates profile accompanying this article.

Reveal: *Navellier may hold securities in one or more investment strategies offered to its clients.

Editor’s note: Summary highlights for this article were selected by Seeking Alpha editors.