Miscellaneous Photography

One of the largest pharmaceutical stocks by market capitalization, Merck (NYSE:MRK) stocks performed well in the first quarter of 2024.After a forgettable 2023, prices are up more than 20% The drug ended the year essentially flat due to its treatment and approvals in the final quarter (Q4 2023) and full year 2023 result.

Supportive fundamentals may be necessary for a stock’s continued success in the market, but they are not sufficient. Here, I’ll look at how the balance between its fundamentals and market indicators play out to assess what’s next for Merck, especially given its extremely high trailing twelve months (TTM) GAAP price-to-earnings (P/E) ratio situation.

Keytruda getting EC approval is a good sign

The company’s largest single treatment, Keytruda, accounting for about 42% of total sales in 2023, received FDA approval European Commission last week. The use of immunotherapies targeting various cancers to fight lung cancer is currently allowed in most of Europe, with promising results. When combined with chemotherapy, it reduces the risk of death by 28% and the risk of disease recurrence, exacerbation, or death by 41%.

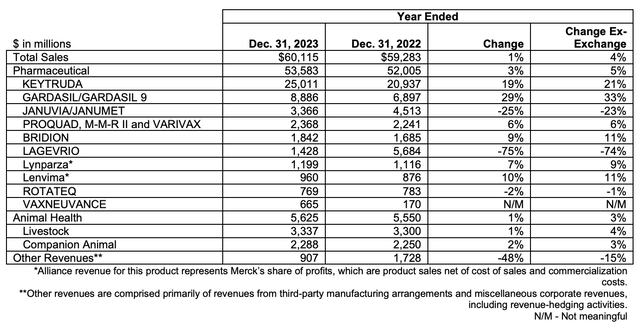

This bodes well for the company, not only because of Keytruda’s significant contribution to sales, but also because the treatment is expected to grow a strong 19% in 2023, while total sales grew just 1.4%. To be fair, total sales took a 75% hit (see chart below) due to the expected drag from COVID-19 drug Lagevrio. But Keytruda’s total sales growth also exceeded Lagevrio’s 9.5%. Moreover, its growth is second only to the HPV vaccine Gardasil, which grew by 29%.

Sales by product (Image source: Merck)

Merck’s recent acquisition of Harpoon Therapeutics has also expanded its lung cancer portfolio specifically, as well as its broader oncology portfolio. Harpoon’s lead drug candidate is MK-6070, which is being developed to treat small lung cancer.

High blood pressure treatment gets FDA approval

Its cardiovascular portfolio also received a boost after the U.S. Food and Drug Administration (FDA) approved its injectable Winrevair to treat high blood pressure that can lead to heart failure. The treatment’s unique selling point is its potential to reduce mortality by targeting the root cause of the problem. This differs from the company’s existing treatments, which are more symptom-focused.

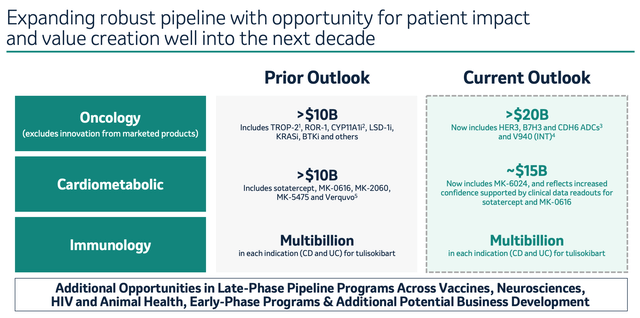

This is an important approval for Merck in many ways. First, the therapy originated from Acceleron, which Merck acquired in 2021 for $11.5 billion. For context, this amounted to 12.5% of the company’s total assets the previous year. In this sense, its commercialization is key to assessing whether the acquisition will pay off for Merck. Second, it’s a step forward toward the company’s goal of $15 billion in cardiometabolic sales over ten years (see chart below), bringing it closer to the oncology space.

Source: Merck

Earnings continue to be weak, but for good reason

Sales growth and approvals are both good news for Merck. However, its profits suffered a setback in 2023, with GAAP earnings per share (EPS) at market exchange rates falling 98% and non-GAAP EPS falling 80%. Although this seems bad, there is a good explanation for these numbers. details as follows:

- There is a reasonable reason why its share will fall from 9.6% in 2022 to 2.4% in 2023 due to the sharp decline in COVID1-19 drug revenue and weak sales throughout the year.

- Prometheus Biosciences completes Acquisitions Q2 2023 $10.8 billion, resulting in a loss for the quarter. Like Acceleron at the time of purchase, Prometheus’ revenue numbers are small and therefore won’t have any impact on Merck’s financials in the short term. But at the same time, it likely has a bright future due to its focus on autoimmune diseases.These diseases are expected to affect One for every ten people Globally, this means 810 million people suffer from these diseases, which demonstrates the potential of the market.

- A partnership with Japan’s Daiichi Sankyo (OTCPK: DSNKY ) expanded its oncology portfolio, resulting in $5.5 billion in R&D expenses. This does not include increased costs for the acquisition of Prometheus and oncology specialist Imago BioSciences. The Daiichi Sankyo partnership alone had a $1.69 per share impact in the fourth quarter of 2023. Without this charge, GAAP earnings per share would have increased slightly by 2.6% year over year.

Outlook and potential stock returns

Due to the significant decline in earnings per share, Merck’s trailing TTM GAAP P/E ratio is as high as 935.6 times, which is incredibly high. However, if the drag from the latest developments is added back to full-year 2023 GAAP EPS numbers, the TTM P/E ratio will fall significantly. Its price-to-earnings ratio dropped to 20.5 times, which is lower than the average price-to-earnings ratio of 30 times over the past five years, with the average price-to-earnings ratio for 2023 already taken into account.

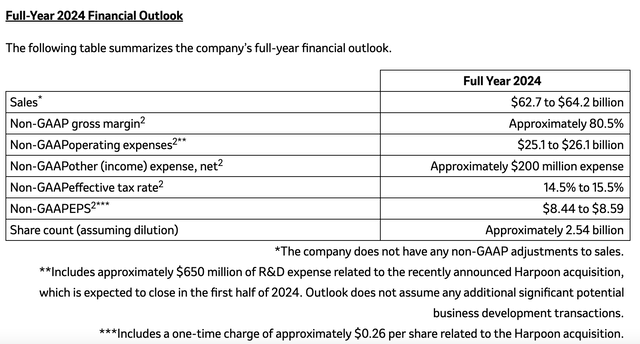

The company’s outlook for 2024 (see chart below) is also encouraging for the stock. At the midpoint of the sales forecast range, that number will grow 5.6% this year, with sales excluding Lagevrio likely to grow at a higher rate. After the setback in 2023, non-GAAP earnings per share are also expected to grow significantly by 5.6 times, reaching the midpoint of the guidance range.

Source: Merck

The EPS guidance translates into a non-GAAP forward price-to-earnings ratio of 15.3x, which is also below the five-year average of 18.8x. TTM and forward P/E ratios suggest the stock has an average upside of 35%.

Dividends also need to be considered. The company’s TTM dividend yield is 2.3%, which is higher than the Healthcare industry’s average dividend yield of 1.49%. Additionally, it has increased its dividend for the past 13 consecutive years and paid dividends for the past 34 years. While dividend growth is now likely to be paused based on the latest earnings, a resumption of dividend growth is highly likely based on the earnings outlook.

What’s next?

Discussion suggests that now is a good time to buy Merck, even though Merck has risen quite a bit so far in 2024. Earnings numbers should improve this year as the company moves away from high spending on acquisitions and research and development. These fees are likely to result in profit.

Revenue growth is also expected to rise as the impact of the COVID-19 drug sales slowdown fades. The recent EC approval of its blockbuster cancer treatment Keytruda is also a step in the right direction. The FDA approved hypertension treatment Winrevair, which will also expand Merck’s cardiovascular portfolio in line with its goals.

Meanwhile, Merck’s forward P/E ratio looks attractive, and if we add in the impact of near-term R&D and acquisition spending on EPS, the TTM P/E ratio is also attractive. The company’s consistent dividend payments and better-than-average healthcare dividend are also noteworthy aspects to consider. All in all, there are better days ahead than 2023 for Merck investors. I give it a buy rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.