Luke Schultz

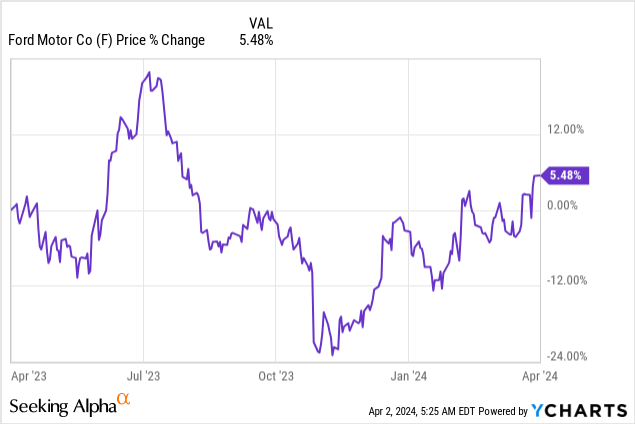

Ford Stock (NYSE: F) entered a new upward phase in November. In my opinion, even if the market realizes that electric vehicle demand will not be as high as initially expected. Ford said earlier this year that it would scale back production of its F-150 Lightning pickup truck as demand for electric vehicles was slowing. However, I see strong potential for Ford to declare incremental supplemental cash dividends in the future, as the company expects free cash flow of at least $6.0B in fiscal 2024. While Ford is investing aggressively in electric vehicles, it remains highly dependent on the number of internal combustion engine vehicles it sells…and that’s unlikely to change anytime soon.As the stock continues to sell at very competitive earnings and free cash flow multiples, I believe Ford is likely to deliver strong earnings Even if the electric vehicle market performs poorly, invest in FY2024!

Previous rating

In January, before the auto brand reported fourth-quarter results, I recommended the company’s stock — which remains a buy ahead of the fourth quarter — as Ford reached a negotiated settlement with the United Auto Workers union, Eliminates the uncertainty of investing in the car brand. Ford shares have since risen 11%, although they temporarily fell after the company in January forecast a slowdown in production of its F-150 Lightning pickup truck. I believe Ford will be able to handle a slowdown in EV sales better than other companies because it remains overly reliant on internal combustion vehicles.

Why I’m not worried about electric cars slowing down

Ford made a announcement In January, the automaker said it would scale back production of the F-150 Lightning amid a weak demand environment, slowing the transition to electric vehicles. General Motors (GM) made similar remarks when it released its fourth-quarter results. The bottom line: Weak demand for electric vehicles is causing production to slow down.

The slowdown in demand is also affecting companies such as China’s Li Auto (LI) and the world’s largest electric car maker Tesla (TSLA), as Ford has yet to make a profit in its electric vehicles, so demand calculations are wrong for electric vehicle products. For companies with growing lines, this means higher short-term losses.

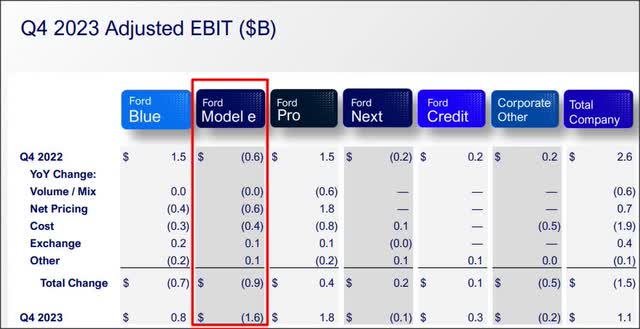

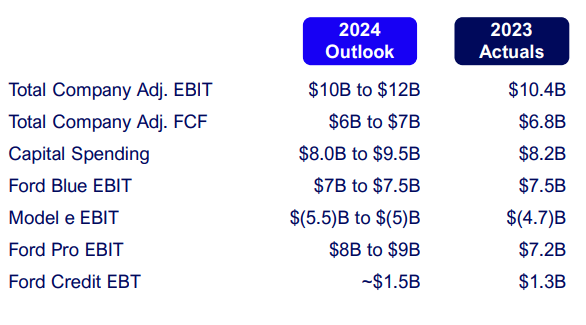

Ford’s electric vehicle business lost $160 million in earnings before interest and taxes (EBIT) in the fourth quarter, bringing the total loss for the year to $470 million. These losses will apparently widen in fiscal 2024, as the auto brand is expected to post $5.0-5.5B losses in its electric vehicle division this year due to increasing pricing pressure and production slowdowns.

Ford

The slowdown in the electric vehicle market has taken a toll on the industry, with companies such as Fisker at risk of going out of business. Several electric vehicle manufacturers, including Tesla and Li Auto, have recently lowered their electric vehicle delivery and sales expectations for fiscal 2024.

The reason I remain bullish on Ford given these changing market trends is that despite the fastest growth in the EV segment, Ford remains overly reliant on ICE vehicles… which provides a natural hedge against deteriorating EV fundamentals in the industry. Therefore, traditional automakers with large internal combustion engine businesses are much less affected by slowing demand for electric vehicles than pure electric vehicle manufacturers such as NIO, Li Auto or Tesla.

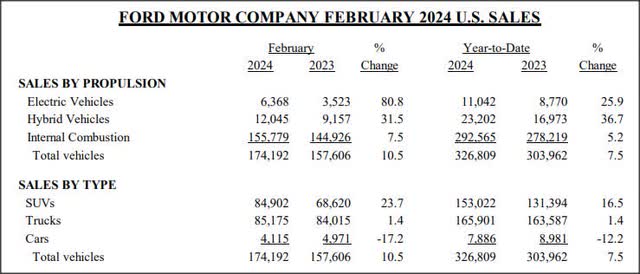

In fact, in the first two months of this year, only 3.3% of Ford’s total vehicle sales were electric vehicles (including hybrids, this proportion rises to 10.5%). In other words, nine out of ten cars sold are non-electric. The same is true for General Motors, whose electric vehicle sales share in fiscal 2023 was only 2.9%.

Ford

2024 Guidance and Valuation

Ford expects fiscal 2024 adjusted free cash flow to be $6.0B to $7.0B, which in the best-case scenario would represent a $200MY/Y increase over last year. For context, GM expects free cash flow of $8.0B to $10.0B.

Ford

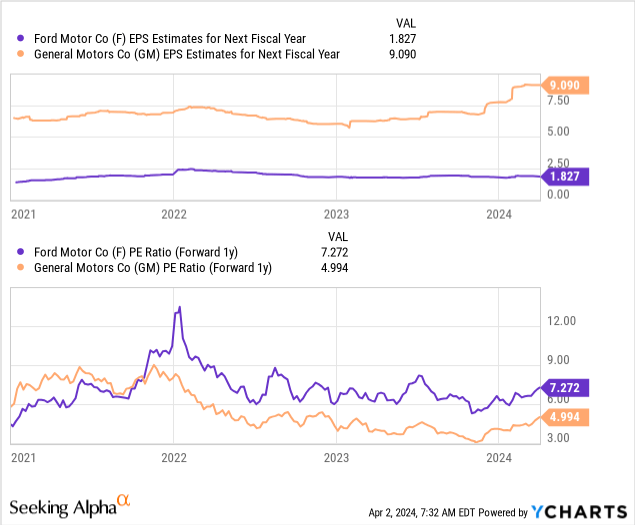

Based on free cash flow, Ford and GM are trading at 8.1x and 5.8x FCF, respectively, at the midpoints of their respective forecasts. Ford and GM also offer good value for money in my opinion. Based on earnings, Ford trades at a price-to-earnings ratio of 7.3 times…which translates into a high earnings yield of 13.8%. In my opinion, Ford’s fair value P/E ratio can reach 10x given its strong free cash flow, reliance on ICE Automobiles, and the fact that the stock pays a dividend yield of nearly 5%. At 10 times earnings, Ford stock is reasonably valued at about $18, implying 38% upside rerating potential. General Motors’ price-to-earnings ratio for fiscal 2025 is 5.0 times, and its current profit rate is 20%. I recently recommended General Motors because of its crazy yield, specifically: Car deals with a yield of 23%.

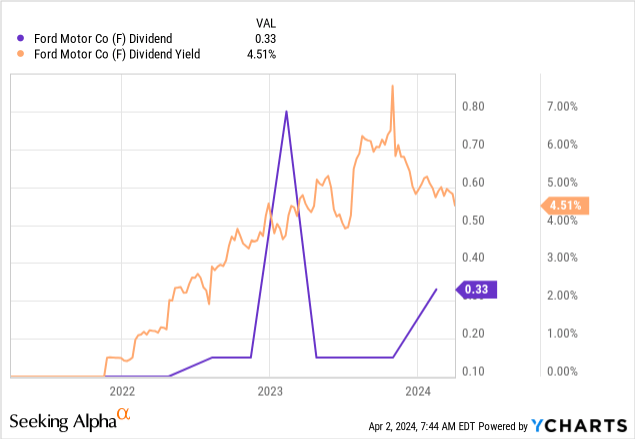

Ford has income value for dividend investors

Ford pays a quarterly dividend of $0.15 per share, and the auto brand announced a first-quarter supplemental cash dividend of $0.18 per share. Since Ford is much less affected by the slowdown in the EV market and expects to have fairly solid free cash flow in fiscal 2024 (on a year-over-year basis), the auto brand may decide to pay shareholders a further supplemental cash dividend moving forward. The current quarterly dividend of $0.15 per share costs Ford $2.34B annually, which implies a free cash flow payout ratio of just 36%, so the auto brand will have plenty of room to grow the dividend or pay a supplemental cash dividend. Even without this incremental payment, Ford’s stock would yield 4.5%…about 3.4 times the S&P 500’s dividend yield.

Ford’s Risks

Ford is less vulnerable to a slowdown in the EV market than other niche-focused companies due to its reliance on internal-combustion-engine vehicles. For example, while a surge in EV demand won’t benefit Ford as much as it would for Tesla, the negatives here are fairly limited in my opinion. What would change my view on Ford is if the car company lowers its free cash flow forecast, which may be the case if the U.S. economy slips into recession in fiscal 2024.

final thoughts

Ford has considerable revenue/special distribution potential in 2024 and beyond, and I wouldn’t be surprised to see the company distribute a greater portion of its free cash flow to shareholders to compensate for a slowdown in its EV business. Ford’s shares are on an upward trend, and based on earnings and free cash flow, they remain cheap. So far, the slowdown in the EV market has not had a significant impact on Ford’s valuation, which I believe makes sense: The percentage of EV sales (about 3% of total sales in the first two months of fiscal 2024) is Still relatively low…which provides a hedge against a slowdown in the EV market. Given that Ford stock has a very respectable yield of 4.5% (and room for earnings upside), I believe Ford remains an attractive investment for dividend investors despite the slowdown in the EV market!