Anya Belkut

generalize

Readers can find my previous reports through this link. My previous rating was Sell as I didn’t see any catalysts that could move Telos Corporation’s stock price (NASDAQ: TLS)up.My opinion is TLS needs to show a few more quarters of growth before the market will believe the business has recovered. Now that TLS is showing very strong signs of a growth recovery in Q4 2023, I am adjusting my rating from Sell to Buy.

Nonetheless, I must make it clear that this Buy rating is intended to advocate a small position as there is still some uncertainty (i.e. protest) about the growth outlook. However, if the protests are resolved as expected and TLS continues to increase its penetration of other instant registration sites, I expect TLS to continue to accelerate growth in the 2024/25 fiscal year.Also, please note that I I’m not modeling FY25 today because I want to have more certainty on the outcome of the protests before looking further ahead.

Finance and Valuation

In the fourth quarter of 2023, TLS’s revenue fell 13% to $41.1 million, much better than market expectations ($32.1 million). The results also topped the high end of management’s guidance range of $30-34 million. While this was attributed to accelerated deliveries of $7.8 million worth of customer contracts (originally scheduled for Q1 2024), it’s worth noting that the supply chain has improved.

By market segment, security solutions revenue fell 32% to $20.7 million, while secure networking revenue grew 20% to $20.4 million. Adjusted EBITDA performance also surprised, exceeding the high end of management’s guidance range of -$3.2 million, compared with a range of -$4.50 to -$6.5 million. As a result, adj. earned -$0.09 per share, beating the consensus estimate of -$0.11.

transport layer security protocol

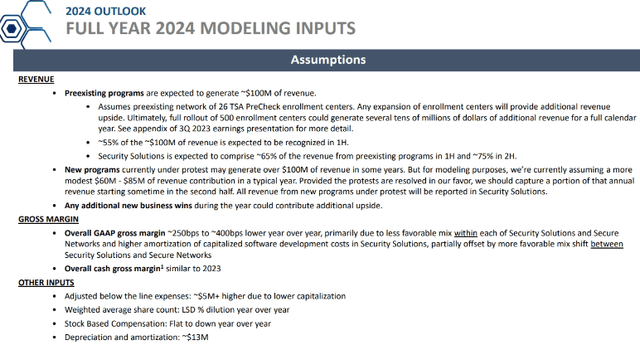

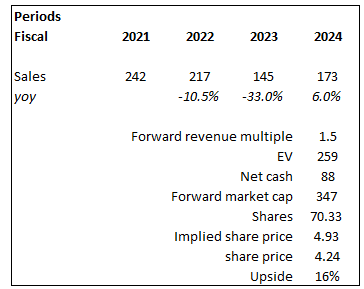

For fiscal 2024, while no revenue guidance was provided, management expects existing programs to provide $100 million; new projects already won may add $100 million in revenue, but due to protests, management conservatively expects revenue to reach $600 million. – $85 million. Using this guide to understand TLS’s value in the short term, I assume TLS will generate $173 million in revenue in FY2024 (returning to positive growth in FY2024).

Assuming TLS trades at 1.5x forward revenue today, the potential upside is 16%. There could be potential upside from here, as management didn’t include any revenue contribution from new business transactions throughout the year, and the protest was resolved earlier than expected. If TLS outperforms the market, its P/E ratio will likely revalue higher, and the market seems willing to do so based on valuation and share price trends over the past few months.

Based on the author’s own mathematical calculations

Comment

I think the worst is over for TLS and it seems to be only a matter of time before TLS starts to grow aggressively. There are several reasons why I believe this is the case going forward. First, TLS has multiple new contracts worth $525 million over the next 5 years (from FY25 to FY30, with $85 million of the $610 contract likely to be recognized in FY24). This is very positive news as it means TLS is able to convert pending deals into actual revenue-generating contracts.

Recall that management previously noted that the potential deal size was as high as $610 million. The problem with achieving this kind of revenue today is that TLS needs to deal with delays caused by the resolution of protests (a common practice among competitors after winning an award). While no one knows how this protest will play out, I think TLS will eventually get through this. Historically, only 5% of such protests have been sustained (out of approximately 10,000 protests). Assuming TLS can overcome this hurdle, the company should see a material acceleration in revenue growth in FY2025, as I expect TLS to achieve ~$100M between FY2025 and FY2030 ($525M average over 5 years ), while expected revenue contribution is US$60 million to reach US$85 million in fiscal 2024 (management’s conservative expectation).

While we cannot comment on the merits of any specific protest, by way of background and example, nearly 10,000 protests have been filed against the government over the past five fiscal years, according to the Government Accountability Office (GAO). The Government Accountability Office (GAO) said that only about 5% of these protests were ultimately sustained.Source: 4Q23 Earnings

Second, TLS and TSA PreCheck transaction volume has increased for three consecutive quarters, which clearly shows the underlying “demand situation.” While the number of TLS live registry sites remains the same as last quarter at 26, underlying volume trends lead me to believe TLS can further penetrate the 500 sites identified as potential targets.

The potential financial impact is huge, as management mentioned revenue from these sites is worth tens of millions of dollars. The expected timeline for full penetration is by the end of 2025, and based on how TLS is performing (management says throughput at existing sites is in line with expectations), it appears they can achieve that goal.

Gaining scale is important because it will be a huge incremental margin for TLS (management notes that TSA margins are currently close to the company average). So while the impact on top line may be limited (tens of millions of dollars vs. TLS 100+ millions of dollars in revenue), the impact on EBIT will be substantial due to the smaller base.

We believe a fully completed network of new registration locations will ultimately generate tens of millions of dollars in revenue.Source: 4Q23 Earnings

risk

Telos’s close relationship with the U.S. government creates a reliance on spending cycles, competitive bidding, and long sales and implementation cycles. Additionally, if the protests continue, the $610 million worth of contracts may not flow through TLS’s income statement, significantly impacting the business’s growth prospects.

in conclusion

I’m upgrading my TLS purchase. TLS revenue growth has trended significantly upward, from a decline of over -40% to a decline of over 10%, and with $525 million worth of new contracts awarded over the next five years, I believe growth will return to positive growth. The growth in TSA PreCheck transaction volume also shows that further penetration of targeted enrollment sites is achievable. As for FY24, I do see upside potential if the protests are resolved sooner than expected and TLS can further penetrate live admissions center sites.