I will do my best to create the greatest work of art with my mind, my hands and my mind.

Qudian Inc. (NYSE: QD) defines itself as a “consumer-facing technology company. The company has historically focused on providing credit solutions to consumers. Qudian is Give full play to scientific and technological capabilities, explore innovative logistics services, and meet consumers’ e-commerce transaction needs. “

in the most recent fourth quarter and full year 2023 reportFounder and CEO Mr. Luo Min also added:

Looking ahead, we are keen to launch strategic initiatives to enter new online and offline retail businesses, connecting China’s supply chain advancements with discerning global consumers, complemented by “buy now, pay later” solutions . Detailed insights on these efforts will be communicated in due course.

Now, do you know what kind of company Qudian is? No? I have the same problem.let us So let’s take a look at Qudian’s business history so that we can have a better idea of what kind of business it is.

Business overview

2019, Qudian It provides small-amount online consumer credit through its mobile app in China and targets young people who need credit for discretionary spending. They use big data-driven artificial intelligence models to assess credit risk. Later in 2020, Chinese regulatory agencies increased their crackdown on small P2P online lending institutions, and the existing business model had no hope. Therefore, the company decided to withdraw from the credit business and completely cease the credit business at the end of 2022.

They also offered cheap car finance products under the Dabai Auto brand, but the business was not successful and closed in 2019.

Qudian quickly reinvented itself in 2020, launching the e-commerce platform Warimu to provide online luxury fashion products. However, this was not successful and the company was shut down.

In 2021, Qudian launched the Wanlimu Kids Club to provide “young children’s education” (whatever that means), but the business was again not successful and closed in November 2022.

But the management did not give up. In March 2022, they founded “QD Food” to make and sell “ready-to-eat” dishes. CEO Luo Min spent about US$30 million on live broadcast promotion business. As you might have guessed, this business was also unsuccessful, with the company losing 361 million yuan ($50 million) in 2022.

If you want to know more about CEO Luo Min, his business story and how he tries to promote QD Food, I recommend you read this article article.

As the food business plunged into another disaster, in December 2022, the company reinvented itself as a smart last-mile delivery business. They operate under the name “Fast Horse Express” in the United States, Canada, Australia and New Zealand. The last mile delivery business is tough as they have to compete with big players like FedEx, US Postal Service, UPS, DHL and others. However, they have a unique approach. They work on an individual contractor model, allowing you to schedule your work so that you can deliver packages in your spare time. All you need is your own car and 15 minutes of online training, and you’re good to go.

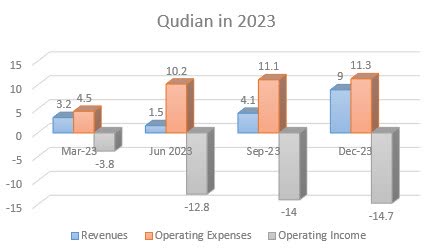

If you think this business is a disaster too, you’re right. The “Kuaima Express” service has 1,268 reviews online product check The page, 93% of which is negative, has a rating of 1.3 stars out of 5 (5 stars being the best). This is not the kind of business you want to own. Just look at the chart below; operating expenses are much higher than revenue.

Qudian 2023 quarterly results (unit: million US dollars) (author)

Based on the current performance of “Kuaima Express”, I predict that this business will also gradually end. This is also supported by the CEO’s statement, who mentioned that they intend to “venture into new online and offline retail businesses, connecting the advancement of China’s supply chain with discerning global consumers, and complemented by ‘first Buy later, pay later’ solution.”

Will this new business be successful? I have no idea. However, judging from its current performance, Qudian is a failure story.

To assess the severity of this failure, we need to examine the financial reports.

business finance

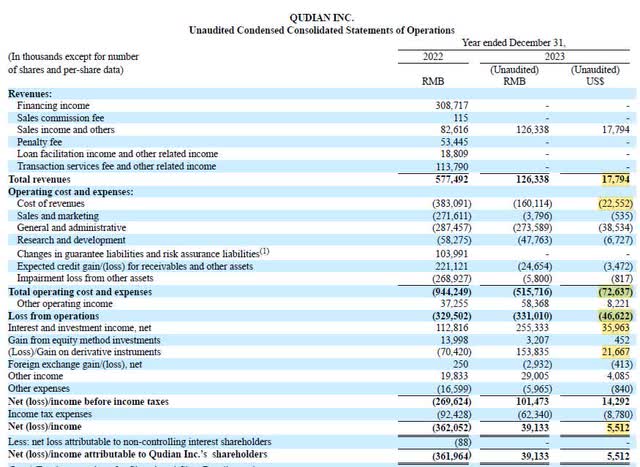

The company’s financial performance last year was dismal. See the numbers for yourself.

Qudian 2023 fourth quarter and full-year report

They spent $22.5 million and generated $17.8 million in revenue. Add to that $38.5 million in general and administrative expenses (including $10.7 million spent on third-party professional services and travel expenses in the fourth quarter), $6.7 million in research and development expenses to explore new opportunities and various other expenses, and you have Total operating expenses of $72.6 million. Spending such a large amount of money and generating only $17.8 million in revenue requires talent.

Earnings were saved by interest income on bank deposits and derivatives investments, which are speculative and can generate positive or negative returns, as seen in 2022.

Looking at the income statement, I have a feeling it would be better to cease all operations, minimize costs, and invest existing cash ($1.1 billion) in U.S. Treasuries, earning an interest rate of 5.2%. This will generate $57.2 million annually. However, anyone can do this without spending millions of dollars in operating expenses.

The cash on the balance sheet comes primarily from funds raised during the 2017 NYSE IPO, when they raised $900 million. Initially, cash is used for business purposes and assets are primarily in the form of accounts receivable. However, as the company’s business activity decreased and they exited the lending business, the assets reverted to cash. On the positive side, shareholders’ equity was $1.646 billion, an increase of $200 million from 2017, showing no ongoing loss of value. However, obtaining this funding is currently challenging.

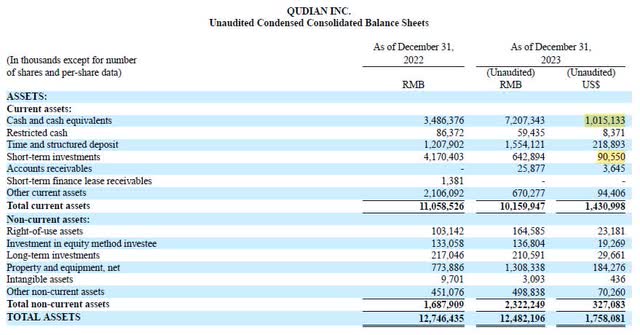

Qudian assets (Qudian 2023 fourth quarter and full-year report)

It has approximately $1.1 billion in cash and $600 million in other assets. Assuming $200 million of these assets can be converted into cash during the company’s liquidation, we have a total of $1.3 billion. We then have to subtract debt, which is only $111.9 million, so we have $1.2 billion in net cash with 204 million shares outstanding. This gives me a value of $5.88 per share in the company.

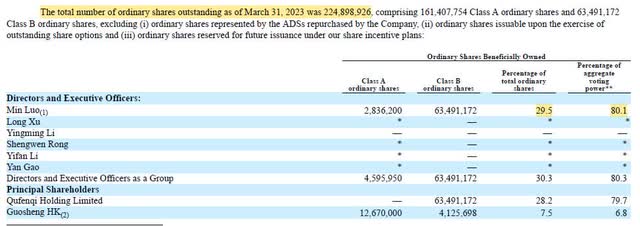

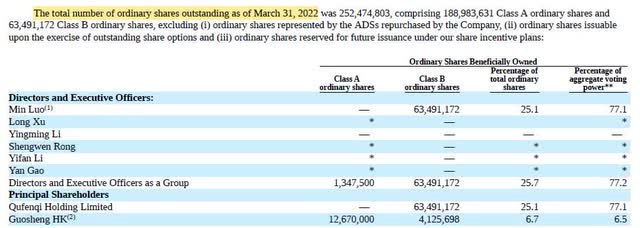

The question is, how do shareholders get the $5.88? The answer is that unless the CEO decides to liquidate the company and distribute the assets to shareholders, they will not receive the money. This is because the CEO owns over 29.5% of all shares (2.8 million shares acquired through his spouse in 2023) and controls 80.1% of the voting rights.

Qudian equity (Qudian 2022 fiscal year report)

To facilitate comparison, the following is the equity position in March 2022.

Qudian equity (Qudian FY2021 Report)

As you can see, the CEO increased his ownership in the company by 4.4% in one year through indirect holdings and share buybacks.

When we looked at the latest 2023 fourth quarter and full-year reports, we found two interesting statements about the stock repurchase program:

The company purchased a total of 34.7 million American depositary shares in the open market in the 12 months ended March 13.

…Our board of directors approved a new stock repurchase program in March 2024 to purchase up to $300 million of our Class A common stock over the next 36 months beginning June 13, 2024 or U.S. Depositary Shares.

To me, this suggests that the CEO is trying to acquire more shares of the company to have more cash on the balance sheet. I wouldn’t be surprised if the CEO’s ownership exceeds 33% as of March 2024.

What to do about Qudian stock?

Over the long term, I think the stock is worth selling as the company continues to branch out into new businesses. It’s unclear exactly what you’re investing in. Is it a last-mile delivery company, a food business, or a “buy now, pay later” business? What will it look like next year? It’s difficult to estimate a company’s long-term financial prospects without knowing its future revenue streams.

However, from a short-term perspective, I would put Qudian on hold as the announced $300 million buyback program will kick off in June this year. If $300 million is allocated to repurchase stock in a company with a market capitalization of $562 million, the stock price should rise.

But will the share price reach the level of cash per share on the balance sheet? I doubt it unless the company builds a profitable business model that consistently generates positive free cash flow. If that happens, I’ll reconsider my stance on buying the stock.

in conclusion

Qudian is a company that is constantly trying to find itself and reinvent itself almost every year. The search has so far been unsuccessful, but the CEO is not giving up. In my opinion, the best outcome for shareholders is for CEO Luo Min to liquidate the company, sell all assets, and pay the available cash to shareholders so they can decide how to invest again. In this case, each shareholder would receive approximately $5.88 per share, which isn’t bad since the current share price is $2.50 per share. But I don’t think this is a realistic outcome because the CEO has over 80% of the voting rights and is desperately trying to start a business that will eventually succeed.

In my opinion, Qudian is not a stock worth investing in because the company’s future is uncertain and the business model changes almost every year. To me, this is a sell from a long-term perspective. In the short term, the stock is worth holding as I expect the stock price to rise as the company spends $300 million on share buybacks. How much will the stock rise? This is impossible to predict. Ultimately, it’s up to each shareholder to decide whether to play the stock buyback game or sell now and invest in more promising opportunities.