Afternoon pictures

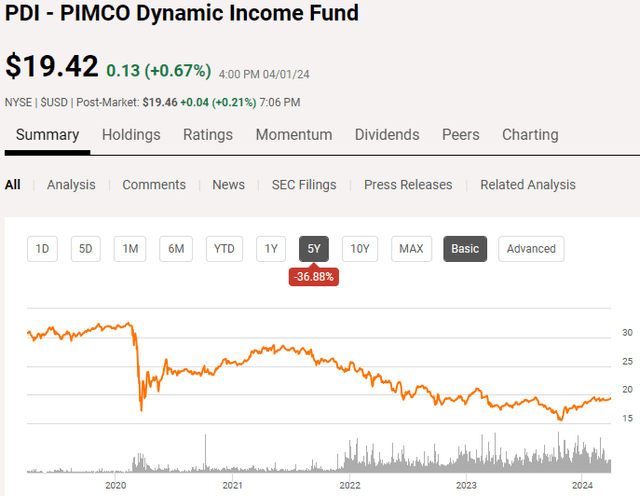

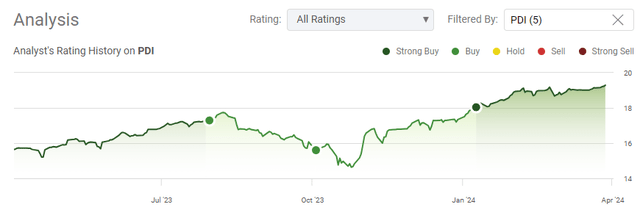

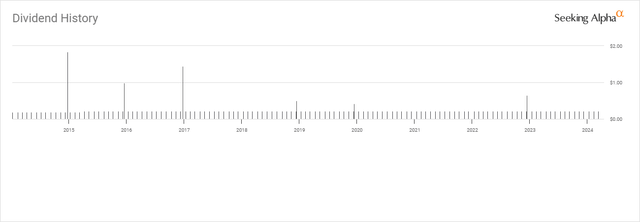

Since bottoming in October 2023, the PIMCO Dynamic Income Fund (NYSE:PDI) has been working on its restoration.Since reaching $15.53 on October 25day, PDI’s shares rose $3.89, or 25.05%.Its recovery continues By 2024, PDI has appreciated 8.19% year-to-date.This also does not take into account $0.22 Monthly allocation PDI has been paying out since 2015 and the current yield is 13.65%. PDI It’s not for everyone because it’s focused on generating current income. Its near-term investment objective is to invest in global debt and other income-producing securities, rather than focusing solely on capital appreciation. I continue to believe there are strong opportunities in global debt instruments, which should see a sharp recovery in a rate-cutting environment, which should push PDI’s net asset value (NAV) higher.Before the pandemic, PDI stock was As low as $30, they returned to that level before macroeconomic conditions caused a sell-off in debt markets. Now that we have received more clear information from the Fed, with economic data indicating that inflation is stabilizing and a lower interest rate environment is imminent, I believe the PDI will continue to rebound. I wouldn’t be surprised if PDI trades around 20 by the end of 2024.

Seeking Alpha

Following my previous article on PDI

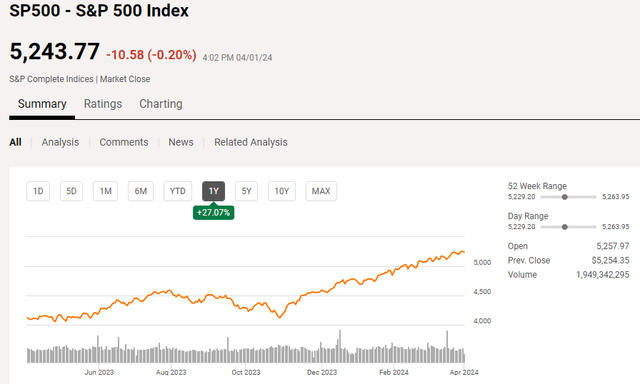

I continue to be bullish on PDI because it is my favorite PIMCO fund.Since my last post on January 9thth (can be read here), shares gained 3.91%, for a total return of 7.59%, while the S&P 500 gained 10.58%. In that article, I discussed why I believe the PDI has bottomed and how it maintains its larger distribution through volatile economic cycles. I want to follow up on that thought now that the March Fed meeting is in the books and we have more economic data and a clearer picture of what’s going on with the interest rate environment. I remain very bullish on PDI as I believe it will remain a strong income-producing asset while having the ability to generate capital appreciation as its underlying assets trade close to their face value.

Seeking Alpha

Risks to My Investment Thesis

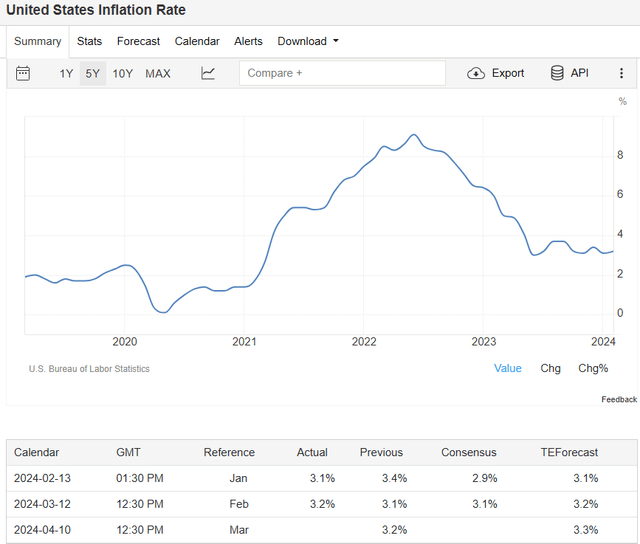

PDI is not a fund that performs well in periods of high inflation and interest rates. Inflation and interest rates go hand in hand, as manipulating interest rates is the Fed’s greatest tool to combat inflation. PDI’s assets Includes debt and other income-producing securities, including mortgage-backed securities, investment grade and high-yield corporate bonds, developed and emerging market corporate and sovereign bonds, other income-producing securities and related derivatives. When inflation rises, businesses’ operating costs increase, squeezing profits. In addition to creating a tougher business environment, rising inflation often leads the Federal Reserve to raise interest rates in an attempt to slow economic growth, leading to an increase in the cost of new debt and floating-rate debt. This does two things, firstly, on the business side it becomes more expensive to repay debt and on the investment side it makes previously issued debt with lower coupons less attractive so it will trade at a discount to replicate the current rate of return.

inflation Stopped falling, it has been stuck between 3-4% for the past few months. If inflation rises, it may cause the Fed to change its stance on interest rates at the end of the year. If we maintain a higher interest rate environment for an extended period of time, or if the Fed raises interest rates because it believes there is no further progress in inflation, that could cause PDI stock to fall back to its October lows. If interest rates move higher, some of PDI’s assets will trade below current trading prices because new debt will be issued at higher interest rates. A higher interest rate environment will also put pressure on debt markets as business operating conditions become more severe and debt defaults may occur. Just because PDI is a closed-end fund (CEF) and has a portfolio of over 1,800 stocks, it doesn’t mean that PDI is a safe investment. If the economy continues to be hot, the Fed may not cut interest rates and may even raise interest rates, which is negative for PDI stock. While the distribution is likely to remain unchanged, PDI stock is likely to face a sharp sell-off.

trade economics

I think PDI stock has hit a bottom, and now that we have more data from the Fed, I want to own more stocks under $20

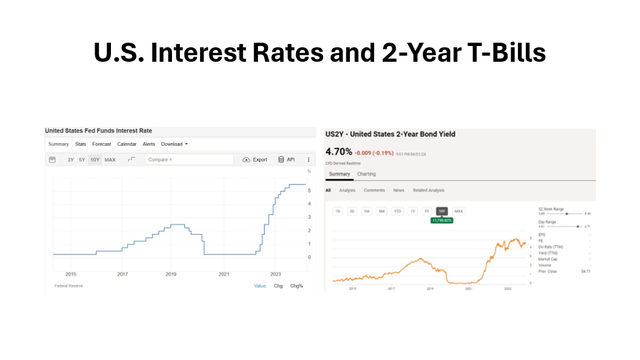

I view PDI as a proxy for traditional fixed income. While risk-free rates have been attractive, it has created an environment where baskets of debt instruments are yielding in excess of double digits. I’m not opposed to traditional fixed income like CDs and Treasury bills, in fact I’ve been taking advantage of the CD ladder with idle cash on hand rather than letting it float in a low-interest savings account or in the money market. To me, certificates of deposit, Treasury bills, and money markets have only become interesting in the past year and a half. Before mid-2022, the two-year Treasury note rate had not exceeded 3% in more than a decade. When interest rates fall, there are fewer reasons to hold Treasury bills and CDs if you hope to generate income. There will always be a place for these investments, as many people use short-term derivatives as an alternative to cash, but the incentive to lock up capital in the long term to generate income will decline.

Steven Fiorillo, Tatin Economics

Looking back ten years ago, the two-year rate was 0.42%. Buying a $1,000 2-year note will generate $4.20 in income over the life of your investment. If you roll over the 2-year note in April 2016, you will lock in an interest rate of 0.70% for another 2 years. In April 2018, the 2-year Treasury note yielded 2.27%, and by April 2020, the rate had all but disappeared, with the yield sitting at 0.21%. As inflation began, the Federal Reserve raised interest rates, and in April 2022, the two-year Treasury yield was 2.52%. Over a 10-year period, rolling a $1,000 2-year note would generate $58.52, or a yield of 5.85% over 10 years. For cash on hand, I have no problem rolling out 3-month Treasury bills or certificates of deposit because they generate more interest than most savings accounts, but they are not attractive for me to generate income in the long run.

Over the past ten years, PDI has generated $31.9b in revenue through monthly and special distributions.The consideration was that PDI stock sold for $28.14 on April 7th Since 2014, its value has decreased by -$8.72 or -30.99%. Some would view this as owning an asset that is depreciating in value, while I view this as owning an asset that has paid for itself and will continue to distribute monthly income. While the $1,000 is still worth $1,000 and you are left with $58.52 in interest by rolling over the 2-year note, the $1,000 invested in PDI will purchase 35.54 shares and generate $1,133.61 in income. The initial investment in PDI is worth $690.12, but the initial $1,000 investment will be repaid out of income and generate an additional $133.61 in income, leaving the original 35.54 shares still worth $690.12 with monthly distributions of $7.84. On an annualized basis, this would be $94.03, and that’s assuming the distribution is treated as cash rather than reinvested. PDI generates large enough returns that I can tolerate price fluctuations over the long term because the revenue generated is worth the risk from a revenue perspective.

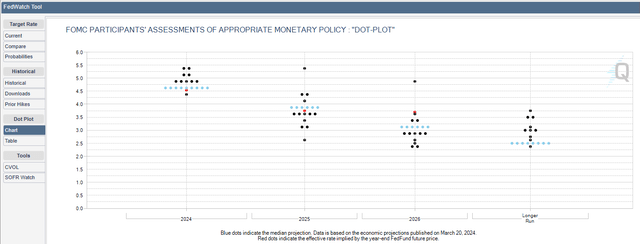

Seeking Alpha

PDI’s stock price appears to have bottomed out, and this turning point has a lot to do with the Federal Reserve.Look at the S&P 500, the market is Fed Chairman Powell The Federal Reserve issued a dovish outlook in the fall of 2023. Since then, we’ve had more economic data, with Fed Chairman Powell saying that while the economy is strong and inflation isn’t where they’d hoped, there’s a good chance interest rate cuts will begin in 2024. The Fed’s median forecast is for the federal funds rate to end 2024 at 4.6%, before falling to 3.6% in 2025 and 3.1% in 2026. This is bullish for PDI because its underlying holdings include a range of interest-rate sensitive debt investments. When interest rates rise, the par value of many of the bonds PDI holds declines because new bonds carry higher coupons. When this happens, existing debt needs to trade at a discount; otherwise, the market for its benefits disappears. This is the main reason why PDI’s share price has fallen in a rising interest rate environment, as the net value of its portfolio has always been in decline. While shares have moved higher from their October lows, I think PDI shares could move much higher during a rate-cutting cycle.Based on the Fed’s outlook and CME Group Fed Watch Tool, the probability of a first rate cut in June is 56.3%, while the forecast for the end of the year is only 1.8%. Just as the value of PDI shares declines as interest rates rise, I believe they will gradually rise as interest rates fall because new debt will be issued at lower coupon rates, which will make existing debt trading at a discount more attractive Attractive.

Seeking Alpha

CME Group

in conclusion

since Establishment of PDI Back in 2012, the stock distributed $37.87 in revenue, accounting for 151.48% of its original $25 share price. While the stock ended up losing -22.32% of its initial share price since inception, the amount of revenue generated made it a valuable investment. According to the Fed meeting minutes and forecasts, the first rate cut is only a matter of when, not if. I think investors can lock in a double-digit yield on cost, as PDI stock will likely appreciate in 2024 and 2025 if we enter a lower interest rate environment. While PDI’s share price is far from its lows, I believe it is an income investment that can generate a disproportionate amount of income compared to many other investments and future capital appreciation. I plan to add to the position again before reaching $20, and if the trend looks like it will continue higher, I will consider adding to the position again at the low of $20.