Michael Way

Palantir Technologies (NYSE:PLTR) business has started to show real strength in recent quarters, thanks in large part to the company’s artificial intelligence platform. However, the current growth of different customer groups varies greatly, hiding some advantages.

While Palantir’s valuation exposes investors to significant downside risk and could limit its upside in the near term, Palantir’s consistent performance and ability to create a compelling narrative will likely continue to support the stock price.

I’ve said before that Palantir’s growth may continue to accelerate with AIP’s support, but that may not be enough to meet rapidly expanding expectations. While growth accelerates, Palantir also continues to benefit from multiple expansions, which isn’t surprising given the current hype surrounding artificial intelligence.

Palantir Business Update

Palantir provides a data management platform that leverages The capabilities of artificial intelligence. It enables users to integrate data from various sources and perform analysis in a scalable manner. AIP brings LL.M. capabilities to Foundry, which Palantir believes improves accessibility. Based on the recent surge in demand, that appears to be the case so far.

Recent commentary from Accenture (ACN) suggests that while clients are starting to invest significant capital into generative AI, this is still largely in the exploratory phase as most companies lack the technology infrastructure to fully realize the value of AI . This is consistent with Palantir’s suggestion that customers are working to implement their own AI solutions. Palantir could be an early beneficiary of this need for generative AI, as its platform should solve many customer pain points and create value faster. However, not all companies are willing to outsource their data infrastructure or pay millions of dollars per year.

Palantir is trying to drive adoption of AIP through training camps. These are hands-on sessions where customers work with Palantir engineers to deploy artificial intelligence in operations. This is a combination of training and developing initial use cases. Palantir sees momentum, especially in its U.S. commercial business, but thinks it’s still early days. To date, the company has completed more than 560 bootcamps across 465 organizations, which it believes is compressing sales cycles and accelerating customer acquisition. Palantir also works with channel partners in certain regions, including Japan, and recently expanded its partnership with Fujitsu in an attempt to increase AIP adoption globally.

The extent of Palantir’s long-term advantage may depend on whether the platform’s ontology actually helps LL.M.s provide accurate and relevant data. This is unclear, as longer context windows and RAGs may diminish any advantage.

In addition to its data platform, Palantir has developed infrastructure technology to support its business and is increasingly making it available to customers. Mission Manager is a new infrastructure bundle (Apollo, Ontology SDK and Rubix) that enables software integration. Mission Manager is now available for every government project with full IL6 security.

Apollo is an infrastructure abstraction layer that reduces the complexity of deploying and managing applications across heterogeneous environments. Rubix is Palantir’s custom Kubernetes infrastructure. It provides a secure and scalable scheduling and execution engine for distributed computing frameworks.

Palantir also provides customers with highly secure infrastructure and opportunities for governments. FedStart enables customers to run their products in Palantir’s secure and certified environment, built on the capabilities of Mission Manager. This significantly lowers the barriers to delivering government software and accelerates time to market.

- FedStart IL5 – Available now.

- FedStart IL6 – 2024 Season 2.

- FedStart FedRAMP Highs – Q4 2024.

Growth in Palantir’s government business has been relatively weak in recent quarters, but Palantir believes this does not reflect the true state of its business.Some of this is due to the timing of the large contract with the U.S. Army Recently selected Palantir The next phase of TITAN. The contract, worth nearly $180 million, involves the development of 10 TITAN prototypes, including 5 advanced and 5 basic versions. TITAN is a system that collects data from a variety of sensors to provide situational awareness and situational understanding. The main difference between these variants is that the advanced version includes a direct downlink from space-based assets.

Palantir also recently expanded its partnership with the Army to continue developing and operating the Army Vantage platform. The platform is used for data-driven operations and decision-making.

While these contracts aren’t necessarily that significant individually, the use of software in military applications is likely to continue to expand, and Palantir is well-positioned to take advantage of that. Palantir estimates that the Army currently spends only about 0.015% of its budget on command and control software, and believes that this percentage will increase significantly over time.

financial analysis

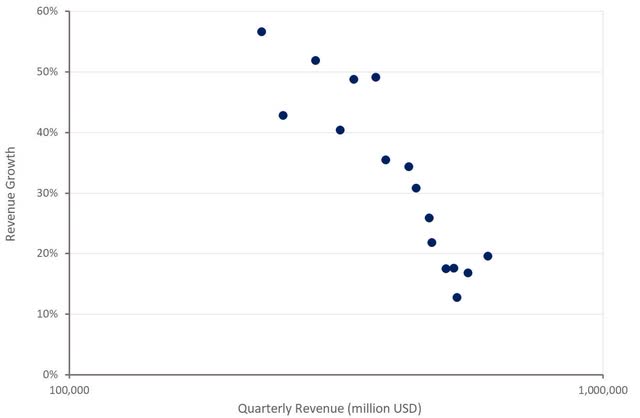

Fourth-quarter revenue was US$608 million, an annual increase of 20%, of which commercial revenue grew by 32%. U.S. commercial business grew 70% year-on-year, which Palantir attributes to AIP.

Palantir expects first-quarter revenue of $612-616 million, with a mid-point growth of 17%. The company expects full-year revenue to be US$2.652-2.668 billion, a growth of 20%, which means a significant acceleration for the full year. U.S. business revenue is expected to grow by at least 40% in fiscal 2024.

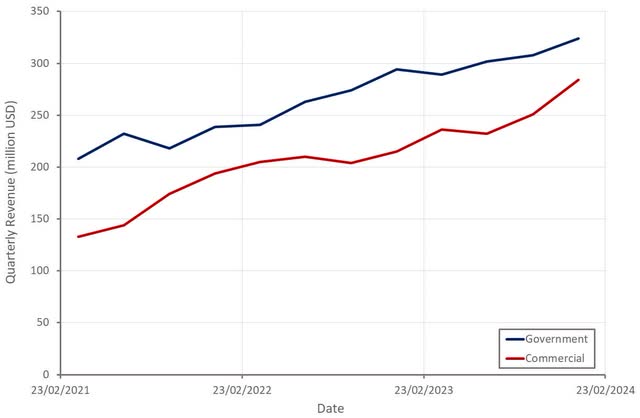

Figure 1: Palantir revenue growth (Source: Author created using Palantir data)

Commercial revenue in the fourth quarter increased by 32% year-on-year, with U.S. commercial revenue growing by 70% and international commercial revenue growing by 11%.

In the fourth quarter, government revenue increased by 11% year-on-year, with U.S. government revenue growing by 6% and international government revenue growing by 27%. International government revenue includes funds received, which led to a pickup in revenue during the quarter. Palantir expects its U.S. government business to accelerate growth in 2024.

Figure 2: Palantir revenue by customer segment (Source: Author created using Palantir data)

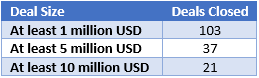

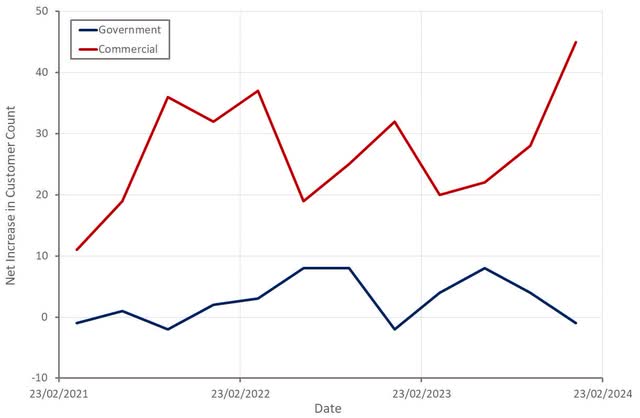

Palantir’s number of customers in the fourth quarter was 497, a 35% increase from the same period last year. Customer growth was driven by commercial customers, particularly in the United States. Although Palantir’s customer count remains low, the company continues to sign large contracts.

Net dollar retention in the fourth quarter was just 108%, although that’s a retrospective number that hasn’t really benefited from the re-acceleration of the U.S. commercial business. Revenue from Palantir’s top 20 customers in the fourth quarter increased 11% year over year to $55 million per customer in the trailing 12 months.

Table 1: Palantir completed transactions in Q4 2023 (Source: Author created using Palantir data) Figure 3: New Palantir Net customers (Source: Created by the author using Palantir data)

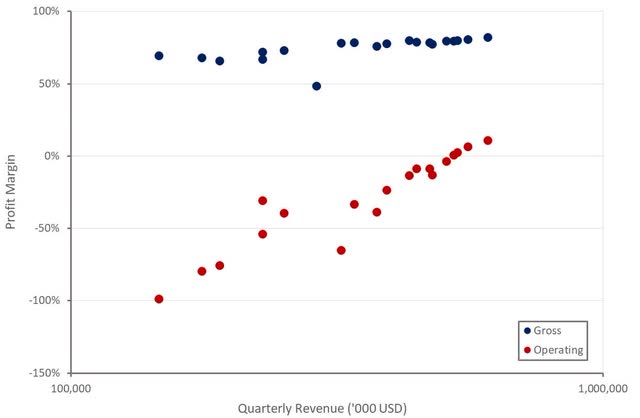

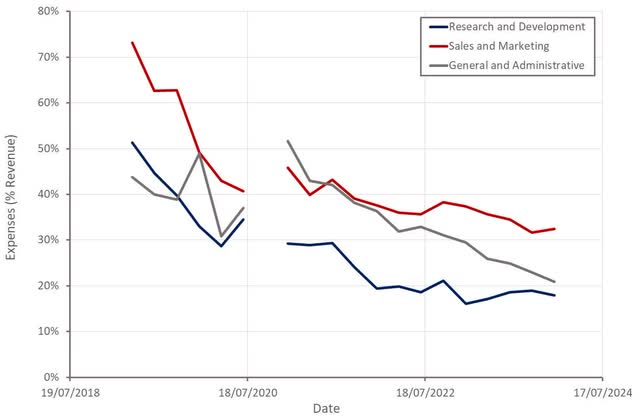

Palantir’s profit margins continue to expand steadily, something many software companies have failed to achieve in recent years. However, the improvement in the fourth quarter was more modest than in previous quarters. This appears to be primarily attributable to sales and marketing expenses. General and administrative expenses remain relatively high, which means this area should help further improve profitability going forward.

Figure 4: Palantir profit margin (Source: Created by the author using Palantir data) Figure 5: Palantir operating expenses (Source: Created by the author using Palantir data)

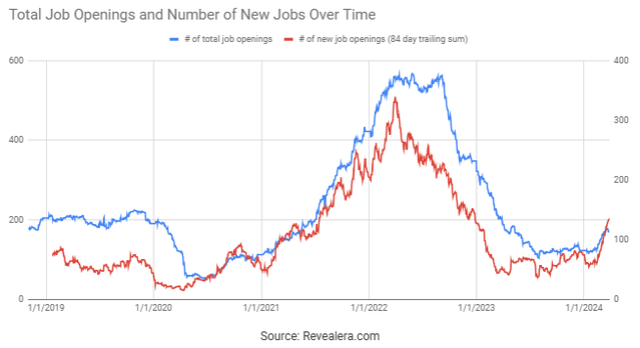

Palantir’s job openings are increasing in early 2024, supporting near-term improvements in revenue growth. Many software companies have significantly increased hiring in recent months, which may indicate an improving demand environment. For some companies, this may also indicate a lack of recruitment in 2023.

Figure 6: Palantir job openings (Source: Revealera.com)

in conclusion

Palantir’s growth has improved in recent quarters and should grow further in 2024, especially if the company’s government business strengthens. Palantir also became profitable and generated free cash flow, and the company’s margins continue to improve steadily. These factors, combined with a strong narrative, contribute to Palantir’s premium valuation.

However, Palantir’s revenue currently looks excessive compared to peers with similar growth and profitability. It may not matter as execution is solid and investors remain enamored with anything related to artificial intelligence, but valuation will ultimately come into play.

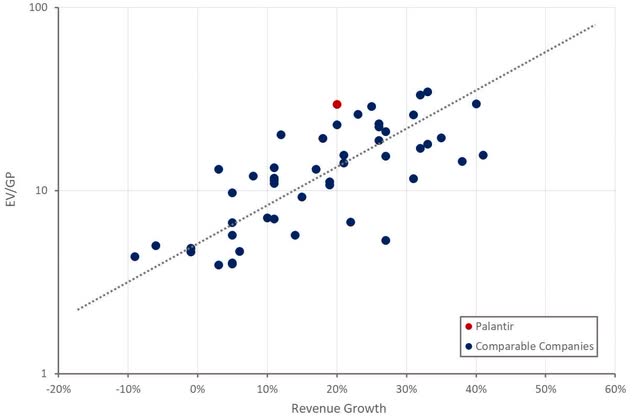

Figure 7: Palantir relative valuation (Source: Author created using information from Seeking Alpha)