Vectorian/iStock via Getty Images

On Wednesday, security technology vendors Identify the company or “identity” (NASDAQ: INVE) adds another chapter to its decades-long story of underperformance against investor expectations.

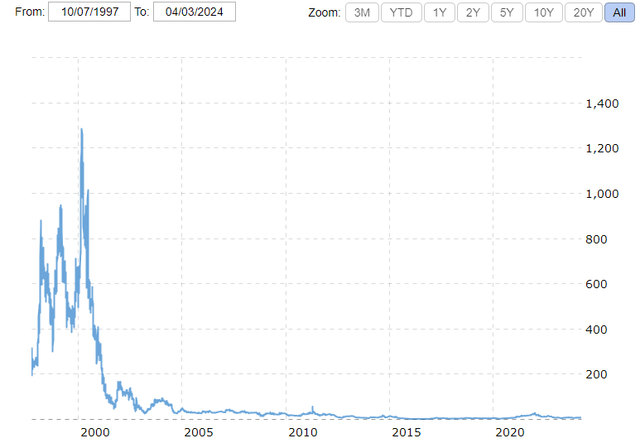

The company, formerly known as SCM Microsystems, went public on a reverse stock split. $130 per share during the dot-com bubble. Shares peaked at well over $1,200 in early 2000, but lost 95% of their value over the next 12 months:

Macro Trend Network

follow get In 2010, Swiss-based RFID technology supplier Bluehill ID AG merged, and the combined company adopted a new name “same group” has been changed to “Identify the company” Year 2014.

However, the addition of RFID solutions didn’t really change the company’s fortunes, so Identiv has needed to dilute common shareholders multiple times just to stay afloat to this day.

Investors are excited again in the short term A few years ago, the company’s RFID business proved to be unfounded.

The following another year Disappointingly, management decided in early 2023 to initiate a review of strategic alternatives and hired an independent consultancy.

Last month, Identiv report Fourth-quarter results were less than ideal and guidance for first-quarter 2024 was provided, well below consensus expectations, as one of the company’s major RFID solutions customers is “Going through a technological transformation“As a result, shipments need to be suspended.”Over the next two to four quarters,As management outlined on the fourth-quarter conference call.

However, the damage to share prices proved to be rather short-lived, as market participants apparently used the sell-off to prepare for expected near-term strategic trades.

On Wednesday, the company finally declare The long-awaited results (emphasis added by the author):

Identiv (…) has entered into a definitive asset purchase agreement Sells its physical security, access card and identity reader businesses and assets to Vitaprotech, security solutions provider. Proceeds from the sale will significantly strengthen Identiv’s financial position, generating capital to fund future organic and inorganic growth of its specialized IoT solutions business.

According to the terms of the agreement, Upon completion of the transaction, Identiv will receive a cash payment of US$145 million, make adjustments as usual. Identiv, Inc. will remain a listed company on the Nasdaq Stock Exchange under the symbol “INVE.”

Approximately $10 million of the proceeds will be used to repay amounts outstanding under the company’s existing East West Bank credit facility.

The transaction is expected to close in the third quarter, subject to regulatory and shareholder approvals and customary closing conditions.

According to details provided by Identiv Promotional meeting The deal will result in the sale of 32% of the company’s assets and account for 63% of fiscal 2023 revenue, according to filings with the SEC.

Apparently, the company is selling not only its entire high-margin premises business, but also a significant portion of its identification business, while retaining only its struggling, low-margin RFID business.

Also note that several senior executives, including current CEO Steven Humphreys, will move to Vitaprotech, while Identiv’s remaining operations will be led by incoming President and CEO Kirsten Newquist, who will depart from Avery Dennison (AVY ) join the company.

In Wednesday’s strategy review update call, management was unwilling to provide any financial details about the cost structure of the company’s remaining operations. However, given the Identity segment’s larger size and lower margins, it’s reasonable to assume that Identiv’s stub business could generate meaningful initial losses.

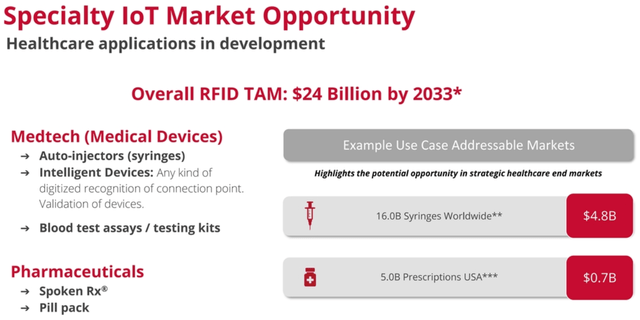

Going forward, the company plans to increase its focus on the healthcare market:

Company Profile

Identiv also intends to strengthen its new core business through acquisitions and therefore does not expect to pay any proceeds from the sale to common shareholders.

Frankly, I think this is a terrible outcome for shareholders, as they will be left with a struggling, low-margin RFID business, while the cash proceeds from the sale of the company’s more stable, high-margin business will obviously be used specifically to expand Identiv’s stub business. and to cover significant initial losses.

It appears the company simply hasn’t been able to find a buyer for the worst-performing part of its business.

Wednesday’s 20% sell-off is not surprising given the significantly increased risk profile going forward and the complete lack of return on shareholder capital.

With the remaining low-margin RFID business challenged by the aforementioned technology transitions at key customers, I wouldn’t be surprised to see the company’s post-closing quarterly revenue run rate deteriorate below $10 million, resulting in significant initial cash losses.

bottom line

Identiv’s long-awaited strategic trading announcement failed to impress market participants. Instead of receiving an outright takeover offer or at least receiving a large special dividend, shareholders will now be left with the low-margin, loss-making RFID business, along with the proceeds from the sale of the company’s stable, high-margin business, which were apparently earmarked for the acquisition , debt repayment and covering expected cash losses.

Given Identiv’s dismal track record, the current challenges facing its remaining RFID business, and the company’s significantly increased risk profile, I recommend investors consider selling its shares and moving on.