Azman L

generalize

Readers can find my previous reports through this link. My previous rating was Buy because I believed in Braze (Nasdaq: Fast) will continue to see >30% growth after reviewing BRZE’s performance in Q3 2024.I reiterate my buy rating Because I think the slowdown in growth (in fiscal 2025) is due to changes in sales strategy. Once BRZE stabilizes, we should see growth accelerate back to 30%.

Finance/Valuation

In the fourth quarter of 2024, revenue and subscription revenue increased by 33% year-on-year, in line with my expectation that BRZE can continue to grow by more than 30%. Even adjusting for NorthStar’s contribution, BRZE still grew 29.5% organically, which I view as a positive as it accelerated 50 basis points from Q3 2024. While BRZE’s estimated gross margin is 100 basis points below consensus at 68%, its estimated EBIT margin is in line with consensus and guidance at -6%.Other leading growth indicators also indicate Growth going forward is very healthy, with calculated billings growing 26%, cRPO growing 31%, and RPO growing 40%.

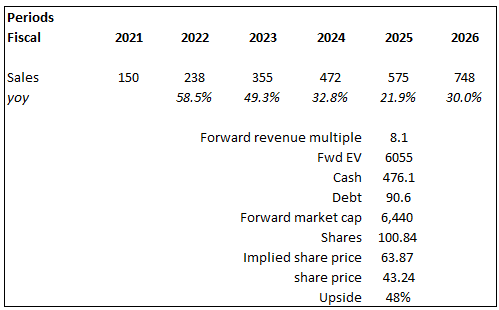

Based on the author’s own mathematical calculations

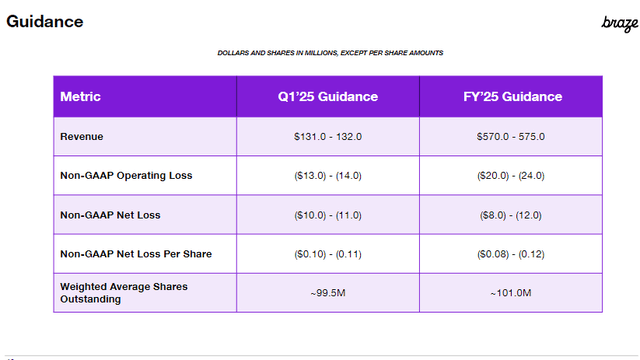

Based on my view of the business, I still believe BRZE can return to growth to 30% in FY2026. I think the slow growth in FY25 is because of changes in go-to-market strategy, which typically affects sales because sales reps change tactics (in terms of sales pitches, etc.) and it also takes time for them to become more productive. Therefore, my assumption is that BRZE will achieve the midpoint of management’s guidance for growth ($575 million) in FY25, followed by 30% growth in FY26.However, I did lower my forward revenue multiple assumption from 8.7x to 8.1x (8.1x is the average for BRZE) as peers also revised down – likely because Fear There will be no interest rate cut in 2H24. Peers such as HubSpot (HUBS), Salesforce (CRM), Freshworks, Sprinklr (CXM) and Amplitude have all seen their P/E ratios decline since the start of the year, falling from an average of 7 times forward revenue to 6.4 times.

hurry up

Comment

While organic revenue growth fell short of my expectations of over 30%, I believe BRZE can accelerate its growth to over 30% in the coming quarters, and the driver will be BRZE’s success in capturing enterprise demand. In this regard, management noted continued share growth, driven by customers re-platforming legacy solutions. I believe Braze’s previous spinoff of its email solution is catalyzing this momentum. This spin-off essentially allows BRZE to take on specific functions and then expand them through phased divestitures and replacements. Investments in the global system integrator ecosystem have also certainly helped drive this momentum – significantly expanding BRZE’s distribution reach and expanding its deal pipeline. The logic here is that these large dealers already have relationships with large enterprises, and by leveraging their expertise, BRZE achieves this relationship “immediately”, albeit indirectly. If BRZE did it themselves, it would take longer and require more resources. Once BRZE gains enough experience, they can eventually build their own sales team to target these enterprise customers. I think management has shown that they are doing this as they increase their sales capabilities to enterprise customers based on momentum in 2023.

You know, one of the things that we’ve been talking about over the past few quarters is how pleased we are with the success of our global systems integrator and large marketing agency holding company.

I mean, I think that’s a lot of the things that we’ve discussed on the call so far. We are very excited about how the agency ecosystem and global systems integrator ecosystem can continue to find and influence new pipelines.Source: Q4 2024 Earnings

The second driver is BRZE’s increased focus on upselling rather than adding new logos. Therefore, I’m not too worried about the slowdown in net additions (33 in FY24, 53 in Q3’24, 55 in Q4’23), with net additions down 31% in FY24 . Also, one thing to mention here is that the customer churn that BRZE faces in Q4 2024 is in the lower end of the spectrum, so they are unlikely to fit well with BRZE’s current upsell strategy anyway (i.e., They are lower quality customers). I’m positive about this change in strategy because it’s in line with a strategy targeting large enterprises. The difference between large and small accounts is that large accounts have enough headroom (i.e. many departments, seats, functions) that BRZE can slowly penetrate (up/cross-sell). And for small accounts, there are less opportunities for up/cross-sell due to their smaller size. Notably, this strategy seems to be working well so far, with new order forms continuing to hold steady. The problem is, given that the nature of the upsell is to land the new brand or territory with existing customers who require the same sales intensity as the new logo, this strategy requires more sales reps.

Another issue is that this could impact sales in the short term, as any changes to go-to-market strategy will take time to produce results. Looking to the medium term, I expect sales to accelerate beyond FY25 as sales reps become more productive and BRZE gains greater traction in penetrating enterprise customers.

The last area that I expect to support more than 30% growth is BRZE’s product innovation, especially in the field of artificial intelligence. Braze was an early adopter of GenAI and has incorporated various AI and ML-driven features into its products. I believe these capabilities in AI help differentiate BRZE from its traditional peers, which are not built in a way to support non-linear customer journeys, which limits the degree of personalization GenAI can ultimately help provide. Some recently launched product features that I think are worth mentioning include:

- Personalized Recommendations: This can help customers make their messages more relevant by providing better product, service and catalog item recommendations to individual consumers

- Personalized Path: This is an interesting path because it allows customers to test multiple iterations of the customer journey so that they can find the best way to target their customers,

- Estimated Actual Open Rate: This should become increasingly important as it helps address the challenges posed by the changes Apple has made Email Privacy Policy.

They interact with brands on their terms, they’re on a non-linear customer journey, they have an ever-expanding array of media and channels they want to communicate with and use when they access your products and services.Source: Q4 2024 Earnings

risk

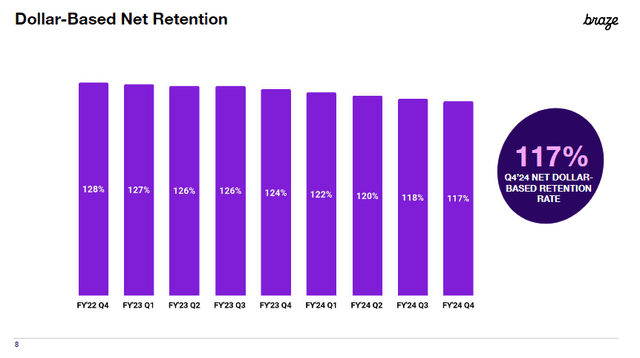

BRZE’s net retention in dollar terms has been declining over the past few quarters, which could become a major issue if it continues to decline, suggesting that BRZE’s up/cross-sell efforts are not working or that customers are continually being lost. So far, I think it’s the latter (low-end churn), and we should see improvements here as BRZE executes its new up/cross-sell strategy.

hurry up

in conclusion

Although growth is expected to slow in fiscal 2024, I still recommend giving BRZE a Buy rating. In my opinion, the sales slowdown is due to a change in sales strategy – now the goal is to attract enterprise customers and upsell – which usually affects sales in the short term. I believe BRZE can continue to see momentum in penetrating large accounts as its current strategy leverages global system integrators, thereby significantly expanding BRZE’s reach.