Justin Sullivan

investment thesis

Stock markets continue to see strong growth in 2024, with large technology and semiconductor stocks continuing to drive gains. in my opinion, greedy investor The bigger it is, the higher the chance of a stock market correction.since growing up Stocks are generally more susceptible to corrections, and I’m now looking for potential high-yield safe havens. British American Tobacco Company (NYSE: BTI) stock looks like a quality defensive stock with a high forward dividend yield of 9.6%. The business is highly profitable and has a healthy balance sheet, which makes the dividend yield safe. The stock is severely undervalued due to the long-term decline in smokers, but BTI looks to be a very solid short-term investment that can weather potential short-term storms for growth stocks. All in all, I give BTI a Strong Buy rating.

company information

Anglo-American Tobacco companies are among the largest in the world. The company owns well-known brands such as Kent, Pall Mall, Rothmans, and Lucky Strike.

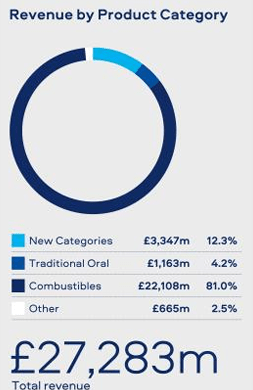

The company’s fiscal year ends on December 31. BTI generates 81% of its revenue from its traditional products, but it also strives to diversify its revenue mix to adapt to changing consumer preferences.

BTI latest annual report

finance

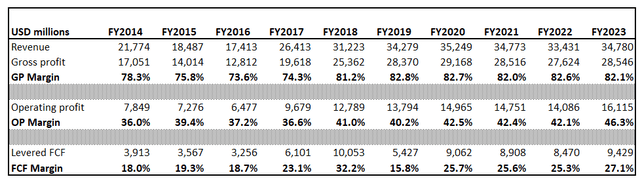

As I usually do when I start analyzing a new company, I narrow down the scope and focus on long-term financial performance. Over the past decade, BTI’s revenue has grown at a compound annual growth rate of 5.3%, which is impressive. Profitability metrics are also excellent and expand significantly as revenue grows.

Author’s calculations

The company’s overall profitability, especially its free cash flow (FCF) margin, is excellent, allowing the company to maintain a healthy balance sheet with fairly modest leverage and keep shareholders happy with returns. BTI currently offers a forward dividend yield of 9.6%, which is a huge number in my opinion. Dividend growth has been relatively slow, with a CAGR of 2.8% over the past five years.

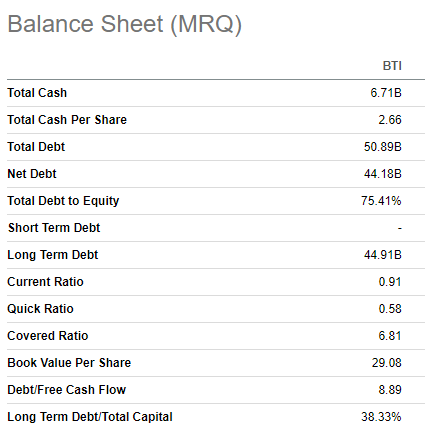

Seeking Alpha

As we can see in the Company Information section, more than 80% of the company’s revenue comes from its legacy brands representing smokable cigarettes. At the same time, I appreciate that management understands the need to diversify the revenue mix in light of the changing environment. The company is expanding its business into healthier alternatives to traditional cigarettes, including e-cigarettes/e-cigarettes (Vuse), heated tobacco (glo) and oral pouches (Velo and Grizzly).

BTI latest annual report

As we can see from the screenshot above from BTI’s latest annual report, all of these products have captured significant market share. Under the long-term unfavorable trend of the traditional tobacco industry, it is crucial for companies to diversify their income structure. Forecasts for these new industries indicate that the product categories mentioned above are likely to eventually replace smokable products such as cigarettes.

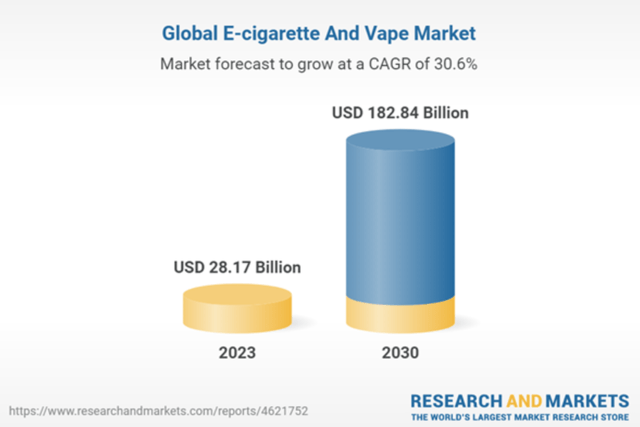

The forecast for the e-cigarette/e-cigarette market is optimistic, and it is expected that the industry’s WACC compound growth rate will reach 30.6% by 2030. The growth rate is huge, not much different from the expected growth rate of the hottest topics right now, generative artificial intelligence. Since BTI’s Vuse brand is present in 63 markets around the world, I think the company is well-positioned to absorb this favorable industry trend.

Research and Marketing Website

What’s more worth mentioning is that Vuse has a dominant position in this emerging industry.The brand has an amazing 42% market share, which looks like a powerful catalyst for commercial success. Having a strong market share in a fast-growing market is likely to help BTI maintain its excellent profitability for longer. In the hot tobacco market, BTI is presented under the “glo” brand, which is even more popular than electronic cigarettes and e-cigarettes.industry It’s expectation Growing at an incredible 52% CAGR. BTI’s performance in this rapidly growing market is also impressive, as glo has a solid foundation 19.4% market share.

Unfortunately, I don’t see market share for BTI brands in the nicotine pouch market, but the company’s success with legacy brands and emerging industries increases my optimism about its ability to gain a solid position in the nicotine pouch market.

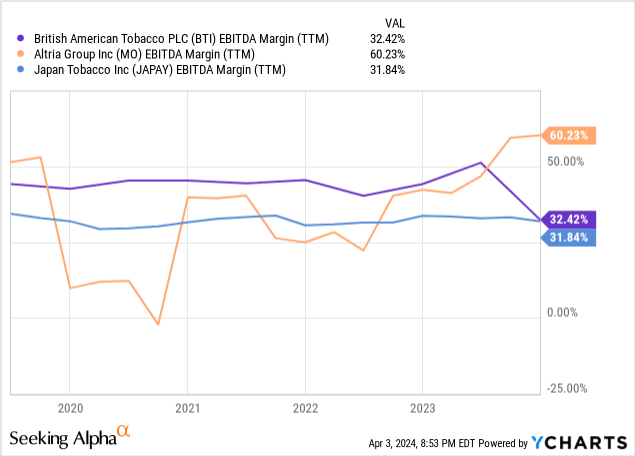

If we look at BTI’s performance against its closest competitors Altria (MO) and Japan Tobacco (OTCPK:JAPAY), we see that the company has been leading the pack in terms of EBITDA margins in recent years. The sharp decline last fiscal year was due to a one-time, non-cash charge on the income statement, which I describe in more detail in the Risks to Consider section. Additionally, BTI performed more consistently during the pandemic, while Altria’s EBITDA deteriorated significantly in 2020-2021. Overall, BTI’s leadership in EBITDA indicates that the company is demonstrating best-in-class business efficiency.

Going forward, I expect BTI’s profitability to recover for the foreseeable future. In order to monitor my thesis in the coming days, the dynamics of the revenue structure will be crucial. With the company’s traditional smoking products business in long-term decline, the importance of smoke-free products cannot be underestimated. I expect new products to grow as a share of the company’s revenue mix. Since these products already have what I described as a solid market footprint, I believe new products will likely continue to gain momentum as customer preferences shift from smoked to smokeless options.

Valuation

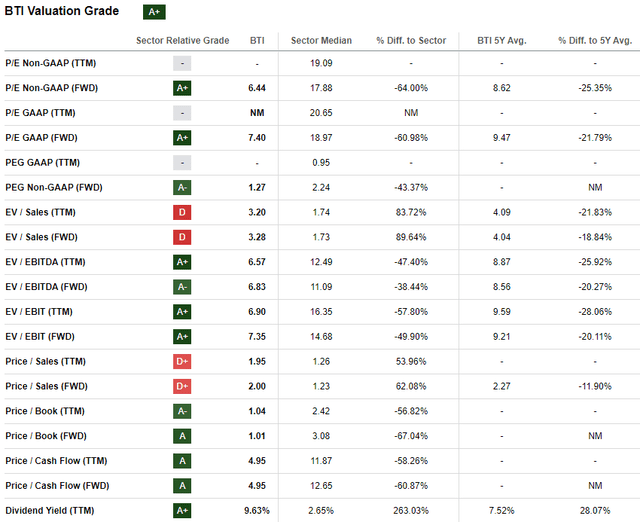

BTI has had a modest start to 2024, rising 3.5% year-to-date. The stock has fallen about 15% in the past 12 months, lagging the broader U.S. market by a wide margin. Valuation ratios clearly indicate undervaluation, as the current P/E ratio is well below its average over the past five years.

Seeking Alpha

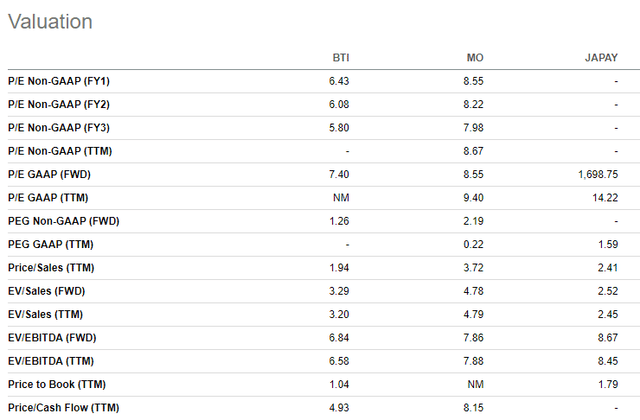

If we look at peer analysis, BTI’s valuation ratios are significantly lower than Altria’s. Considering the temporary decline in profitability last year, this looks fair to me and means BTI has a lot of potential to return to MO’s multiple.

Seeking Alpha

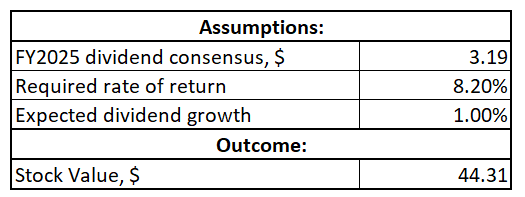

Just looking at valuation ratios isn’t enough to give me confidence that it’s undervalued. Therefore, I will run a Dividend Discount Model (DDM) simulation. I use a required rate of return of 8.2%, which is consistent with valueinvesting.io’s recommendations. For the base year dividend, I use the consensus estimate for fiscal 2025, which is currently $3.19. My long-term dividend growth forecast is very conservative, implementing a 1% growth rate.

Author’s calculations

According to my DDM simulation, the fair price for the stock is $44.3. This is 46% higher than the current market price. An upside potential of 46% and a forward dividend yield of over 9% looks like a compelling investment opportunity to me.

Risks to consider

The company’s traditional cigarette business is in an industry going through a secular decline.Smoking rates have dropped significantly as people around the world become more educated and aware of the health risks posed by smoking in recent decades. This is likely the reason for the weak investor sentiment towards the stock, as the stock has lost 26% of its value over the past five years. If we look at the BTI share price chart below, we can see that the stock is unlikely to be a good long-term investment. Readers should understand that my bullish thesis is intended for dividend investors seeking a safe haven in the current era of massive gains in technology stocks.

Seeking Alpha

It’s hard to drive organic growth in a declining industry. As such, BTI relies on acquisitions to drive growth.In addition to the huge billions Acquire Reynolds, the company has also made several smaller (but still larger) investments over the past decade. There is also BTI shares acquired Another multibillion-dollar deal for Brazil’s largest cigarette company, Souza Cruz SA. There are other smaller investments too, I won’t list them all. The key idea here is that pursuing an aggressive acquisition strategy is inherently risky. Merger costs may be higher than expected, there is always a risk that synergies may not work as planned, and investments may ultimately not be recouped.This is actually what happened to Reynolds Investments, as the company documented $31 billion impairment charge This was a big negative catalyst for the stock last year.

bottom line

All in all, BTI is a “Strong Buy” stock at its current valuation and huge forward dividend yield. The balance sheet is healthy and financial performance remains strong, making the dividend safe. I wouldn’t recommend investing in this stock for the long term, but BTI looks like a good safe haven for a solid dividend amid the current huge uncertainty about the sustainability of the growth stock rally. I think if there is a new pullback in growth stocks, there is a high likelihood that money will move to quality value stocks. However, as we saw in 2022, this is unlikely to last much longer. Therefore, I believe BTI is a strong high-yield investment over the next 12 months.

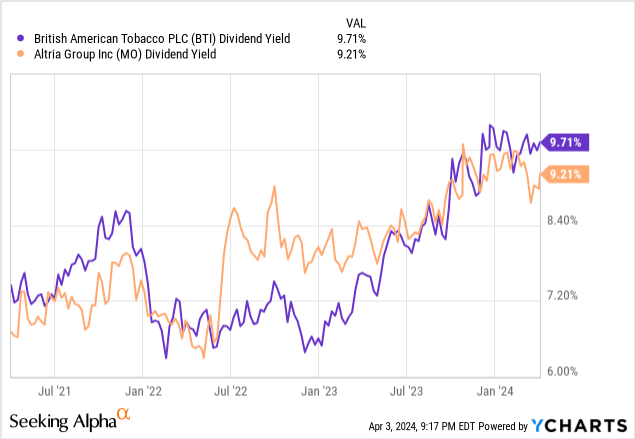

I’m confident in BTI as an excellent high-yield pick due to its consistently strong profitability, successful transition into emerging industries, and clean balance sheet. The company’s main competitor, Altria, is also a well-known high-yield company, but its forward dividend yield is low, and my peer valuation ratio analysis suggests that BTI is attractively valued.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.