JHVE photos

Overview

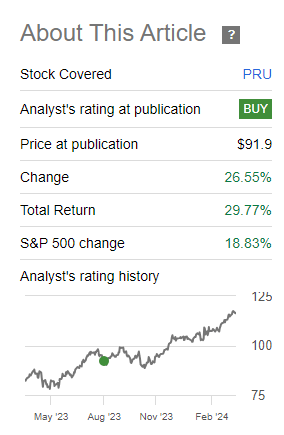

Last time I reported on Prudential Financial Group (NYSE:PRU) was in August 2023, with total returns exceeding those of the S&P 500 Index (SPY) since then.Prices have risen by 26%, reaching their highest level Since then, dividend yields have pushed total returns to nearly 30%. I think now is a good time to revisit and re-evaluate whether PRU remains a buy after the price run.

Seeking Alpha

Since my initial report, some of PRU’s business units have grown and the dividend has increased slightly. I think PRU doesn’t get the recognition it deserves as a dividend growth stock, so I’ll look at that later as well.Additionally, I believe that PRU remains a solid choice despite being near all-time highs due to continued growth in the segment and the authorization of $1 billion in share repurchases Agreement initiated by their board of directors.

In terms of valuation, I think a reasonable price target is $130 per share. This represents a potential upside of approximately 12%. When you consider this along with the high dividend yield of 4.5%, you see the potential for solid double-digit returns.

Update financial data

Prudential reported fourth-quarter earnings in February, completing its fiscal year results. Reported fourth-quarter adjusted operating income was $943 million, equivalent to $2.58 EPS (earnings per share). That’s a slight improvement from last year’s fourth quarter, when profit was $932 million and earnings per share were $2.42. As of the end of this fiscal year, full-year 2023 operating income was $4.286B, with earnings per share of $11.62. This compares to 2022 earnings of $10.31 per share.

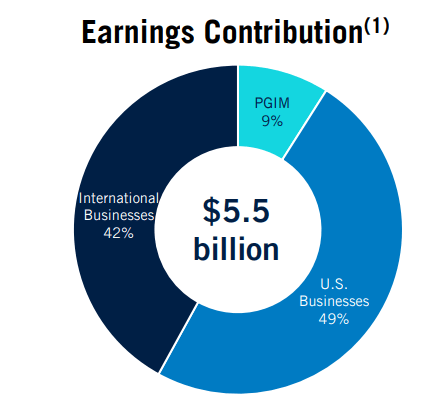

The company’s total revenue reaches $51BB, generated from three main segments. The U.S. business accounts for 49%, followed by international business at 42% and PGIM business at 9%. PRU’s business is diversified, but the majority of its revenue can come from premiums and annuities earned from its individual life insurance and insurance businesses.

Prudential Q4 Briefing

As of the fourth quarter, the amount of capital returned to shareholders was $708 million. This includes $250 million in share repurchases and $458 million in dividends. I mention this because as of the last earnings call, the board had authorized $1 billion in stock repurchases in 2024. This is noteworthy because I believe further buybacks initiated at these levels mean management is confident in their ability to continue to generate greater returns. Not only that, it may return more capital to shareholders by increasing PRU prices.

We also received confirmation during the last earnings call that PRU is taking aggressive steps to continue to grow its various business areas:

We continue to focus on business diversification and expand into the field market and association market segments with less than 5,000 people. We are adding new products, such as supplemental health products, and continuing our growth and disability. We have made progress in diversification, with disability premiums and fees growing at a higher rate than before and our supplemental health premiums growing strongly at double-digit annual rates. This diversification is driving stronger core earnings and higher margins. – Caroline Feeney, Executive Vice President and Head of U.S. Operations

Market segment growth

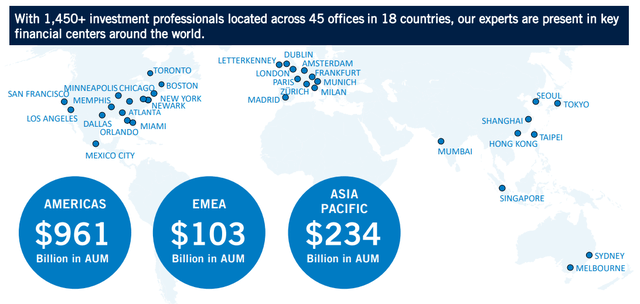

Prudential’s revenue comes from three main parts Their businesses include: PGIM, US operations and international operations. PGIM is the asset management segment, which accounts for the smallest revenue share, accounting for only 9%. The business unit generated $713 million in revenue and continues to grow by delivering a diverse set of attractive asset classes and performance. AUM (assets under management) percentage continues to outperform public benchmarks. However, PGIM’s revenue for the quarter was lower due to lower incentive fees and higher expenses. Thankfully, this is offset by higher asset management fees.

The largest portion of their business comes from operations in the United States. This accounted for 49% of its revenue, bringing in approximately $3.792 billion. When I last reported on PRU, this arm of their business brought in just $3.041 billion in revenue, which meant the segment grew by $751 million. This growth can also be attributed to the benefits of higher interest rates and lower fees.

Retirement Strategies generated $16.4B in sales in the fourth quarter. Of that, the personal retirement pipeline brought in $2.1B in sales, the highest level since before the pandemic in 2019. Fixed annuity sales have doubled since the fourth quarter of 2022, and individual life insurance sales are up 33%.

Prudential Q4 Briefing

Finally, their international markets continue to show growth in Japan and emerging markets. Their international business sales increased 24% year-on-year. This segment accounted for 42% of its profit contribution, amounting to US$3.183 billion. I believe their product portfolio will continue to grow as the aging population provides opportunities for expansion. In Japan, for example, sales of life planners grew 21% due to recent product launches.

Another large portion of their international revenue comes from smaller emerging markets. Sales of life planners in the Brazilian market increased by 24%. I’m confident in PRU’s ability to continue to grow internationally as they continue to reinvest in the business and adjust expenses as needed. Each business unit continues to successfully navigate the macro environment without compromising the strength of its balance sheet.

Helping reduce risk is the cash buffer PRU has on hand. Management stated that liquidity targets are in the range of $3-$5B. As it stands, PRU’s cash and liquid assets currently stand at $4.1B, well within target. This should help offset any potential obstacles or resistance they face in their development. expected Rate cuts in the second half of the year.

Dividends and Valuation

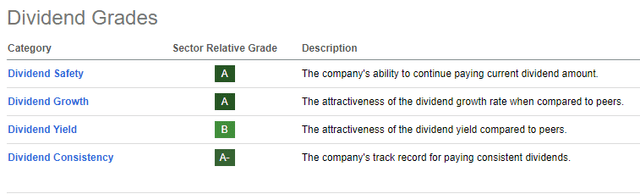

The dividend has increased 4% since I originally underwrote PRU. As of the latest announced quarterly dividend of $1.30 per share, the current dividend yield is 4.5%. Seeking Alpha’s dividend ratings are excellent across the board, and for good reason. The dividend payout ratio remains at a healthy level of 43.46%. While this is above the industry median dividend payout, it is still at a level that could support further growth.

Seeking Alpha

Additionally, the dividend growth has been spectacular. Over the past five years, dividends have grown at a CAGR of 6.42%. Even more impressive is that, looking out 10 years, the dividend compound annual growth rate is 10.5%. That’s great considering the dividend yield is already high. For reference, the industry’s median dividend is only 3.5%, so a growth of this magnitude is pretty impressive. PRU has also maintained its 15-year streak of dividend increases, further reinforcing management’s confidence in its ability to continue paying growing dividends.

The average price target on Wall Street is $109.15 per share. This means the stock is currently overvalued by about 6%. The highest price target is only $118 per share, and the lowest price target is $99 per share. I expect to eventually upgrade the price target, especially given the aforementioned $1 billion in share repurchases in 2024.

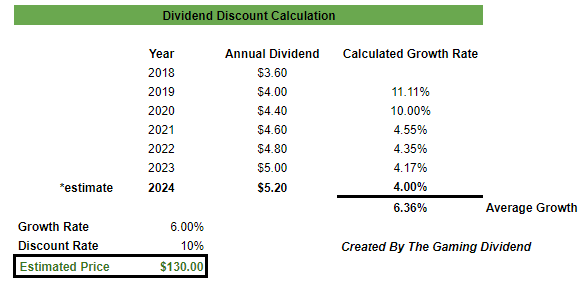

However, I decided to run my own dividend discount calculation to determine a reasonable price target. I first compiled data on the amount of all annual dividend payments since 2018. We can see that the average annual dividend growth rate since then has been 6.36%. I then use an assumed growth rate of 6% to be consistent with the long-term average. Full-year sales were up 11%, but I’m aiming to take a more conservative stance on the outlook as things can easily change based on the macro environment. Therefore, I arrive at an estimated price target of around $130 per share. This implies a potential upside of 12%.

Author – Dividend Discount Model

The potential upside of 12% due to the growth in each of the previously mentioned business units is attractive enough to me. When combining this with the already high 4.5% yield, we have the ability to capture double-digit upside from these levels. Therefore, I plan to increase my position sometime this quarter to take advantage of this.

risk

As we are likely to continue to be in a higher interest rate environment, PRU may face challenges from potential declines in asset values. Because the business model relies on insurance annuities and premium income, they rely on more premiums than they have to pay in claims.

PRU prices may also abhor previous highs. The price is not as attractive as it used to be. My personal price target is $130 per share, but if you look at some other valuation metrics, the stock might look a little expensive right now. For example, PRU currently has a P/E ratio of 8.64. At the same time, the average 5-year price-to-earnings ratio is only 8.01.and adjusted book value At around $96.64 per share, the price is likely to remain stagnant until earnings in the next few quarters are released, which will give us a better idea of future growth.

take away

Prudential remains a dividend growth stock, but it doesn’t get the recognition it deserves. With over 15 years of consistent dividend increases, a high 4.5% dividend yield, and a solid dividend compound annual growth rate, PRU deserves a spot in any dividend growth-focused portfolio. Additionally, PRU may be undervalued based on the dividend discount model I shared previously. My current price target is $130 per share, representing about 12% upside. When you combine this potential upside with a high dividend yield of 4.5%, you’re looking at some solid potential double-digit growth.

Business units in the U.S. and international markets continued to show growth in key areas. By agreeing on a $1 billion share repurchase, I believe we will finally get Wall Street’s increased price target. This stock repurchase agreement further strengthens management’s confidence in its ability to continue generating returns for shareholders.